The 2024 Ethereum Devcon conference in Bangkok, although considered the largest in history, has seen a rather lackluster market enthusiasm. The content shared at the venue lacked highlights, mirroring the sluggish performance of the secondary market. As the "engine" of the bull market in previous years, ETH has appeared particularly listless this year, with the ETH/BTC exchange rate repeatedly hitting new lows, while BTC broke through $93,000, ETH still hovered around $3,000.

Lack of Innovation and Shrinking Ecosystem in Ethereum

In this bull market, we can easily see that Ethereum is facing the dilemma of lack of innovation and a shrinking ecosystem. The ICO craze of 2017 and the DeFi Summer of 2020 had injected strong momentum into the Ethereum ecosystem, but this bull market has not seen Ethereum leading the technological innovation trend, with no phenomenal application narratives driving new capital and new users, resulting in gwei remaining in single digits even in a bull market.

In the PoW era, the value support of Ethereum came from mining power and energy consumption, but the transition to PoS has tightly bound it to the depth of the ecosystem. The prosperity of the ecosystem can attract attention and drive capital inflows, driving price increases, and ultimately promoting staking to maintain the stability of the blockchain. Conversely, without an ecosystem, demand will decrease, prices will fall, and the destruction rate will not meet expectations, leading to inflation, directly weakening its value storage potential, which is a fatal challenge for Ethereum under the PoS mechanism.

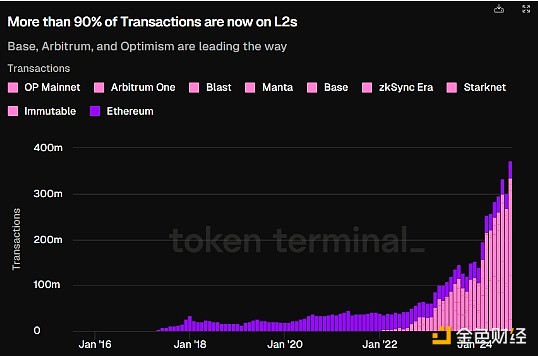

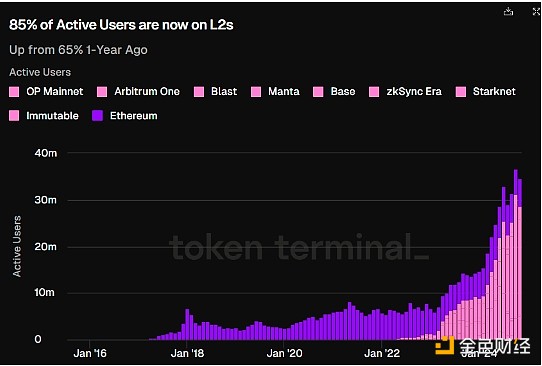

High-speed, low-cost blockchain experience is the pursuit of all public chains. In the past two years, a key strategy for Ethereum in terms of scalability has been the vigorous development of L2, but the functions of L2 highly overlap with the main chain, and in the case where the ETH ecosystem cake has not been further expanded, even the ecosystem is shrinking, the hundreds of L2s have become "parasitic, bloodsucking" on Ethereum. Internally, there is a fierce battle among the L2 warlords, and externally, a new and old group of public chains are swallowing and devouring, leading to a gradual weakening of ETH's discourse power and competitiveness.

Over 90% of transactions are now conducted on L2

85% of active users are now using L2

Blockchain faces a "Blockchain Trilemma", and Ethereum's over-emphasis on technological narratives and idealistic governance structure has sacrificed performance, which is at odds with the current market expectations. Nowadays, even Bitcoin, which is seen as the spiritual belief of the industry, is gradually being tamed by regulatory authorities and finding a home in the hands of more and more Wall Street institutions. This inevitably makes one wonder whether the idea of decentralization is still important in the face of prices.

When crypto ideals cannot be converted into returns, the power of the market will weaken all beliefs, and investors will choose to vote with their feet.

Meme Economy and Solana's Comeback

In stark contrast to Ethereum's sluggishness is Solana's return to center stage, driven by the rise of Meme culture.

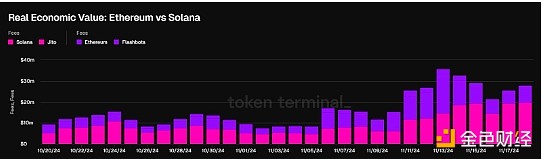

In the context of ample liquidity and a lack of application narratives to connect to, memes that are free from the inherent narratives of the crypto world have become the best carriers of liquidity. And the majority of the Meme community is on Solana, the phenomenal Meme culture has attracted a large number of gold diggers, driving a significant increase in on-chain transaction activity. Data shows that since late October, Solana's daily on-chain fees have consistently exceeded Ethereum's, with the heat of the Meme track continuously bringing capital into the Solana ecosystem, making it the hottest ecosystem in the circle currently.

This bull market is seen as a BTC and meme bull market, and Solana, with its low fees and high throughput, has become the center of the new meme coins, reminiscent of the heyday of the Ethereum ICO era in 2017. SOL has benefited from the value accumulation of Meme coins, analogous to Ethereum's ICO and ETH in 2017.

Solana has risen from the ashes after the FTX collapse, and its low fees, low latency and high throughput naturally benefit various applications. When the overall market heat picks up, its ecosystem has not fallen behind, and they all have good performance. The current Meme craze has even driven the entire Solana ecosystem to become hot, with a "I bloom and then kill all other flowers" momentum. Previously, "ETH killer" was the pursuit of many public chains, but now the target has changed, and the market is debating whether Sui can become the Solana killer.

Conclusion

The decline of Ethereum and the rise of Solana are contrasts that cannot be ignored in this bull market. On one side is the struggle and self-adjustment of the old aristocracy, and on the other is the rapid rise and market pursuit of the emerging forces. This confrontation between new and old forces reflects the transformation of the crypto market from technological idealism to pragmatism.

Although Ethereum's performance in this bull market has been disappointing, its strong developer community, continuous technological iteration capabilities, and adaptability to emerging market demands still provide hope for its future development. Ethereum needs to balance long-term technological innovation and application implementation in its ecosystem development. Only by finding a balance between technology and market demand in the ecosystem can it avoid falling behind in the competition.

4E, as the official partner of the Argentine national team, supports the spot and contract trading of Bitcoin, Ethereum, SOL and many meme coins, with high liquidity and low fees. At the same time, 4E has also integrated traditional financial assets into the platform, establishing a comprehensive one-stop trading system covering from deposit to crypto assets, to US stocks, indices, forex, and bulk gold, with over 600 different risk level assets, and holding USDT can invest in one click at any time. In addition, the 4E platform has a $100 million risk protection fund to provide an extra layer of security for user funds. With 4E, investors can keep up with market dynamics, flexibly adjust strategies and leverage, and seize every potential opportunity.