Author: Chloe, PANews

With the return of Trump to the White House and the entry of crypto-friendly candidates into the U.S. Congress, the industry expects cryptocurrency to thrive in a favorable regulatory environment, causing the price of Bitcoin to soar above $90,000. According to a November 18 CNA report, Taiwan's "legislators" recently raised concerns about the taxation of cryptocurrencies in Taiwan, discussing whether personal cryptocurrency transactions should be taxed.

During the interpellation, the "legislators" questioned the "Ministry of Finance" about the taxation measures on personal cryptocurrency transaction income, stating that currently only business tax and corporate income tax are levied on cryptocurrency exchanges, and there are no clear tax regulations on the profits that individuals or legal entities obtain from transactions. They emphasized that the "Ministry of Finance" should take the initiative to improve Taiwan's cryptocurrency taxation mechanism.

Currently, there are 26 virtual asset operators in Taiwan who have completed the anti-money laundering compliance declaration to the "Financial Supervisory Commission" and have registered for tax purposes, paying business tax and corporate income tax. However, the "legislators" still believe that in terms of cryptocurrency taxation, the focus is mainly on operators, and the taxation and auditing of personal transactions are still not comprehensive enough.

Sung Hsiu-ling, the director-general of the Taxation Administration, pointed out that according to the current tax laws, cryptocurrencies are not considered currency, but rather digital asset transactions. As long as there are asset transactions with income, they must be taxed. However, since it is a self-declaration, the auditing needs to be strengthened. The Ministry of Finance will also cooperate with the Financial Supervisory Commission to introduce new audit measures after the virtual asset-specific law is enacted in the future. "The tax authorities currently have audit tools that can be used to review digital commodity transactions, and they have promised to deliberate on the relevant measures for the taxation of cryptocurrency trading profits within 3 months," Sung Hsiu-ling said.

Finally, the "Ministry of Finance" stated that it will continue to pay attention to the global trends in the taxation of cryptocurrencies and digital services, and will adjust the tax system in a timely manner based on Taiwan's actual situation.

The taxation issue of cryptocurrency trading has become a focus of attention in various countries in recent years. PANews has compiled a simple overview of how different countries/regions handle the taxation of crypto assets.

Increasing transparency of crypto asset transaction tax information globally

The United States, the European Union, and other regions will introduce new tax reporting requirements for crypto asset brokers and other intermediaries in 2023, aiming to increase transaction transparency. The Organization for Economic Cooperation and Development (OECD) also released the Crypto-Asset Reporting Framework (CARF) and updated the Common Reporting Standard (CRS) last June, bringing new financial products into the reporting scope.

As countries gradually implement crypto asset tax information reporting to prevent them from becoming tax avoidance tools, PwC's "2024 Global Crypto Asset Tax Survey" indicates that as of December 1, 2023, 54 major crypto market jurisdictions have stated that they will quickly adopt the OECD's "Crypto-Asset Reporting Framework" (CARF), and are expected to implement an automatic exchange mechanism for crypto asset transaction information by 2027. The transactions that need to be reported include: exchange of crypto assets, exchange of crypto assets for fiat currency, and transfer of crypto assets as consideration for goods or services worth more than $50,000.

Looking at the cryptocurrency taxation issue that was recently raised by Taiwan's "legislators", the current situation in Taiwan mainly focuses on KYC and anti-money laundering, where crypto-related practitioners need to grasp customer information, and large withdrawals (over NT$500,000) must be reported proactively. In other words, apart from the Anti-Money Laundering Act, there are no clear guidelines or income tax regulations specifically applicable to cryptocurrencies in Taiwan.

For ordinary transaction users, at the current stage, there is no need to pay transaction tax when buying and selling cryptocurrencies. The profits are treated the same as gains from other asset transactions (such as foreign exchange trading profits), and "must be declared" as property transaction income, which is included in the personal consolidated income tax.

In simple terms, the principle of cryptocurrency taxation in Taiwan is "taxable upon withdrawal of profits". As long as the investor's profit funds have not been withdrawn to a bank account, there will be no actual profit. Once the cryptocurrency profits are withdrawn to a bank account, i.e., the withdrawal reaches a certain amount, it will be taxed.

Additionally, for cryptocurrency traders whose main business is buying and selling cryptocurrencies, if their monthly sales exceed NT$40,000, they are considered regular cryptocurrency traders and must complete tax registration and pay business tax and corporate income tax.

The United States treats cryptocurrencies as taxable property, with varying calculation methods across states

The U.S. government defines virtual currency as a digital asset recorded on a cryptographically secure distributed ledger, which is not actual legal tender, as it is not the coin and paper currency of the United States or any other country's central bank-issued legal tender.

Furthermore, the U.S. Internal Revenue Service (IRS) treats cryptocurrencies as taxable property. If the market value of cryptocurrencies changes, and the current price is higher than the investor's original purchase price, the investor will incur capital gains or losses when they withdraw the funds. If there are profits, the holder must pay taxes on the sold cryptocurrencies. Additionally, if one party receives cryptocurrency payments for business activities, the recipient must treat the received cryptocurrency as business income and pay taxes accordingly.

For example, if party A purchases 1 BTC for $5,000 and sells it three months later for $7,000, the party must pay taxes on the $2,000 withdrawal profit based on the short-term capital gains tax rate. If the profit is from the sale of assets held for less than a year, in the 2023 tax year, the tax rate ranges from 0% to 37%, depending on the taxpayer's reported actual income.

In addition to trading profits, other income in the cryptocurrency ecosystem also requires taxation. For example, cryptocurrency mining rewards, staking rewards, and interest earned through lending platforms are typically classified as ordinary income and subject to regular income tax rates. In 2023, the IRS has issued a series of new regulations, further clarifying the recognition timing of staking rewards and defining NFTs as collectibles, subject to special tax treatment rules.

In mid-2022, the IRS released the final draft of the cryptocurrency tax system, which will require cryptocurrency brokers to submit Form 1099-DA to the IRS, reporting client transaction information starting in 2025. This new system is expected to significantly improve tax compliance, while also bringing more compliance requirements for market participants.

At the state level, the calculation methods for tax collection also vary, but so far the states have not reached a consensus on the definition and taxation of NFTs.

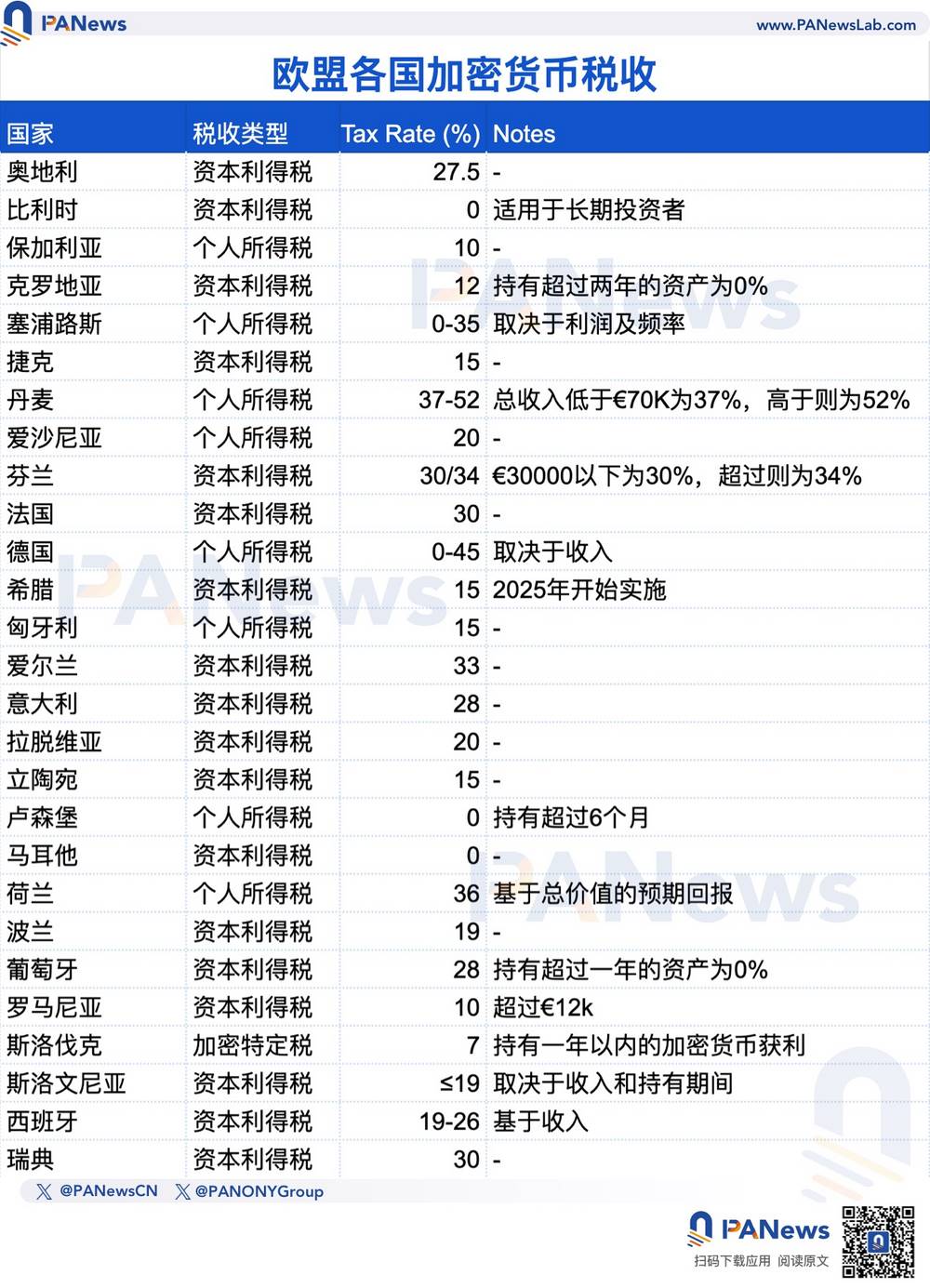

Significant tax rate differences among EU countries, with Denmark as high as 52%

Additionally, in Europe, EU countries are continuously updating their cryptocurrency tax systems. If the goal is to minimize the tax burden on cryptocurrency holders, Slovakia, Luxembourg, Bulgaria, Greece, Hungary, or Lithuania would be relatively friendly choices, as these countries currently have the lowest tax rates on cryptocurrency holders in the EU.

In comparison, Denmark, Finland, the Netherlands, Germany, and Ireland are less friendly towards cryptocurrency transactions. Denmark treats cryptocurrency gains as personal income and levies a high tax rate of 37% to 52%. The following is a summary of the tax types and rates in various EU countries. Capital Gains Tax mainly taxes investment gains, and the tax rate is generally more fixed, while Personal Income Tax uses a progressive tax rate system and is related to the taxpayer's total income.

Hong Kong and Singapore currently do not tax individual capital gains

Finally, there are the Asian countries. In the case of Japan, the profits from cryptocurrency transactions are classified as "miscellaneous income" and are subject to progressive income tax rates. The tax rate depends on the individual's income, with the lowest rate for cryptocurrency in Japan being 5% and the highest being 45%. For example, the tax rate for an annual income exceeding 40 million yen (about $276,000) can be as high as 45%. Notably, the Japanese government stipulates that cryptocurrency losses cannot be deducted from the taxpayer's income or other assets, and only losses from real estate, business, and forestry income can be deducted from income, as cryptocurrencies do not fall into these categories.

In South Korea, the country plans to impose a 20% cryptocurrency profit tax on gains exceeding 2.5 million won (about $1,800), but the implementation has been repeatedly postponed, originally scheduled for 2023, then delayed to 2025, and now further delayed to 2028. The main reason for the delay is the consideration of market volatility, as in the past, there was a lack of proper tax infrastructure, and the government was concerned that an early implementation would affect investor sentiment.

Additionally, in Hong Kong and Singapore, individual capital gains are currently not taxed. First, Hong Kong currently does not have specific tax provisions for digital assets, but the Inland Revenue Department of Hong Kong updated Departmental Interpretation and Practice Notes (DIPN) No. 39 in March 2020, adding a section on the taxation of digital assets.

However, the guidelines have not yet covered staking, DeFi, or Web3-related content (such as NFTs and tokenization of physical assets). Nevertheless, Hong Kong adopts a territorial tax system, levying a 16.5% capital gains tax on profits from trading, professional or business activities carried on in Hong Kong, but this does not include profits of a capital nature. As for the profits from cryptocurrency transactions, whether they are of an income or capital nature depends on the specific facts and circumstances.

The Inland Revenue Authority of Singapore (IRAS) does not impose capital gains tax on individuals' cryptocurrency transactions. Profits from long-term cryptocurrency investments are tax-free. However, if an individual frequently trades cryptocurrencies or operates a cryptocurrency-related business, the income may be considered trading income and subject to progressive income tax rates of up to 22%.

The tax policies of different countries have significantly impacted cryptocurrency investment strategies. Lower tax rates are more attractive for multinational companies to invest in those countries. Conversely, high-tax policies in countries like the United States, Japan, France, and Spain may deter some investors, as a Coincub survey indicates that the US alone could have collected around $1.87 billion in cryptocurrency taxes last year.

The situation in European countries is mixed, with some providing favorable conditions for long-term holders, while others maintain high tax rates, which may influence investor behavior. Overall, the cryptocurrency tax rates in European countries are higher than the global average, reflecting a part of the European Union's overall fiscal system.