Since the birth of Bitcoin, it has repeatedly become the focus of discussion for global investors. In 2024, with the increasing complexity of the macroeconomic situation and the growing market attention to digital assets, the price of Bitcoin has repeatedly hit new highs. After the recent announcement of the election results, Trump was re-elected as the President of the United States, a result that was originally believed by many investors to lead to increased market uncertainty and potentially bring negative effects. However, the price of Bitcoin did not fall due to this event, but continued to rise, triggering heated discussions in the market about the future trend.

Table of Contents

ToggleCan the Bitcoin price continue to rise in the short term?

First, we need to examine on-chain data, as on-chain activities often directly reflect the behavior and sentiment of market participants. As of November 18, 2024, data on the balance of Bitcoin exchanges indicates that there is currently no significant selling pressure in the market. Normally, when the Bitcoin balance on exchanges rises significantly, it often means that more investors are preparing to sell Bitcoin, which may lead to a price decline. However, the current on-chain data shows that the Bitcoin balance on exchanges remains at a low level, indicating that the selling pressure in the market is relatively low. This phenomenon provides support for further short-term price increases.

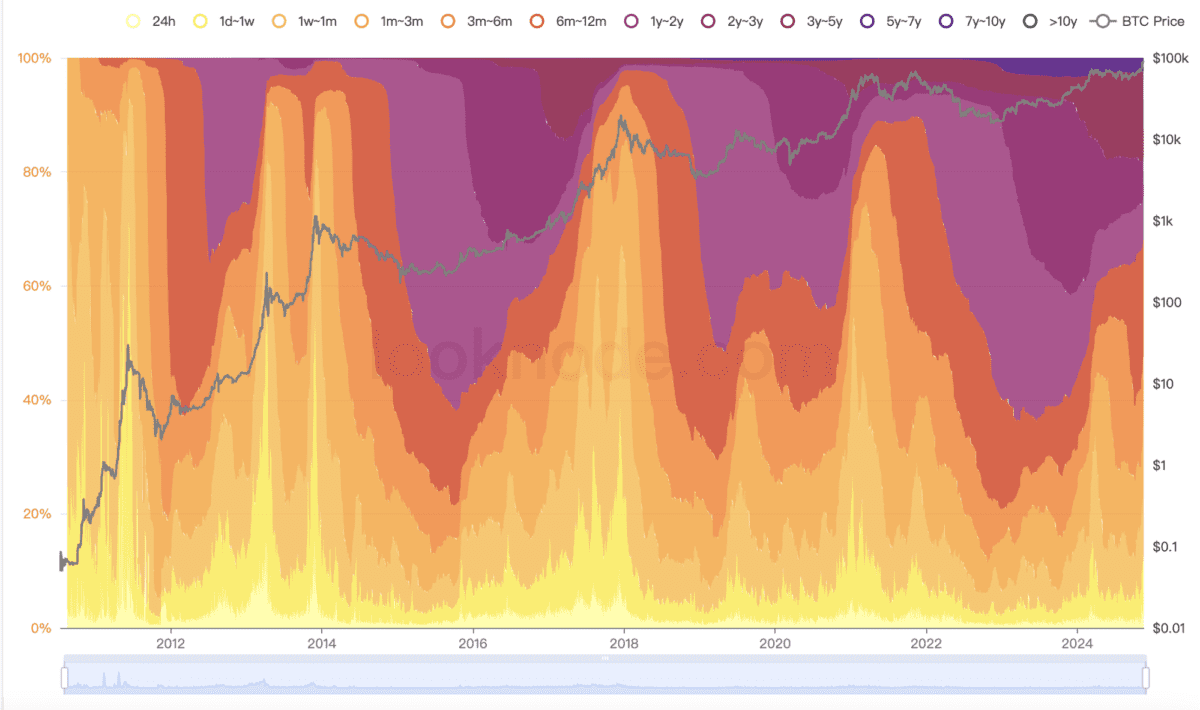

In addition, another important on-chain indicator - Realized Cap HODL Waves - also supports the bullish outlook for Bitcoin prices in the short term. This indicator tracks the proportion of Bitcoin held by investors with different holding periods. From historical data, when the proportion of long-term holders decreases significantly, the market often experiences a significant correction. However, as of now, long-term holders remain steadfast in holding Bitcoin and have not shown any signs of selling. This indicates that the bullish force of Bitcoin still dominates the market, and the upward trend in prices has not yet ended in the short term. This series of factors may allow the Bitcoin price (click to see the latest Bitcoin price analysis) to reach the $120,000 level before the end of this year.

Where is the bottom of the Bitcoin price in the short term?

Although Bitcoin prices have the momentum to continue rising in the short term, investors also need to pay attention to the potential risk of correction. Market prices are usually determined by the behavior of short-term investors, so the cost basis of short-term investors is a key indicator. As of November 17, 2024, on-chain data shows that the average cost basis of short-term investors is around $70,500. If the market experiences unexpected volatility, this price range is likely to become an important support level for Bitcoin.

Based on historical experience, Bitcoin prices often exhibit violent fluctuations, especially when approaching key psychological levels. For example, when the price approaches $100,000, the market may face significant profit-taking pressure. If Bitcoin price cannot quickly break through this level, a short-term adjustment will be inevitable. However, as long as the $70,500 support level is not breached, the overall bullish trend is still expected to continue.

Conclusion

Based on the analysis of on-chain data, macroeconomic background, and market sentiment, the possibility of Bitcoin breaking through the $120,000 mark by the end of 2024 does exist. The reduction in exchange balances, the steadfast attitude of long-term holders, and the uncertainty in the macroeconomic environment all provide support for further price increases in Bitcoin. At the same time, the cost basis of short-term holders indicates that even if a correction occurs, Bitcoin has strong support around $70,500.

However, investors should maintain rationality when formulating their trading strategies, avoiding excessive chasing of rising prices or panic selling due to market sentiment fluctuations. The volatility of Bitcoin prices is both the source of its appeal and the biggest challenge for investors. Regardless of how the market develops, reasonable risk management is always the key to successful investment.

About BingX

BingX was founded in 2018 and is a leading global cryptocurrency exchange, providing over 10 million users worldwide with a diverse range of products and services, including spot, derivatives, copy trading, and asset management. It also regularly provides market analysis on mainstream cryptocurrencies such as the Bitcoin price and ETH price, meeting the needs of users from beginners to professionals. BingX is committed to providing a trustworthy platform, empowering users with innovative tools and features to enhance their trading capabilities. In 2024, BingX proudly became the main partner of Chelsea Football Club, marking its exciting debut in the sports world.

Disclaimer: This article represents the views of BingX and provides market information. All content and opinions are for reference only and do not constitute investment advice. Investors should make their own decisions and trades, and the author and BingX will not be responsible for any direct or indirect losses incurred by investors.

This content is provided by the official source and does not represent the position or investment advice of this site. Readers must carefully evaluate and make their own judgments.