Source: C Labs Crypto Observer

Three years ago, you entered the Ethereum market with over 4,000 U

Then you uninstalled the exchange

Diligently working, seriously living

You firmly believe in the future of crypto

These days, you hear that Bitcoin has already exceeded 90,000

And you also hear that Ethereum has gone crazy

Tears are flowing uncontrollably, and you have finally returned

Under the gaze of the whole family, you opened the exchange

Seeing Ethereum at over 3,000, you suddenly feel a bit at a loss

Why is this happening? Why can't Ethereum get hard?

Actually, from the perspective of the coin price, Ethereum priced in Bitcoin has been steadily maintaining a downward trend:

Anyway, there are all kinds of opinions, so what's going on with Ethereum?

Big Beauty today, from the perspective of the rise and fall of dynasties, will discuss with everyone what's going on with Ethereum.

Why use the analogy of a dynasty, rather than a business company?

Because the survival of a business company mainly depends on cash flow, which either comes from making money through business or VC investment.

But Ethereum actually doesn't have this pressure, as the most comprehensive crypto project in the ecosystem, it's more like a regime.

There are many ways for a regime to survive, it can do business to earn cash flow, it can also collect taxes like gas fees, and it can also issue various new assets within the ecosystem.

At the peak of the Ethereum ecosystem, it was almost the must-have for all crypto projects, it would not be an exaggeration to call it the Ethereum Dynasty.

And throughout history, dynasties have only three reasons to die:

Official change, civil change, and foreign invasion.

If we apply this to Chinese history, about 40% of dynasties died from official change, 40% from civil change, and 20% from foreign invasion.

Official change: Central governance aging, vassal states out of control

Let's first look at official change.

There are two forms of official change, one is internal division within the central government, such as Wang Mang's usurpation of power in the Han Dynasty and Chen Qiaozhen's mutiny in the Song Dynasty, both of which are considered official change.

The central government of Ethereum has actually split up many times.

Several of Ethereum's co-founders have publicly rebelled in the early days

For example, Charles Hoskinson built the PoS public chain Cardano, and Gavin Wood launched Polkadot.

And these two chains are both touted as Ethereum killers.

But the Zhou Tianzi was in the ascendant at the time, with many supporters, so these early rebels have hardly made a big impact.

The most successful official change in the crypto circle has to be Binance, when CZ, a core member of the OKX central government, and the first lady left, they built Binance into the number one in the universe.

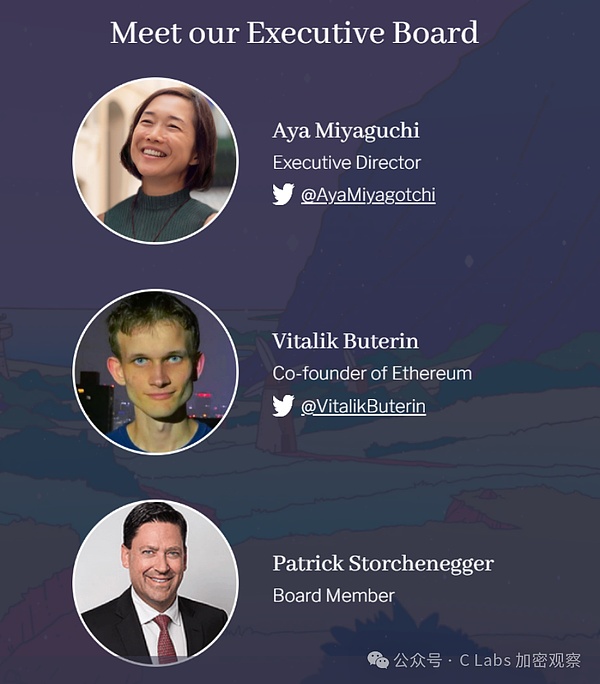

Before analyzing the situation of Ethereum's central government, let's first look at Ethereum's central structure, which is like the three dukes and six ministers:

Many people think Vitalik is the emperor of Ethereum, but that's not the case, as a decentralized organization, Ethereum doesn't have an emperor, it can be considered a dynasty with a virtual monarch and a constitutional system.

And Vitalik is currently ranked second among the three dukes, and from his daily work, Vitalik is more like the Grand Secretariat, who can influence the court and public opinion.

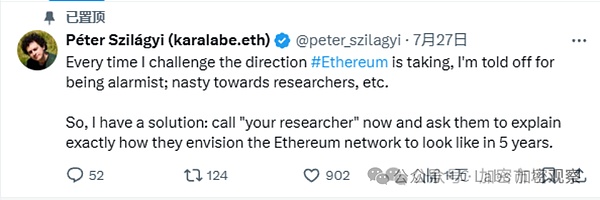

Among the six ministers, there are also those who openly disagree with Vitalik:

Developer bigwig Peter directly criticized Ethereum's unclear roadmap on Twitter

Actually, a little disagreement and argument is not a big deal, but what the community complains about the most about the foundation is the suspicion that they are eating from the inside and feathering their own nests.

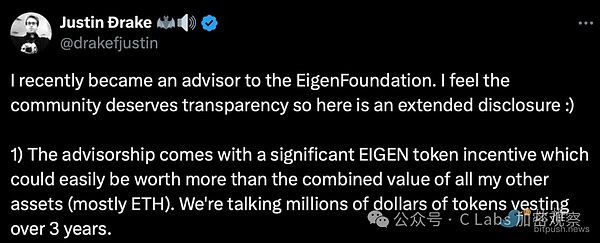

For example, two of the six ministers, Justin Drake and Dankrad Feist, have previously disclosed that they have become advisors to EigenLayer and will receive "possibly more than their current total wealth" in EIGEN tokens as compensation. In the community's view, this "wanting both" behavior is really ugly, and some even mockingly call the EF researchers "in the process of 're-pledging' themselves".

Although the above mentioned two researchers have recently resigned as advisors to EigenLayer, it is very clear that various predatory capital has long been lurking around the Ethereum Foundation, either appointing them as advisors or directly sponsoring the personal research of the researchers, and these foundation members do not seem to be averse to this.

The one who is hunted the most, of course, is the one with the greatest personal influence, Vitalik.

In the eyes of the market, Vitalik is the legitimacy, as long as it is related to Vitalik, the market will recognize it, and this recognition extends to all aspects of the ecosystem.

The most classic case is Scroll, which during the heyday of the L2 narrative, transformed from an obscure "Chinese on-chain meme" to a mainstream L2 worth $100 million, such as Starktnet and zkSync, all because of an email from the founder to the EF that received a reply from Vitalik.

It is precisely because the Ethereum central foundation has long been hunted, and since they can make money just by lying down, why stand up?

What Ethereum really fears is the rebellion of the vassal states.

The current relationship between the Ethereum mainnet and L2s is actually very similar to the relationship between the Tang Dynasty and the various military governors, and not like the Spring and Autumn Period.

Because in the Spring and Autumn Period, the various feudal lords were fighting each other, with no external pressure.

While in the late Tang Dynasty, the military governors were mainly to defend against foreign enemies.

And Ethereum has been vigorously promoting L2 in the past two years, also to defend against attacks from various high-performance chains, and has successfully undermined the ecosystem of many so-called Ethereum killers.

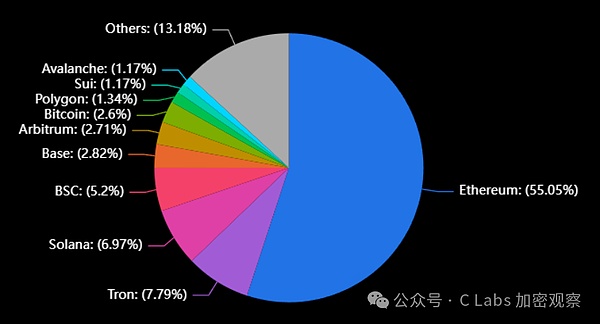

The current situation is: the Ethereum mainnet accounts for about 55% of the assets of various public chains, which is still able to maintain a majority position.

But the ones behind, TRON/Solana/BSC, are no longer Ethereum's L2s.

At this point, the central Ethereum has two paths to choose from:

One is to grow and strengthen the mainchain, which is the path the Song Dynasty chose to resist the Liao, Jin and Mongols.

The second path is to let go and let the L2s compete with other public chains. This is the path the Tang Dynasty faced the Turks, and later Cixi suppressed the Taiping Heavenly Kingdom.

From the roadmap published by Ethereum, in the face of the aggressive Solana, improving the performance of the mainchain may be a lost cause, and the only option is to let go and let the L2s continue to compete on performance.

We'll talk about the competition with Solana and other public chains later, let's first look at the situation of Ethereum's L2s.

From the data, the only two chains that can truly help Ethereum defend against external enemies are Base and Arbitrum.

This is actually very similar to the situation in the middle of the Tang Dynasty, where the main fighting forces were the two groups: An Lushan in the east and Geshu Han in the west.

And these two L2s also have their own little schemes, Arbitrum is openly developing Layer3, and even accepts USDC as gas fees, it's on the path to becoming a sovereign; while Base's strategic choice will definitely prioritize the interests of Coinbase.

BNB was first issued on Ethereum in 2017, and Binance still chose to rebel and build its own Binance Chain, it has to be said that Binance is full of rebellious spirit, it has caused a central split in OKX, and it has also staged a vassal rebellion on Ethereum.

And most other L2 projects, not to mention defending Ethereum's central position, are almost all in the position of shearing sheep and undermining the foundation.

These L2s have raised a large amount of capital from VCs on the one hand, and on the other hand, they are also using airdrops as bait to attract a large amount of Ethereum tokens from users.

As the saying goes, "the front is tight, the back is tight to eat", this is probably referring to these Layer2s.

A large amount of capital and development have been invested in a lot of ineffective redundant infrastructure, to the extent that Vitalik also openly announced in the second half of this year that he will no longer support new L2 projects, and the assets and users on the various Layer2s launched this year have basically all run away after the airdrops ended.

Foreign Invasion: Other Public Chains Become Stronger, Consensus Becomes Scattered

After discussing the various lords of Ethereum, let's take a look at the external enemies Ethereum is facing.

The biggest headache for Ethereum right now is Solana.

In the past, major innovations in Crypto, such as the ICO in 2017, the DeFi Summer in 2020, and the Gamefi and Non-Fungible Token trends in 2021-2022, have all occurred on the Ethereum mainnet without exception.

However, many projects, whether meme, AI/payment, etc., have chosen Solana or other high-performance chains for the current market narrative.

Specifically, in the AI and meme track, Solana and Base are competing.

Solana has directly given birth to the new AI Meme track, which has also received open support from a16z.

Meanwhile, Base previously completed the first-ever AI-to-AI payment and recently launched a new fully on-chain AI agent that can create an AI Agent with an integrated crypto wallet in just 3 minutes.

In the payment track, Ton, with Telegram's nearly 1 billion users, is also eyeing the opportunity, which is definitely a force that Ethereum cannot ignore.

And this year, relying on Telegram's virality, Ton has even snatched away a significant market share of Gamefi.

If three years ago, Ethereum could represent the development direction of crypto application innovation.

But now, I believe this consensus has been basically scattered, and no one should be certain that large-scale crypto application deployment will definitely happen in the Ethereum ecosystem.

At least Solana and Ton still have great opportunities.

Rebellion: The Industry Enters a Period of Disillusionment, with Limited Real-World Applications

In addition to the internal and external troubles mentioned earlier, Ethereum's recent price weakness may also be due to the wavering of its supporters.

It has been nearly 10 years since Ethereum's mainnet launch, and its total market capitalization has reached $300 billion, making it a behemoth among global assets.

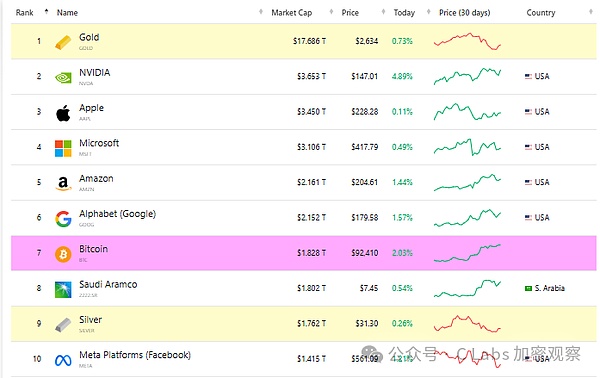

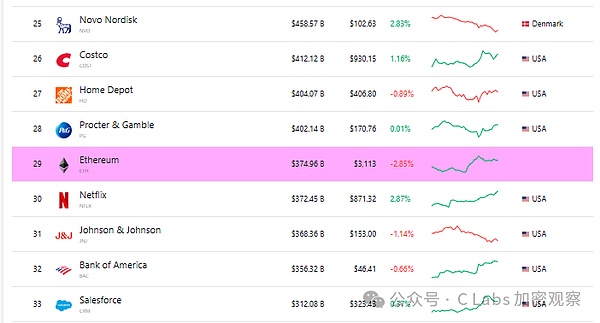

The largest global asset is gold, with $18 trillion.

Bitcoin is now ranked higher than silver, at $1.8 trillion, ranking 7th, still 10 times behind gold.

Ethereum's market cap ranks 29th globally, not a low ranking, ahead of Ecolab and Cosco Bank, and behind Netflix and Bank of America.

In the financial industry, there is a saying that once an asset reaches a market cap of $300 billion, it becomes very difficult for its valuation to rise further, and it must rely on performance to continue growing, which is hard for the original supporters to maintain.

Now, while Bitcoin is still making rapid progress, Ethereum lacks momentum, and if this continues, a year from now, Ethereum priced in Bitcoin may drop to 0.02.

Why is this happening?

Ethereum's supporters can be divided into three categories.

The first group is the miners, who strongly supported Ethereum when it was still a Proof-of-Work (PoW) network, but were essentially alienated after Ethereum's transition to Proof-of-Stake (PoS).

The second group is the various on-chain users, who contributed the majority of Ethereum's gas fees and can be considered the true breadwinners. However, due to the lack of real-world application scenarios on-chain, users are essentially limited to two activities: trading memes and farming.

In the recent meme war, many users have shifted to Solana, and the farming community has been deeply hurt, with one Ethereum ecosystem project after another adopting a "dead pig doesn't fear boiling water" attitude, forcing users to migrate to the Ton chain to farm.

The third group is Ethereum's investors, some of whom are stubborn and have long-term support for Ethereum.

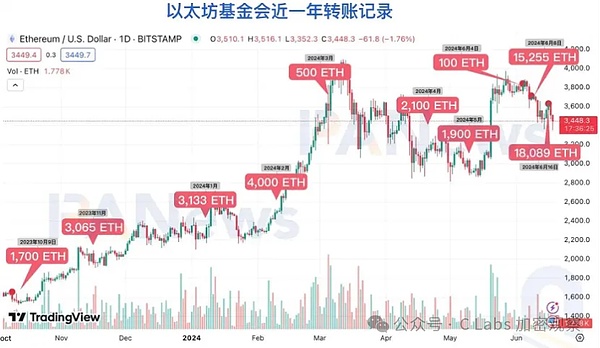

However, it is interesting that the Ethereum Foundation has always been able to sell its Ether at the right time when the price is doing well:

Particularly in 2021, the Foundation sold 35,000 Ether at $3,533.3 just two days before May 19, and another 20,000 Ether at the all-time high of $4,677.6, establishing its reputation as a signal for market dumps.

In the past year, the Ethereum Foundation has been even more active, with operations almost every month.

This series of maneuvers has undoubtedly cooled the enthusiasm of many investors.

Meanwhile, if you look at Bitcoin, the miners not only continue to support it, but many large miners have even gone public on Nasdaq to raise funds and expand their computing power.

With the development of the Bitcoin ecosystem this year, Bitcoin's chain has also seen the emergence of meme players and farmers, contributing around 10% of the miners' revenue.

On the investor side, not only is there no so-called foundation selling, but the narrative of Bitcoin as a store of value has also continued to gain mainstream market recognition, and the US might even list Bitcoin as a federal reserve asset at some point.

It can be said that Bitcoin's supporters are growing, while Ethereum's supporters are dwindling.

Summary of Issues

To summarize:

First, the internal troubles, where the Ethereum Foundation seems to have become a bit strange, with its members essentially being hunted by capital and getting rich, yet the Foundation still has to sell Ether occasionally to maintain operations.

Another issue is the development strategy of Layer 2 solutions, as it appears that the only viable Layer 2 options for Ethereum are Arbitrum and Base, with the rest mostly being laggards.

If this situation continues to evolve, as long as either Arbitrum or Base rebels, the Ethereum ecosystem will essentially cease to exist.

Against this backdrop, Ethereum's external troubles are also very serious.

Historically, the scenes that ignited each crypto bull market have occurred in the Ethereum ecosystem, with VC investments of over 90% going to Ethereum-based projects.

But this year, it is very likely that the action will happen on Solana and Ton, and VCs have already diversified their investments into the Solana and Ton ecosystems.

Since 2022, Ethereum has first alienated the miners, and this year it has also alienated the farming community, and with the price stagnation, the Ethereum Foundation continues to sell Ether, which may end up alienating the investors as well.

It must be said that this situation is really difficult to resolve.

When a dynasty reaches its end, it is very difficult to turn the situation around.

Is there any solution?

I'll just throw out a random suggestion here:

For example, maybe the Ethereum Foundation members could share a portion of the money they earn as external consultants with the Foundation, since they are essentially being hired for their identity anyway.

Perhaps this way, the Ethereum Foundation not only wouldn't need to sell Ether, but could even have additional profits to buy back Ether, right?

In the crypto world, there is no problem that can't be solved by a good market dump. If the dump is not enough, then just dump harder; a good dump might even bring Ethereum a renaissance like the Tongzhi Restoration of the Qing Dynasty!