Stablecoin Playbook: Flipping Billions to Trillions

Author: Rui Shang, Investor at SevenX Ventures

Table of contents

Introduction: Distribution

Crypto Natives: Ongoing peg wars, liquidity bootstrapping challenges, DeFi gateways (trading pairs, lending, derivatives, returns, risk-weighted assets)

Aliens in the developed world of banking: key player changes, efficiency drivers (B2B, P2P, C2B payments)

Outliers in an underbanked world: Shadow dollar economy, dollar channels (savings, spending, foreign exchange)

Ending — Intertwined: Interoperability (cross-currency, cross-currency, cross-chain), opportunity highlights, open questions

Introduction: Distribution

The younger generation is the native of the digital age, and stablecoins are their natural currency. As AI and IoT drive billions of automated small transactions, global finance needs adaptive currency solutions. Stablecoins act as "currency APIs" with transmission speeds as seamless as internet data. The transaction volume in 2024 has reached $4.5 trillion, and as more and more institutions realize that stablecoins are an unparalleled business model, this number will grow - Tether made a profit of $5.2 billion by investing in USDT reserves in the first half of 2024.

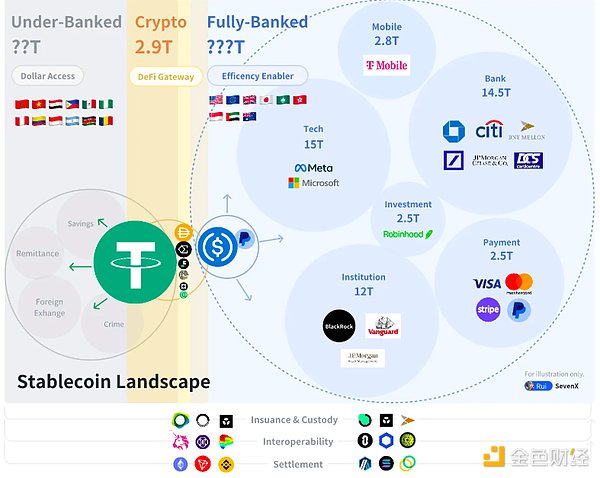

In the stablecoin race, distribution and true adoption are what matters , not complicated cryptographic mechanisms. Their adoption involves three key areas: the crypto-native, well-banked, and under-banked worlds.

In the $2.9 trillion world of native cryptocurrencies, stablecoins act as DeFi gateways, essential for trading, lending, derivatives, yield farming, and RWA. Native crypto stablecoins compete through liquidity incentives and DeFi integration.

In the developed world of banking, which is worth more than $400 trillion, stablecoins increase financial efficiency and are primarily used for B2B, P2P, and B2C payments. Stablecoins focus on regulation, licensing, and leveraging banks, card networks, payments, and merchants for distribution.

In an underbanked world, stablecoins provide access to dollars and promote financial inclusion. Stablecoins are used for savings, payments, foreign exchange, and yield generation. Going to the grassroots is critical.

Crypto natives

Stablecoins account for 8.2% of the total cryptocurrency market capitalization in the second quarter of 2024. Maintaining anchor stability remains challenging, unique incentives are key to expanding on-chain distribution, and the key issue is limited on-chain utility.

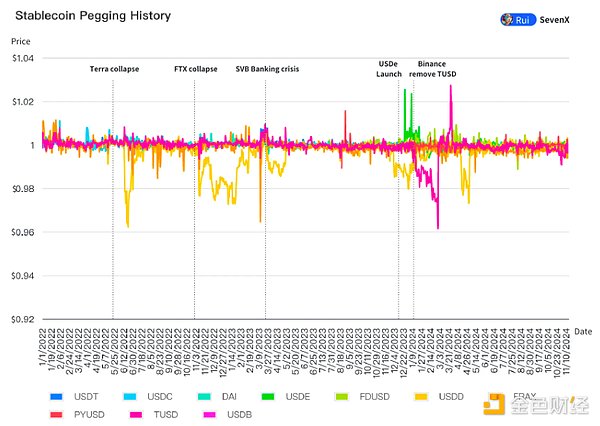

The ongoing hook war

Fiat-backed stablecoins rely on banking relationships to operate:

93.33% Stablecoins are fiat-backed stablecoins. They have greater stability and capital efficiency, and banks have the final say by controlling redemptions. Regulated issuers such as Paxos became PayPal’s USD issuer due to their reliability in successfully redeeming billions of dollars in BUSD.CDP stablecoins have improved collateralization and liquidations for a better peg :

3.89% Stablecoins are Collateralized Debt Position (CDP) stablecoins. They use cryptocurrencies as collateral, but face scaling and volatility issues. In 2024, CDPs have increased resilience by accepting a wider range of liquid and stable collateral, with Aave's GHO accepting any asset in Aave v3 and Curve's crvUSD recently adding USDM (RWA). Some liquidations are improving, especially crvUSD's soft liquidations, which create a buffer for further bad debts through its custom AMM. However, as CRV's valuation fell after large-scale liquidations, crvUSD's market cap shrank and the ve token incentive model declined.Synthetic USD uses hedging to maintain stability :

Ethena USDe alone has captured 1.67% of the stablecoin market cap at $3 billion in a year. It is a delta-neutral synthetic dollar that can open short positions in derivatives to offset volatility. Funding rates are expected to perform well in the upcoming bull market and even in the post-quarter. However, its long-term viability with heavy reliance on CEX is questionable. With the proliferation of similar products, the influence of small funds on Ethereum may weaken. These synthetic dollars may be vulnerable to black swan events and persistently low funding rates during bear markets.Algorithmic stablecoins reduced to 0.56%

Liquidity Launch Challenge

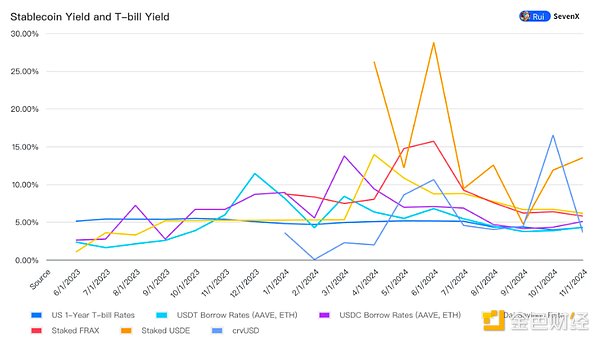

Crypto stablecoins use yields to attract liquidity. Fundamentally, their liquidity cost consists of the risk-free rate plus a risk premium. To remain competitive, stablecoin yields must at least match Treasury rates - we have seen stablecoin borrowing costs fall as Treasury rates reach 5.5%. sFrax and DAI lead in Treasury exposure. In 2024, several real-world asset (RWA) projects increased the composability of on-chain Treasury bonds: CrvUSD added Mountain's USDDM as collateral, while Ondo's USDY and Ethena's USDtb were backed by BlackRock's BUIDL.

Depending on the Treasury rate, stablecoins employ various strategies to increase risk premiums, including fixed budget incentives such as DEX issuance (constraints and death spirals); user fees (tied to the number of borrowing and perpetual contracts); volatility arbitrage (falls when volatility decreases); and reserve utilization such as staking or re-hypothecation (unattractive).

Innovative liquidity strategies will emerge in 2024:

Maximizing intra-block yields: While many yields currently come from self-consuming DeFi inflation as an incentive, more innovative strategies are emerging. By leveraging reserves as a bank, projects such as CAP aim to deliver MEV and arbitrage profits directly to stablecoin holders, providing a sustainable and potentially more profitable source of yield.

Compounding Treasury bond returns:

Taking advantage of the newfound composability of RWA projects, initiatives such as Usual Money (USD0) offer “theoretically” unlimited returns through their governance tokens, benchmarked to Treasury yields, attracting $350 million from LPs and entering Binance Launchpool. Agora (AUSD) is also an offshore stablecoin with Treasury yields.Balanced high returns to resist volatility:

Newer stablecoins adopt a diversified basket approach to avoid single returns and volatility risks and provide balanced high returns. For example, Fortunafi's Reservoir allocates treasury bonds, Hilbert, Morpho, PSM, and dynamically adjusts the proportion and incorporates other high-yield assets as needed.Is TVL a flash in the pan?

Stablecoin yields often struggle to scale. While fixed budget yields can trigger an initial spike, growing TVL dilutes the yield, making the yield less effective over time. Without sustainable yields or real utility from incentivized trading pairs and derivatives, their TVL is unlikely to remain constant.

The DeFi Gateway Dilemma

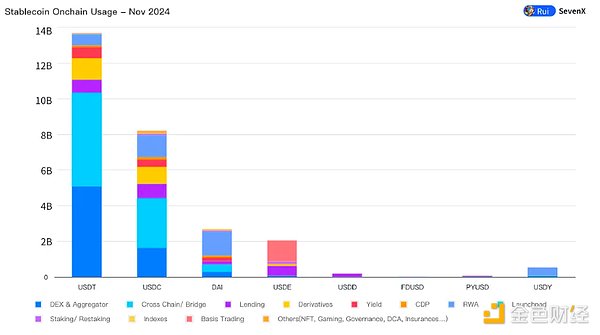

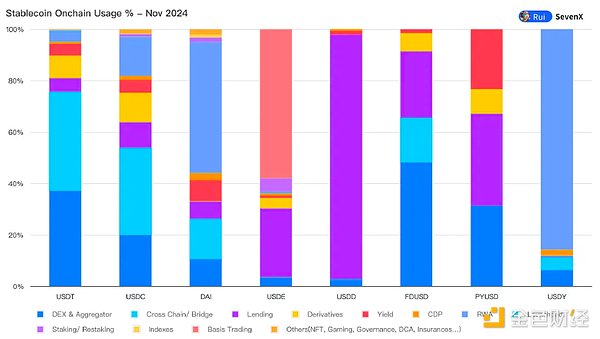

On-chain visibility allows us to examine the nature of stablecoins: Are stablecoins a true representation of money as a medium of exchange, or are they simply financial products for earning yield?

Only the most advantageous stablecoins will be used as trading currencies on CEX:

Nearly 80% of trading still occurs on centralized exchanges, with top CEXs supporting their "preferred" stablecoins (e.g., Binance's FDUSD, Coinbase's USDC). Other CEXs rely on overflow liquidity from USDT and USDC. In addition, stablecoins are working to become margin deposits on CEXs.Some stablecoins are used as trading pairs on DEX:

Currently only USDT, USDC, and a small amount of DAI are used as trading pairs. Other stablecoins, such as Ethena, where 57% of USDe is pledged to its own protocol, are purely financial products held to earn yield, far from being a medium of exchange.Makerdao + Curve + Morpho + Pendle, a distribution combination:

Markets such as Jupiter, GMX, and DYDX prefer to use USDC as deposits because USDT's minting and redemption process is more cautious. Lending platforms such as Morpho and AAVE prefer USDC because it has better liquidity on Ethereum. On the other hand, PYUSD is mainly used for lending on Kamino on Solana, especially with incentives provided by the Solana Foundation. Ethena's USDe is mainly used for Pendle's yield activities.RWA is underrated:

Most RWA platforms (such as BlackRock) use USDC as a minting asset for compliance reasons. BlockRock is also a shareholder of Circle. DAI has achieved success in its RWA product.Expand the pie or expand the scale:

Although stablecoins can attract major liquidity providers through incentives, they face a bottleneck - DeFi usage has been declining. Stablecoins now face a dilemma: they can either wait for the expansion of crypto-native activities or seek new uses beyond crypto-native activities.

Aliens in the developed world of banking

Changes in key players

Global regulation is becoming clearer:

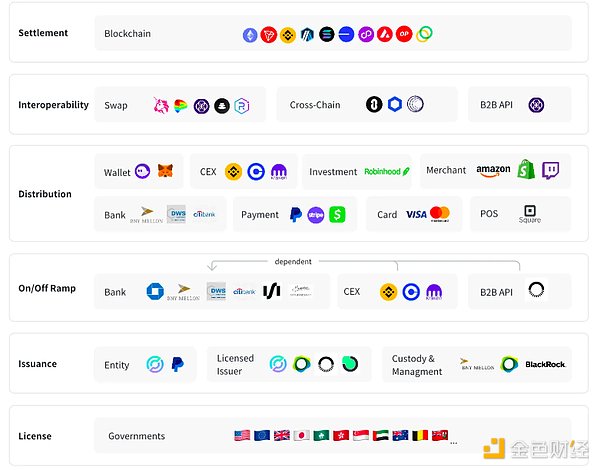

99% of stablecoins are pegged to the US dollar, and the US federal government has ultimate influence. The US regulatory framework is expected to become clearer after the crypto-friendly Trump takes office, promising lower interest rates and a ban on CBDCs, which could benefit stablecoins. The US Treasury report noted that stablecoins have an impact on demand for short-term Treasury bonds, and Tether holds $90 billion in US debt. Preventing crypto crime and maintaining the dominance of the US dollar are also motivations. In 2024, several countries established regulations based on common principles, including approval for the issuance of stablecoins, reserve liquidity and stability requirements, restrictions on the use of foreign currency stablecoins, and generally prohibiting the generation of interest . Main examples: MiCA (EU), PTSR (UAE), Sandbox (Hong Kong), MAS (Singapore), PSA (Japan). Notably, Bermuda became the first country to accept stablecoin tax payments and license interest-bearing stablecoin issuers.Licensed issuers are gaining trust:

Stablecoin issuance requires technical prowess, cross-regional regulatory compliance, and strong management. Major players include Paxos (PYUSD, BUSD), Brale (USC), and Bridge (B2B API). Reserve management is handled by trusted institutions, such as BNY Mellon, which is responsible for USDC and generates returns safely by investing in its BlackRock-managed funds. BUIDL now allows a wider range of on-chain projects to earn returns.Banks are the gatekeepers of the withdrawal channel:

While on-ramps (fiat to stablecoins) have become easier, challenges with off-ramps (stablecoin to fiat) remain as it is difficult for banks to verify the source of incoming funds. Banks favor licensed exchanges such as Coinbase and Kraken, which perform KYC/KYB and have similar AML frameworks. While well-known banks such as Standard Chartered are beginning to embrace off-ramps, small and medium-sized banks are also moving quickly, such as Singapore's DBS Bank. B2B services such as Bridge aggregate off-ramps and manage billions of dollars in trading volume for high-profile clients including SpaceX and the US government.The distributor has the final say:

Circle, the leader in compliant stablecoins, relies on Coinbase and is currently seeking global licenses and partnerships. However, due to the unparalleled business model, this strategy may be undermined as institutions issue their own stablecoins - Tether, a company with 100 employees, made $5.2 billion by investing its USDT reserves in the first half of 2024. Banks such as JPMorgan Chase have launched JPM Coin for institutional transactions. Payment application Stripe's acquisition of Bridge shows their interest in having a stablecoin stack, not just integrating USDC. PayPal also issued PYUSD to obtain reserve returns. Payment card networks Visa and Mastercard are testing the waters by accepting stablecoins.

Efficiency drivers

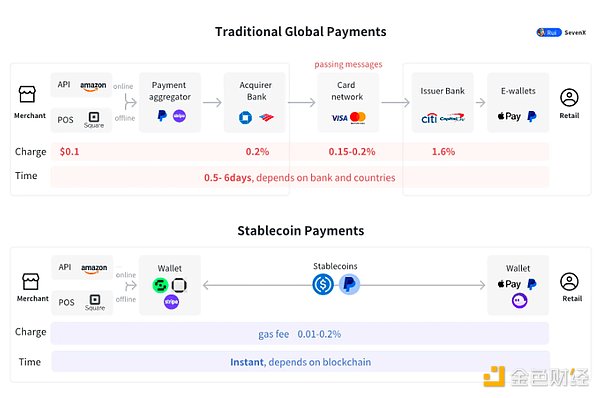

Underpinned by trusted issuers, healthy banking relationships, and distributors, stablecoins could improve efficiencies across the larger financial system, particularly in payments.

Traditional systems face efficiency and cost limitations. In-app or intra-bank transfers offer instant settlement, but only within their ecosystem. Interbank payments charge fees of around 2.6% (70% for the issuing bank, 20% for the acquiring bank, and 10% for the card network), and settlement takes more than a day. Cross-border transactions have even higher fees of around 6.25% and take up to five days to settle.

Stablecoin payments provide instant point-to-point settlement by eliminating intermediaries . This speeds up the circulation of funds and reduces capital costs, while providing programmable functions such as conditional automatic payments.

B2B ($120-150 trillion per year): Banks are the best choice to promote stablecoins. JPMorgan Chase developed JPM Coin on its Quorum chain, and as of October 2023, JPM Coin will trade about $1 billion per day.

P2P ($1.8-2 trillion per year):

E-wallets and mobile payment apps are in the best position, with PayPal launching PYUSD, which currently has a market cap of $604 million on Ethereum and Solana. PayPal allows end users to join and send PYUSD for free.B2C commerce ($5.5-6 trillion per year):

Stablecoins need to work with POS, bank API entry points, and card networks, with Visa becoming the first payment network to settle transactions in USDC in 2021.

A rising star in an underbanked world

Shadow Dollar Economy

Emerging markets are in desperate need of stablecoins due to severe currency devaluation and economic instability. In Turkey, stablecoin purchases account for 3.7% of its GDP. Individuals and businesses are willing to pay a premium over the fiat dollar for stablecoins, with Argentina's stablecoin premium reaching 30.5% and Nigeria's 22.1%. Stablecoins provide access to the dollar and financial inclusion.

Tether has dominated the space with a 10-year track record of solid performance. Even with sticky banking relationships and redemption crises (Tether admitted in April 2019 that USDT was only 70% backed by reserves), its peg has remained stable. This is because Tether has built a strong shadow dollar economy: in emerging markets, people rarely exchange USDT for dollars; they treat it as dollars, a phenomenon evident in regions like Africa and Latin America, where it is used to pay employee salaries, invoices, and the like. Tether has achieved this without incentives, simply through long-term existence and continued utility, which has increased its credibility and acceptance. This should be the ultimate goal of every stablecoin.

US Dollar Channel

money transfer:

Inequality in remittances slows economic growth. On average, economically active people in Sub-Saharan Africa pay 8.5% of their remittances to low- and middle-income countries and developed countries. For businesses that have a harder time doing business, high fees, long processing times, bureaucracy and exchange rate risk are barriers that directly affect growth and competitiveness of businesses in the region.Channels for obtaining US dollars:

Currency volatility caused a $1.2 trillion loss in GDP for 17 emerging market countries between 1992 and 2022, or 9.4% of their combined GDP. Access to dollars is critical to local financial development. Many crypto projects are dedicated to getting started, with ZAR focusing on grassroots “DePIN” approaches. These approaches use local agents to facilitate cash-to-stablecoin transactions in Africa, Latin America, and Pakistan.Foreign Exchange:

Today, the foreign exchange market trades over $7.5 trillion per day****In the Global South, individuals often turn to the black market to convert local fiat currencies into USD, primarily because of more favorable exchange rates compared to official channels. Binance P2P has begun to be adopted, but it lacks flexibility due to its order book approach. Many projects, such as ViFi, are building on-chain AMM foreign exchange solutions.Humanitarian aid distribution:

Ukrainian war refugees can receive humanitarian aid in the form of USDC, which they can store in digital wallets or cash out locally. In Venezuela, frontline health workers use USDC to purchase medical supplies during the COVID-19 outbreak amid a deepening political and economic crisis.

Ending: Intertwined

Interoperability

Foreign Exchange (FX):

The traditional FX system is extremely inefficient and faces multiple challenges: counterparty settlement risk (CLS is enhanced but cumbersome), multi-bank system costs ( an Australian bank purchases yen from a London dollar office involving six banks), global settlement time zone differences (the Canadian dollar and Japanese yen banking systems overlap for less than 5 hours a day), and limited access to the FX market (retail users pay 100 times more than large institutions). On-chain FX has significant advantages:Cost, efficiency and transparency: Oracles such as Redstone and Chainlink provide real-time price quotes. DEXs provide cost efficiency and transparency, with Uniswap CLMM transaction costs at 0.15-0.25% - about 90% lower than traditional FX. The move from T+2 bank settlement to instant settlement allows arbitrageurs to employ a variety of strategies to correct for mispricing.

Flexibility and accessibility: On-chain FX allows corporate treasurers and asset managers to access a wide range of products without the need for multiple currency-specific bank accounts. Retail investors can use crypto wallets embedded with DEX APIs to access the best FX prices.

Separation of currency from jurisdiction: Transactions no longer require domestic banks, separating them from the underlying jurisdiction. This approach leverages the efficiency of digitalization while maintaining monetary sovereignty, although its pros and cons remain.

However, challenges remain, including scarcity of non-USD-denominated digital assets, oracle security, support for long-tail currencies, regulation, and unified interfaces with withdrawal/refund channels. Despite these obstacles, on-chain foreign exchange still provides lucrative opportunities. For example, Citi is developing a blockchain foreign exchange solution under the guidance of the Monetary Authority of Singapore.

Stablecoin exchanges:

Imagine a world where most companies are issuing their own stablecoins. Stablecoin exchanges present a challenge: using PayPal’s PYUSD to pay JPMorgan’s merchants. While offline and online channels can solve this problem, they lose the efficiency promised by cryptocurrencies. On-chain AMMs offer the best real-time and low-cost stablecoin-to-stablecoin. For example, Uniswap offers many such pools with fees as low as 0.01%. However, once billions of dollars are brought on-chain, they must trust the security of smart contracts and must have deep enough liquidity and instant performance to support real-life activities.

Cross-chain transactions:

Mainstream blockchains have their own strengths and weaknesses, so stablecoins need to be deployed across multiple chains. This multi-chain approach brings cross-chain challenges, and bridging brings huge security risks. In my opinion, the best solution is for stablecoins to launch their own layer 0, as seen with USDC's CCTP, PYUSD's Layer0 integration, and we have seen that USDT's move to recall bridge-locked tokens may launch a similar Layer0 solution.

In the meantime, several unanswered questions remain:

Given that compliant stablecoins can monitor, freeze, and withdraw funds, will regulation harm “open finance”?

Will compliant stablecoins still avoid offering returns that could be classified as securities, preventing on-chain DeFi from benefiting from its massive expansion?

Given Ethereum’s slow speeds and its L2’s reliance on a single collator, Solana’s imperfect uptime record, and other chains’ lack of long-term track records, can any open blockchain really handle huge amounts of money?

Will the separation of currency and jurisdiction bring more chaos or opportunities?

We are on the verge of a financial revolution led by stablecoins that is both exciting and unpredictable - a new chapter in which freedom and regulation dance in a delicate balance.