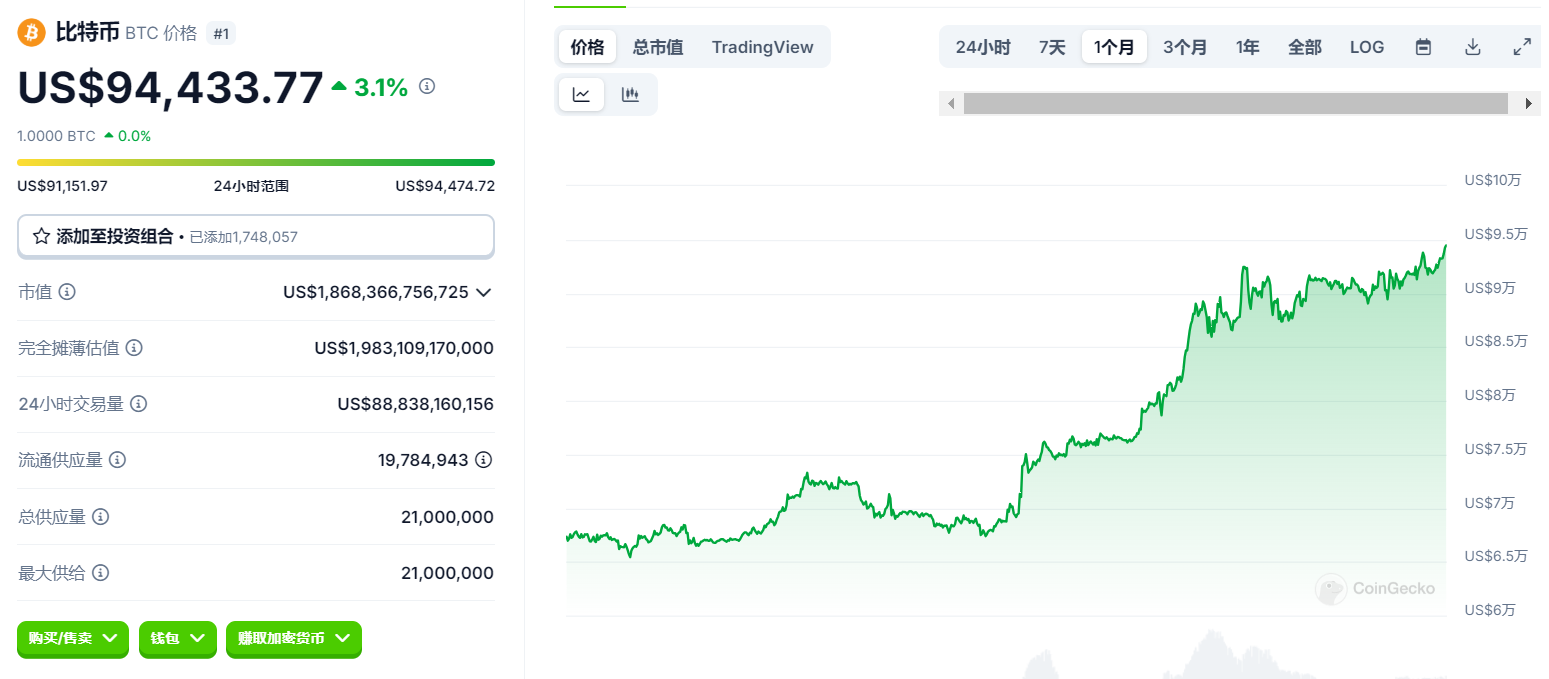

Bit has continued to hit new all-time highs since November 2024, reaching over $94,500 as of the time of writing, getting closer and closer to the psychological barrier of $100,000. With the market sentiment becoming increasingly bullish, investors are full of confidence in Bit's prospects, and are predicting that Bit will continue to rise all the way to the $100,000 mark. However, although this target is within reach, the process of breaking through $100,000 is still full of challenges. At this critical price level, multiple factors within the market, such as sentiment fluctuations, capital flows, on-chain data changes, and the dynamics of the options market, may become obstacles to Bit's further rise.

This article will delve into these factors, revealing the potential obstacles Bit faces in breaking through the $100,000 mark, and exploring the deeper-level implications behind this price level.

Market Sentiment: Concerns Behind the Extreme Greed

According to Alternative.me data, the current market sentiment for Bit has reached a state of "extreme greed". The Fear & Greed Index shows that the market sentiment has reached 90, which is the highest point since 2021. Investor sentiment is overly optimistic, and the market is usually prone to price corrections in such a state.

The surging greed sentiment means that more and more traders are starting to lock in profits. Although the price has hit new highs, historical experience shows that when market sentiment becomes too optimistic, it often means that the price top is approaching. Bit's short-term trend may experience a short-term adjustment due to the market's excessive optimism. At this time, the large-scale profit-taking in the market may bring selling pressure.

The Selling Wave of Long-Term Holders: On-Chain Data Releases Warning Signals

Long-Term Holders (LTHs) of Bit are usually seen as the cornerstone of market stability, but recent on-chain data shows that the behavior of this group of investors is changing.

According to glassnode data, the net position change of Bit's long-term holders has dropped to the lowest point in 5 months. Especially between November 15 and 17, 2024, the net position of LTHs experienced a significant decline. This indicates that Bit's long-term holders have started to sell a large amount of Bit recently, with a single-day selling volume exceeding $3 billion, the largest since June 2023. This change means that the market supply has increased significantly, which may create resistance to the rise in Bit's price.

In fact, the behavior of LTHs is often an important barometer of Bit's price. In February 2021 and early 2023, the selling wave of LTHs has led to significant price corrections in the market. Therefore, the current selling behavior of LTHs may signal potential pressure on Bit's price.

MVRV Ratio: A Warning of Bit's Valuation Bubble

The MVRV ratio (Market Value to Realized Value) is an important indicator for measuring Bit's market valuation. Its value reflects the degree of deviation of Bit's market value from its actual value. When the MVRV ratio exceeds 3.7, it usually indicates that Bit has entered the overvalued range, which may mean that the market is in a bubble.

Currently, the MVRV ratio has reached 2.67, which, although not yet breaching the warning line, is still close to the historical high. This means that the current market value of Bit has deviated significantly from its actual value, and the sustainability of the price increase may be affected by market sentiment. If the MVRV ratio continues to rise, the market may experience a value correction, leading to a short-term pullback in Bit's price.

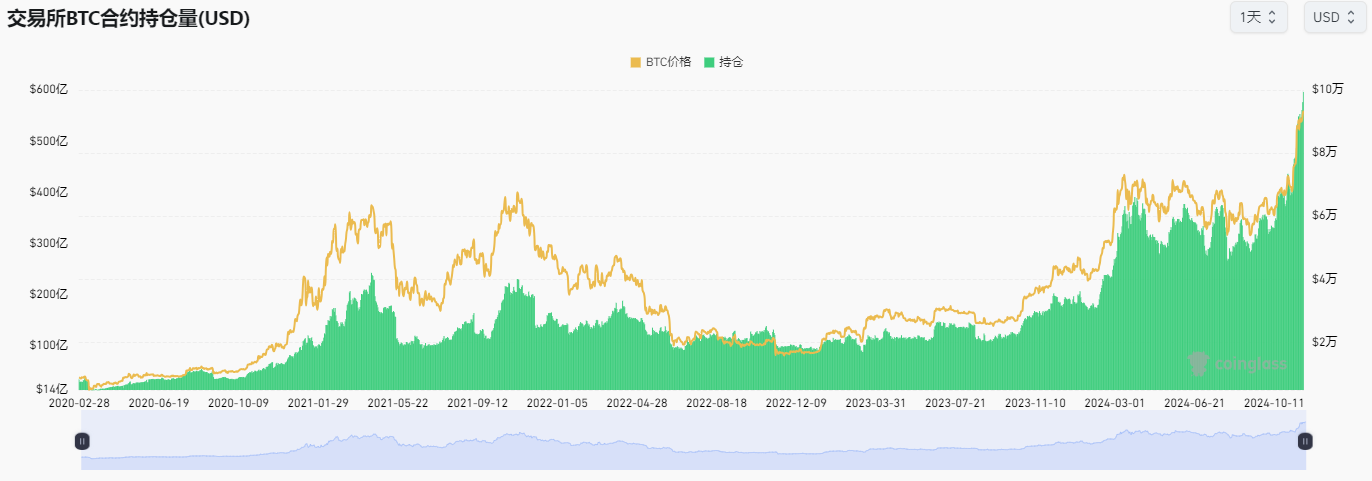

Dynamics of the Bit Futures Market: Funding Rates and Support from the Spot Market

According to Coinglass data, the current open interest of BTC contracts on trading exchanges has exceeded $59.6 billion, a new all-time high. Although the funding rate has recently risen to 30% (annualized), it has now fallen back to 15%, indicating that some leveraged long traders have chosen to unwind their positions. It is worth mentioning that even with the decrease in funding rate, the Bit price has remained strong, highlighting the active buying pressure in the spot market. As the funding rate declines, speculative long traders can re-enter the market at a lower cost, further boosting the bullish sentiment in the market.This series of market changes indicates that the upward momentum of Bit remains solid.

The Impact of the Options Market: The Debut of IBIT Options

On November 19, 2024, the IBIT options launched by BlackRock saw exceptionally active trading, with a notional exposure approaching $2 billion. According to a report by Bloomberg Intelligence analyst James Seyffart, the trading volume on the first day reached 354,000 contracts, of which 289,000 were call options and 65,000 were put options, a ratio of 4.4:1. This data indicates that the market has very strong expectations for Bit's future upside.

The launch of IBIT options will greatly increase the participation of institutions in the Bit market. The options market provides tools for risk hedging and speculation, which can bring more liquidity to the Bit market. Especially for those institutions that are unwilling to hold Bit directly, IBIT options provide a way to profit through options trading. This not only can effectively diversify risk, but may also drive the rise in Bit's price.

However, the introduction of the options market may also change the market structure of Bit.Analysts predict that as the options trading volume increases, the implied volatility may be suppressed, especially during bull markets, which will lead to more violent market price fluctuations, and may even trigger a "gamma squeeze" phenomenon similar to the GameStop stock price surge, which could accelerate the violent fluctuations in Bit's price.

Capital Inflows: The Positive Performance of Bit Spot ETFs

Bit's continued rise is inseparable from the active participation of institutional investors, especially the inflow of ETF funds.The current net inflow of Bit ETFs has exceeded $28.677 billion, a new all-time high. Among them, BlackRock's iShares Bit ETF (IBIT) alone contributed $29.6 billion in net inflows, while Fidelity's Bit ETF (FBTC) attracted $11 billion in capital inflows. The influx of these funds not only reflects the recognition of the Bit market by institutions, but also further consolidates Bit's position as a digital asset. The strong momentum of ETF capital inflows indicates that Bit is gradually entering the mainstream investment market and becoming a long-term holding asset for large institutions and investors.

Slowdown in Bit Miner Selling

The activities of Bit miners continue to have a profound impact on the market, especially their holding and selling behavior, which directly affects market supply and demand and price fluctuations. With the continued rise in Bit's price, the profitability and selling strategies of miners have changed, providing support for the price.

Bit Holdings of Listed Mining Companies

According to the latest data from HODL15Capital,the "holding amount" of Bitcoin miners has increased by about 7.5%, indicating that miners are more inclined to hold Bitcoin rather than sell it immediately in the current market environment. This trend suggests that the selling behavior of miners has slowed down, and their long-term holding intention may help maintain the market price. Especially when the Bitcoin price breaks through key technical levels, miners choose to reduce sales, thereby reducing the circulation of Bitcoin in the market.

The increase in Bitcoin computing power is also an important factor affecting the market. According to data from Blockchain.com, the total computing power of the Bitcoin network has exceeded 640 EH/s, approaching the historical high level. This indicates that the investment of miners has increased, and mining activities have become more intensive.Although the increase in computing power represents an acceleration in Bitcoin production, it also means that more miners are willing to continue to invest, and even at high prices, they are not eager to sell the Bitcoin they hold.

Large institutions continue to increase their holdings of Bitcoin: Potential actions by Microsoft

As the Bitcoin market continues to rise, the attention of institutional investors is also increasing.

On November 18, MicroStrategy announced that it would use the proceeds from the sale of stocks to purchase an additional 51,780 Bit, with an average purchase price of $88,627, during the period from November 11 to 17, 2024, with a total investment of $4.6 billion. This move once again shows that MicroStrategy's investment strategy in Bitcoin has not changed, and its long-term bullish expectation for Bitcoin is becoming more and more firm.

On November 20, MicroStrategy announced that it would issue $2.6 billion in convertible preferred notes and use the proceeds to purchase Bit. The issuance scale of this note is larger than the previously announced principal amount of $1.75 billion, and the issuance is expected to be completed by November 21, 2024.

After the announcement, MSTR's intraday gain expanded to 6.43%.

At the Spaces conference hosted byVanEck, Saylor said he would submit a proposal to the Microsoft Board of Directors

At the same time, the attractiveness of Bit has also attracted the attention of other large companies. MicroStrategy chairman Saylor recently said that he will submit a 3-minute proposal to the Microsoft Board of Directors, suggesting that Microsoft consider investing in Bit as a corporate asset. Although the Microsoft Board of Directors has previously stated that it has evaluated various investment assets including Bit, Saylor still believes that Bit will make the company's stock value more stable and the risk lower. This proposal is expected to be voted on on December 10, and whether Microsoft will adopt this suggestion is still unknown, but its potential actions will undoubtedly provide a demonstration effect for more institutions to invest in Bit.

Policy New Wind: The Trump Administration May Usher in a Golden Development Period for Bit

With the election of Trump as President of the United States, Bit may face a series of favorable policy changes, further consolidating its position as a global store of value asset.

Trump's senior team also includes a number of well-known cryptocurrency supporters. Vice Presidential candidate JD Vance and Defense Secretary nominee Pete Hegseth are both known for their support for cryptocurrencies, especially Bit. Especially the addition of Doge Father,the co-head of the Department of Government Efficiency (DOGE)Musk, undoubtedly injected a strong signal into the market.

Nominated the CEO of financial firm Cantor Fitzgerald (Howard Lutnick) to serve as Secretary of Commerce.

In addition, Trump's nominations further demonstrate his support for the cryptocurrency industry.

Trump nominated Bit supporter and Cantor Fitzgerald CEO Howard Lutnick as US Secretary of Commerce.

The Secretary of Health and Human Services nominated by Trump, Robert F. Kennedy Jr., has long been a staunch supporter of Bit.

Lutnick himself holds hundreds of millions of dollars in Bit and has publicly announced that Cantor Fitzgerald plans to launch a Bit financing business. In addition, Trump is also considering appointing blockchain legal expert Teresa Goody Guillén as Chairman of the US Securities and Exchange Commission (SEC). Guillén has long advocated for a more relaxed regulatory policy for the cryptocurrency industry, and if she is elected, she may push the SEC to be more actively supportive of the development of the cryptocurrency market.

As the Trump administration's policies are gradually implemented, the market expects Bit to receive greater support in a more favorable policy environment. This not only creates conditions for the future development of Bit, but will also further enhance market confidence and attract more investors to enter this field.

$100,000 may be the next new chapter for Bit

As Bit approaches the psychological barrier of $100,000, the market sentiment and capital flow are at a critical intersection. Although the upward momentum of Bit is strong, the underlying risks and challenges should not be ignored. The extreme greed in the market, the slowdown in miners' selling behavior, the rise of the options market, and the gradual increase in holdings by traditional financial institutions and large companies are all shaping the future direction of Bit. Behind this, whether Bit can break through this historic price level ultimately depends not only on the fluctuations of the technical aspect and market sentiment, but also on the deep-seated changes in the global economy, policy environment, and investor confidence.

As more and more institutions join the investment camp of Bit, the market may usher in a new structural change. Perhaps in the not-too-distant future, $100,000 will no longer be an unreachable goal, but a new starting point. And we, as witnesses to the digital currency wave, may be experiencing a new era where assets and technology are intertwined, witnessing Bit's transformation from an asset class to a global consensus. Regardless of the outcome, the path ahead is destined to be extraordinary.