Author: Azuma, Odaily Planet Daily

As former President Trump's second term approaches, some key positions in his cabinet have surfaced in the past few days, but the battle for the Treasury Secretary position has become increasingly intense.

According to current market expectations, the nomination of the new Treasury Secretary could be announced as early as this week, but the Trump team has not yet made a final decision on the candidate. This morning, Fox Business reporter Charles Gasparino revealed that the Trump team has sought opinions from BlackRock CEO Larry Fink and at least one other BlackRock executive; in addition, Trump will also meet with Coinbase CEO Brian Armstrong to discuss personnel issues for the next administration.

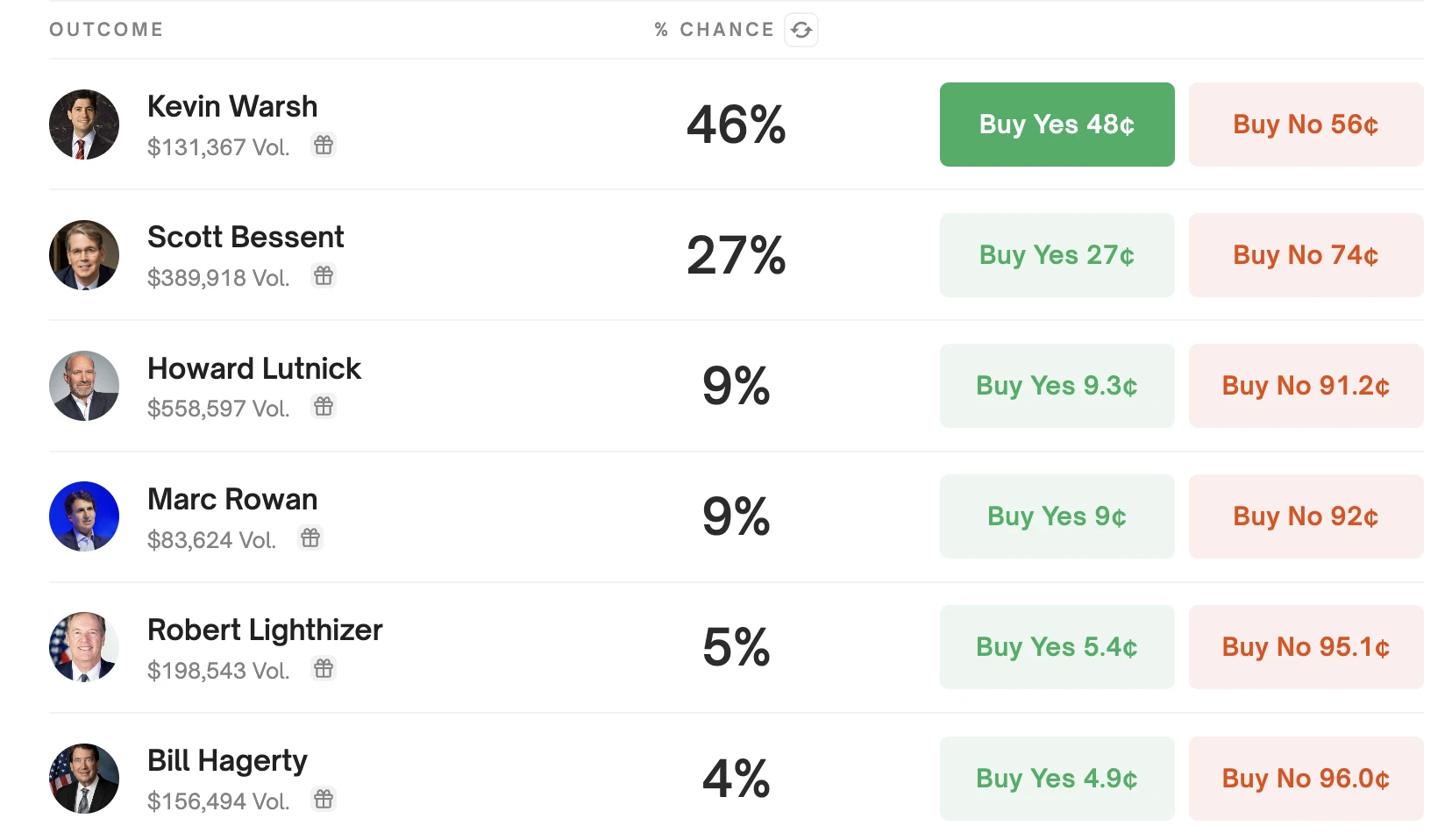

The prediction market Polymarket has opened a betting pool for the Treasury Secretary position, and as of around 10:00 AM, the trading volume in this pool has exceeded $2 million. The currently most popular potential candidates are as follows (only covering the top 6 candidates, the remaining candidates have an extremely low probability):

Former Federal Reserve Governor Kevin Warsh;

Key Square Group founder Scott Bessent;

Cantor Fitzgerald CEO Howard Lutnick;

Apollo Global Management CEO Marc Rowan;

Former U.S. Trade Representative Robert Lighthizer;

Senator Bill Hagerty.

Currently, the market is obviously most anticipating a person with a more crypto-friendly attitude to take control of the Treasury, which would provide a more relaxed environment for the industry to grow. Next, Odaily Planet Daily will review the past attitudes of these six potential candidates towards the crypto industry.

Frontrunner: Kevin Warsh

First of all, it is worth celebrating that the current frontrunner, former Federal Reserve Governor Kevin Warsh (46%), has long been seen as a supporter of cryptocurrencies - even earlier than Trump's attitude change.

As early as in an interview with CNBC in early 2021, Warsh stated: "In a weak dollar economic environment, Bitcoin as part of a portfolio makes sense."

In 2022, Warsh also invested in Bitwise, one of the driving forces behind BTC and ETH ETFs.

However, Warsh's own controversy is that he has repeatedly expressed support for central bank digital currencies (CBDCs), which the decentralized crypto industry may not be too fond of.

The latest news is that the Trump team supports Warsh as the next U.S. Treasury Secretary, and Warsh has been invited to Mar-a-Lago to discuss, but the discussions are still ongoing.

Soros' Former Deputy: Scott Bessent

Scott Bessent, the founder of the hedge fund Key Square Group and former deputy to Soros, was once seen as the most likely candidate for the next Treasury Secretary, and his nomination probability also once led on Polymarket. However, after Elon Musk publicly opposed Bessent as Treasury Secretary, his nomination probability dropped directly.

As Musk criticized Bessent as "just business as usual", Bessent is seen as a more traditional figure, and the Associated Press once positioned him as a "cryptocurrency skeptic" in a report.

However, as Trump has become increasingly supportive of cryptocurrencies, Bessent's attitude has also changed. He stated in July: "I'm excited about the president embracing cryptocurrencies, I think it's very consistent with the Republican party, cryptocurrencies represent freedom, the crypto economy will continue to exist."

The latest news is that Bessent may instead be appointed as the chairman of the National Economic Council, but this result is also not yet certain.

The Man Behind Tether: Howard Lutnick

While Elon Musk publicly opposed Bessent, he also publicly supported Trump transition team co-chair and Cantor Fitzgerald CEO Howard Lutnick, which once boosted Lutnick's nomination probability. However, it has since declined due to the rumor of Warsh's impending appointment.

Lutnick himself is an absolute supporter of cryptocurrencies and can be seen as the most crypto-friendly among the major candidates.

Lutnick's Cantor Fitzgerald manages over half of Tether's stablecoin reserves; Lutnick has personally taken the stage at the Bitcoin conference in Nashville to give a speech; Lutnick has also advocated for classifying Bitcoin as a commodity similar to gold and oil, and called for clearer regulation in the crypto space.

The $700 Billion Helmsman: Marc Rowan

The name of Apollo Global Management CEO Marc Rowan has only recently been added to the list of potential candidates.

Although Rowan's company focuses on alternative asset investment, he has rarely made any statements about cryptocurrencies. In 2022, Rowan told Bloomberg that "the ecosystem built around cryptocurrencies is simply amazing"; however, when asked this year whether cryptocurrencies will play a role in the future of the U.S. financial system, he said the topic was "beyond his understanding".

The Financial Times reported that some Wall Street executives have a positive attitude towards Rowan's potential nomination, but they also believe Rowan would be hard-pressed to give up his role as CEO of Apollo Global Management, which has assets under management of $700 billion.

The "Trade War" Designer: Robert Lighthizer

Robert Lighthizer has not explicitly expressed his attitude towards cryptocurrencies, but the market still needs to pay attention to his potential appointment.

Lighthizer served as the U.S. Trade Representative during Trump's first term and is seen as a "staunch trade protectionist". Politico even once referred to him as the "architect" of Trump's tariff trade war with China, and the market generally worries that Lighthizer's appointment will affect the vitality and stability of global trade activities.

Crypto Legislation Advocate: Bill Hagerty

Republican Senator Bill Hagerty from Tennessee has a low probability of being appointed as Treasury Secretary, but as a senator, he has actually pushed for the advancement of cryptocurrency-related legislation.

In October this year, Hagerty released a draft legislation discussion, aiming to establish a regulatory framework for stablecoins. Investment bank TD Cowen has stated in a report that this draft could become the outline for future legislation in 2025.

Hagerty has also expressed support for Trump's efforts to make the U.S. a cryptocurrency hub, and said in July when discussing the Bitcoin industry: "We need to make sure this happens in America."

The Regulatory Spring for Cryptocurrencies

In summary, the next U.S. Treasury Secretary is expected to emerge soon. From the perspective of the potential successors, except for the ambiguous Robert Lighthizer, the names that have been revealed so far mostly have relatively friendly attitudes towards cryptocurrencies.

For the cryptocurrency industry, which has long suffered from regulatory difficulties, the next few years may be the most relaxed growth environment in the industry's history, and this regulatory spring may be the best opportunity for all parties in the industry to seek development.