Bitwise Asset Management has filed to establish a Delaware trust for a proposed Solana ETF (exchange-traded fund). This move represents a new attempt to expand cryptocurrency products amid growing interest in blockchain-based assets.

The filing is an initial step towards launching a financial product. The general view is that this could lead to a submission for approval to the U.S. Securities and Exchange Commission (SEC).

Bitwise Strategically Expands with Solana ETF

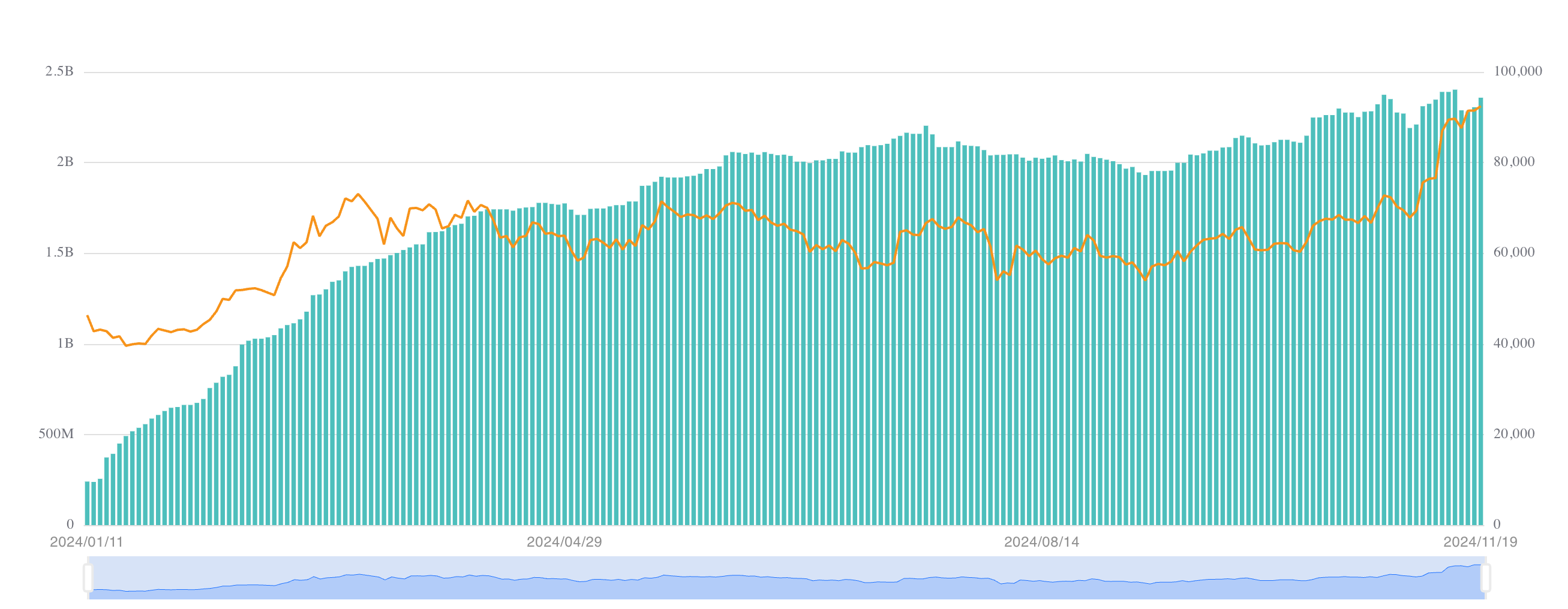

According to state records, the proposed Bitwise Solana ETF aims to track the price of Solana (SOL). This move is part of Bitwise's broader expansion strategy, following a 400% growth in assets under management (AUM) this year. Bitwise currently manages at least $5 billion in assets.

Recent acquisitions include Ethereum staking service Attestant, and the success of the BITB physical Bitcoin ETF underscores its aggressive growth trajectory. Notably, Bitwise's BITB has attracted $2.3 billion in inflows. Meanwhile, the Ethereum ETF (ETHW) is currently recording a positive flow of $373 million.

While the proposed ticker or exchange listing has not yet been disclosed, Bitwise's Solana ETF filing positions it alongside competitors such as VanEck, 21Shares, and Canary Capital, who have also sought to capitalize on Solana's growing significance. VanEck has likened Solana to products like Bitcoin and Ethereum.

"The 19b4 language for the Ethereum ETF describes ETH as a commodity, and that would apply to Solana as well," said Matthew Sigel, Head of Digital Assets Research at VanEck.

While the filing represents progress, the path to regulatory approval for a Solana ETF faces many challenges. The SEC has historically scrutinized cryptocurrency ETFs due to concerns over market manipulation, custody risks, and the classification of assets like Solana. Industry experts have expressed doubts about the SEC approving a Solana ETF. In past filings, Solana's status as a commodity has been questioned.

Furthermore, the Solana ETF forms were previously removed from CBOE (the Chicago Board Options Exchange) due to regulatory issues. This turmoil has nearly zeroed out the chances of approval earlier this year, sparking skepticism among market participants.

The Trump Administration, a New Hope

However, the situation appears to be changing following Donald Trump's re-election. The industry views this as a potential catalyst for the cryptocurrency sector. The Trump administration has expressed a pro-crypto stance, and experts have suggested that his policies could make the regulatory environment more favorable for products like ETFs.

According to analysts, Trump's promises to promote innovation and reduce bureaucratic barriers could enable the SEC to approve more cryptocurrency ETFs, including those centered on Solana.

"The biggest win for Solana under a new Trump presidency will be the long-awaited ETF, likely in 2025 or 2026. Unsurprisingly, the excellent VanEck team will lead the charge, with the support of 21Shares and Canary Capital," said Dan Jablonski, Head of Growth at Syndica, a news and research company.

If a Solana ETF is approved, it could bring about a significant change in the U.S. regulatory landscape. Furthermore, it could help solidify the U.S. position as a leader in the global cryptocurrency market, as countries like Brazil have already launched Solana ETFs earlier this year.

The potential approval of a Solana ETF under the Trump administration could have a profound impact on the U.S. cryptocurrency market. It could facilitate greater institutional adoption, drive innovation, and position the country as a leader in blockchain technology.

Additionally, the more crypto-friendly regulatory environment would send a strong signal, attracting further investment and talent. The possibility of an XRP ETF also exists, with Bitwise and Canary Capital already in the lead.

"In addition to the listing of cryptocurrency index funds by Grayscale and Bitwise, there are currently spot ETF applications for SOL, XRP, HBAR, and I would expect at least one issuer to challenge for an ADA or AVAX ETF," said Nate Geraci on X (Twitter).