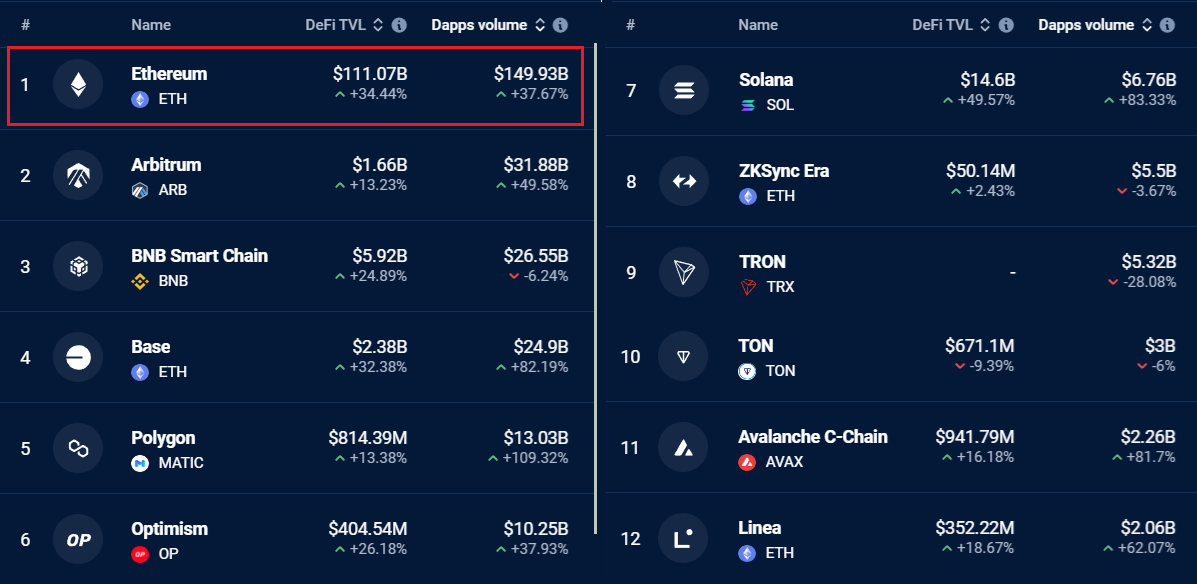

*Blockchain ranking by 30-day DApp transaction volume, in USD. Source: DappRadar*

**Over the past 30 days, no blockchain's on-chain transaction volume has come close to Ethereum's $149 billion. The second-largest competitor, BNB Chain, reached only $26.6 billion, a decrease of 82% despite much lower transaction fees. More importantly, Ethereum's activity grew 37.7% over the past month, while BNB Chain's transaction volume declined by 6%.**

### **Ethereum dominates in fees, TVL, and staking rewards**

**Critics argue that Ethereum's $7.50 average transaction fee hinders growth and retail adoption, but this view overlooks the increasing use of Layer 2 scaling solutions like Arbitrum, Base, and Optimism. Ultimately, these networks rely on Ethereum's base layer for security and finality, creating incentives for more independent validators and staked deposits.**

**The remarkable growth of the Solana network may be Ethereum's biggest Achilles heel, with its on-chain transaction volume growing by up to 83%, thanks to an $8.3 billion Total Value Locked (TVL). While Solana's deposits are much lower compared to Ethereum's $59.4 billion, Solana leads in decentralized exchange (DEX) trading volume.**

**According to defillama data, Ethereum remains the dominant force in fees, generating $163.7 million in fees over the 30-day period, which is crucial for network security. In comparison, Solana generated $133.4 million in fees during the same period, with TRON in third place at $51 million. Interestingly, Solana's three leading decentralized applications (DApps) - Raydium, Jito, and Photon - generated an impressive $338.5 million in fees over the 30-day period.**

**While Ethereum critics point out that Layer 2 rollup solutions are not enough to generate fees, Solana faces similar challenges. SOL stakers and investors have not benefited from the success of its DApps. According to StakingRewards data, Solana's staking yield is 6.2% annually, while the SOL inflation rate is 5.2%, meaning the adjusted returns are much smaller.**

**In contrast, the annualized staking return for Ethereum is 3.3%, while the ETH inflation rate is 0.7% or lower. Although this difference may seem small at first glance, Ethereum's 2.6% adjusted return is more attractive compared to Solana's 1%. From a practical standpoint, this allows Ethereum to attract institutional deposits, a key factor in maintaining its lead in Total Value Locked (TVL).**

**Ethereum's biggest challenge seems to be the lack of a clear strategy to achieve scalability without disrupting its thriving Layer 2 ecosystem, which currently benefits from blob space and relatively low-cost state bridging. Ethereum 3.0 aims to improve scalability by reintroducing sharding and leveraging the Ethereum Virtual Machine (zkEVM) at the base layer.**

This innovative scaling approach can enable multiple execution shards, increasing transactions per second. JOE Lubin sees it as a way of aggregating computation, and some speculate it may eventually eliminate the need for rollups. However, realizing these goals may take years.

**From an on-chain perspective and competitive advantage, ETH is poised to outperform the broader Altcoin market capitalization, but its success will depend on the realization of its roadmap.**

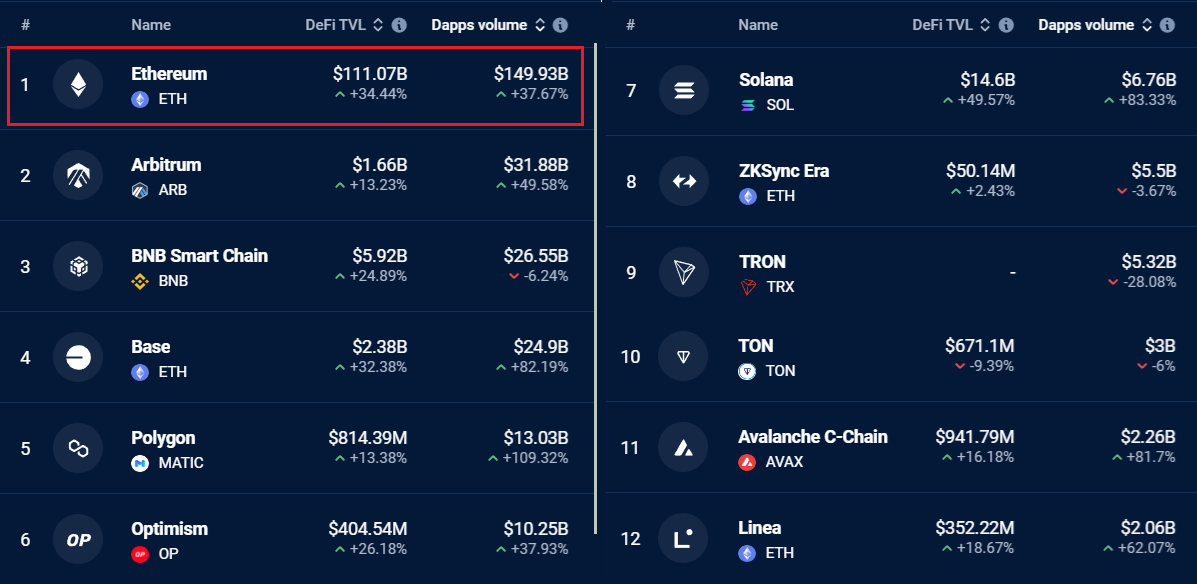

*Blockchain ranking by 30-day DApp transaction volume, in USD. Source: DappRadar*

**Over the past 30 days, no blockchain's on-chain transaction volume has come close to Ethereum's $149 billion. The second-largest competitor, BNB Chain, reached only $26.6 billion, a decrease of 82% despite much lower transaction fees. More importantly, Ethereum's activity grew 37.7% over the past month, while BNB Chain's transaction volume declined by 6%.**

### **Ethereum dominates in fees, TVL, and staking rewards**

**Critics argue that Ethereum's $7.50 average transaction fee hinders growth and retail adoption, but this view overlooks the increasing use of Layer 2 scaling solutions like Arbitrum, Base, and Optimism. Ultimately, these networks rely on Ethereum's base layer for security and finality, creating incentives for more independent validators and staked deposits.**

**The remarkable growth of the Solana network may be Ethereum's biggest Achilles heel, with its on-chain transaction volume growing by up to 83%, thanks to an $8.3 billion Total Value Locked (TVL). While Solana's deposits are much lower compared to Ethereum's $59.4 billion, Solana leads in decentralized exchange (DEX) trading volume.**

**According to defillama data, Ethereum remains the dominant force in fees, generating $163.7 million in fees over the 30-day period, which is crucial for network security. In comparison, Solana generated $133.4 million in fees during the same period, with TRON in third place at $51 million. Interestingly, Solana's three leading decentralized applications (DApps) - Raydium, Jito, and Photon - generated an impressive $338.5 million in fees over the 30-day period.**

**While Ethereum critics point out that Layer 2 rollup solutions are not enough to generate fees, Solana faces similar challenges. SOL stakers and investors have not benefited from the success of its DApps. According to StakingRewards data, Solana's staking yield is 6.2% annually, while the SOL inflation rate is 5.2%, meaning the adjusted returns are much smaller.**

**In contrast, the annualized staking return for Ethereum is 3.3%, while the ETH inflation rate is 0.7% or lower. Although this difference may seem small at first glance, Ethereum's 2.6% adjusted return is more attractive compared to Solana's 1%. From a practical standpoint, this allows Ethereum to attract institutional deposits, a key factor in maintaining its lead in Total Value Locked (TVL).**

**Ethereum's biggest challenge seems to be the lack of a clear strategy to achieve scalability without disrupting its thriving Layer 2 ecosystem, which currently benefits from blob space and relatively low-cost state bridging. Ethereum 3.0 aims to improve scalability by reintroducing sharding and leveraging the Ethereum Virtual Machine (zkEVM) at the base layer.**

This innovative scaling approach can enable multiple execution shards, increasing transactions per second. JOE Lubin sees it as a way of aggregating computation, and some speculate it may eventually eliminate the need for rollups. However, realizing these goals may take years.

**From an on-chain perspective and competitive advantage, ETH is poised to outperform the broader Altcoin market capitalization, but its success will depend on the realization of its roadmap.**Ethereum DApps Grow 38% in One Month — Will ETH Price Follow?

This article is machine translated

Show original

Although the number of DApps on Ethereum has surged, all currencies other than ETH seem to be rising. What's going on?

ETH's price has struggled to maintain above $3,200 from September 13 to September 19. However, on-chain metrics have improved, especially compared to some of Ethereum's direct competitors. Given Ethereum's dominance in fees and network deposits, traders are now questioning how long it will take for ETH to recover its bullish momentum.

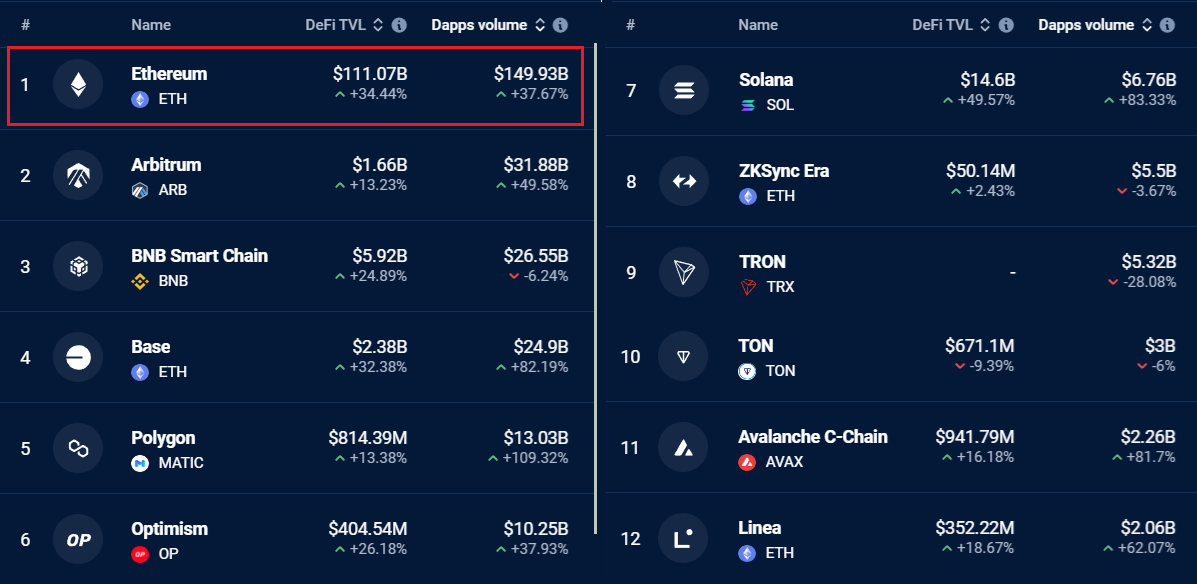

*Blockchain ranking by 30-day DApp transaction volume, in USD. Source: DappRadar*

**Over the past 30 days, no blockchain's on-chain transaction volume has come close to Ethereum's $149 billion. The second-largest competitor, BNB Chain, reached only $26.6 billion, a decrease of 82% despite much lower transaction fees. More importantly, Ethereum's activity grew 37.7% over the past month, while BNB Chain's transaction volume declined by 6%.**

### **Ethereum dominates in fees, TVL, and staking rewards**

**Critics argue that Ethereum's $7.50 average transaction fee hinders growth and retail adoption, but this view overlooks the increasing use of Layer 2 scaling solutions like Arbitrum, Base, and Optimism. Ultimately, these networks rely on Ethereum's base layer for security and finality, creating incentives for more independent validators and staked deposits.**

**The remarkable growth of the Solana network may be Ethereum's biggest Achilles heel, with its on-chain transaction volume growing by up to 83%, thanks to an $8.3 billion Total Value Locked (TVL). While Solana's deposits are much lower compared to Ethereum's $59.4 billion, Solana leads in decentralized exchange (DEX) trading volume.**

**According to defillama data, Ethereum remains the dominant force in fees, generating $163.7 million in fees over the 30-day period, which is crucial for network security. In comparison, Solana generated $133.4 million in fees during the same period, with TRON in third place at $51 million. Interestingly, Solana's three leading decentralized applications (DApps) - Raydium, Jito, and Photon - generated an impressive $338.5 million in fees over the 30-day period.**

**While Ethereum critics point out that Layer 2 rollup solutions are not enough to generate fees, Solana faces similar challenges. SOL stakers and investors have not benefited from the success of its DApps. According to StakingRewards data, Solana's staking yield is 6.2% annually, while the SOL inflation rate is 5.2%, meaning the adjusted returns are much smaller.**

**In contrast, the annualized staking return for Ethereum is 3.3%, while the ETH inflation rate is 0.7% or lower. Although this difference may seem small at first glance, Ethereum's 2.6% adjusted return is more attractive compared to Solana's 1%. From a practical standpoint, this allows Ethereum to attract institutional deposits, a key factor in maintaining its lead in Total Value Locked (TVL).**

**Ethereum's biggest challenge seems to be the lack of a clear strategy to achieve scalability without disrupting its thriving Layer 2 ecosystem, which currently benefits from blob space and relatively low-cost state bridging. Ethereum 3.0 aims to improve scalability by reintroducing sharding and leveraging the Ethereum Virtual Machine (zkEVM) at the base layer.**

This innovative scaling approach can enable multiple execution shards, increasing transactions per second. JOE Lubin sees it as a way of aggregating computation, and some speculate it may eventually eliminate the need for rollups. However, realizing these goals may take years.

**From an on-chain perspective and competitive advantage, ETH is poised to outperform the broader Altcoin market capitalization, but its success will depend on the realization of its roadmap.**

*Blockchain ranking by 30-day DApp transaction volume, in USD. Source: DappRadar*

**Over the past 30 days, no blockchain's on-chain transaction volume has come close to Ethereum's $149 billion. The second-largest competitor, BNB Chain, reached only $26.6 billion, a decrease of 82% despite much lower transaction fees. More importantly, Ethereum's activity grew 37.7% over the past month, while BNB Chain's transaction volume declined by 6%.**

### **Ethereum dominates in fees, TVL, and staking rewards**

**Critics argue that Ethereum's $7.50 average transaction fee hinders growth and retail adoption, but this view overlooks the increasing use of Layer 2 scaling solutions like Arbitrum, Base, and Optimism. Ultimately, these networks rely on Ethereum's base layer for security and finality, creating incentives for more independent validators and staked deposits.**

**The remarkable growth of the Solana network may be Ethereum's biggest Achilles heel, with its on-chain transaction volume growing by up to 83%, thanks to an $8.3 billion Total Value Locked (TVL). While Solana's deposits are much lower compared to Ethereum's $59.4 billion, Solana leads in decentralized exchange (DEX) trading volume.**

**According to defillama data, Ethereum remains the dominant force in fees, generating $163.7 million in fees over the 30-day period, which is crucial for network security. In comparison, Solana generated $133.4 million in fees during the same period, with TRON in third place at $51 million. Interestingly, Solana's three leading decentralized applications (DApps) - Raydium, Jito, and Photon - generated an impressive $338.5 million in fees over the 30-day period.**

**While Ethereum critics point out that Layer 2 rollup solutions are not enough to generate fees, Solana faces similar challenges. SOL stakers and investors have not benefited from the success of its DApps. According to StakingRewards data, Solana's staking yield is 6.2% annually, while the SOL inflation rate is 5.2%, meaning the adjusted returns are much smaller.**

**In contrast, the annualized staking return for Ethereum is 3.3%, while the ETH inflation rate is 0.7% or lower. Although this difference may seem small at first glance, Ethereum's 2.6% adjusted return is more attractive compared to Solana's 1%. From a practical standpoint, this allows Ethereum to attract institutional deposits, a key factor in maintaining its lead in Total Value Locked (TVL).**

**Ethereum's biggest challenge seems to be the lack of a clear strategy to achieve scalability without disrupting its thriving Layer 2 ecosystem, which currently benefits from blob space and relatively low-cost state bridging. Ethereum 3.0 aims to improve scalability by reintroducing sharding and leveraging the Ethereum Virtual Machine (zkEVM) at the base layer.**

This innovative scaling approach can enable multiple execution shards, increasing transactions per second. JOE Lubin sees it as a way of aggregating computation, and some speculate it may eventually eliminate the need for rollups. However, realizing these goals may take years.

**From an on-chain perspective and competitive advantage, ETH is poised to outperform the broader Altcoin market capitalization, but its success will depend on the realization of its roadmap.**

*Blockchain ranking by 30-day DApp transaction volume, in USD. Source: DappRadar*

**Over the past 30 days, no blockchain's on-chain transaction volume has come close to Ethereum's $149 billion. The second-largest competitor, BNB Chain, reached only $26.6 billion, a decrease of 82% despite much lower transaction fees. More importantly, Ethereum's activity grew 37.7% over the past month, while BNB Chain's transaction volume declined by 6%.**

### **Ethereum dominates in fees, TVL, and staking rewards**

**Critics argue that Ethereum's $7.50 average transaction fee hinders growth and retail adoption, but this view overlooks the increasing use of Layer 2 scaling solutions like Arbitrum, Base, and Optimism. Ultimately, these networks rely on Ethereum's base layer for security and finality, creating incentives for more independent validators and staked deposits.**

**The remarkable growth of the Solana network may be Ethereum's biggest Achilles heel, with its on-chain transaction volume growing by up to 83%, thanks to an $8.3 billion Total Value Locked (TVL). While Solana's deposits are much lower compared to Ethereum's $59.4 billion, Solana leads in decentralized exchange (DEX) trading volume.**

**According to defillama data, Ethereum remains the dominant force in fees, generating $163.7 million in fees over the 30-day period, which is crucial for network security. In comparison, Solana generated $133.4 million in fees during the same period, with TRON in third place at $51 million. Interestingly, Solana's three leading decentralized applications (DApps) - Raydium, Jito, and Photon - generated an impressive $338.5 million in fees over the 30-day period.**

**While Ethereum critics point out that Layer 2 rollup solutions are not enough to generate fees, Solana faces similar challenges. SOL stakers and investors have not benefited from the success of its DApps. According to StakingRewards data, Solana's staking yield is 6.2% annually, while the SOL inflation rate is 5.2%, meaning the adjusted returns are much smaller.**

**In contrast, the annualized staking return for Ethereum is 3.3%, while the ETH inflation rate is 0.7% or lower. Although this difference may seem small at first glance, Ethereum's 2.6% adjusted return is more attractive compared to Solana's 1%. From a practical standpoint, this allows Ethereum to attract institutional deposits, a key factor in maintaining its lead in Total Value Locked (TVL).**

**Ethereum's biggest challenge seems to be the lack of a clear strategy to achieve scalability without disrupting its thriving Layer 2 ecosystem, which currently benefits from blob space and relatively low-cost state bridging. Ethereum 3.0 aims to improve scalability by reintroducing sharding and leveraging the Ethereum Virtual Machine (zkEVM) at the base layer.**

This innovative scaling approach can enable multiple execution shards, increasing transactions per second. JOE Lubin sees it as a way of aggregating computation, and some speculate it may eventually eliminate the need for rollups. However, realizing these goals may take years.

**From an on-chain perspective and competitive advantage, ETH is poised to outperform the broader Altcoin market capitalization, but its success will depend on the realization of its roadmap.**

*Blockchain ranking by 30-day DApp transaction volume, in USD. Source: DappRadar*

**Over the past 30 days, no blockchain's on-chain transaction volume has come close to Ethereum's $149 billion. The second-largest competitor, BNB Chain, reached only $26.6 billion, a decrease of 82% despite much lower transaction fees. More importantly, Ethereum's activity grew 37.7% over the past month, while BNB Chain's transaction volume declined by 6%.**

### **Ethereum dominates in fees, TVL, and staking rewards**

**Critics argue that Ethereum's $7.50 average transaction fee hinders growth and retail adoption, but this view overlooks the increasing use of Layer 2 scaling solutions like Arbitrum, Base, and Optimism. Ultimately, these networks rely on Ethereum's base layer for security and finality, creating incentives for more independent validators and staked deposits.**

**The remarkable growth of the Solana network may be Ethereum's biggest Achilles heel, with its on-chain transaction volume growing by up to 83%, thanks to an $8.3 billion Total Value Locked (TVL). While Solana's deposits are much lower compared to Ethereum's $59.4 billion, Solana leads in decentralized exchange (DEX) trading volume.**

**According to defillama data, Ethereum remains the dominant force in fees, generating $163.7 million in fees over the 30-day period, which is crucial for network security. In comparison, Solana generated $133.4 million in fees during the same period, with TRON in third place at $51 million. Interestingly, Solana's three leading decentralized applications (DApps) - Raydium, Jito, and Photon - generated an impressive $338.5 million in fees over the 30-day period.**

**While Ethereum critics point out that Layer 2 rollup solutions are not enough to generate fees, Solana faces similar challenges. SOL stakers and investors have not benefited from the success of its DApps. According to StakingRewards data, Solana's staking yield is 6.2% annually, while the SOL inflation rate is 5.2%, meaning the adjusted returns are much smaller.**

**In contrast, the annualized staking return for Ethereum is 3.3%, while the ETH inflation rate is 0.7% or lower. Although this difference may seem small at first glance, Ethereum's 2.6% adjusted return is more attractive compared to Solana's 1%. From a practical standpoint, this allows Ethereum to attract institutional deposits, a key factor in maintaining its lead in Total Value Locked (TVL).**

**Ethereum's biggest challenge seems to be the lack of a clear strategy to achieve scalability without disrupting its thriving Layer 2 ecosystem, which currently benefits from blob space and relatively low-cost state bridging. Ethereum 3.0 aims to improve scalability by reintroducing sharding and leveraging the Ethereum Virtual Machine (zkEVM) at the base layer.**

This innovative scaling approach can enable multiple execution shards, increasing transactions per second. JOE Lubin sees it as a way of aggregating computation, and some speculate it may eventually eliminate the need for rollups. However, realizing these goals may take years.

**From an on-chain perspective and competitive advantage, ETH is poised to outperform the broader Altcoin market capitalization, but its success will depend on the realization of its roadmap.**Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content