The Russian authorities are planning to ban cryptocurrency mining in the occupied territories of Ukraine, marking a new regulatory phase as the conflict exceeds 1,000 days.

Russian Deputy Prime Minister Alexander Novak convened a meeting with senior officials to address power supply issues, particularly the energy problems caused by cryptocurrency mining in regions with limited power capacity.

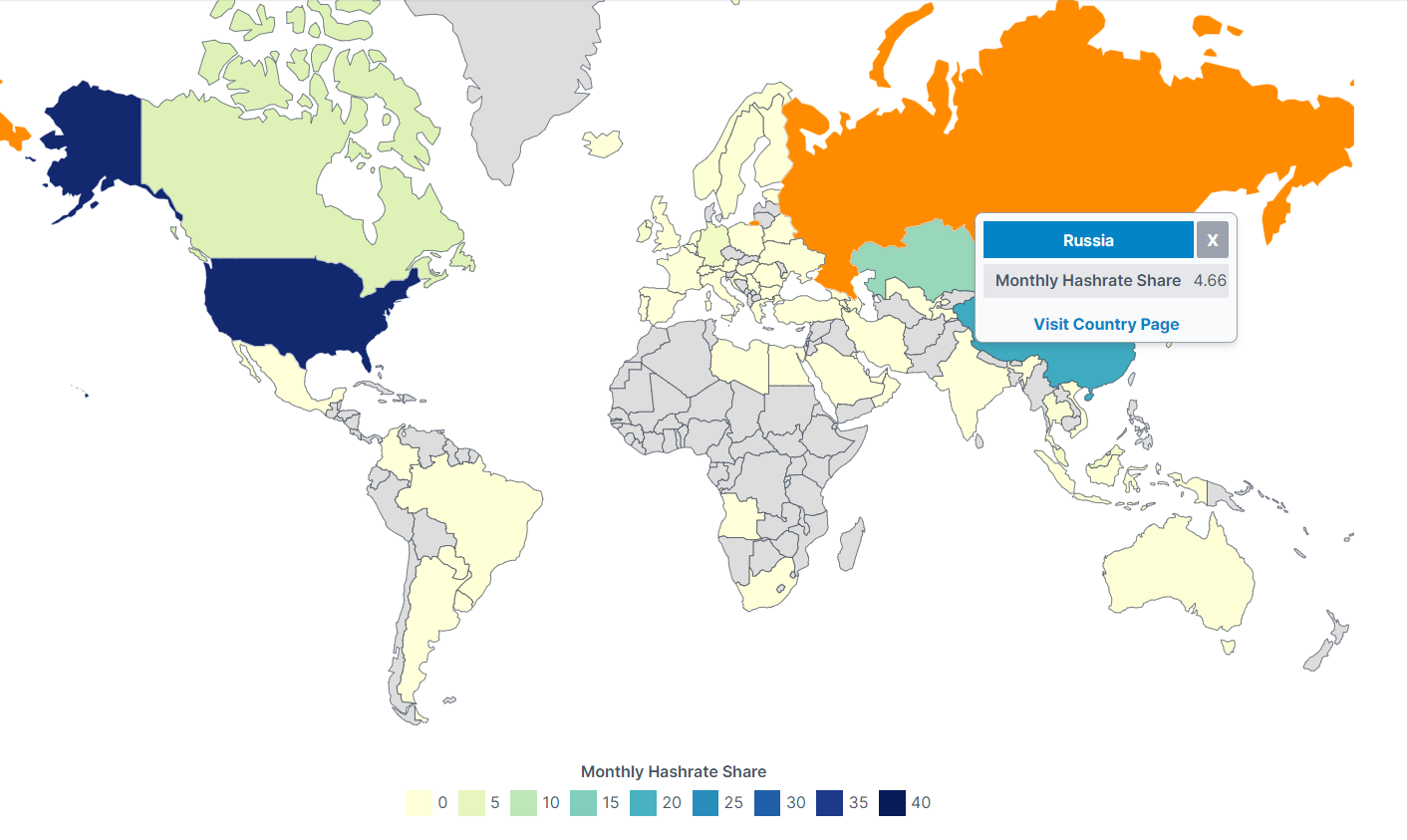

Russia to Restrict Cryptocurrency Mining Until 2031

According to The Moscow Times report, the proposed ban will cover territories under Russian control, including Donetsk, Luhansk, Zaporizhzhia, and Kherson. The government aims to curb mining activities in these regions, citing the impact on local power grids.

The full-scale ban on mining will be implemented in the North Caucasus and the occupied Ukrainian regions from December 2024.

Additionally, cryptocurrency mining in Siberia will be suspended from December 1, 2025, to March 15, 2026. Similar restrictions will apply annually from November 15 to March 15 until 2031.

"From December 2024, the Russian Energy Ministry will intensify inspections of mining equipment in energy-deficient regions like Irkutsk, Chechnya, and the DPR. The conclusion is clear: energy is not infinite, and miners may have to operate covertly or consider a transition," wrote Maria Naumova on X (formerly Twitter).

The Putin government has been considering various changes to Russia's cryptocurrency regulations in recent months. The new law will allow for the direct regulation of mining pools, while support for using cryptocurrencies as a means of payment remains strong.

Last week, the government revised its cryptocurrency tax policy. Under the new regulations, cryptocurrencies are classified as property for tax purposes. Income from mining is taxed based on the market value at the time of receipt.

However, miners can deduct operating expenses, providing some financial relief to the industry. Cryptocurrency transactions are exempt from value-added tax (VAT).

Instead, profits are taxed under the same framework as securities. This limits individual cryptocurrency-related income tax to 15%.

Additionally, reports indicate that Russia is pursuing the establishment of state-backed cryptocurrency exchanges. These exchanges are likely to be located in St. Petersburg and Moscow.