The SUI price has recently reached a new all-time high, rising nearly 74% last month. This surge reflects the momentum driven by increased adoption of the asset and market activity.

Along with the price performance, the total value locked (TVL) of SUI has also set a new record, reaching $1.65 billion before retreating slightly.

SUI Total Value Locked Hits New High

The SUI total value locked (TVL) reached an impressive $1.65 billion on November 15, setting a new all-time high. However, it has since decreased slightly and stabilized around $1.62 billion over the past few days.

This change indicates a cooling-off period following the strong growth trajectory observed earlier this month.

Tracking SUI's TVL is important as it reflects the platform's ability to attract capital and maintain user trust. After exceeding $900 million on October 28, SUI has demonstrated its ability to maintain significant TVL on the network, recording its first $1 billion TVL milestone on September 30.

However, the recent decrease in growth momentum may suggest a temporary pause in this upward trend.

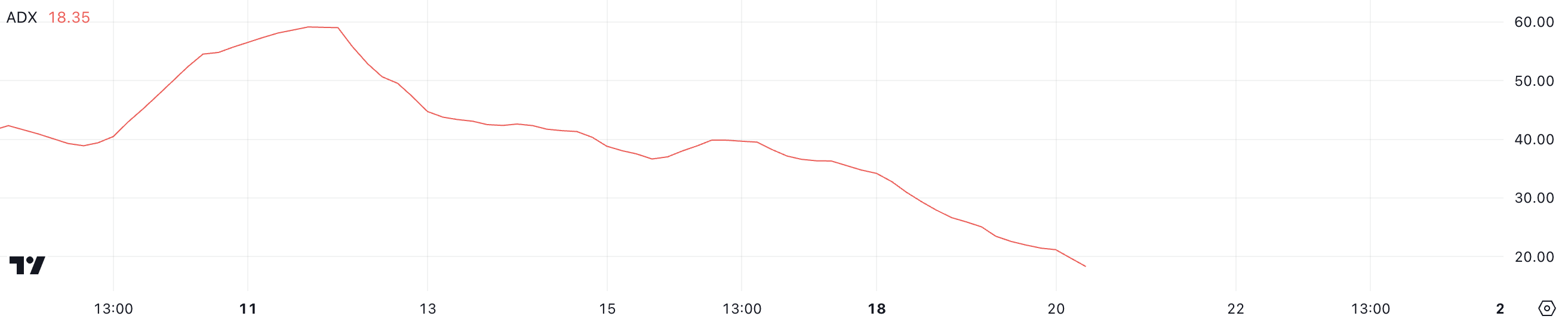

SUI's ADX Indicates Weakening Uptrend

The average directional index (ADX) for SUI has dropped significantly, currently at 18, after exceeding 30 just two days ago. This decline suggests that while SUI remains in an uptrend, the strength of this trend is weakening.

A declining ADX often indicates a decrease in momentum, and it may imply that SUI's recent price movements may lack the vigor seen in the current rally.

The ADX measures the strength of a trend, regardless of its direction, with various thresholds representing different momentum levels. Values below 20 indicate a weak or non-existent trend, while values above 25 suggest a strong trend is gaining strength.

The fact that SUI's ADX has fallen below these thresholds suggests that the uptrend is losing steam. If this weakened trend persists, SUI's price may be due for a correction or even a pullback.

SUI Price Prediction: Can It Break Above $4?

If SUI's current uptrend regains strength, it is likely to test the previous all-time high resistance at $3.94. Breaching this level would open the door for further gains, with the next key threshold at $4.

This scenario would signal a renewed bullish momentum and could attract the interest of traders looking to capitalize on the rally.

Conversely, a reversal to the downside could see SUI's price test the nearest support at $3.1. If this level fails to hold, the price could further decline, potentially reaching $2.2.

This would represent a significant 39% correction, indicating substantial downside risk should the market sentiment turn bearish.