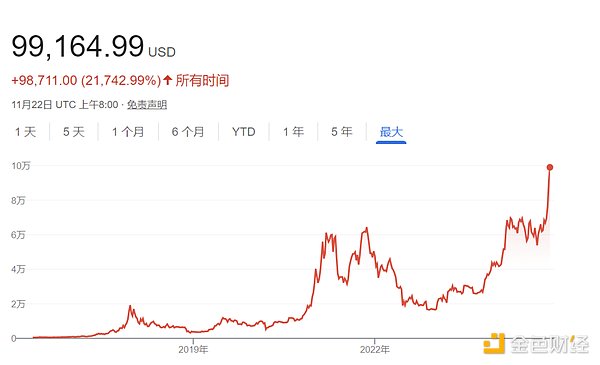

On November 22, the price of Bitcoin broke through the $99,000 mark, setting a new all-time high, just one step away from the long-awaited $100,000. The increase has exceeded 40% in the past two weeks. Since Donald Trump's victory in the US presidential election on November 5, the market capitalization of the crypto market has increased by about $900 billion, becoming the focus of the global financial market.

Trump Becomes the "Cheerleader" of the Crypto Circle

The historic high of Bitcoin approaching $100,000 is largely due to the market's optimistic expectations. Trump's support for cryptocurrencies is seen as the biggest driver of the prosperity of the crypto market, indicating that the US will move towards a more friendly regulatory policy for the crypto circle.

According to reports, Trump's team has begun to discuss whether to set up a dedicated position for digital asset policy in the White House, which will be the first such position in the US and will be in direct contact with the incoming president. These discussions are the latest boost to the US sentiment towards the digital asset market, following the Trump Media Group's plan to acquire the crypto trading platform Bakkt and the launch of the US Bitcoin ETF options.

Meanwhile, the news that SEC Chairman Gary Gensler will resign on January 20, 2025 has also sparked a positive reaction in the market. Gensler's series of tough enforcement actions during his tenure as SEC chairman, which resulted in the collection of about $21 billion in fines, have been widely criticized by the crypto circle. Trump also clearly stated during the election campaign that he would replace the SEC chairman.

The Era of Institutions is Coming

As the price of Bitcoin continues to rise, the market's focus has shifted from "whether it will break through $100,000" to "when it will break through".

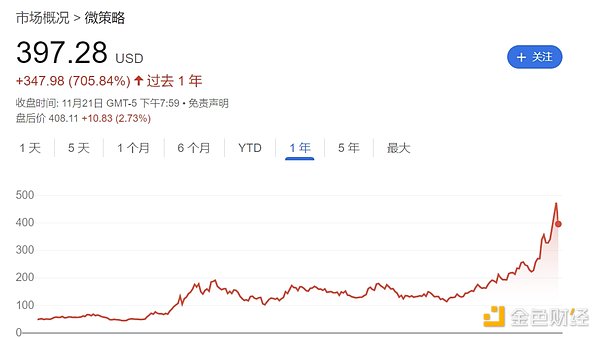

The "Bitcoin whale" MicroStrategy announced today that it has raised $3 billion through the issuance of convertible senior notes to continue purchasing Bitcoin. Since November, the company has raised $6.6 billion and bought 78,000 new Bitcoins. MicroStrategy currently holds about 1.67% of the world's circulating Bitcoins, with a digital asset reserve value of up to $31 billion. Thanks to this strategy, the company's stock price has soared 750% this year.

MicroStrategy's success is attracting more companies to imitate. Many companies are imitating its successful experience, using long-term zero-interest bonds to raise low-cost, low-risk financing to purchase and accumulate BTC as corporate reserve assets.

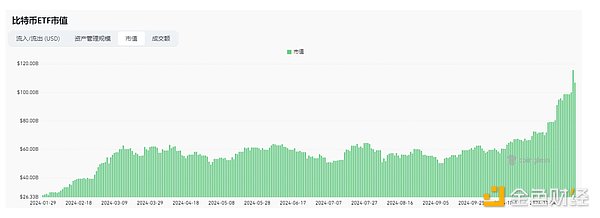

In addition, the asset size of US Bitcoin spot ETFs is also growing rapidly. Data shows that after the November election, the net inflow of funds into 12 Bitcoin-related ETFs in the US market reached $5.8 billion, with total assets exceeding $100 billion. These ETFs have cumulatively held over 1 million Bitcoins, further consolidating the dominance of institutional investors.

At the industry level, Trump's crypto-friendly stance will not only impact US policy, but also drive the crypto asset layout of countries around the world, and even trigger a competition among countries for the web3 industry.

Previously, the Bitcoin market was mainly driven by retail investors, but now BTC has entered the institutional era and is transitioning from a "speculative tool" to a "mainstream asset". The value of Bitcoin as a hedge asset is becoming increasingly prominent, given the limited supply of only 21 million Bitcoins globally.

Have investors missed the opportunity?

The $100,000 price not only reflects the market's enthusiasm, but also the comprehensive embodiment of Bitcoin's long-term scarcity, global consensus, and value storage. For retail investors who have successfully held Bitcoin so far, they only need to sit back and relax on the high-speed Bitcoin train, letting institutions and subsequent sovereign states serve as the new driving force to continue pushing the train forward.

For investors who are still hesitant, many may feel discouraged. However, the "high" and "low" of prices are essentially subjective, depending on the investor's perception of their long-term value. Even if the current price seems high, it may only be a stage in the process of its value rising. Historical data shows that as long as investors can persist in long-term holding, the upward trend of Bitcoin is often able to make up for the risk of buying at the short-term high.

Of course, market changes are difficult to predict, and predicting the top and bottom is extremely challenging, especially as bull markets are often accompanied by crashes. For investors who want to enter the market, regular fixed-amount investment is a relatively ideal strategy. Regardless of market fluctuations, invest a fixed amount at regular intervals, which can buy more units at lower prices and fewer units at higher prices, smoothing the overall investment cost and reducing dependence on market timing. As time passes and the market recovers, the assets may experience exponential growth.

4E, as the official partner of the Argentine national team, supports the spot and contract trading of more than 200 cryptocurrencies including Bitcoin and Ethereum, covering various sectors with high liquidity and low fees, and has specially launched a fixed investment function to provide investors with a simple and efficient investment method.

At the same time, 4E has also integrated traditional financial assets into the platform, establishing a comprehensive one-stop trading system covering from deposit to cryptocurrencies, and then to US stocks, indices, foreign exchange, and bulk commodities like gold, with more than 600 different risk-level assets that can be invested in with just holding USDT. In addition, the 4E platform has a $100 million risk protection fund to provide an extra layer of security for user funds. With 4E, investors can keep up with market dynamics, flexibly adjust their strategies and leverage, and seize every potential opportunity.