Analyst: Manuel|Grant|Corey Translator: Matt|Peter

If there is a track like DeFi that can become a key force in promoting financial innovation and blockchain applications and shaping the new financial landscape of the future, 5Mind DAO will invest in PayFi.

The concept of PayFi

PayFi (Payment Finance) is a relatively new concept that combines payment and decentralized finance (DeFi). It was first proposed by Lily Liu, chairman of the Solana Foundation, and defined as a new financial market built around the time value of money.

To understand PayFi, we first need to understand the "time value of money" . The " time value of money" refers to the change in the value of money over time. Usually (taking into account inflation and investment returns, etc.), the current value of the same amount of money is higher than the future value of the same amount of money (100 yuan this year > 100 yuan next year); if people want to get money now, rather than in the future, then they should pay extra fees for these funds, that is, interest.

Let's take an example to make it simple: suppose you can get 1,000 yuan now, and if you deposit it in the bank, the annual interest rate is 5%. One year later, you will get 1,050 yuan (1,000 yuan principal + 50 yuan interest). In this case, the value of 1,000 yuan today is higher than 1,000 yuan a year later, because you have the opportunity to get interest returns through investment. If the inflation rate is 5%, then the purchasing power of 1,000 yuan a year later is: 1,000*(1-0.05)=950, which is equal to 950 yuan today.

In addition, since payment itself is rooted in real-world life scenarios, in order to effectively capture the monetary time value of real-world payment scenarios, real-world assets (such as real estate, equity, bonds, etc.) must be introduced into the blockchain through tokenization (RWA), and payments and business processes must also be moved to the blockchain, thereby forming the logic of Web3 payments.

From this, we can make a more detailed supplement to PayFi. PayFi refers to an innovative financial field that improves and optimizes the payment system based on the time value of money through blockchain technology, smart contracts and tokenization, based on payment settlement scenarios.

Traditional payment and Web3 payment

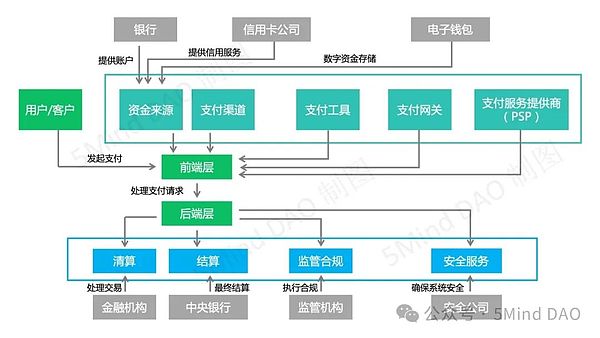

We know that payment is the act of transferring funds to ensure the completion of transactions and the realization of value exchange. However, traditional payments usually rely on centralized payment networks and intermediaries (such as banks, credit card companies, payment gateways, etc.) to complete the transaction process. This multi-party participation method greatly increases transaction time and fees. Especially in the context of globalization, cross-border payments involve domestic clearing systems in various countries (such as Fedwire of the US central bank and CNAPS of the People's Bank of China), transnational payment and clearing systems for settlement currencies (such as the Cross-China RMB Clearing System CIPS and the New York Clearing House Interbank Payment System CHIPS), international funds clearing systems (such as SWIFT, the Society for Worldwide Interbank Financial Telecommunication), and various banks participating in these systems. The complexity is obvious.

*Note: Traditional payment structure

On the other hand, Web3 payments based on blockchain technology and the concept of decentralization effectively leverage the advantages brought by the characteristics of blockchain: near-instant settlement, 24/7 availability, low transaction costs, and the programmability, interoperability, and unlimited possibilities brought by the compatibility of digital currencies with DeFi.

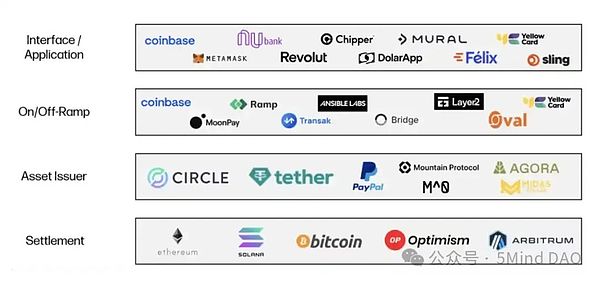

So, how does Web3 payment achieve value transfer? From the perspective of the technology stack, Web3 payment is mainly divided into four layers: settlement layer (blockchain), asset issuer, currency acceptance (legal currency channel) and front-end application.

*Source: Galaxy Ventures

Settlement layer: the underlying blockchain infrastructure for settlement transactions, equivalent to the "settlement agency" or "clearing system" in the traditional financial system, responsible for ensuring that all transaction information is recorded and confirmed on the blockchain and cannot be tampered with. Layer1 such as Bitcoin, Ethereum, Solana and general Layer2 such as Optimism and Arbitrum provide different settlement solutions to the market by selling their block space (users pay gas fees to use the storage and processing resources of the blockchain, record their own transactions or data on the blockchain, and complete transaction confirmation and settlement). These chains have their own advantages in speed, cost, scalability, security and distribution channels.

Asset issuer: an institution or entity that creates and issues digital assets (such as stablecoins, tokens, etc.) on the blockchain, responsible for establishing, maintaining and redeeming financial transactions and payment media. For example, the well-known asset issuer Tether created a stablecoin USDT pegged to the US dollar (USDT is pegged 1:1 to the US dollar), allowing users to use USDT on the blockchain for payment and value exchange without worrying about the value fluctuations of the token. This is also one of the most widely used digital assets in the cryptocurrency market.

Currency acceptance: It is an important channel that connects digital currencies on the blockchain with legal tender in traditional bank accounts. Currency acceptance providers play a key role in increasing the availability and adoption of stablecoins as the primary mechanism for financial transactions. Their business model is often traffic-driven and they earn a small commission from the funds flowing through their platform.

Front-end Applications: The ultimate manifestation of a front-end application is customer-facing software that provides a user interface for crypto payments and leverages the rest of the stack to enable such transactions. Their business models vary, but tend to be some combination of platform fees plus traffic-driven fees generated through front-end transaction volume.

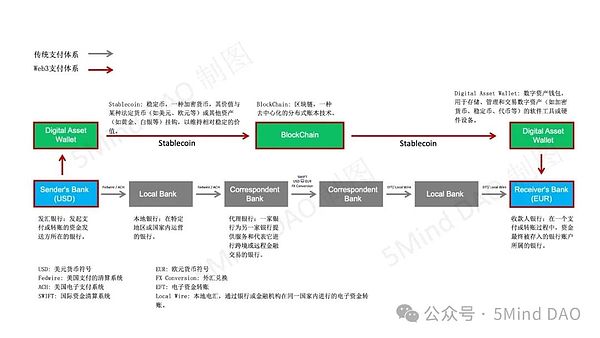

To help users further understand the difference between traditional payments and Web3 payments, we take the structure of cross-border payment transactions as an example.

*Click to enlarge

Different countries and financial institutions may have different regulatory requirements, payment systems and information transmission standards. In addition, due to limited banking hours and reliance on many intermediaries, cross-border payments under the traditional payment system often incur high costs (transaction fees, exchange rate markups, intermediary fees, etc.) and take up to 5 working days to settle. In addition, the opacity of the entire cross-border payment process may also cause problems such as difficulty for users to track and verify payments.

The cross-border payment solution under Web3 payment can settle transactions instantly around the world simply through stablecoins built on the blockchain. Compared with traditional payments, Web3 payment can provide lower costs by eliminating various intermediaries and their infrastructure; coupled with the open and transparent nature of blockchain, users also gain higher visibility and convenience in tracking fund flows and reducing reconciliation management costs.

It is not difficult to see that Web3 payment, a new payment method that does not rely on traditional financial institutions but directly transfers value between users through a decentralized network, can greatly simplify the payment and settlement process, making payments fast, cheap and easy to access. It is the only choice to meet the public's current demand for free payment.

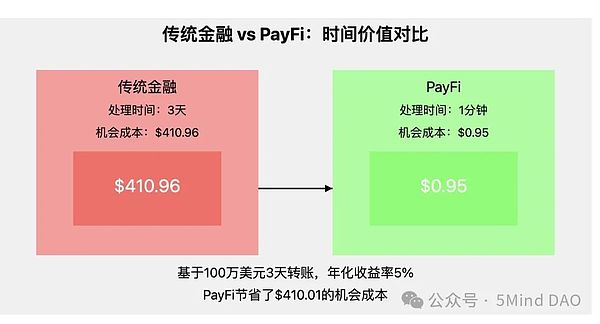

If Web3 payment is mainly done with the money we have now, then PayFi allows us to use tomorrow's money to do transactions. Let's use a simple mathematical model to illustrate the time value of money captured by PayFi in this process:

Suppose there is a fund of $1 million, which takes 3 days to complete a cross-border transfer in the traditional banking system. With an annualized rate of return of 5%, the opportunity cost of these 3 days is: $1 million * (5% / 365) * 3 = $410.96. Now, suppose PayFi shortens this process to 1 minute: $1 million * (5% / 525600) * 1 = $0.95.

*Source: @0xNing0x

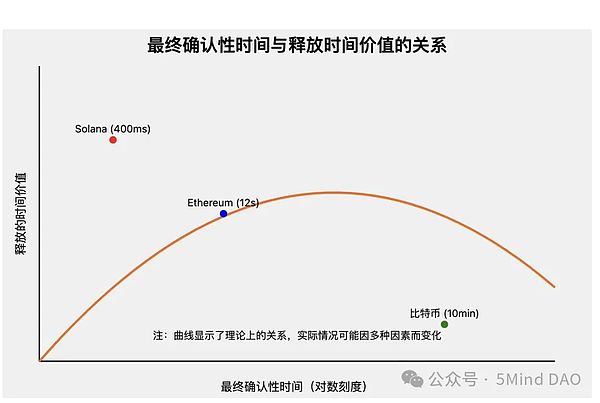

It is worth noting that the time value of the currency released has a nonlinear relationship with the final confirmation time. Therefore, when designing the PayFi system, it is extremely important to find a balance between speed, security and decentralization.

*Source: @0xNing 0x

PayFi's Market Size

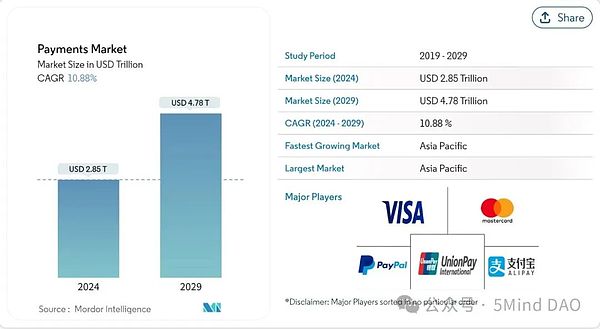

From the perspective of the overall macro market, according to the Cryptocurrency Market Report released by Mordor Intelligence, the cryptocurrency market size is expected to be US$44.29 billion in 2024 and US$64.41 billion by 2029, with a compound annual growth rate of 7.77% during the forecast period (2024-2029). Thanks to the adoption of digitalization, the global payment system is rapidly shifting from cash to digital payments, and crypto payments, as a newly emerging innovative payment method, are gradually becoming an important force in digital payments.

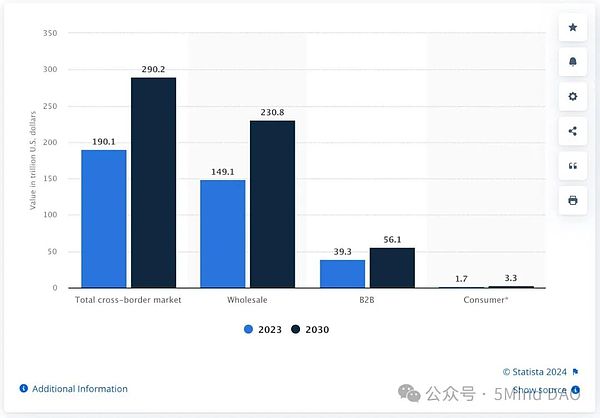

The report predicts that the increasing use of cryptocurrencies for cross-border remittances will expand the market by reducing consumer fees and exchange costs. Data compiled by Statista shows that the total value of cross-border payments will be $190.1 trillion in 2023. This figure is expected to reach $290.2 trillion by 2030, with most of the growth coming from the expansion of cross-border payments initiated by consumers.

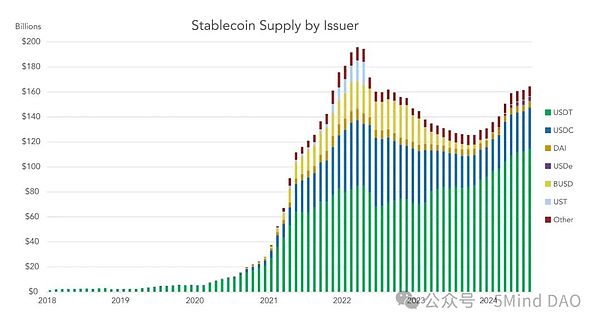

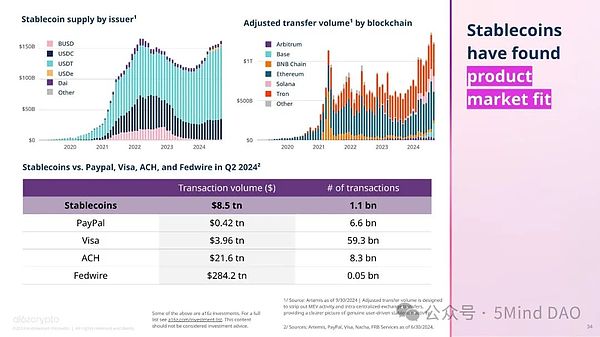

On the other hand, stablecoins are anchored to fiat currencies, avoiding the volatility of cryptocurrencies and becoming an important financial tool and medium of exchange in the Web3 field. Since 2020, the global supply of stablecoins has continued to rise, especially stablecoins pegged to the US dollar (such as USDT and USDC). The latest research from institutions such as Visa and Castle Island Ventures shows that by 2024, the total circulating supply of stablecoins will exceed US$160 billion, while in 2020, this figure was only a few billion US dollars. This substantial growth not only reflects the strong market demand for stablecoins, but also highlights its huge potential in solving cross-border payments, savings protection, and currency conversion.

*Stablecoin supply by issuer

According to the latest research estimates released by institutions such as Visa and Castle Island Ventures, the total settlement amount of global stablecoins in 2023 is conservatively estimated to reach US$3.7 trillion, and the settlement amount in the first half of 2024 will reach US$2.62 trillion (the same period, the 2024 Cryptocurrency Status Report released by a16z showed this figure to be US$8.5 trillion). On an annualized basis, this figure is expected to rise to US$5.28 trillion for the whole year.

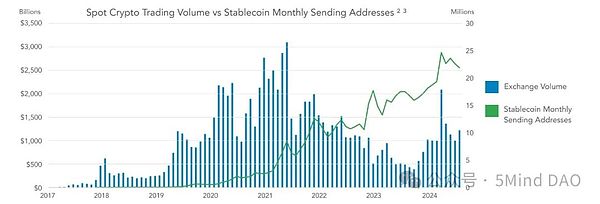

Another interesting phenomenon is that although the cryptocurrency market experienced greater volatility and a downward cycle from 2022 to 2023, the transaction volume and usage frequency of stablecoins were not significantly affected. This shows that stablecoins are no longer limited to the cryptocurrency market, and their application scenarios are rapidly expanding to the real economy.

* Comparison of cryptocurrency spot trading volume and the number of monthly active stablecoin sending addresses

PayFi’s innovation needs

From the market demand side, on the one hand, the old (SWIFT was established in 1973), complex and inefficient traditional payment and settlement system has given rise to an urgent need for the adoption of Web3 payments. Coupled with today's increasingly complex geopolitical environment and financial oligarch effects, its neutrality is even more questionable (in 2022, against the backdrop of the intensified Russian-Ukrainian conflict, Russia was removed from the SWIFT system, a move that almost stagnated Russia's cross-border payments and import and export settlements, bringing great pressure to its economy).

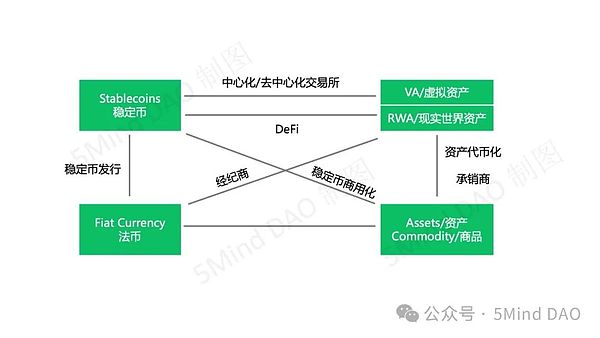

On the other hand, in the context of insufficient innovation and lack of liquidity (the ability to quickly buy or sell assets/markets at close to market prices), PayFi, which combines payment and DeFi, shows great potential, especially in improving currency turnover efficiency and increasing market liquidity. By connecting real assets with on-chain financial activities through stablecoins, RWA and other means, PayFi can increase the real demand of the market, reduce speculative behavior, and make the liquidity of the entire crypto market more solid and stable. At the same time, it can also attract more users who are interested in blockchain applications, especially traditional financial users who want to enter the crypto market but have not found a suitable entry point. In addition, unlike the short-term high-yield incentives in DeFi, PayFi emphasizes long-term use value and actual payment scenarios. The more frequently users use PayFi, the stronger the stickiness, and the liquidity of the market will also increase accordingly.

In summary, the market demand for PayFi comes from the demand for payment efficiency, cost, cross-border payment, transparency, security, and the integration of real-world assets and on-chain assets. It has irreplaceable advantages and broad market prospects. With the rapid development of Web3 and decentralized finance, PayFi is expected to become a key infrastructure in the future digital economy, meeting the multi-level needs of digital payment, financial innovation, and global users.

PayFi's business model

Unlike DeFi, PayFi does not focus on lending and high-yield investments, but emphasizes the smoothness, security and wide practicality of payments. From the perspective of business model, PayFi can currently be divided into four categories:

A. Move the traditional payment logic to the blockchain, aiming to build a comprehensive Web3 payment framework. Representative projects: stablecoins (USDT, USDC, PYUSD, etc.).

Stablecoins, as one of the key components for moving traditional payment logic to the blockchain, not only provide the foundation for the Web3 payment framework, but are also the most successful PayFi application. In addition to tokenizing real assets, the integration of stablecoins and DeFi fully demonstrates its advantages of interoperability, programmability, and composability, and maximizes the capture of the time value of money (similar to interest and compound interest in traditional finance).

This capture of time value not only encourages users to hold and use stablecoins, but also increases the attractiveness of cryptocurrencies and blockchain in daily payments and financial management. For example, before payment or during the payment waiting period, stablecoins can be deposited into the liquidity pool to obtain transaction fees provided by the platform. In this process, the payment can not only capture the time value, but also provide liquidity for on-chain transactions.

B. Payment tokens, such as tokens representing the time value of tokenized U.S. Treasury bonds or stablecoins that generate income. Representative projects: Ondo Finance.

Ondo Finance

Ondo Finance is a decentralized institutional-level financial protocol. Its main business is to introduce zero/low-risk, stable interest-bearing, scalable fund products (such as US Treasury bonds, money market funds, etc.) into the blockchain (tokenization) within the compliance framework for investors on the chain to invest, lower the threshold for ordinary investors to enter financial products, and enable holders to obtain income from their assets.

The tokenized financial products currently launched by Ondo Finance mainly include the interest-bearing stablecoin Ondo US Dollar Yield Token ($USDY) and the tokenized US Treasury fund Short-Term US Government Treasuries ($OUSG). KYC certification is required to purchase the above products.

USDY is a tokenized note secured by short-term U.S. Treasury bonds and demand bank deposits, available for purchase by non-U.S. individuals and institutional investors. Investors will receive a token certificate after making a contribution, and will receive USDY in 40–50 days, which can be transferred on-chain for free. In addition to being a payment medium, USDY can also provide additional capital efficiency utility and composability in DeFi scenarios, such as using USDY as collateral when borrowing.

Compared with stablecoins, USDY's innovation lies in that it provides investors with an investment tool that can store dollar-denominated value and generate dollar returns without permission. The token price of USDY is calculated based on the token price on the first working day of the month and the token yield of the month.

For example, if the USDY price on June 1 is $100.000000000 and the APY for June is 4.00000000%, the USDY price on June 3 will be: 100.00000000 × ( 1 + [( 1 + 0.04 )1365–1 ])2 = 100.02149311 (rounded to eight decimal places). As of November 10, 2024, the USDY price is $1.0665.

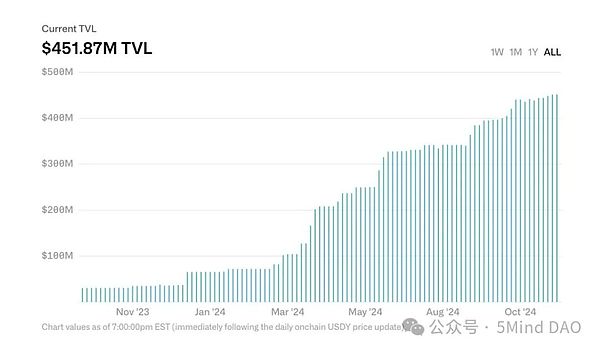

It is reported that the annualized rate of return (APY) provided by USDY is adjusted by Ondo every month according to actual conditions. As of November 10, 2024, the APY of USDY is 4.90%, and the total locked value (TVL) is approximately US$451.87 million. The collateral is worth approximately US$451.69 million, the over-collateralization amount is US$14.06 million, and the over-collateralization rate is 3.11%. (USDY is a priority debt secured by bank demand deposits and short-term U.S. Treasury bonds. Ondo over-collateralizes it and provides a 3% first loss position to absorb short-term fluctuations in U.S. Treasury prices. In other words, for every $100 worth of USDY issued, there is at least $103 worth of bank deposits and U.S. Treasury bonds as collateral.)

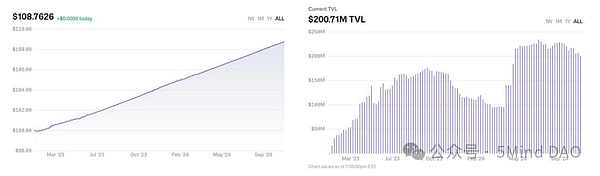

Another tokenized U.S. bond fund, OUSG, is mainly aimed at institutional investors, with a minimum investment amount of 100,000 USDC, and aims to provide a liquidity exposure to purchase short-term U.S. Treasury bond ETFs. Since its issuance in February 2023, its token price has continued to rise as the returns are realized. As of November 10, 2024, the price of 1 OUSG is $108.7626, with an annualized yield of 4.71%, and a total locked value of approximately $200.71 million.

C. Provide financing for real-world assets (RWA) through DeFi lending and realize on-chain benefits in real payment scenarios. Representative project: Huma Finance.

Huma Finance

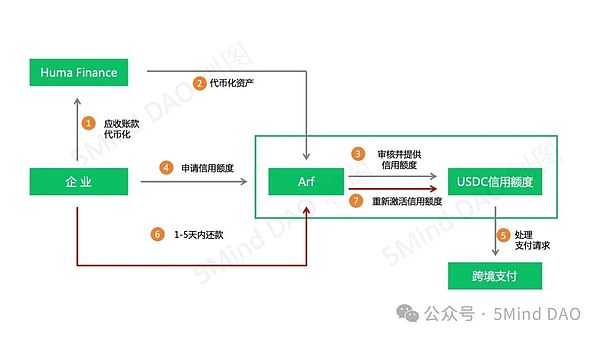

Huma Finance is an income-based lending protocol that allows borrowers to borrow against [future income] by matching with global on-chain investors and provides the function of underwriting accounts receivable (accounts receivable are customer bonds generated by the sale of goods or provision of services during the business operation, representing the company's future cash flow income). In April this year, Huma acquired the liquidity and settlement platform Arf. Huma's RWA tokenization technology combined with Arf's liquidity solution has created a fully transparent and traceable cross-border payment system on the blockchain.

Through Huma's technology, companies can tokenize assets such as accounts receivable. These tokens can not only circulate on the platform to improve asset liquidity, but can also be used as collateral to apply for a USDC credit line from Arf. When a company receives a cross-border payment request, it can use the USDC credit line provided by Arf for instant payment without locking funds in advance. After the payment is completed, the company must repay the used credit line and related fees within 1 to 5 days. Once the repayment is completed, the credit line will be reactivated, enabling the company to continue to process future cross-border payment requests.

According to Richard Liu, founder of Huma Finance, Arf mainly provides short-term loans to licensed financial institutions around the world. Currently, Arf's bad debt rate is 0, and its institutional lending can generate an annualized return of 20%, while the cost of obtaining funds is about 12% to 13%. Therefore, Arf can provide investors with a low-risk return of more than 10%, which is about 7% higher than the return of US bonds. At the same time, Arf itself can maintain a gross profit of 8% to 10%. After the merger with Arf, Huma is responsible for the user's deposit part, and Arf is responsible for lending to the Web2 world + collecting interest, forming a sustainable cycle.

In September this year, Huma announced that it had received $38 million in investment to expand its RWA-based PayFi platform. According to data disclosed by the media, Huma Finance's payment financing transaction volume has exceeded $2 billion, with a monthly growth rate of 10% , and zero credit defaults, with about $500 million in new demand waiting to be met each month.

D. New Web3 payment innovation business that is seamlessly integrated with the DeFi protocol. Here we mainly list the income return payment incentive represented by SOEX and DePlan that introduces economic efficiency into subscription payment.

SOEX

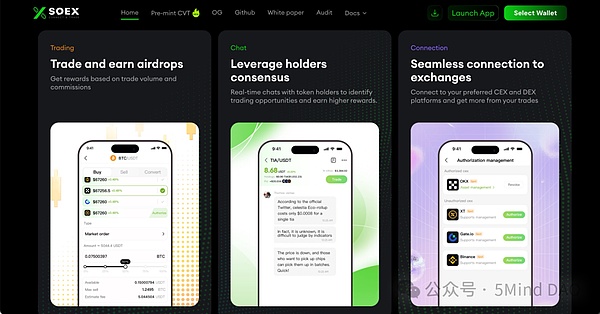

SOEX is a cryptocurrency trading aggregation tool that combines social functions with professional trading. It allows users to tokenize their trading behaviors (mainly spot trading) on various exchanges (currently mainly CEX) to obtain incentives and support value capture and redistribution of the Web3 social ecosystem.

Generally speaking, transactions in Web3 mainly occur in centralized exchanges (such as Binance, OKX) and decentralized exchanges (such as Uniswap). In this process, the exchange will charge a certain transaction fee, which is also one of the main ways for the exchange to make money. In a decentralized exchange (DEX), users can get a certain transaction fee in return by providing liquidity (such as USDT/USDC). However, in a centralized exchange (CEX), users cannot directly provide liquidity to earn transaction fees like in a DEX (in a CEX, the role and profit method of liquidity providers are usually controlled and managed by the exchange, which is significantly different from the mechanism of a DEX).

In order to attract users to participate in transactions, increase transaction volume or provide liquidity, CEX usually provides different types of incentives to attract users, but this usually requires high transaction volume or institutional users, and most retail investors have little chance to participate. SOEX aggregates small transaction behaviors of multiple users in a social way, obtains and optimizes exchange rebates, and then distributes these rebates to users based on their contribution (percentage of total transaction volume).

DePlan

DePlan is a consumer application built on the Solana blockchain that allows users to monetize unused subscription time. DePlan enables users to earn income from their subscriptions by renting out unused portions of their subscriptions to others, and provides a flexible pay-as-you-go option for users who need temporary use of the service.

Under the traditional subscription system, consumers need to pay a monthly fee to use the subscription content, but in reality, there are often cases where users rarely use or even do not use the subscription after subscribing, resulting in a waste of resources. DePlan has introduced a new way. By tracking the user's screen usage time, DePlan can determine the unused time of each application subscription and tokenize it on the blockchain (each token represents 1 hour of unused application time). Users can put these tokens on the DePlan market for other users to rent. At the same time, users who need temporary access to the application only need to pay for the time they use, without having to commit to a full subscription.

It is understood that DePlan's hourly price is calculated by dividing the ideal subscription fee by the total number of hours of monthly smartphone usage to ensure that the price paid by users is proportional to their actual usage. At the same time, the actual price will be dynamically adjusted based on supply and demand to ensure that buyers and sellers enjoy a fair market price.

PayFi's Future Vision

PayFi brings greater imagination space for Web3 payments, which includes Web3 payment innovations that integrate DeFi, and Web3 transformations of traditional financial systems, payment systems, and payment business logic. What we have seen is just the tip of the iceberg.

Let's look at the entire market. Currently, Web3 payments mainly rely on instant fund exchange, that is, the "one hand for money, one hand for goods" model. Although on-chain lending is relatively mature, considering the user's solvency, it also adopts an over-collateralized model. In the traditional centralized financial system, in addition to the most common cash transactions, there are also various credit-based payment methods such as credit cards, credit loans, and installment payments. In the future, whether there will be an on-chain credit system to further promote the development of PayFi, we don't know, but now there are projects such as PolyFlow that have begun to explore these areas.

Previously, Lily Liu mentioned Buy Now Pay Later in her sharing, which can be transformed into Buy Now Pay Never through PayFi. The core is to use DeFi's income to cover the payment fees, such as Ether.Fi's Cash business.

Ether.Fi is an innovative project in the DeFi ecosystem that focuses on Ethereum staking (locking assets in a specific protocol and obtaining certain returns) and liquidity re-staking (reusing already staked assets for other protocols or networks to enhance their capital efficiency or increase additional rewards), enabling users to earn staking returns while maintaining asset liquidity. Ether.Fi's Cash business is essentially the most common Crypto Payment Card business. That is, users use cryptocurrency payments, connect with traditional payment channels through currency acceptors, and achieve legal currency settlement with merchants. Ether.Fi's Cash business can be directly combined with its pledge/pledge business to form the characteristics of PayFi, using Ether.Fi's assets as collateral in exchange for USDC for consumption, and repaying with the income from staking (Stake) and liquidity staking (Liquid).

After deep integration with DeFi, PayFi will no longer be limited to the payment function itself. In the future, users will be able to enjoy financial products and services such as lending, investment, and insurance while making payments, or combine with AI to recommend the most suitable financial products and payment methods for users, which will gradually become a reality.

PayFi's development path

This picture intuitively reflects the significance of PayFi's existence and its relationship with relevant participants. It can be seen that compared with DeFi, PayFi has a wider range of inclusiveness. It is not only a financial tool, but also a payment bridge connecting traditional finance and the Web3 world. Because of this, the development path of PayFi is quite different from that of DeFi, especially in the early stage of construction. The development of PayFi is more dependent on the improvement of infrastructure and the leading role of industry institutions. In other words, the innovation of DeFi laid the foundation for PayFi.

From the perspective of the development of DeFi. Attracted by the high returns of DeFi, most of the participants in the first wave of DeFi were individuals who tried to master the power of this new technology (the iconic innovation of DeFi 1.0 is that individual users participate in liquidity provision through the automated market maker (AMM) model to obtain rewards). However, this way of relying on external liquidity providers is not stable, especially since users are mainly attracted by high returns. When the rewards end or are transferred to other more attractive projects, liquidity will quickly drain away, thus affecting the development of the entire project. In order to deal with this problem, DeFi 2.0 began to transfer the control of liquidity providers from retail investors to project parties, that is, led by enterprises or institutions, and achieve ecological stability through centralized liquidity control. The emergence of DeFi 3.0 is to allow more ordinary users, especially retail investors who lack knowledge of DeFi, to have the opportunity to easily participate in DeFi without having to deeply understand complex operations or technologies. Since then, DeFi has entered a stage of parallel development for individuals, enterprises, and institutions, with both project parties leading and innovative models that simplify operations, making DeFi more popular.

However, the development of PayFi is quite different from that of PayFi. Due to its reliance on infrastructure (such as payment networks, compliance systems, basic chains, etc.), the early construction of PayFi needs to rely on large enterprises, financial institutions or infrastructure providers to build technical frameworks and solutions. Individual users cannot directly participate in it. The operation of the entire ecosystem needs to be led by institutions with technology and resources in the industry. As the infrastructure gradually improves, more and more enterprises and institutions will begin to participate, using existing systems and technologies for integration and providing more diversified services. The participation of various enterprises and institutions makes the ecosystem more complete, but it is still dominated by enterprises and institutions, and the participation of ordinary users is relatively low. After the infrastructure matures, individual users can begin to access and participate in the PayFi ecosystem, and drive more people into payment and financial innovation scenarios. In this process, how to maintain decentralization and compliance of the payment system, ensure security and privacy protection will become one of the key factors affecting the development of PayFi.

Challenges facing PayFi

The prospects are broad, but the challenges are numerous. This is the true portrayal of PayFi at present. As an emerging payment technology, the development of PayFi faces a series of challenges and risks, especially in terms of regulatory compliance, user acceptance, technological development and network effects.

1. Regulatory and compliance issues

Since it involves cryptocurrency and blockchain technology, it is currently still in a gray area of existing regulations. In addition, countries have different regulatory policies on cryptocurrencies, and the regulatory framework is not yet fully mature. These factors pose major challenges to the widespread application of PayFi.

Global regulatory differences: Different countries have very different regulatory attitudes towards crypto assets and Web3 payments. For example, in some countries (such as the United States and the European Union), cryptocurrencies and DeFi may face strict compliance requirements, while other countries (such as China, India, etc.) may implement comprehensive bans or strict regulatory measures. This uncertainty poses a great risk to PayFi's cross-border payments and global expansion.

Anti-money laundering (AML) and KYC requirements: In order to comply with the anti-money laundering regulations and customer identity verification requirements of various countries, the PayFi platform must conduct strict identity verification and transaction monitoring. This not only increases operating costs, but may also affect users' privacy protection and usage experience, especially in decentralized systems, where privacy protection should be a priority.

Tax compliance issues: PayFi’s transactions span the traditional financial system and the crypto system, and may face complex tax treatment issues, especially how to define the tax status of crypto assets and transaction tax rules. For example, some countries have unclear regulations on income tax for crypto transactions, which poses a significant compliance risk to the PayFi platform and its users.

2. User acceptance and education

The popularity of PayFi depends on the acceptance of users, especially for users with non-technical backgrounds. It may take a long time to understand and accept PayFi, an emerging payment technology. User education is crucial to achieve widespread market penetration.

Cognitive bias towards cryptocurrency: Many users still have doubts about cryptocurrency and blockchain technology, especially about technical security, volatility, privacy protection, etc. As a decentralized payment technology, PayFi has a relatively high threshold for understanding, and ordinary users may not understand or trust its potential and advantages.

Complex operation process: For ordinary consumers, PayFi's operation process may be complicated. Users need to understand how to use crypto wallets, how to conduct transactions, how to handle private keys, etc. This threshold may lead to the loss of potential users, especially in payment scenarios, where users prefer simple and intuitive payment tools.

Education and training costs: Promoting PayFi is not just a matter of marketing, it also requires large-scale user education. To change users’ payment habits and cognition, the PayFi project needs to invest a lot of resources in education and training, such as online tutorials, training videos, community interactions, etc., which will directly affect the promotion costs.

3. Technology and network effects

As a blockchain-based payment technology, PayFi faces challenges in terms of technical scalability, network effects, and compatibility with the existing financial system. Without sufficient technical support and network effects, PayFi may not be able to attract enough users and merchants, resulting in slow market penetration.

Scalability issues of blockchain technology: Currently, many blockchain networks (such as Bitcoin and Ethereum) still have bottlenecks in terms of transaction speed and processing power, and cannot meet the needs of large-scale, high-frequency payments. Even more efficient blockchain platforms such as Solana and Polygon face the risk of performance degradation when facing extremely large transaction volumes.

Lack of network effect: PayFi’s development cannot be separated from the participation of a wide range of users and merchants, but in the early stages of the market, there may be a “chicken and egg” problem: without enough merchants and users, the platform’s attractiveness will be limited, and merchants will hesitate to join due to the lack of a sufficient user base. This vicious cycle may lead to the lack of network effects, thereby limiting PayFi’s market penetration.

Compatibility issues with the traditional financial system: PayFi's compatibility with existing payment systems (such as credit cards, bank transfers, etc.) is also a challenge. Many merchants and consumers are accustomed to traditional payment methods, and the widespread use of PayFi requires seamless integration with the existing payment system, which requires not only technical support but also cooperation with traditional financial institutions.

4. Security issues

In the field of PayFi, security issues are particularly important, involving the user's fund security, transaction privacy and the technical stability of the platform. Hacker attacks (so far, hacker attacks are still a major security risk in the field of blockchain and cryptocurrency), protocol vulnerabilities (security flaws in the underlying blockchain protocol or payment protocol, which usually stem from errors in system design, development implementation or operation, and may lead to fund theft, user data leakage or malicious use of the protocol) and other security risks are among the main risks it faces.

Therefore, PayFi projects usually need to use multiple security strategies, technical audits and compliance measures to ensure the security of the platform and user funds. Although it is almost impossible to completely eliminate all security risks, through technical optimization and continuous strengthening of security protection, PayFi can reduce risks while improving its market competitiveness.

PayFi's potential investment opportunities and growth points

Investment opportunities in the PayFi track mainly focus on improving payment efficiency, reducing costs, promoting financial inclusion, exploring new business models, and enhancing the diversity of payment scenarios. You can focus on the following key areas:

First, payment infrastructure projects, especially cross-border payment and clearing layer innovations , will improve the efficiency of payment settlement, such as stablecoin issuers and Web3 payment platforms. Second, the application of Layer 2 expansion solutions in high-frequency payment scenarios can solve the limitations of existing Layer 1 blockchains in the payment field.

In addition, the combination of decentralized finance (DeFi) and payment applications, especially innovations in credit lending, stablecoins, and payment circulation , has also brought new investment opportunities. PayFi, as a derivative scenario of DeFi, may provide automated payment solutions through smart contracts, which is worth further exploration.

Payment intermediaries and cross-border payment solutions are also developing, providing more convenient settlement channels and innovative payment methods. With the rise of the PayFi field, compliance issues are becoming increasingly important, so the development of compliant contract platforms, KYC/AML solutions, and compliant stablecoins are also key investment opportunities.

Finally, as Web3 payment applications continue to gain popularity, paying attention to the platform's user growth, market share, and community activity can help identify potential projects. At the same time, monitoring market demand changes and technology trends, especially in encrypted payments, tokenized assets, and cross-chain interoperability, can also help discover projects that can solve the pain points of existing payment systems.

Summarize

This article systematically analyzes the concept and market potential of PayFi, an emerging field. Through practical cases, it demonstrates the typical application scenarios, market demand and development path of PayFi, analyzes its challenges in regulatory compliance, user acceptance, technical scalability and security, and proposes investment opportunities in payment infrastructure construction and innovative business models, looking forward to its potential to become a key infrastructure of the future digital economy.