Sandbox [SAND] has seen increased activity recently, with 9.04 million SAND (US$3.28 million) deposited into Binance in the past 13 hours, and a total of 19.05 million SAND (US$5.9 million) deposited in the past 26 days. As of the time of writing, the trading price of SAND is US$0.3465, down 2.20% in the past 24 hours.

However, bullish on-chain signals and key technical levels seem to suggest that a major move is imminent.

Join the discussion group → → VX: TZCJ1122

SAND Tests Key Resistance Level

The price of SAND has been consolidating around the key resistance level of US$0.375, which has been a critical area historically. The Bollinger Bands are narrowing, indicating decreased volatility and hinting at a potential breakout. A successful close above US$0.375 could pave the way for a rebound to US$0.50, but a failure to hold could push the price back to the support level of US$0.34.

As of the time of writing, the Stochastic RSI is at 71.87, suggesting that SAND is approaching overbought levels. A potential bearish crossover could lead to a short-term price pullback, providing traders with an opportunity to re-enter before another attempt at the resistance level. Therefore, the next few trading days will be crucial in determining the direction of SAND.

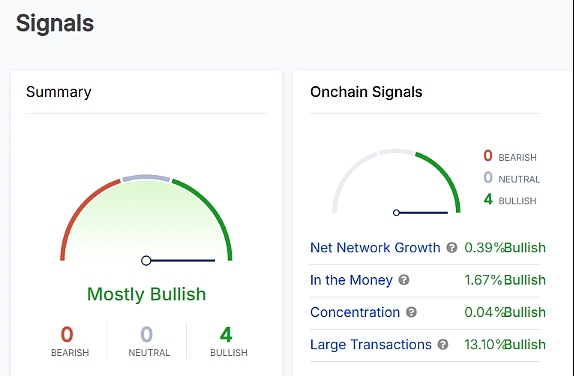

Bullish On-Chain Signals Boost Confidence in SAND

However, on-chain indicators remain a bullish factor for SAND. The Net Network Growth rate has increased by 0.39%, indicating that user adoption has been steadily rising. Additionally, 1.67% of SAND holders are "in profit" as of the time of writing, suggesting that positions remain profitable despite the recent price decline.

The concentration metric has increased by 0.04%, highlighting a stable balance in the distribution of tokens between large holders and small investors.

Meanwhile, large transaction volumes have surged by 13.10%, indicating growing interest from institutional investors and high-net-worth individuals. These data points may bolster confidence in the long-term potential of the altcoin and could signal a stronger uptrend ahead.

Short Bias Reveals Contrarian Investment Opportunity

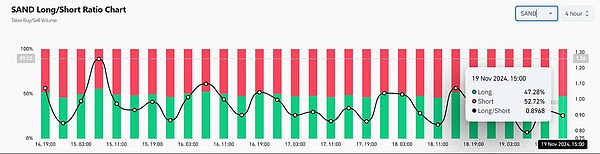

As of the time of writing, the long-short ratio shows that 52.72% of traders hold short positions, while 47.28% hold long positions, with an overall ratio of 0.8968.

While this suggests a slightly bearish market sentiment, such situations often create opportunities for short squeezes. If SAND breaks above the resistance level, the liquidation of short positions could accelerate the price increase.

Is the Altcoin Ready to Break Out?

Sandbox's bullish on-chain signals and technical setup suggest an increasing likelihood of a breakout above US$0.375.

Although the Stochastic RSI implies a potential near-term pullback, the strong on-chain metrics and institutional interest support a long-term bullish outlook. If the key resistance level is breached, SAND could rebound to US$0.50 in the coming days.

That's the end of the article. Follow the public account: Web3 Dumpling for more great articles~

If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have the most professional community, where we publish daily market analysis and recommend high-potential altcoins. There is no threshold to join the group, welcome everyone to join the discussion!

Join the discussion group → → VX: TZCJ1122