The upward trend in Bit coin prices appears to have stalled. This occurred after the all-time highs (ATHs) of last week, and the cryptocurrency is currently facing a critical challenge.

The momentum that had pushed Bit coin up to $93,242 has slowed, and as the market situation changes, concerns about the possibility of an adjustment are growing.

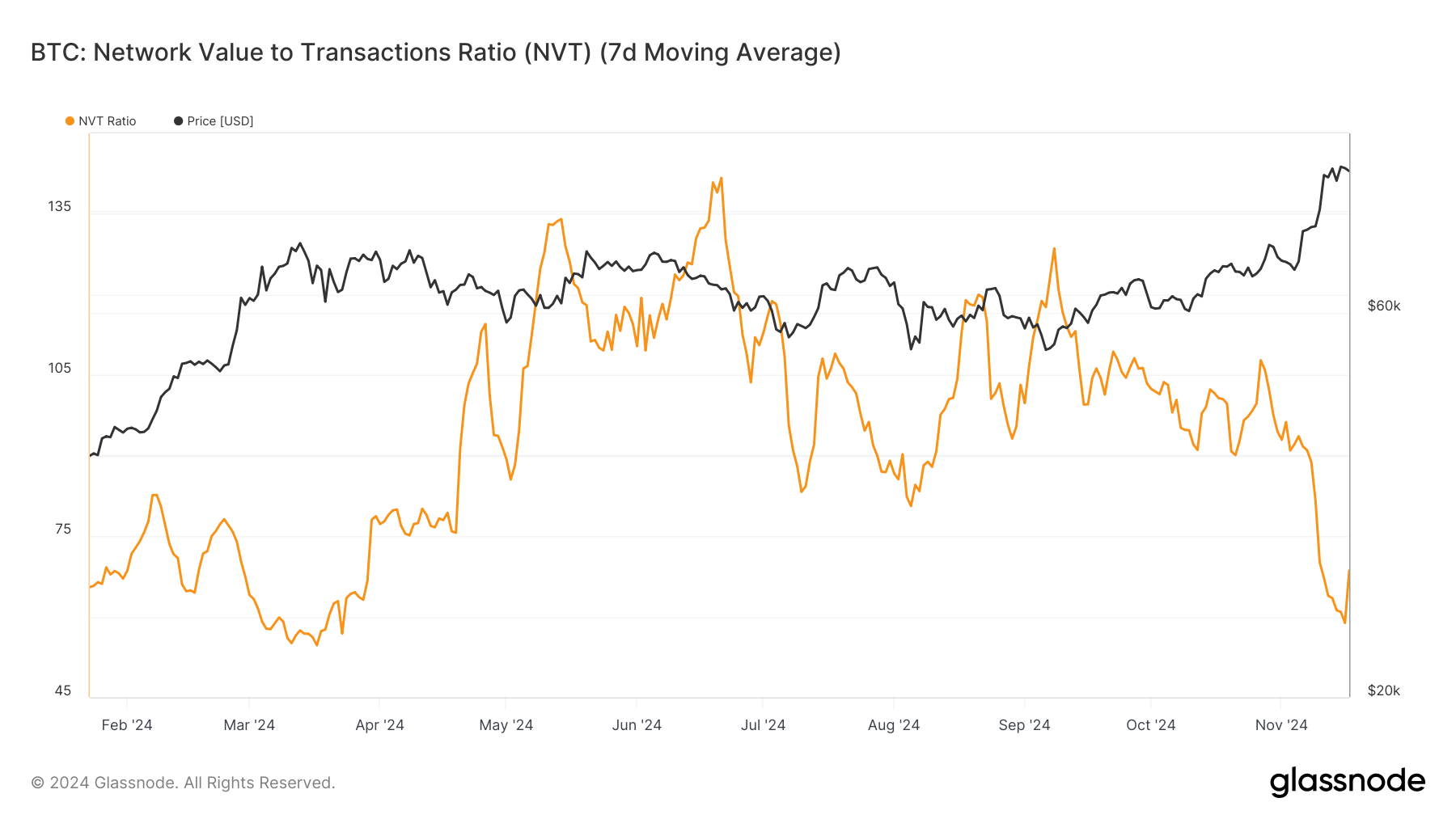

NVT ratio at low levels... possibility of adjustment

The NVT (Network Value to Transactions Ratio) ratio, an important indicator for analyzing the value of Bit coin, has hit an 8-month low and then surged. A low NVT ratio generally indicates that the network's transaction activity is in line with its value, suggesting a balanced and sustainable market.

However, the current uptrend may suggest that Bit coin's network value is outpacing its transaction activity. Historically, such scenarios have presaged adjustments, and closely monitoring this indicator is crucial. If this trend continues, it could exert downward pressure on Bit coin prices.

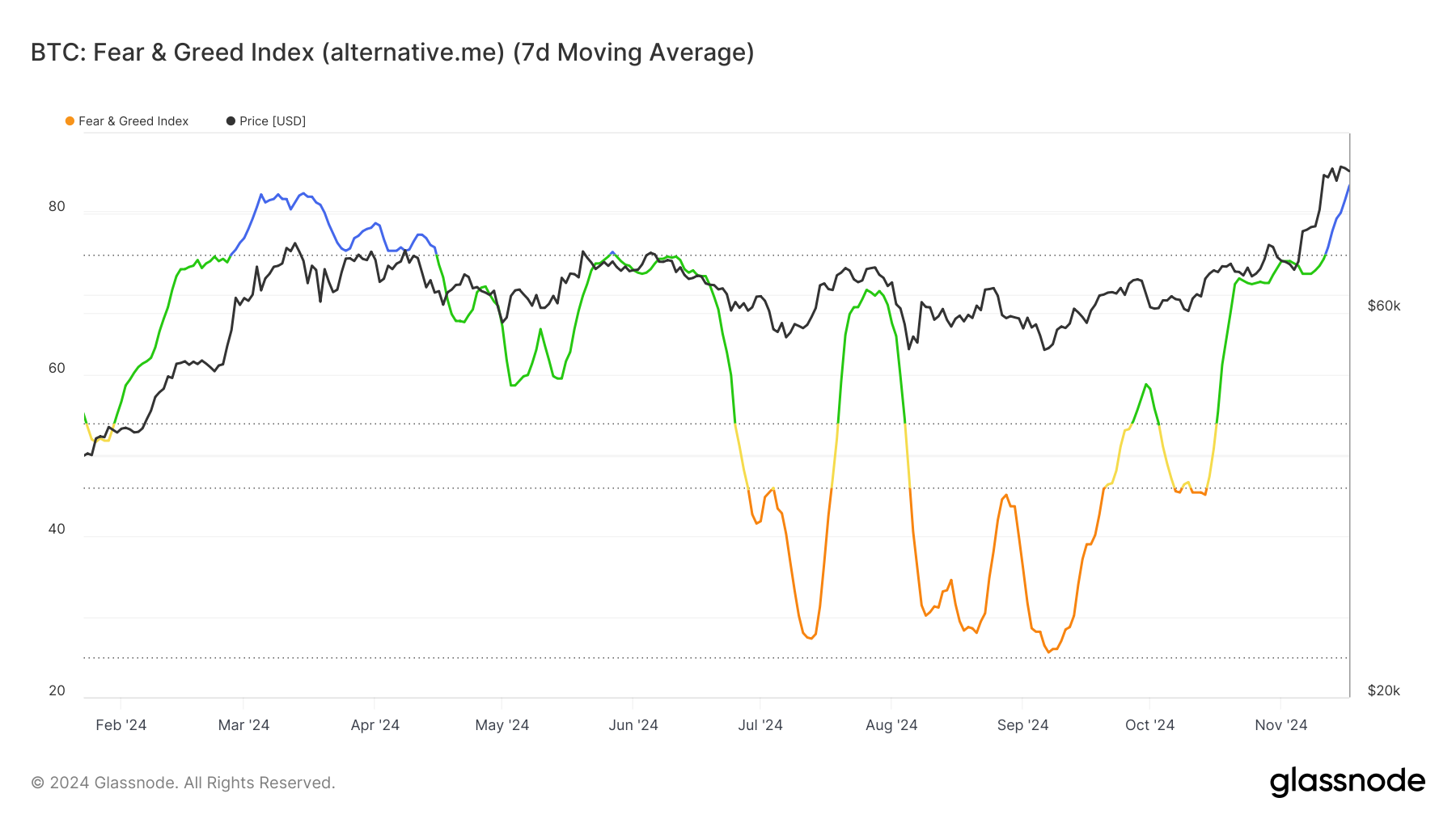

The Fear and Greed Index, which reflects market sentiment, is currently in the "extreme greed" zone, which has historically suggested potential reversals in Bit coin prices. Extreme greed indicates that investors are overly optimistic, making the market vulnerable to sudden sell-offs.

Bit coin has shown resilience under similar conditions in the past, but such high sentiment can be a turning point. As transaction activity declines, Bit coin's macroeconomic momentum may face increasing challenges in maintaining the current price level.

BTC price forecast: Maintaining the $88,691 support level is crucial

Bit coin is currently trading at $90,673 and is facing resistance at the critical $88,691 support level. If Bit coin enters an adjustment within this range over the next few days, it could prevent a larger correction and maintain stability.

However, if Bit coin falls below the $88,691 support level, it could drop to $85,000. If this level is not maintained, Bit coin risks further decline to $80,301, which could exacerbate bearish sentiment.

Conversely, if Bit coin rebounds from $88,691 and breaks through the $92,000 resistance level, the upward momentum could be restored. This could allow Bit coin to target new ATHs, invalidating concerns about a reversal and strengthening the long-term bullish trend.