On Friday, November 15, Bitcoin (BTC) dominance, which represents the cryptocurrency market share of Bitcoin, was on the verge of a 65% surge. However, this scenario did not materialize as Bitcoin's price failed to retest $93,000, and instead, it returned to a downward trend. This suggests that an altcoin season may have arrived.

This stagnation appears to have created opportunities for altcoins that had fallen significantly behind BTC. The critical question now is whether Bitcoin's dominance will continue to decline, and if altcoin prices will surge.

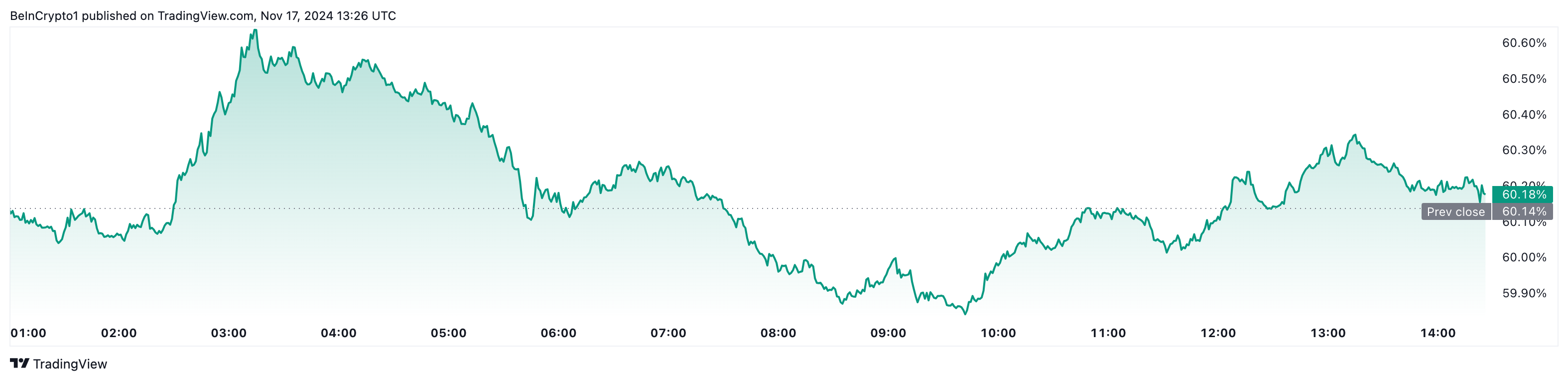

Bitcoin Dominance Retreats Below 60%

As of 1 PM on the 18th, Bitcoin dominance has fallen below 60%. This decline contradicts the expectations of some analysts who predicted that Bitcoin's price could rise to $100,000 within a few days.

According to BeInCrypto's research, this decline may be associated with the rising performance of altcoins. A few days ago, the Altcoin Season Index was 33. Today, Blockchaincenter data shows it has risen to 39.

This increase suggests that more of the top 50 altcoins are outperforming Bitcoin (BTC). Tokens such as Bonk (BONK) and Ripple (XRP) have maintained their upward momentum, contributing to the rise in altcoin market capitalization and the decline in Bitcoin's dominance.

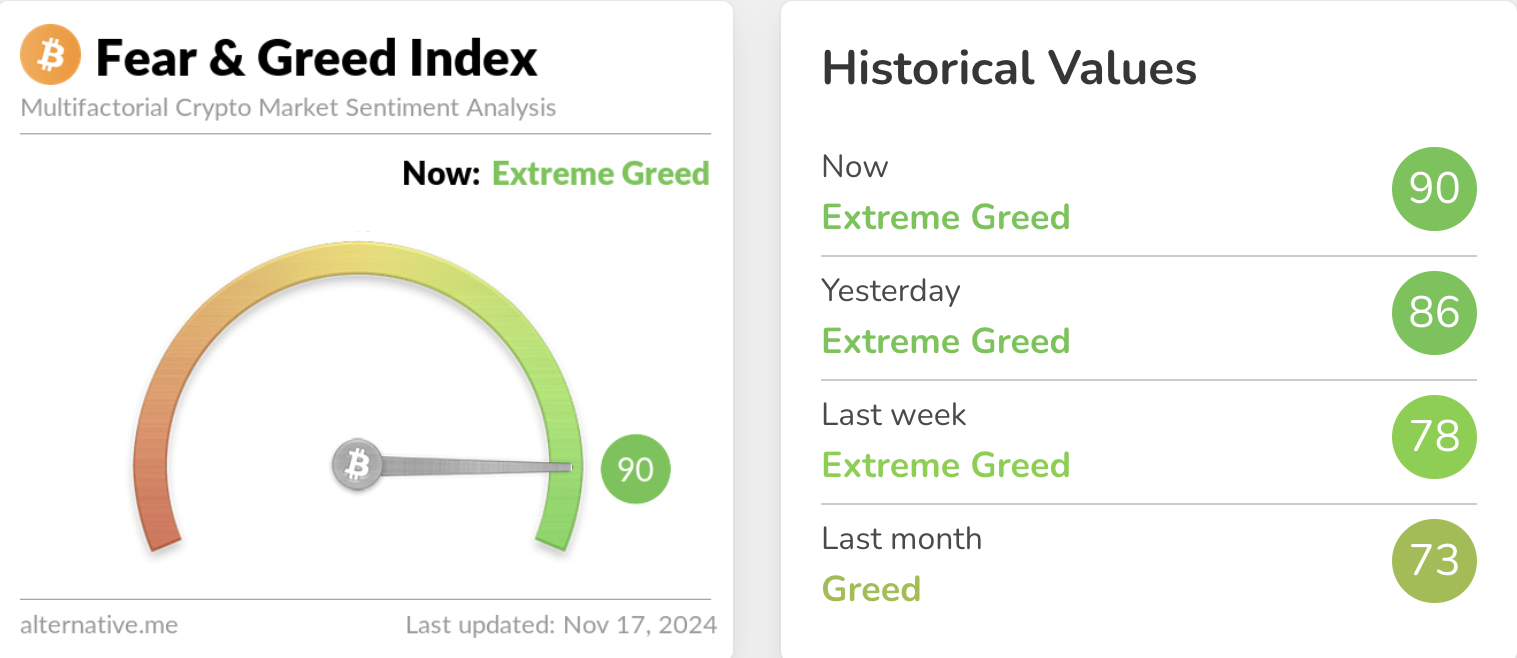

Additionally, the market's extreme greed may be impacting Bitcoin's trajectory. Currently, the Cryptocurrency Fear and Greed Index, which primarily measures Bitcoin sentiment, has reached a remarkable "extreme greed" level of 90.

"Extreme fear" generally indicates high investor anxiety, which can present potential buying opportunities. Conversely, when investors become overly greedy, it may signal that the market is due for a correction.

Therefore, considering the current outlook, Bitcoin's price is likely to face a correction. This view is also consistent with the opinion of analyst Rekt Capital. According to him, the decline in Bitcoin's dominance may soon pave the way for altcoins to break out.

"Bitcoin Dominance — Fully seeing the impact of the best-case scenario. It's Altcoin Season. BTC DOM has fallen to 57.68%, enabling the Altcoin window. Continued downside will enable the Altcoin breakout," Rekt Capital shared on X (formerly Twitter).

Altcoin Rally, Will It Grow Stronger?

Meanwhile, TOTAL2, the total market capitalization of the top 125 altcoins including Ethereum (ETH), has reached $1.19 trillion, the highest level since June.

According to the daily chart, TOTAL2 has reached this point due to widespread interest in altcoins and a breakout from a descending triangle. While a descending triangle is generally considered a bearish pattern, a price breakout in the opposite direction can indicate a bullish reversal, which is the case for the altcoin market capitalization.

If this momentum accelerates, an altcoin season could begin. However, for that to happen, Bitcoin's dominance must continue to decline, and the Altcoin Season Index must approach 75 from the current level of 39.

In that scenario, TOTAL2 could rise to $1.27 trillion. However, if Bitcoin's price surpasses its all-time high, the altcoin season cycle may be delayed, and this prediction could be invalidated.