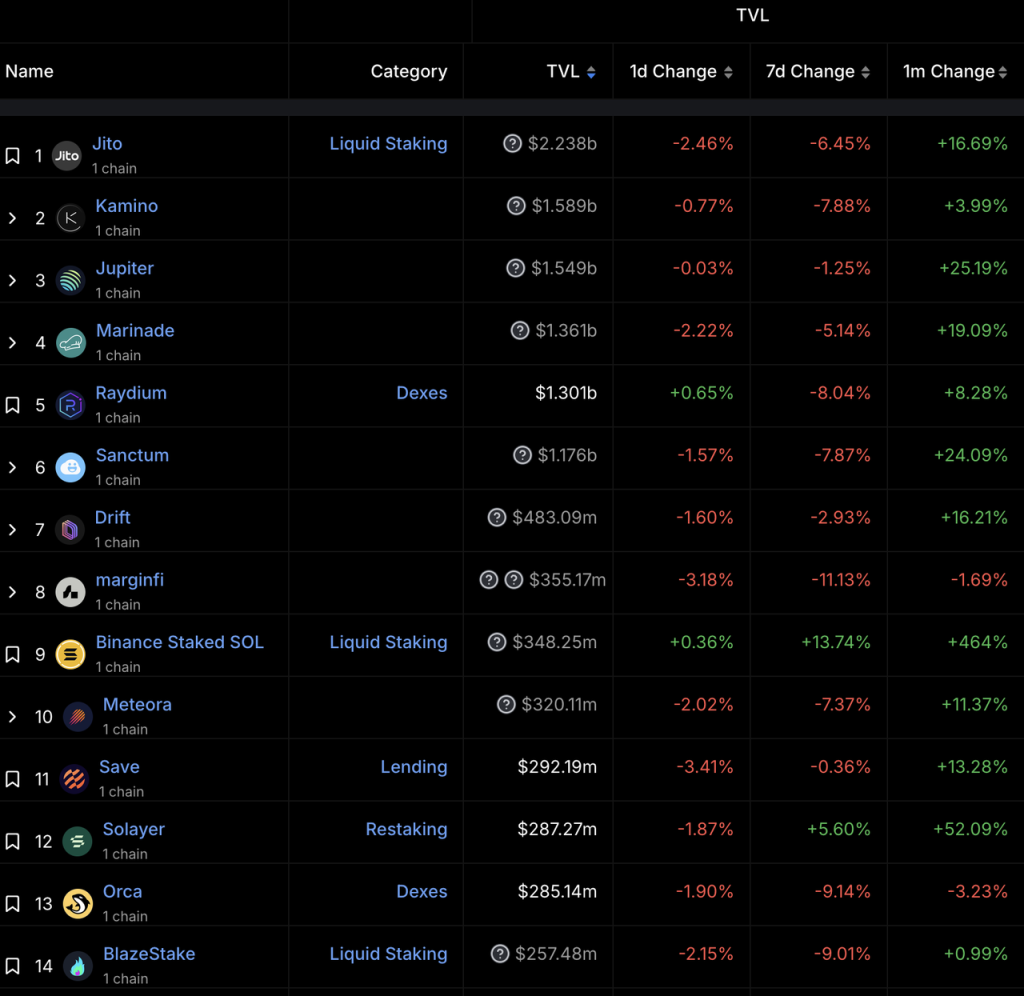

After receiving two rounds of financing in succession, including US$12 million in financing led by Polychain and financing from Binance labs, the restaking project Solayer on the Solana chain has become one of the few bright spots in the DeFi field in the recent market, and its TVL has also continued to rise. Currently It has surpassed Orca and ranks twelfth in TVL on the Solana chain.

Solana Project TVL Ranking Source: DeFillama

As a segmented track native to encryption, the staking track is also the largest encryption track of TVL. Its representative tokens LDO, EIGEN, ETHFI, etc. have struggled very much in this cycle, regardless of the Ethereum network in which they are located. Is there any other reason besides the road?

- How competitive are the staking and restaking protocols that revolve around users' staking behavior in the entire staking ecosystem?

- How is Solayer's restaking different from Eigenlayer's restaking?

- Is Solayer's restaking a good business?

I hope this article can answer the above questions. Let’s start with staking and restaking on the Ethereum network.

The competitive situation and development pattern of Liquid Staking, Restaking, and Liquid Restaking on the Ethereum network

In this section we will mainly discuss and analyze the following projects:

The Ethereum network's top liquid staking project Lido, top restaking project Eigenlayer and top liquid restaking project Etherfi.

Lido’s business logic and revenue structure

For Lido’s business logic, we briefly describe it as follows:

Due to Ethereum's insistence on decentralization, ETH's PoS mechanism softly limits the pledge limit of a single node. A single node can only obtain higher capital efficiency by deploying a maximum of 32 ETH, and at the same time, the pledge has relatively high hardware. , network and knowledge requirements, the threshold for ordinary users to participate in ETH staking is relatively high.

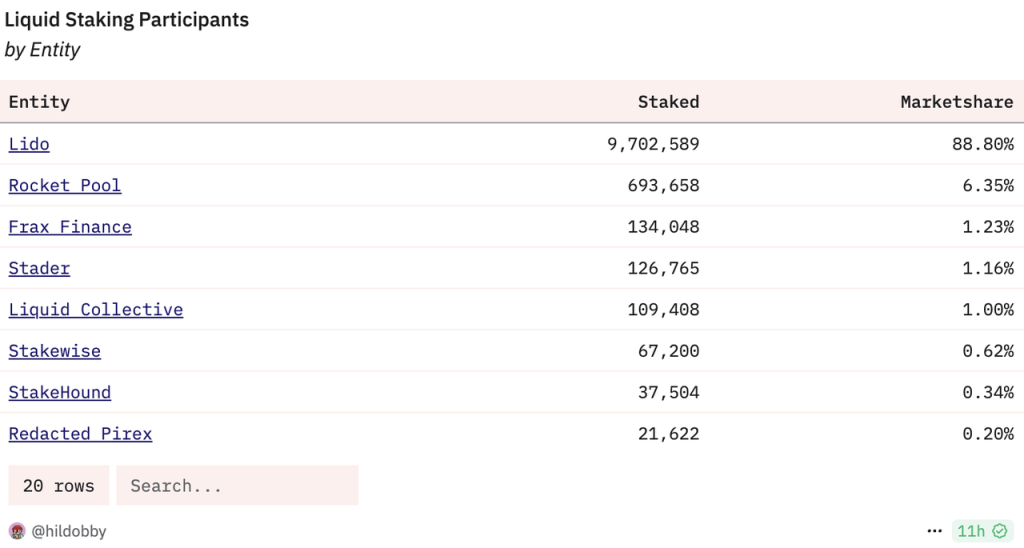

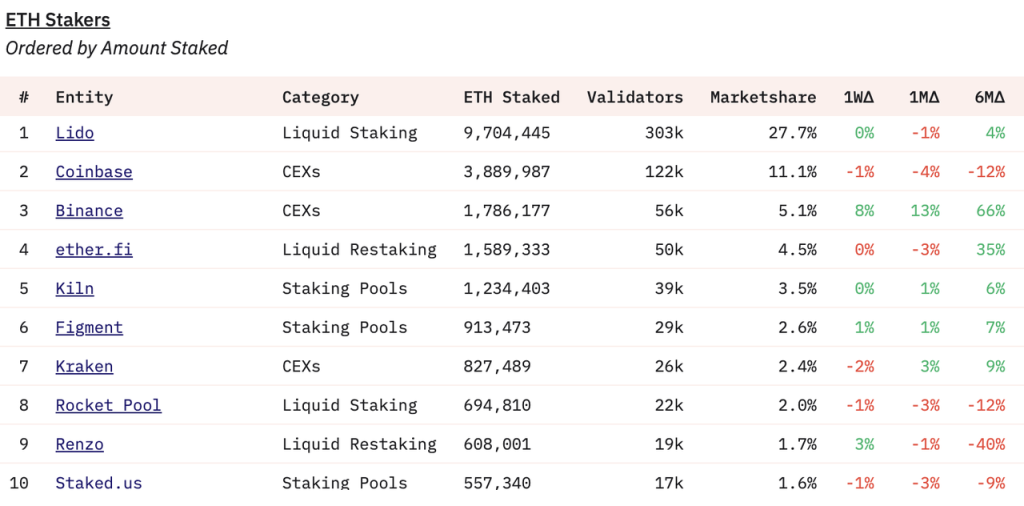

In this context, Lido carries forward the LST concept. Although LST's liquidity advantage has been weakened after Shapella upgraded and opened withdrawals, LST's advantages in capital efficiency and composability remain solid, which constitutes the basic business logic of the LST protocol represented by Lido. In the liquid staking project, Lido leads the market with a market share of nearly 90%.

Liquid staking players and market share Source: Dune

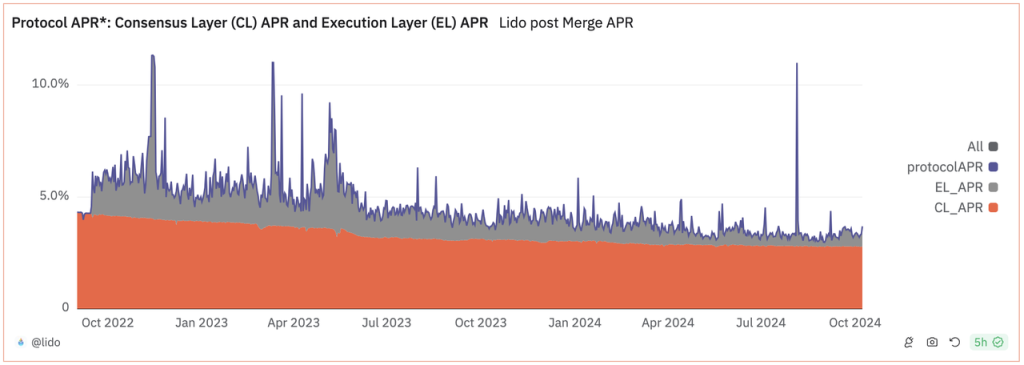

The revenue of the Lido protocol mainly comes from two parts: consensus layer revenue and execution layer revenue. The so-called consensus layer revenue refers to the PoS additional issuance revenue of the Ethereum network. For the Ethereum network, this part of the expenditure is paid to maintain the network consensus, so it is called the consensus layer revenue. This part is relatively fixed. (The orange part in the picture below); and the execution layer revenue includes the priority fee and MEV paid by the user (for the analysis of the execution layer revenue, readers can go to Mint Ventures’ previous article to learn more), this part of the revenue is not generated by the Ethereum network Payment is made by the user in the process of executing the transaction (or indirect payment). This part changes with the popularity on the chain and fluctuates greatly.

Lido Protocol APR Source: Dune

Eigenlayer’s business logic and revenue structure

The concept of Restaking was proposed by Eigenlayer last year and has become a rare new narrative in the DeFi field and even the entire market in the past year or so. It has also given birth to a series of projects with FDV of more than 1 billion US dollars when launched (in addition to EIGEN, there are also ETHFI, REZ and PENDLE), as well as many restaking projects that have not yet been launched (Babylon, Symbiotic and Solayer, which we will focus on below), the market popularity is evident (Mint Ventures conducted research on Eigenlayer last year, and interested readers can check it out).

According to its definition, Eigenlayer's Restaking means that users who have staked ETH can re-stake their already staked ETH on Eigenlayer (thereby obtaining excess income), hence the name 'Re' Staking.

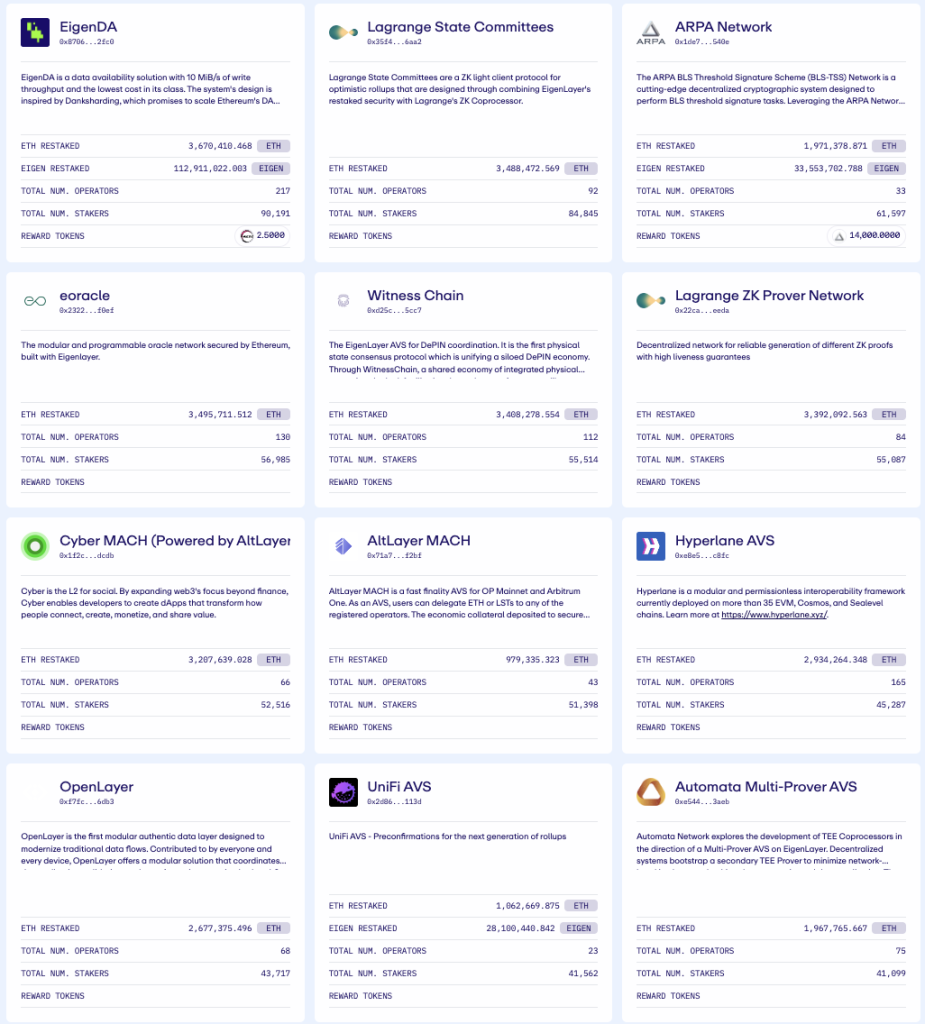

Eigenlayer named the service it provides AVS (Actively Validated Services, literally translated as "Active Verification Service" in Chinese), which can provide services for various protocols that require security, including side chains, DA layers, virtual machines, and oracles. , bridges, threshold encryption schemes, trusted execution environments, etc. EigenDA is a typical representative of using EigenlayerAVS service.

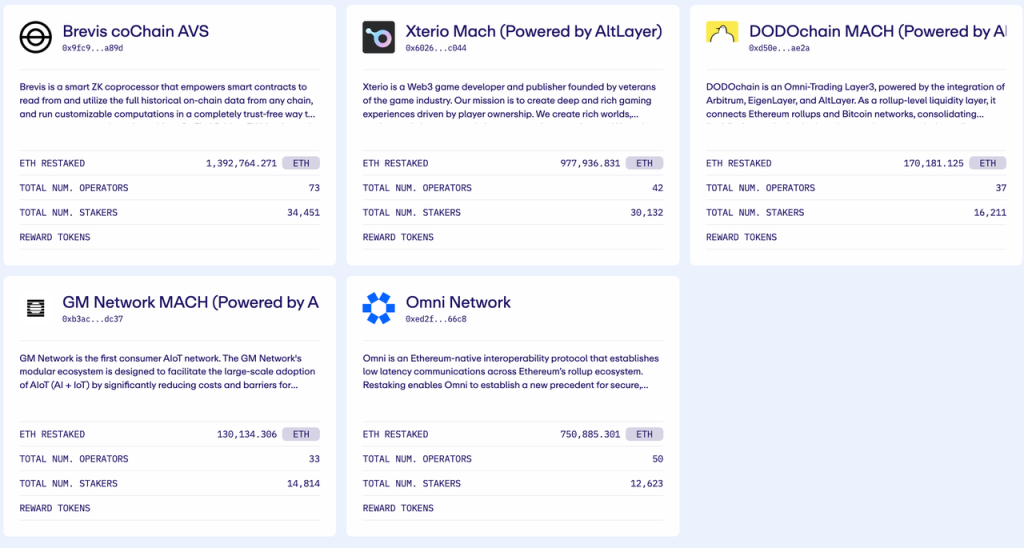

Source of the protocol currently using Eigenlayer AVS: Eigenlayer official website

Eigenlayer's business logic is also relatively simple. On the supply side, they raise assets from ETH stakers and pay fees; on the demand side, protocols with AVS demand pay to use its services, and Eigenlayer acts as a "protocol security market" to match and earn a certain amount of money. cost.

However, when we look at all current restaking projects, the only real yield is still the tokens (or points) of the relevant protocols. We are not yet sure that restaking has obtained PMF: from the supply side, everyone likes the additional income brought by restaking. ; But the demand side is still a mystery: Is there really a protocol that will purchase protocol economic security services? If so, how many?

Multicoin founder Kyle Samani has questions about the restaking business model Source: X

From the perspective of the target users that Eigenlayer has issued tokens: oracles (LINK, PYTH), bridges (AXL, ZRO), DA (TIA, AVAIL), pledging tokens to maintain protocol security is the core use case of its tokens. , choosing to purchase security services from Eigenlayer will greatly weaken the rationality of its token issuance.

Even Eigenlayer itself, when explaining the EIGEN token, used very abstract and obscure language to express the view that "using EIGEN to maintain protocol security" is the main use case.

How to survive Liquid restaking (Etherfi)

Eigenlayer supports two ways to participate in restaking: using LST and native restaking. The way to use LST to participate in Eigenlayer Restaking is relatively simple. After users deposit ETH in the LST protocol and obtain LST, they can deposit the LST into Eigenlayer. However, the LST pool has a long-term limit. Users who want to participate in restaking during the limit period need to follow the following methods Perform native restaking:

- Users first need to complete the entire process of staking on the Ethereum network by themselves, including fund preparation, execution layer and consensus layer client configuration, setting withdrawal certificates, etc.

- The user creates a new contract account named Eigenpod in Eigenlayer

- The user sets the withdrawal private key of the Ethereum staking node to the Eigenpod contract account.

It can be seen that Eigenlayer's restaking is a relatively standard 're'staking. Whether the user deposits other LST into Eigenlayer or native restaking, Eigenlayer does not directly "contact" the user's pledged ETH (Eigenlayer does not directly "contact" the user's pledged ETH. issue any LRT). The process of Native restaking is a "complex version" of ETH's native staking, which means similar capital, hardware, network and knowledge thresholds.

So projects such as Etherfi quickly provided Liquid Restaking Tokens (LRTs) to solve this problem. Etherfi’s eETH operation process is as follows:

- Users deposit ETH into Etherfi, and Etherfi issues eETH to users.

- Etherfi will pledge the ETH it receives, so that it can obtain the basic income of ETH pledge;

At the same time, they follow Eigenlayer’s native restaking process to privately store node withdrawals. - The key is set to the Eigenpod contract account, so that Eigenlayer's restaking income (and $EIGEN, $ETHFI) can be obtained.

Obviously, the services provided by Etherfi are the optimal solution for users who hold ETH and want to earn income: on the one hand, eETH is simple to operate and has liquidity, which is basically the same as Lido’s stETH experience; on the other hand, users By depositing ETH into Etherfi's eETH pool, you can get: basic ETH staking income of about 3%, Eigenlayer's possible AVS income, Eigenlayer's token incentives (points), and Etherfi's token incentives (points).

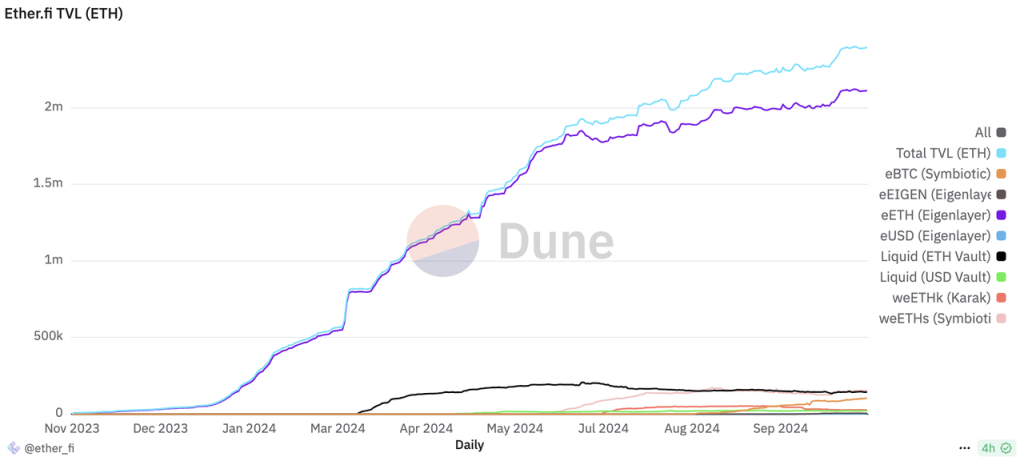

eETH accounts for 90% of Etherfi TVL, contributing to Etherfi more than $6 billion in TVL at its peak and a maximum of $8 billion in FDV, making Etherfi the fourth largest staking entity in just six months.

Etherfi TVL distribution source: Dune

Source of pledge ranking: Dune

The long-term business logic of the LRT protocol is to help users participate in staking and restaking at the same time in a simpler and easier way, thereby obtaining higher returns. Since it does not generate any revenue itself (except for its own token), in terms of overall business logic, the LRT protocol is more similar to ETH's specific revenue aggregator. If we analyze it carefully, we will find that the existence of its business logic relies on the following two premises:

- Lido cannot provide liquid restaking services. If Lido is willing to "imitate" its stETH from eETH, it will be difficult for Etherfi to match its long-term brand advantage, security endorsement, and liquidity advantages.

- Eigenlayer cannot provide liquid staking services. If Eigenlayer is willing to directly absorb users' ETH for staking, it will also greatly weaken the value proposition of Etherfi.

From a pure business logic point of view, as the top liquid staking company Lido provides users with liquid restaking services to provide users with a wider source of income, and it is completely feasible for Eigenlayer to directly absorb user funds for more convenient staking & restaking. So why doesn’t Lido do liquid restaking and Eigenlayer doesn’t do liquid staking?

The author believes that this is determined by the special circumstances of Ethereum. Vitalik In May 2023, Eigenlayer had just completed a new round of financing of US$50 million. When it triggered a lot of discussions in the market, he wrote a special article "Don't overload Ethereum's consensus" (Don't overload Ethereum's consensus), using a series of examples He elaborated on his views on how the Ethereum consensus should be reused (that is, "how should we restake").

As for Lido, because its scale has long accounted for about 30% of the pledge ratio of Ethereum, there have been constant voices within the Ethereum Foundation to restrict it. Vitalik has also personally written articles many times to discuss the issue of pledge centralization, which also forced Lido to " "Aligning with Ethereum" as its business focus, not only has it gradually shut down the business of all other chains except Ethereum, including Solana, its de facto leader Hasu issued a document in May this year, confirming that it would abandon its restaking business. It is possible to limit Lido business to staking, and instead invest in and support the restaking protocol Symbiotic, and establish the Lido Alliance to cope with the competition for its market share from LRT protocols such as Eigenlayer and Etherfi.

Reaffirm that stETH should stay an LST, not become an LRT. (Reaffirm that stETH should stay an LST, not become an LRT.)

Support Ethereum-aligned validator services, starting with preconfirmations, without exposing stakers to additional risk. (Support Ethereum-aligned validator services, starting with preconfirmations, without exposing stakers to additional risk.)

Make stETH the #1 collateral in the restaking market, allowing stakers to opt into additional points on the risk and reward spectrum.

Source of Lido’s position on restaking related matters

As for Eigenlayer, Ethereum Foundation researchers Justin Drake and Dankrad Feist were hired as consultants by eigenlayer very early on. Dankrad Feist said that the main purpose of joining was to "align eigenlayer with Ethereum." This may also be eigenlayer's native restaking. The process is quite inconsistent with the user experience.

In a sense, Etherfi's market space is brought about by the Ethereum Foundation's "distrust" of Lido and Eigenlayer.

Analysis of Ethereum Pledge Ecological Agreement

Combining Lido and Eigenlayer, we can see that in the current PoS chain, surrounding the staking behavior, apart from the token incentives of related parties, there are three long-term sources of income:

- PoS underlying income , the native token paid by the PoS network to maintain network consensus. The rate of return on this part mainly depends on the chain’s inflation plan. For example, Ethereum’s inflation plan is linked to the pledge ratio. The higher the pledge ratio, the slower the inflation rate.

- Transaction sorting income , the fees that nodes can obtain during the process of packaging and sorting transactions, including the priority fee given by users, and the MEV income obtained during the process of packaging and sorting transactions, etc. The rate of return in this part mainly depends on the activity of the chain.

- The income from leasing pledged assets means leasing the assets pledged by the user to other protocols in need, thereby obtaining the fees paid by these protocols. This part of the income depends on how many protocols with AVS demand are willing to pay fees to obtain protocol security.

On the Ethereum network, there are currently three types of protocols surrounding staking:

- Liquid staking protocols represented by Lido and Rocket Pool. They can only obtain benefits 1 and 2 above. Of course, users can take their LST to participate in Restaking, but as far as the protocol is concerned, the only things they can draw are 1 and 2 mentioned above.

- Restaking protocols represented by Eigenlayer and Symbiotic. This type of agreement can only obtain the third type of benefits mentioned above.

- Etherfi and Puffer represent liquid restaking protocols. They can theoretically obtain all 3 types of income mentioned above, but they are more similar to "LST that aggregates restaking income"

At present, the underlying income of ETH PoS is around 2.8% annually, which means it will slowly decrease as the pledge ratio of ETH increases;

The transaction sorting income has dropped significantly with the launch of EIP-4844, and has been around 0.5% in the past six months.

The base of pledged asset rental income is too small to be annualized, and it relies more on EIGEN and the token incentives associated with the LRT protocol to make this part of the incentive considerable.

For the LST protocol, its revenue base is the pledge amount * pledge yield. The amount of ETH pledged is close to 30%. Although this value is still significantly lower than other PoS public chains, from the perspective of decentralization and economic bandwidth of the Ethereum Foundation, we do not want too much ETH to flow into Staking (see Vitalik’s recent blog post, the Ethereum Foundation has discussed whether to set the upper limit of ETH staking to 25% of the total amount); while the staking yield continues to decline, stabilizing at 6% from the end of 22, and can often A short-term APR of around 10% has been reduced to only 3% now, and there is no reason to go back up in the foreseeable future.

For the above protocol tokens, in addition to being subject to the decline of ETH itself:

The market ceiling of LST on the Ethereum network has gradually become visible, which may be the reason for the poor price performance of the LST protocol governance tokens of LDO and RPL;

For EIGEN, restaking protocols on other PoS chains, including the BTC chain, are currently emerging, which basically limits Eigenlayer's business to the Ethereum ecosystem, further reducing the unclear market size of its AVS market. Potential upper limit;

The emergence of the LRT protocol that was not expected (the FDV of ETHFI at its peak exceeded 8 billion, exceeding the historical highest FDV of LDO and EIGEN) has further "diluted" the value of the above two in the staking ecosystem;

For ETHFI and REZ, in addition to the above factors, the excessive initial valuation brought about by listing during the market boom is a more important factor affecting the price of their tokens.

Solana’s staking and restaking

The execution mechanism of the liquid staking protocol of the Solana network represented by Jito is basically the same as that of the Ethereum network. But Solayer's restaking is different from Eigenlayer's restaking. In order to understand Solayer's restaking, we need to first understand Soalna's swQoS mechanism.

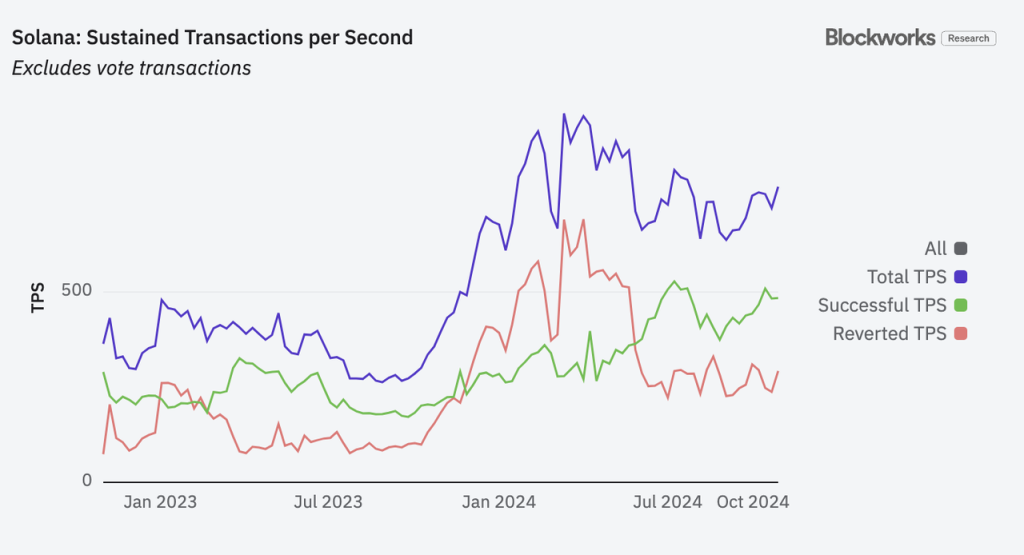

Solana Network's swQoS (stake-weighted Quality of Service, pledge-weighted quality of service mechanism) officially came into effect after a client version upgrade in April this year. The starting point of the swQoS mechanism is for the overall efficiency of the network, because the Solana network experienced a long period of network lag during the meme craze in March.

Simply put, after swQoS is enabled, the block producer determines the priority of its transactions based on the pledge amount of the pledger. A pledger with x% pledge ratio of the entire network can submit up to x% of the transactions (specific details about swQoS Mechanism and far-reaching impact on Solana, readers can read Helius's article). After swQoS was enabled, the transaction success rate of the Solana network increased rapidly.

Solana Network Success and Failure TPS Source: Blockworks

swQoS "floods" the transactions of small-amount pledgers in the network, thereby giving priority to guaranteeing the rights and interests of larger-amount pledgers in the network when network resources are limited, thus avoiding attacks on the system by malicious transactions.

To a certain extent, "the greater the pledge ratio, the more network privileges you can enjoy" is in line with the logic of the PoS public chain: if a greater proportion of the chain's native tokens are pledged, the contribution to the stability of the chain and the chain's native tokens will be the same. The more you have, the more privileges you deserve.

Of course, the centralization problem of this mechanism is also very obvious: larger pledgers can naturally obtain more priority transaction rights, and priority transaction rights will bring more pledgers, so that the advantages of the top pledgers can be self-exclusive. Strengthen and further tend to oligopolize or even form a monopoly.

This seems to run counter to the decentralization advocated by the blockchain, but this is not the focus of this article. From Solana’s consistent development history, we can also clearly discover Solana’s “efficiency first” pragmatism on decentralization issues. manner.

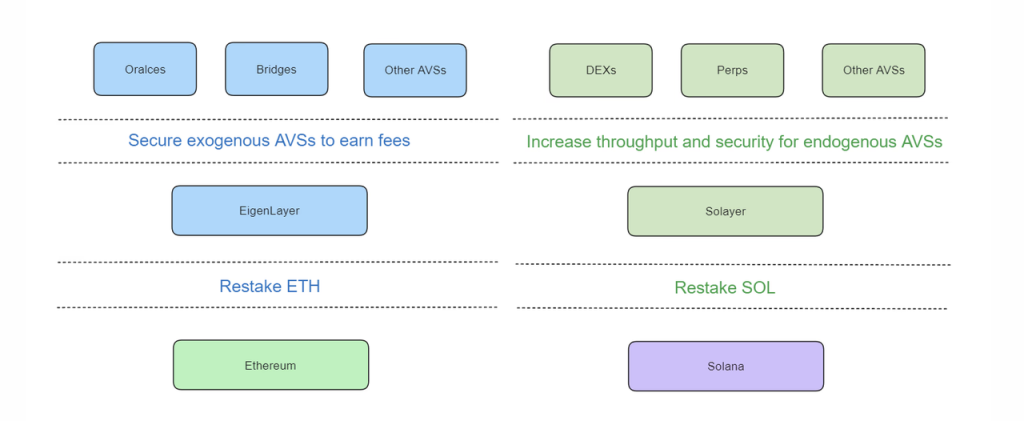

In the context of swQoS, the target users of Solayer's restaking are not oracles or bridges, but protocols that require transaction passability/reliability, such as DEX. So Solayer calls the AVS service provided by Eigenlayer Exogenous AVS, because these systems served by Eigenlayer are usually located outside the Ethereum main chain. The service it provides is called Endogenous AVS because its service objects are located within the Solana main chain.

The source of the difference between Solayer and Eigenlayer

It can be seen that although they both lease pledged assets to other protocols in need to achieve 're'staking, the core services provided by Solayer's endogenous AVS and Eigenlayer's exogenous AVS are different.

Solayer's endogenous AVS is essentially a "transaction passability leasing platform", and its users are platforms (or their users) that require transaction passability, while Eigenlayer is a "protocol security leasing platform". The core support of its endogenous AVS is Solana's swQoS mechanism. As Solayer says in its documentation:

We did not fundamentally agree with EigenLayer's technical architecture. So we re-architected, in a sense, restandardized restaking in the Solana ecosystem. Reusing stake as a way of securing network bandwidth for apps. We aim to become the de facto infrastructure for stake- weighted quality of service, and eventually, a core primitive of the Solana blockchain/consensus.

"We fundamentally disagree with the technical architecture of EigenLayer. So in a sense, we restructured restaking in the Solana ecosystem. Reusing Stake as a way to protect APP network bandwidth. Our goal is Become the de facto infrastructure of swQoS and eventually become the core primitive of the Solana blockchain/consensus.”

Of course, if there are other protocols on the Solana chain that have pledged asset requirements, such as protocol security requirements, Solayer can also lease its SOL to these protocols. In fact, by definition, any rental/reuse of pledged assets can be called re-hypothecation and does not have to be limited to security requirements.

Due to the existence of the Solana chain's swQoS mechanism, the restaking business scope on the Solana chain is wider than that on the Ethereum chain. Judging from Solana's recent hot on-chain activity, the demand for transaction passability is greater than the demand for security. More rigid.

Is Solayer's restaking a good business?

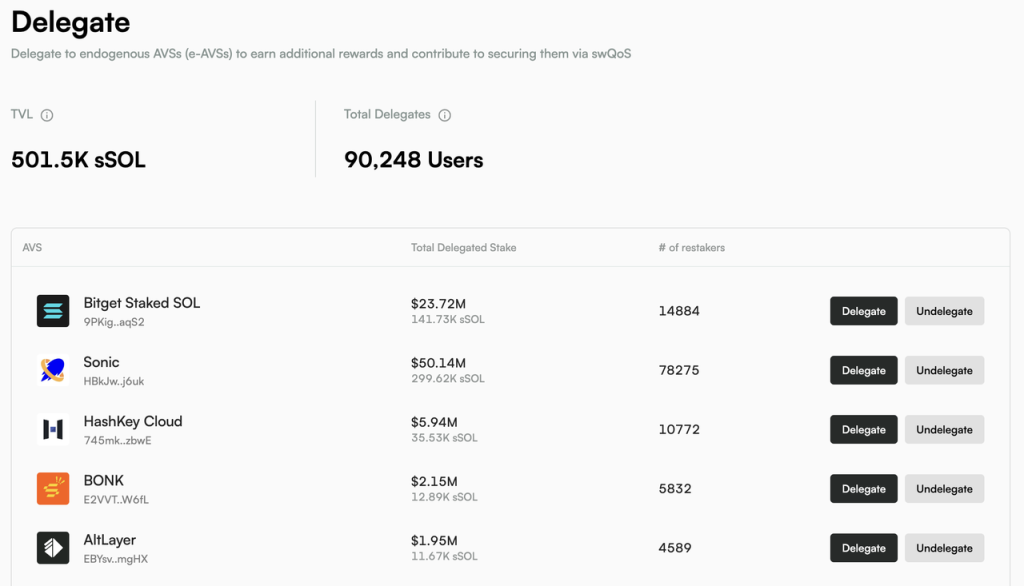

The business process for users to participate in Solayer restaking is as follows:

- Users deposit SOL directly into Solayer, and Solayer issues sSOL to users.

- Solayer will pledge the SOL received to obtain basic staking income.

- At the same time, users can entrust sSOL to protocols that have a demand for transaction approval rates, thereby obtaining fees paid by these protocols.

Current AVS source of Solayer

It can be seen that Solayer is not only a restaking platform, but also a restaking platform that directly issues LST. From a business process perspective, it is like Lido that supports native restaking on the Ethereum network.

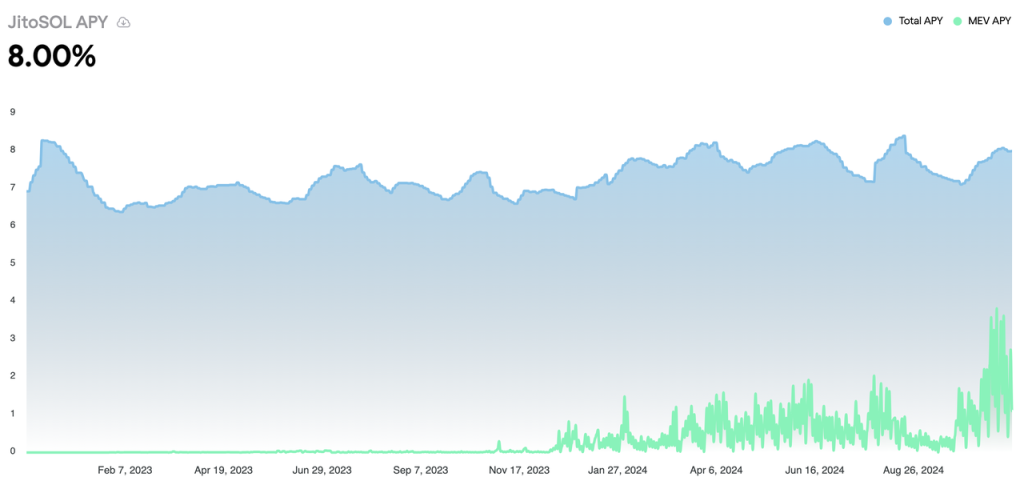

As mentioned earlier, there are three sources of income surrounding staking. The situation of these three incomes on the Solana network is as follows:

- The underlying income of PoS , the SOL paid by Solana in order to maintain the network consensus, the annualized income of this part is around 6.5%, and this part of the income is relatively stable.

- Transaction sorting income , the fees that nodes can obtain during the process of packaging and sorting transactions, including the priority fee given by users for early transactions, and the tips paid by MEV searcher. The two parts add up to approximately The rate is about 1.5%, but it varies greatly, depending on the level of activity on the chain.

- Proceeds from leasing pledged assets , leasing the assets pledged by users to other protocols with needs (transaction passability, protocol security, or other), this part has not yet reached a large scale.

SOL liquid staking (taking JitoSOL as an example) APY’s total income and MEV income sources

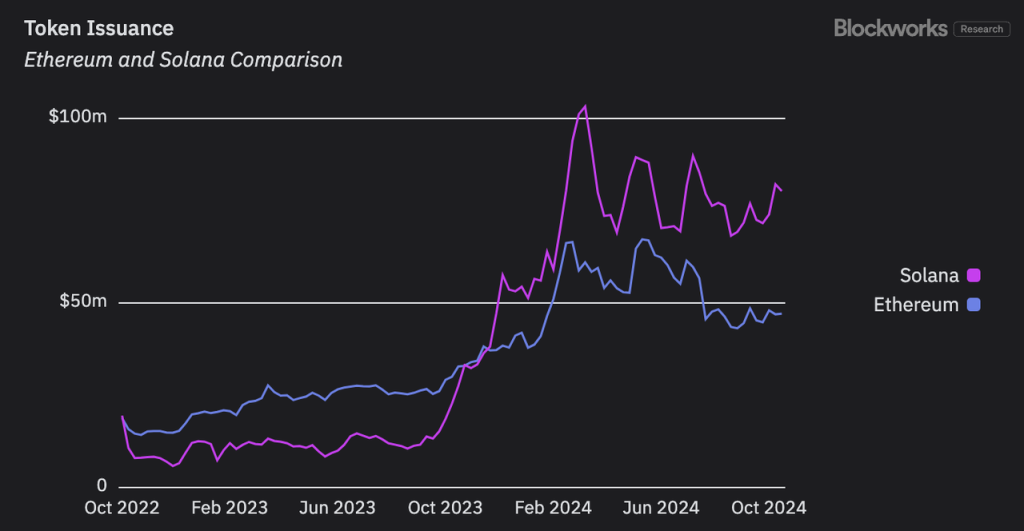

If we carefully compare the above three returns of Ethereum and Solana, we will find that although the market value of SOL is still only 1/4 of ETH, and the market value of staked SOL is only about 60% of the market value of staked ETH, the pledge-related protocols of the Solana chain are less than The staking-related protocols of the Ethereum chain have in fact a larger market and a larger potential market because:

1. PoS underlying income: The income that SOL is willing to pay for additional network issuance has been higher than that of ETH since December 23, and the gap between the two is still widening. Whether it is ETH or SOL staking, this accounts for more than 80% of its yield, which determines the income baseline of all staking-related protocols.

Ethereum and Solana token additional issuance rewards (i.e., the underlying PoS revenue of the network) Source: Blockworks

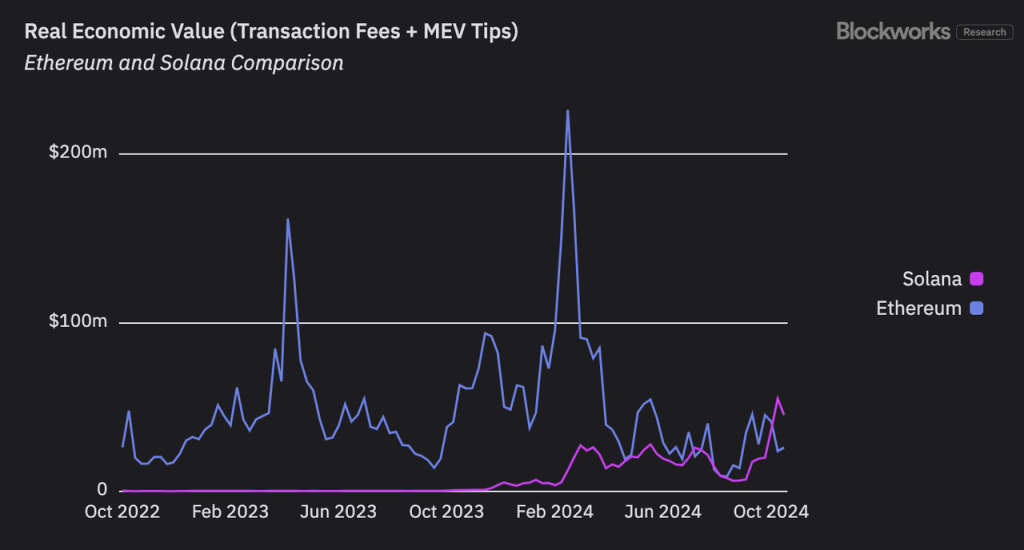

2. In terms of transaction sorting income: Blockworks uses transaction fees and MEV tips to reflect the real economic value (REV, Real Economic Value) of a chain. This indicator can approximately reflect the maximum value of transaction sorting income that a chain can obtain. We can see Although the REV of both chains fluctuates greatly, Ethereum's REV dropped sharply after the Cancun upgrade, while Solana's REV showed an overall upward trend and successfully surpassed Ethereum recently.

REV for Solana and Ethereum Source: Blockworks

In terms of rental income from pledged assets, compared to the current security income of the Ethereum network, Solana's swQoS mechanism can bring additional leasing demand for transaction passability.

In addition, Solana's staking-related protocols can expand the suite business according to business logic. Any liquid staking protocol can carry out restaking business, such as the Jito we have seen; any restaking protocol can also issue LST, such as Solayer and Fragmetric.

More importantly, we currently do not see any possibility of reversal of the above trend, which means that the advantages of Solana staking protocol over Ethereum staking protocol may continue to expand in the future.

From this perspective, although we still cannot say that Solana's restaking has found PMF, it is clear that Solana's staking and restaking are better businesses than those on Ethereum.