The price of Ethereum (ETH) has lagged behind other major cryptocurrencies in this cycle. ETH has risen 32% since the beginning of the year, but its performance is significantly behind Bitcoin's 112% and Solana's 115% gains. Among the top 10 coins, Ethereum showed the least growth, excluding Avalanche.

This poor performance underscores the growing uncertainty around ETH. Key indicators such as whale activity and net exchange flows suggest that investors are becoming more cautious about betting on Ethereum.

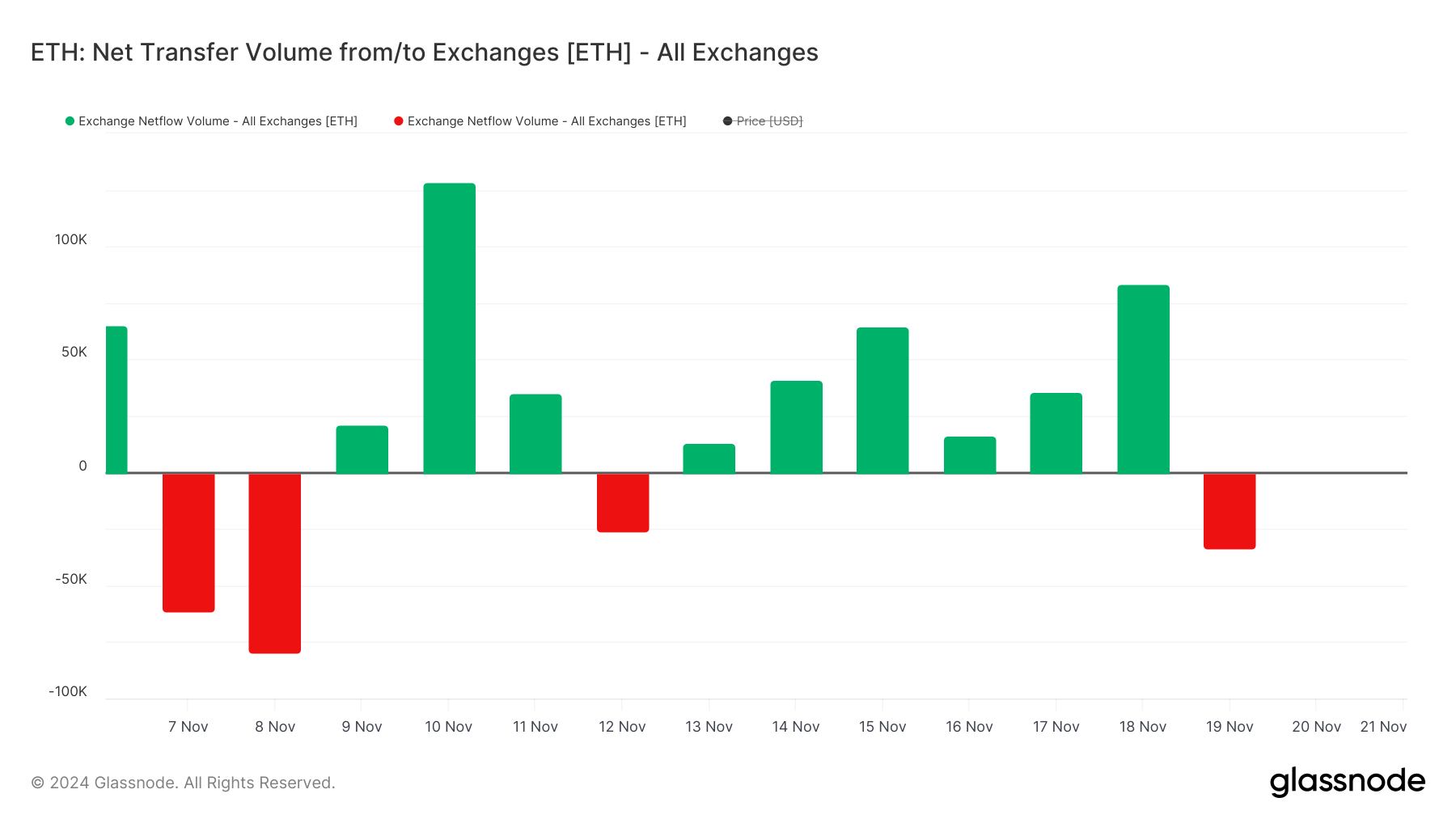

ETH has been flowing out of exchanges for a while... now massive inflows again

Ethereum's net flow from exchanges has seen notable fluctuations in recent weeks. The net flow was consistently positive from November 13 to November 18, reaching 83,500 on November 18.

Earlier this month, it reached a two-week high of 128,000 on November 10. However, on November 19, the flow reversed to -33,400.

Large inflows of ETH to exchanges generally indicate bearish sentiment, as users may be preparing to sell. Conversely, ETH outflows from exchanges can signal bullish outlook, as holders store their assets in personal wallets for long-term holding.

Despite the net outflow on November 19, this followed a positive flow for 6 consecutive days. While the recent withdrawals are a positive signal, sustained negative flows would be needed to decisively turn the ETH price trajectory bullish.

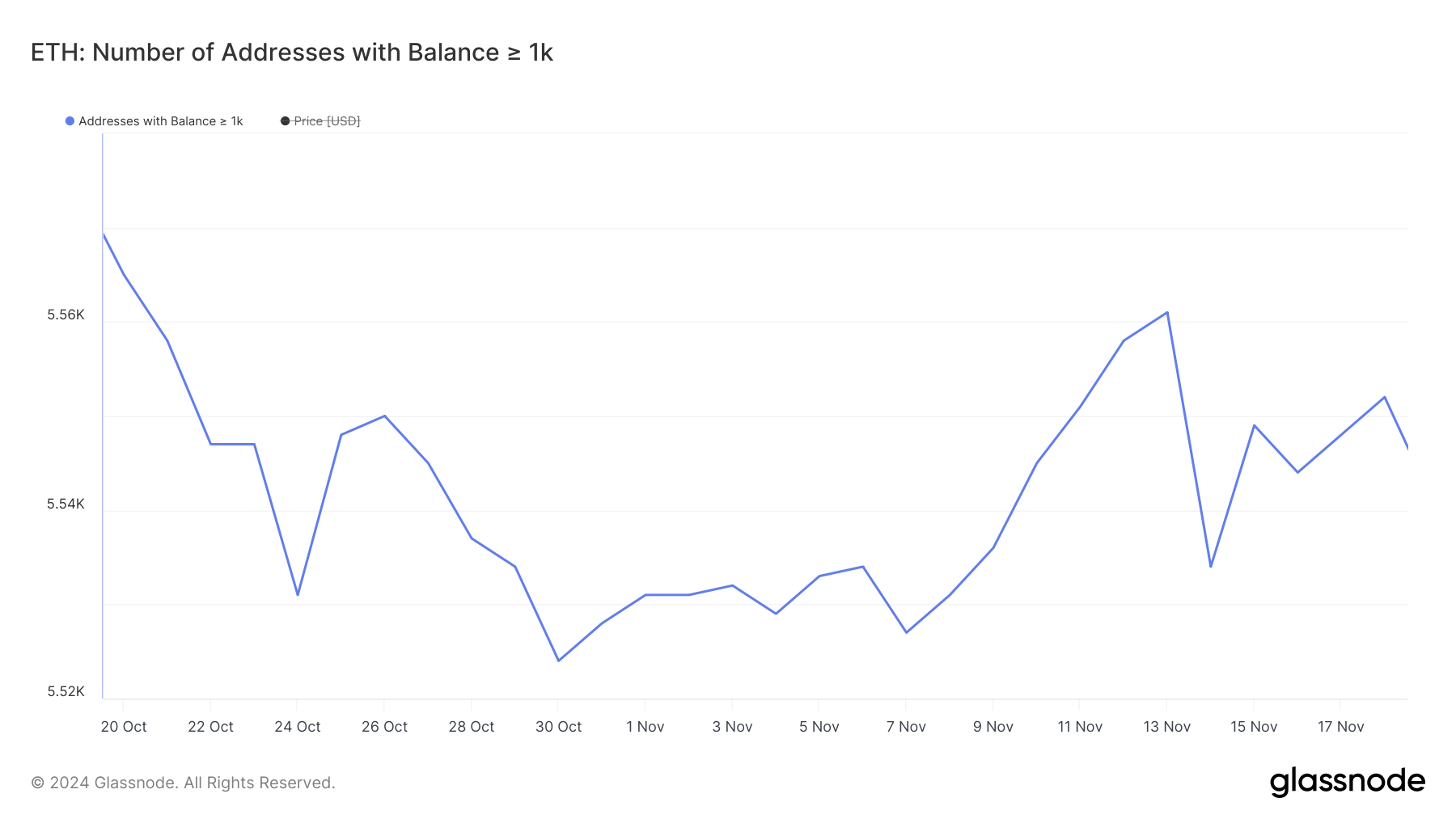

Number of whales holding over 1000 ETH decreasing

The number of Ethereum whales holding over 1000 ETH increased significantly between November 7 and November 13, rising from 5,527 to 5,561, indicating strong accumulation by large holders during this period.

However, on November 14, it dropped sharply to 5,534, and has since struggled to recover. Currently at 5,542, the fluctuations in this metric indicate uncertainty among whales. Their hesitation suggests uncertainty about whether ETH price can sustain a bullish run in the short term.

ETH Price Prediction: Correction or 15% Upside

Ethereum's short-term EMA line is still above the long-term line, but the gap is narrowing. If the short-term line crosses below the long-term line, it will form a death cross, which is a bearish signal that could indicate a strong downtrend.

If Ethereum enters a downtrend, it could test the nearest support at $2,990. Breaking below this level, the price could drop to $2,570.

Conversely, if whale confidence is restored, ETH price could rise. In this case, the price would first test the $3,219 resistance and could then climb to $3,448, providing around a 15% upside potential.