After Trump won the election, everyone expected the US government to accelerate the embrace of cryptocurrencies, keeping the Bitcoin market hot. On November 21, the price of Bitcoin hit a new all-time high, approaching the $95,000 mark.

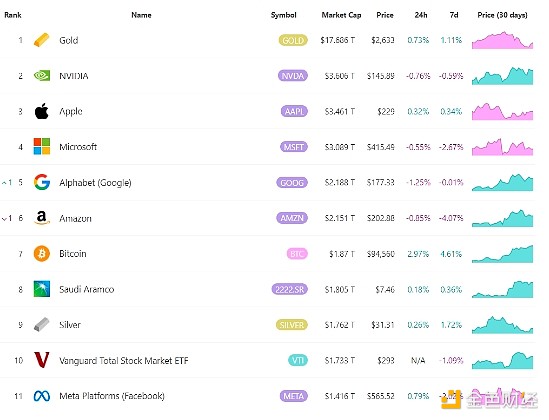

As the world's largest cryptocurrency, Bitcoin played a core role in this "Trump effect", with its price rising more than 35% since election day. So far this year, the price of Bitcoin has doubled. Currently, the market capitalization of Bitcoin is $1.87 trillion, about 10% of the gold market value, surpassing traditional giants such as silver and Saudi Aramco, ranking 7th among global assets.

Clear policy expectations have accelerated the rise of Bitcoin

As the first US president to be very friendly towards cryptocurrencies, Trump promised a number of supportive measures for cryptocurrencies during the campaign, such as including Bitcoin in the national reserves, making the US the world's cryptocurrency capital, and relaxing regulations. With Trump's victory, combined with the Republican sweep of both houses of Congress, Trump will have significant power to implement his agenda after taking office on January 20. The relatively clear policy expectations have accelerated the embrace of Bitcoin by traditional investors.

The Bitcoin spot ETF has become the most convenient channel for US stock investors. Data shows that there has been a continuous inflow of funds into BTC spot ETFs, with the total inflow of the top 10 ETFs increasing steadily in 7 days, and the current Bitcoin spot ETFs now hold over 1 million BTC.

In addition to ETFs, many institutions are also constantly buying. The "Bitcoin whale" MicroStrategy raised about $2 billion from October 31 to November 10 and purchased 272,000 BTC. On November 16, it acquired 51,780 BTC for about $4.6 billion, with the management planning to raise $42 billion from 2025 to 2027 to further increase its Bitcoin holdings. Currently, MicroStrategy owns about 1.67% of the globally circulating BTC. In addition, other listed companies on US, Hong Kong and Japanese stock exchanges have also disclosed their Bitcoin holdings in their latest financial reports, and more and more listed companies are planning to use Bitcoin as a treasury reserve asset.

Trump's crypto-friendly stance has not only impacted US policy, but has also driven the crypto asset layout of countries around the world. El Salvador is still buying 1 BTC per day, with its Bitcoin holdings reaching about 5,900 BTC. The government of Bhutan holds more than 12,000 BTC, accounting for 34% of its GDP. Market news indicates that oil-producing countries in the Gulf region such as Saudi Arabia, the UAE and Qatar may be investing in Bitcoin at the sovereign level.

Still room for upside? A look at BTC's performance after previous elections

In this cycle, the market reaction has been particularly enthusiastic due to Trump's support, and the price is now approaching $100,000. Does this mean that the policy benefits after the election have already been fully priced in, and is the upside potential of Bitcoin limited?

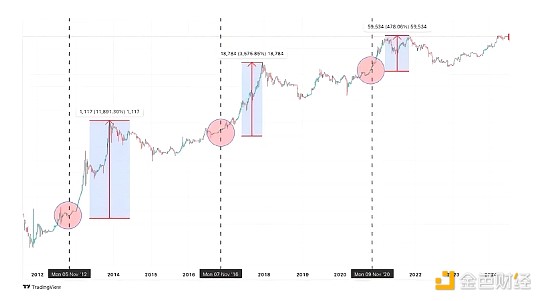

From a historical perspective, US presidential elections have had a long-term impact on Bitcoin prices. During the 2012 election (November 5), Bitcoin's price soared from around $11 before the election to over $1,100 a year later, a gain of nearly 12,000%. After Trump's election as US president in early November 2016, Bitcoin's price rose from around $700 to nearly $18,000 in December of the following year, an increase of about 3,600%. The 2020 election coincided with the COVID-19 pandemic, and Bitcoin surged 478% in a year to reach a high of around $69,000.

The data shows that after the previous three elections, Bitcoin has always maintained an upward trend, although the rate of increase has gradually decreased, but it has never fallen back to the election day price, and has ultimately reached a peak the following year. If this trend appears again, Bitcoin's price should reach its peak about a year later.

It is worth noting that the US presidential election and the Bitcoin halving cycle are synchronized, and in the past Bitcoin was a niche alternative investment market, so the halving had a more direct impact on the price than the election. However, in this cycle, Bitcoin has been integrated into the US financial system and has also become part of policy, so this election has a more direct impact on its price, undoubtedly providing new momentum for the rise of Bitcoin.

All signs indicate that the US election has become a key node in the development of cryptocurrencies, and Bitcoin is likely to end 2024 with an overwhelming positive momentum, and 2025 will be even more optimistic. 4E, as the official partner of the Argentine national team, supports the spot and contract trading of more than 200 cryptocurrencies including Bitcoin and Ethereum, covering various sectors with high liquidity and low fees.

At the same time, 4E has also integrated traditional financial assets into the platform, establishing a comprehensive one-stop trading system covering from deposit to cryptocurrencies, to US stocks, indices, forex, and bulk commodities like gold, with over 600 different risk-level assets that can be invested in with just holding USDT. In addition, the 4E platform has a $100 million risk protection fund to further safeguard the security of user funds. With 4E, investors can closely follow market dynamics, flexibly adjust their strategies and leverage, and seize every potential opportunity.