Original: Liu Jielian

Overnight, BTC continued to surge upwards, once approaching the historical high of 95,000. With BTC constantly hitting new highs and the frenzy of MEME coins, friends who hold a lot of altcoins, especially those heavily invested in ETH, feel their hearts bleeding every day.

The chart below shows the monthly chart of ETH/BTC over the past 6 years. When the wedge convergence comes to an end, not with an upward breakout, but with a downward breakdown, people's hopes are shattered. At this moment, even the KOLs who were bullish on ETH/BTC at the beginning of the year have lost their fighting spirit (refer to the article "Multiple crypto personalities are bullish on ETH/BTC, which may trigger the outbreak of the altcoin season" on 2024.2.28), truly deserving the term "exhausted".

Liu Jielian is also one of those who have jumped into the pit. Without concealment, during the 2021 bull market, Liu Jielian also played with DeFi and Non-Fungible Token, and at that time, those things were all on the Ethereum chain, so naturally he also accumulated a lot of ETH.

There is a kind of self-righteousness called "BTC is too expensive in the bull market, let's buy some altcoins (ETH) instead!" Liu Jielian also fell victim to this great wisdom, and in 2021 stopped adding high-priced BTC and instead bought altcoins including ETH.

When the tide goes out, you realize you're a naked swimmer.

Although Liu Jielian still has some risk control, in terms of US dollars, the ETH position is not currently in loss, but in terms of BTC, buying ETH instead of BTC that year was really a loss of BTC.

On ETH, Liu Jielian is "knowingly going towards the tiger mountain", or can be said to be "waiting for the tiger".

On the one hand, Liu Jielian is well aware of and has publicly written many articles pointing out that the risk of holding ETH is extremely high. The main theories (judgments) formed over the past more than 3 years are three:

1. The EIP-1559 burning mechanism makes ETH "softened" and lose its property as a store of value.

2. Abandoning PoW and switching to PoS greatly reduces the "entropy-absorbing" ability of the ETH system, thereby damaging its long-term value.

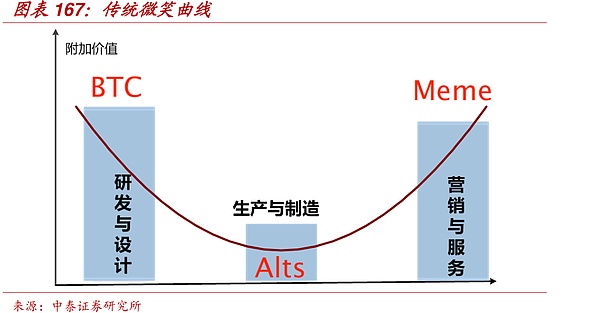

3. The value foundation of ETH - the Ethereum chain as the "web3 infrastructure" and "world computer" - is positioned in the midstream of the industry chain. And the midstream of the industry chain has the lowest moat and the lowest added value, which is the well-known "smile curve" in the industry.

Over the past year, or even the past two years, the BTC and MEME coin tracks at both ends of the smile curve have been pulling each other up, enjoying a great time. Liu Jielian then remembered this theory and quickly drew a picture to illustrate the current two-tier differentiation of the crypto market: institutions are temporarily only focused on increasing their BTC positions, and retail investors are speculating on MEME coins, with no one playing altcoins.

The two ends of the smile curve represent the core technology and brand marketing of the industry chain. One side holds the "core technology" (PoW), firmly grasping the "core value" (the safest store of value and value transfer), such as BTC; the other end firmly grasps the "user mindshare" (researching the All In to get rich, the least scammy air coins are actually more fair), catering to the "user demand" (speculating on coins to get rich), only retaining the "brand value" (no other value besides brand marketing), such as MEME coins, so these links have higher added value. The middle part of the curve represents production and manufacturing, which, although constantly developing, upgrading and innovating (such as Layer 1 and Layer 2 public chain infrastructure), due to fierce competition, low moats, easy replication, and strong substitutability, usually have the lowest added value.

In February this year, Liu Jielian also discussed this issue of the low moat of ETH (see the screenshot of the chat record below):

The original words in the screenshot are: "The use of ETH is to provide an infrastructure for speculation... Although speculation is illusory, the demand generated by speculation is real... So the moat of ETH is not high..."

In the past, when new public chains like Solana were not yet mature, and Layer 2 chains like Arbitrum and Base had not yet been widely replicated, Ethereum still had a technological lead at the left end and occupied the high ground of industry mindshare at the right end. But since 2021, new public chains have caught up, and then Layer 2 chains have sprung up like mushrooms after the rain, not only weakening Ethereum's technological advantage, but also the dazzling brands and names have greatly dispersed users' cognitive focus. Ethereum has been "blocked at both ends", causing its value to shrink seriously towards the middle of the smile curve!

On the other hand, despite the above cognition, Liu Jielian has not "unified knowledge and action", but has insisted on holding the ETH position, because he still has illusions about ETH and wants to see if ETH can defend its position in the industry and not be surpassed by the new public chains.

Frankly sharing these lessons, one is to reflect on and analyze myself, and the other is to show that although Liu Jielian has made some gains in the crypto market, he is by no means always right, on the contrary, he has made countless mistakes. Fortunately, these mistakes are not fatal and have not crushed Liu Jielian.

However, after so much reflection, it is not any operational advice. Liu Jielian often analyzes the bearish theories of his own holdings, both BTC and ETH. This is to stress test his own holdings. If he himself doesn't have the courage to withstand the stress test, maybe he shouldn't have built positions and held them in the first place!

If he can use the most rigorous logic to look bearish on his own positions every day, but still be able to hold firmly without cutting losses, then it will be very difficult for any superficial bearish voices in the market to shake his firm holding.

The most steadfast spot bull must be the expert who knows all the bearish theories the best.

Since positions have been built, one must have the determination to hold them to zero. This is called "facing death with equanimity".

Liu Jielian will not cut his positions and switch at this time.

One principle is to never cut losses at the most pessimistic time in the market.

Of course, Liu Jielian may be wrong again. But the worst consequence of this mistake is just that his ETH position goes to zero.

Before building a position, one must think clearly, if it goes to zero, can you accept such a large position? If not, then reduce it, reduce it further, until you can accept it. This is called "risk control".

One of the main reasons for losses in the financial market is that people invest funds that they cannot afford to lose.

Never wait until the loss occurs to start regretting.

Liu Jielian says, one must revere the market.

Never be complacent about a little profit. Never think you are smarter than the market. Never think you have the ability to beat the market.

The market is ultimately effective. Trying to beat the market and be smarter than the market will only expose one's own ignorance.

You laugh at the market as too crazy, the market laughs at you for not seeing through it.

Cutting losses in despair and not being able to hold on, buying high and selling low, losing everything.