Good afternoon, brothers. Bitcoin has now reached a new all-time high of $97,000. Has your account reached a new high?

Bitcoin broke through $97,000 strongly at noon today, reaching a high of $96,968 before the deadline, setting a new all-time high, up 5.58% in the last 24 hours.

Bitcoin's overall market share has now reached 60%. Based on the data from the previous bull market, when the market share reached around 67%, the altcoins collectively exploded. According to this data, it should be in the mid-term before December.

After the new high in BTC, the altcoins cried as the price slightly dropped. The current market situation is very painful, with Wall Street capital only buying BTC, and US retail investors only buying on-chain meme coins, while the middle-tier altcoins have been temporarily abandoned by the market.

Against this backdrop, data shows that BTC's market share (BTC) soared to 61.61%, a new high since March 2021. It still has the momentum to continue rising, indicating that the crypto market is currently centered on the rise of BTC.

Why is this a "BTC-US stock bull market":

BTC is heading towards $100,000, but the altcoin market is very quiet. After Trump's election, everyone was expecting a surge of liquidity, but apart from the meme hype activated by Binance, all altcoins have been left far behind BTC.

MicroStrategy buying BTC is no longer a new thing in the crypto world, it has become a BTC index in the US stock market since the last cycle. However, in September this year, MSTR has attracted market attention again. This time it is because MSTR actually started before the rise in BTC price, and maintained a continuous premium on BTC in the subsequent market.

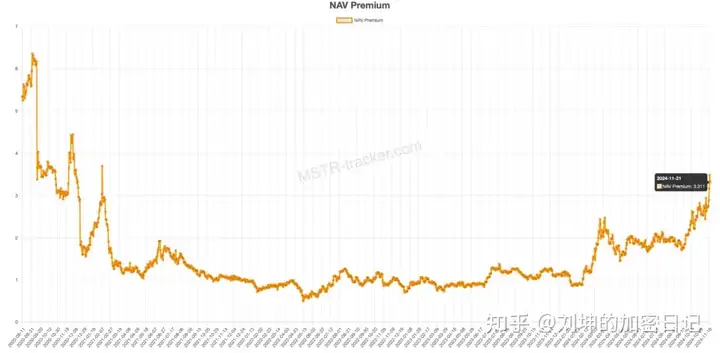

BlockBeats notes that the correlation between the NAV premium factor (Net Asset Value Premium) and MicroStrategy's stock issuance activities is relatively high, and the premium factor will rise shortly after MSTR's issuance. According to MSTR Tracker, the current NAV premium is around 3.3.

In fact, MicroStrategy has quietly started a new BTC buying strategy since the middle and late last year, called "premium issuance".

In simple terms, MicroStrategy has previously been raising funds to buy BTC through debt issuance, which means that each MSTR share represents a certain amount of BTC (which is also why it is seen as a US stock BTC index). However, the "premium issuance" model is more straightforward and immediate: when the BTC price rises and the company's market value increases, the exchange rate between MSTR and BTC will generate a premium.

This means that each time MSTR shares are issued, more BTC can be bought at a premium than the amount corresponding to the shares, so the BTC corresponding to each MSTR share will also rise further, which means the company's market value and the value of MSTR will also rise, and then the cycle will repeat itself, circulating continuously.

What is the relationship between this and the BTC bull market?

The relationship is huge. In addition to the factor that MicroStrategy accounts for 5% of the total circulation, the US stock market seems to be experiencing a Paradigm shift. That is, there will be more and more MSTRs in the US stock market, and the CEO of MicroStrategy even called his model an "infinite money glitch". The implication is that more and more US companies will adopt the "premium issuance" BTC fiscal policy, and BTC prices will be further tied to the US stock market. And this huge liquidity will be entirely borne by BTC as a single target, with no relation to other altcoins (which is also one of the reasons why BTC ETF inflows have surged recently, while Ethereum ETF has been flat).

It can be foreseen that if the crypto industry stops in terms of narrative innovation and practical ability, BTC will gradually drift away from Crypto. In this context, the bull market will only have two betas: one is BTC, and the other is Solana, which absorbs the liquidity within the circle.

Some thoughts on the market trend of this cycle:

1. Meme coins are playing the role of DeFi in the previous bull market. They have brought a lot of new money into the crypto circle. Coins like Doge and Pnut have attracted a lot of new money.

2. After the liquidity of meme coins spills out, and the life cycle of the market cap becomes shorter and shorter, the VC coin sector will start to rotate.

3. But meme coins should still be a persistent theme, but the heat and capital will be gradually diverted.

Key events today

1: The ETH exchange rate has fallen to a low point, continue to buy at low prices, although it has not risen, but also has not lost money, continue to place buy orders at ETH, 3060, 3030, defend 3000.

2: The BTC exchange balance continues to hit new lows, with single-machine upward trend, those who short continue to add margin, the result of fighting against the Americans is liquidation.

3: $7.73 billion flowed into the US BTC ETF market yesterday, the inflow is proportional to the trend.

4: The founder of Three Arrows Capital tweeted that the ETH/BTC position is not bad, suitable for buying, the current exchange rate is already 0.032.

5: There was over $300 million in short positions liquidated at the $99,000 BTC level, and $1.3 billion in long positions were liquidated at $92,000, the shorts are being cleared out.

6: The Desci sector has seen an overall plunge, with a 30% drop as soon as you enter, this old six is really frustrating. 7: Vitalik exchanged 0.082 ETH for 30,303 ANON, the BASE protocol manager exchanged 0.33 ETH for 31,529 ANON, the current price is $0.0422 per ANON.

When will the altcoin market see a turnaround?

Although the current market is not favorable for altcoins, it is not completely hopeless.

If two of the following three conditions are met, we may see the altcoin bull market return:

BTC breaks through $100,000: And stays above $100,000 for at least two weeks.

Ethereum staking ETF is approved: This will attract off-chain capital to pay attention to the Ethereum ecosystem and other native assets.

Crypto regulation relaxes, innovation returns: If the on-chain ecosystem sees another wave of innovation similar to the "DeFi Summer", or even a few "killer apps" emerge, investors' risk appetite may shift towards the higher-yielding altcoin sector.

Pay attention to the unemployment data at 9:30 tonight

21:30: The number of initial jobless claims in the US as of November 16 and the Philadelphia Fed manufacturing index for November will be released simultaneously. The initial jobless claims is a real-time indicator of the tightness of the job market, while the Philadelphia Fed manufacturing index reflects the health of the regional manufacturing industry.