It's just a matter of time before Bitcoin hits $10W

The price of Bitcoin is reaching a record high of $10,000, as the market is optimistically believing that the president-elect Trump's support for cryptocurrencies signals a prosperous future for the crypto market, and the US will shift towards a friendly regulatory environment for the crypto industry, rather than the previous harsh crackdown.

On Thursday, Bitcoin, the largest digital asset, briefly rose 3.6% and approached $98,000. Since Trump's election victory on November 5, the entire crypto market has gained about $900 billion in value.

Good news, don't curse, brothers, Ethereum is standing up, a strong green column has broken through the fluctuation range this week and reached above $3,300

Ethereum makes a strong comeback, L2 tracks advance in tandem

As Bitcoin is about to break through $10,000, the long-dormant Ethereum has also seen a strong rebound. Yesterday, it surged more than 300, with a gain of over 10%.

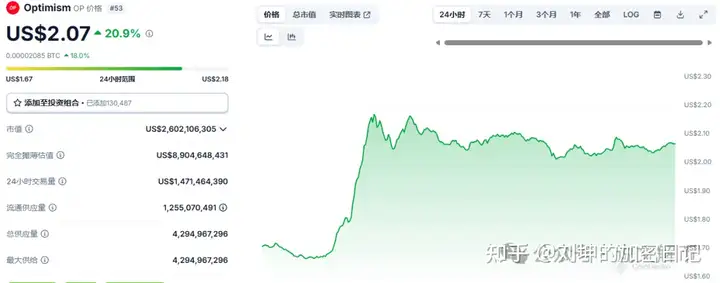

The Layer 2 tracks have also been inspired to rise together, with OP up more than 20% and Arbitrum also up about 12% in the past 24 hours.

Today's market altcoin highlights:

- Meme market: The meme heat on SOL has cooled down, with only Chillguy performing strongly at the moment, while others like $pnut, $act, $ban are still in correction. It is expected that the correction will end and the rebound will be more violent.

- SOL: Due to the progress of the ETF application, it is approaching the historical high, and the breakthrough is imminent.

- Fed's Schmitt: Stated that cryptocurrencies are tradable assets, not currencies.

- FTX restructuring: Planned to take effect in January 2025, with user compensation starting in March, which is also the reason for the surge in FTT.

- Trump's crypto plan: Expected to establish a Bitcoin reserve, the US strategic reserve is a must, European countries may follow suit, and the Bitcoin in hand should not be sold.

- SEC chairman's resignation: Gary Gensler will resign on January 20, which is bullish for the crypto industry, especially the DeFi sector, keep an eye on $uni, $aave, $dydx and others.

- ETH rebound: ETH and L2 tokens like $op, $arb, $strk, $eigen have seen significant increases, worth following up on.

The money-making effect in the crypto world will now be concentrated on Musk and Trump, as well as the SOL they support. Playing meme PVP every day is not as good as buying SOL and its ecosystem jto jup. A few days ago, I mentioned in the group that the SOL new high ecosystem will definitely take off as well, and the market is coming and everything is soaring high. And the takeoff of Ethereum is indispensable, which are ENA, ETHFI, LDO, SSV. The US is cutting interest rates, and the rates will continue to decline, so the funds will definitely flow to other places with higher interest rates, and the interest rates of these Ethereum staking like ENA are 10%, while the US is dropping from 5% all the way down to 4.75%, 4.5%... all the way lower, the money will definitely flow to the big VC coins first, and then to the small ones, because the prerequisite for earning income is safety, in the crypto world to make money, grasp these big prerequisites, make arrangements in advance, and then just wait to make money.

➜ $OP

- OP is the leader of the Ethereum Layer2, and the rise and fall of OP indeed has the meaning of a wind vane for Ethereum altcoins. Now all the L2 chains used are based on OP, including Base, Sony, and these chains, as long as they have user transactions that generate revenue, they need to share the money with OP, in the medium and long term, OP can become a whale that is too big to fail in the ETH ecosystem.

- If the conditions allow, it can actually intervene at any time to recycle its own tokens, and then further stimulate the ETH system market.

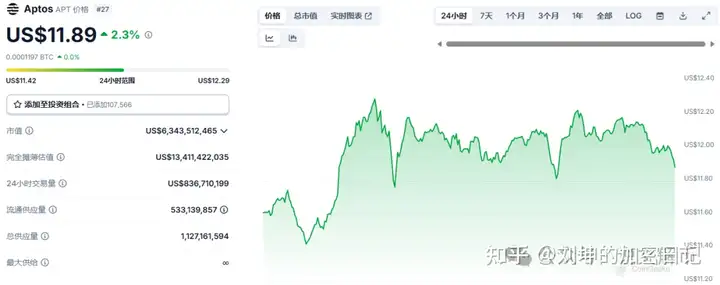

➜ $APT

- Last night, Circle officially announced the launch of USDC on Aptos, and Stripe will also integrate Aptos, Aptos blockchain is rapidly rising, providing a solid foundation for fast, secure stablecoin transactions and business applications.

- Aptos has already gained the recognition of major institutions including Circle, Stripe, Tether, eHKD, Franklin Templeton, Aave;

- Aptos has unparalleled advantages in the fields of finance and payment compared to other public chains; its strong technical and application foundation, as well as the recognition of many institutions, have laid a solid foundation for its future development.

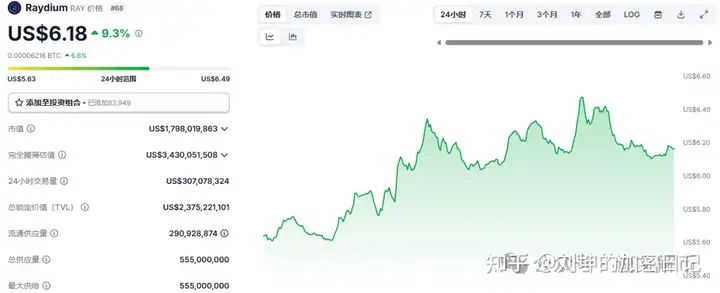

➜ $RAY

- Raydium is an automated market maker (AMM) based on the Solana blockchain, it provides users with a central limit order book, supports fast trading, liquidity sharing, and also allows users to earn rewards.

- Raydium has greater potential than Uniswap. It can generate more fees and token income, and is willing to share these earnings.

- But in the longer term, I think RAY is still severely undervalued.

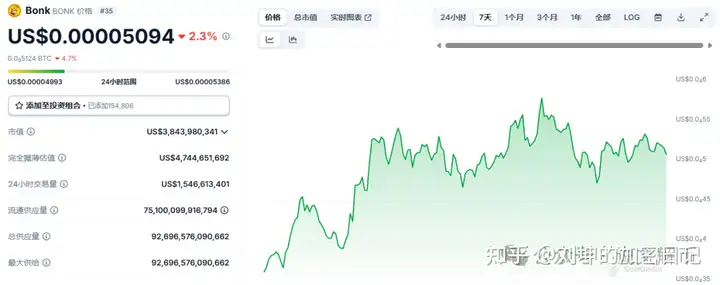

➜ $BONK

- $BONK is the strongest performing Memecoin in the $SOL ecosystem. Data shows that $BONK's gains are about 4.5 times that of $SOL on days when $SOL is actively rising.

- Market logic: When $SOL rises, the gains of $BONK are usually more exaggerated, making it the preferred choice for market speculators.

- With the imminent breakthrough of $SOL, and Solana's dominant position in the Memecoin field, the performance of $BONK is worth close attention.

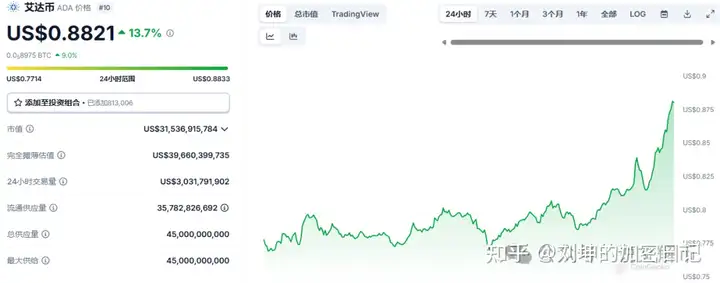

➜ $ADA

- As one of the representatives of the third-generation public chain, ADA stands out with its rigorous academic research background and progressive development model

- Cardano has adopted the pioneering Ouroboros Proof-of-Stake algorithm, committed to building a sustainable ecosystem that can meet regulatory requirements

- With the improvement of the Cardano smart contract platform Goguen stage and the subsequent Alonzo hard fork upgrade that will bring DeFi prosperity, ADA will provide endless momentum for its explosion in the next bull market while enhancing its underlying infrastructure