Table of Contents

ToggleBit continues to hit new highs, Ether is still sleeping

As Bit continues to hit new highs, the ETH/BTC exchange rate on major exchanges has fallen to its lowest level since March 2021.

According to trading data from Binance, the ETH/BTC exchange rate has fallen by about 4.94% in the past 24 hours, standing at 0.03193 BTC at the time of writing. This indicator has fallen by more than 40% since the beginning of 2024.

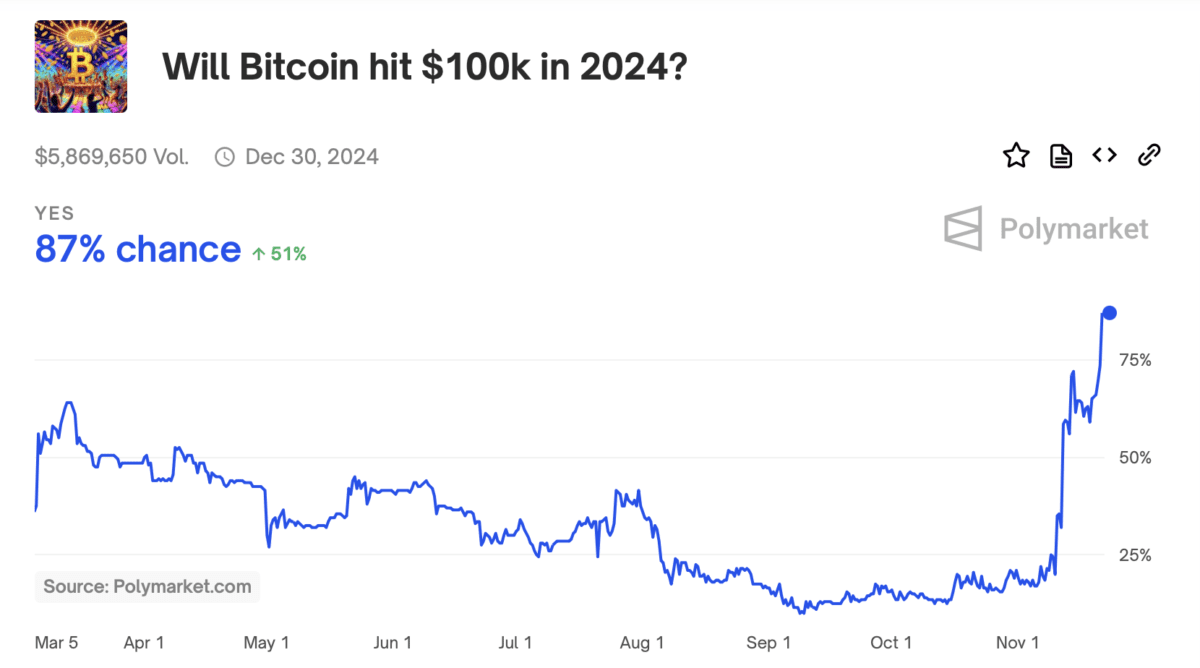

Bit price broke through $97,700 for the first time today, further fueling market expectations that it will reach $100,000 by the end of the year. According to the latest data from the prediction market Polymarket, the market expects the probability of Bit reaching $100,000 by the end of the year to be as high as 87%.

Ether is struggling to regain strength

Affected by the soaring Bit price, the downward trend of ETH/BTC has further accelerated since July. The two major positive factors, the US approval of the Bit spot ETF and Trump's victory, have undoubtedly been the two main drivers of Bit's rise in 2024. Rachael Lucas of BTCMarkets said:

"This has attracted the attention of a large number of institutions and retail investors, further consolidating Bit's position as 'digital gold'."

In contrast, although the overall market has risen due to Trump's victory, Ethereum's performance has been relatively weak. In the past week, Bit has risen by more than 7%, while Ether has fallen by 3.2%. Steven Zheng, a research analyst at The Block, pointed out:

"Ether is currently facing a double competitive pressure. On the one hand, it competes with Bit as a value storage tool; on the other hand, it competes with Solana as a smart contract platform. This makes investors uncertain about the value positioning of Ether in the short term."

In addition, Rachael Lucas supplemented that since the Merge upgrade of Ether in 2022, its momentum has been affected by the regulatory uncertainty of the US possibly classifying it as a financial security, making it difficult to regain strength. However, Steven Zheng believes that Ether is still the most active smart contract platform for economic activity, and it still attracts developers to create new applications, which may help it regain market momentum.