The IBIT options were launched for the first time on Tuesday, and market participants generally expect this move to attract more institutional interest in Bitcoin (BTC).

On the first trading day, the notional exposure of IBIT options was close to $2 billion, which is an unusual trading volume for a new option. Compared to put options, call options had a higher trading volume (the ratio was 4.4:1), which may be the reason why BTC hit a new high.

The introduction of IBIT options is expected to increase institutional participation in Bitcoin, as options provide new avenues for investment and risk management strategies.

Trading options on IBIT can increase liquidity, provide hedging tools, and allow speculation on BTC price movements, thereby affecting market dynamics and leading to changes in market structure.

Options linked to the BlackRock Bitcoin ETF (IBIT) accumulated a notional exposure of nearly $2 billion on their debut, which some analysts described as "unprecedented" in these metrics.

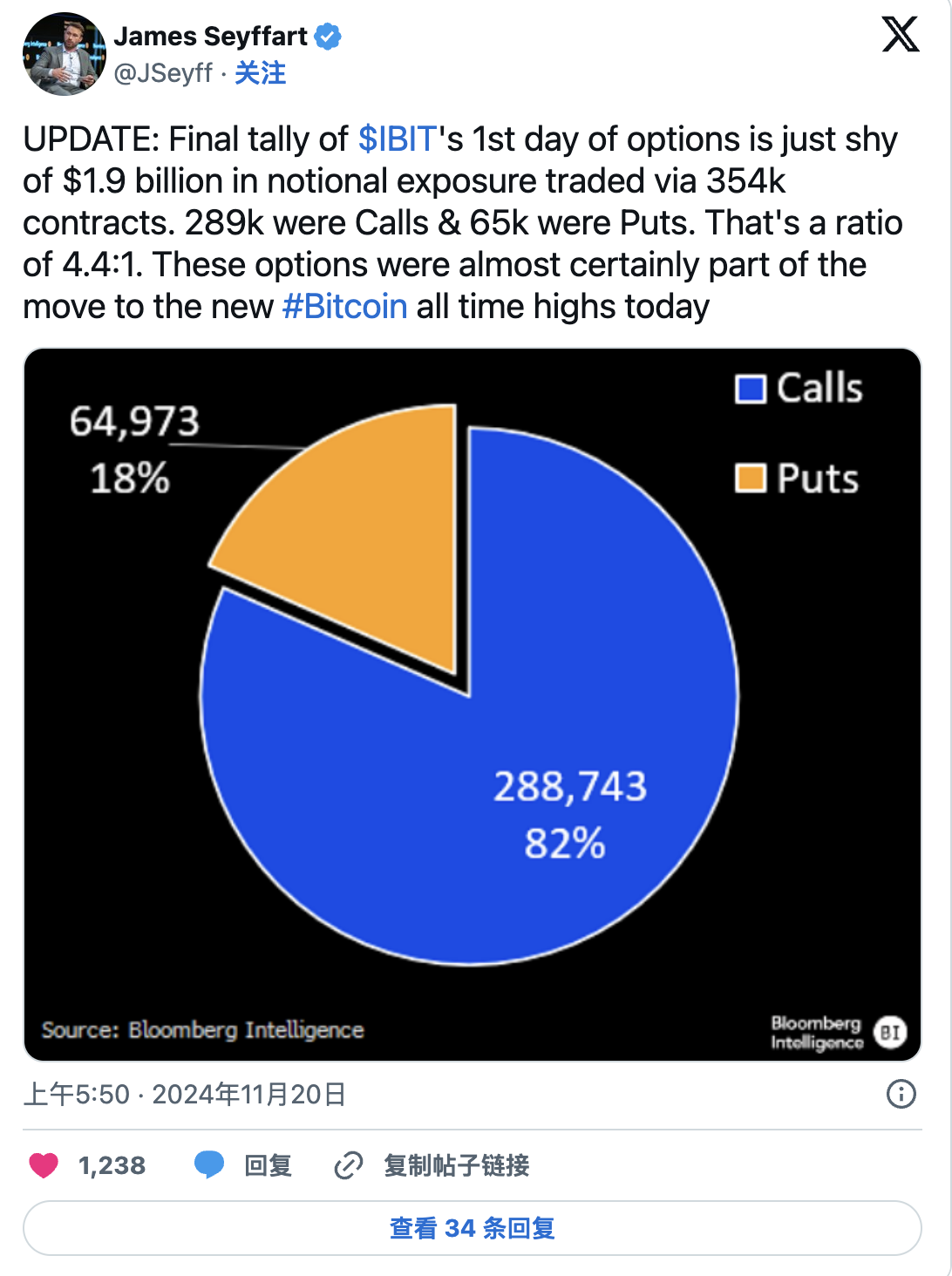

"The notional exposure on the first day of options was just under $1.9 billion, traded through 354,000 contracts. 289,000 were call options and 65,000 were put options," said James Seyffart, a Bloomberg Intelligence analyst, in a post. "That's a 4.4:1 ratio."

"These options were almost certainly a part of what drove #Bitcoin to a new all-time high today," Seyffart added, noting that Bitcoin hit a new high after the US market close on Tuesday.

The IBIT options were launched on Tuesday, and market participants generally expect this move to attract more institutional interest in Bitcoin (BTC). In September, the US Securities and Exchange Commission approved several spot Bitcoin ETFs, and more option products are expected to launch in the coming days.

Expand options

Options are a type of financial derivative that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price on or before a certain date.

Call options give the holder the right to buy the asset at a specific price (called the strike price) within a certain time period. Put options give the holder the right to sell the asset at the strike price within a specified time frame.

Call options are bought when the expectation is that the price will rise; if the prediction is correct, the trader can exercise the option to buy or sell at a profit. Put options can be used as insurance against a price decline or to bet on a decline, and can be exercised to sell at the strike price if the price falls below the market value.

How IBIT options can change the BTC market structure

Using options can open up a wide range of trading strategies for professional investors - this could bring more liquidity to the market and impact market structure.

Institutions that are particularly unwilling to trade in unregulated offshore channels can use IBIT options to hedge their upside risk, while also selling call options to generate additional income. Speculators can use IBIT call and put options to profit from price fluctuations, while avoiding the hassle of owning the underlying asset.

Traders can also sell options and earn a premium, which is a form of passive income that is particularly attractive in a stable or slowly declining market, as the options may expire worthless. Such strategies have already gained popularity among traders compared to leading options exchange Deribit.

In terms of the impact on market structure, some analysts believe that the expected coverage of IBIT call options will suppress long-term implied volatility. In the short term, especially during a bull market, investor demand for call options may lay the groundwork for a GameStop-style gamma squeeze.

Market structure is a broad term that describes how trading involves participants like investors and traders, how assets are bought and sold, and the regulation of a particular asset class.

Options provide more ways to trade, making it easier for professional investors to buy or sell when prices haven't moved much. Tracking options data can show what changes in price traders expect, helping everyone understand market expectations.

Options can also predict and cause price volatility near expiration dates - creating a window for short-term trading.