Author:Duo Nine, crypto analyst

Compiled by: Felix, PANews

Solana has occupied the retail market in this cycle in a way that other chains cannot match, because it got one thing right.

Competitors like Ethereum have failed in this regard and paid a heavy price. BNB Chain failed. TRON tried and failed.

These competing L1 chains have failed, but Solana has succeeded, and SOL deserves respect for that.

How did Solana do it?

Solana VCs have captured the greed of the market in a way that other L1s cannot match.

TRON's transaction costs are also low, as is BNB Chain. Solana has no advantage in this regard. However, the focus of these competing chains was wrong.

Binance is focused on their CEX, airdropping new coins listed on Binance to users. Users must stake BNB for this. This method can effectively keep the price of BNB at a high level.

BNB has also hit an all-time high this cycle, but it has not risen 28x (compared to the 2022 low) like Solana.

Tether official data shows that there are 60.2 billion USDT on the TRON network, close to half of the existing 130.7 billion USDT, 66.3 billion USDT on the Ethereum chain, and only 860 million USDT on the Solana network.

USDT on ETH is mainly used for DeFi, while USDT on TRON is used for transfers and payments. TRON and Justin Sun tried to create memes and bring retail into their chain, but failed. They were too late to the game, and TRX prices did not 28x this cycle.

As for Ethereum, it has completely divorced from market realities. Vitalik is pontificating on forums, talking about a 5-year roadmap.

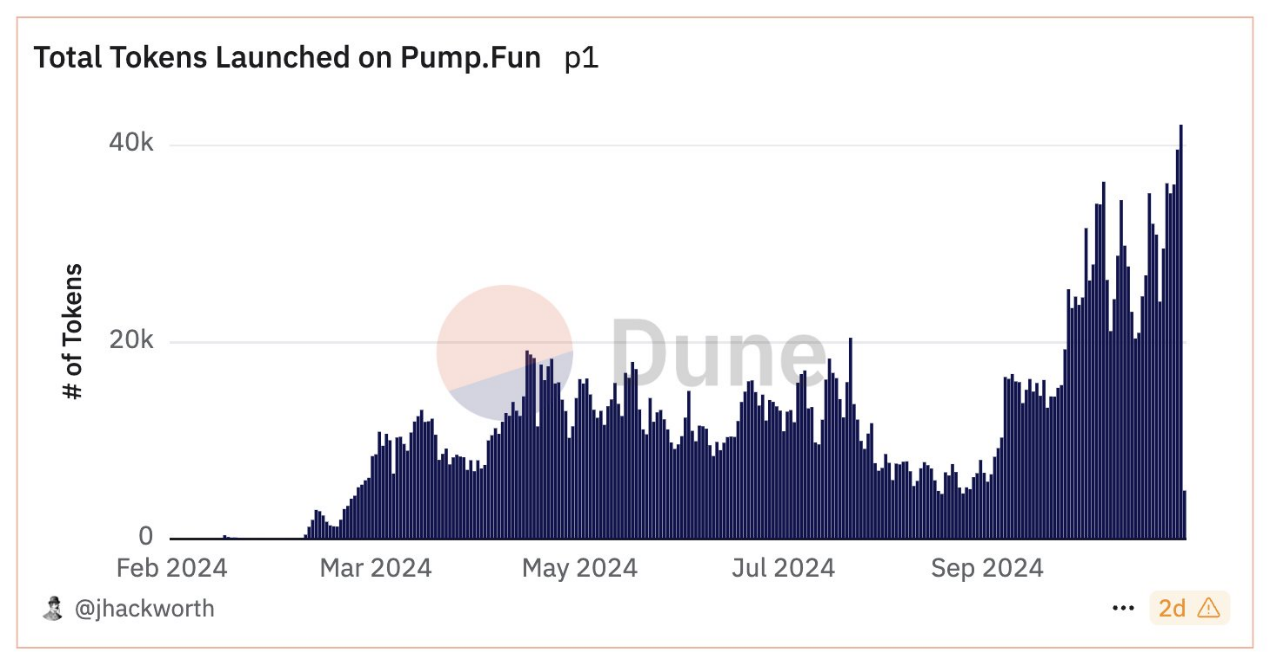

But retail attention span is 30 seconds, which is the time it takes for a Solana meme to 10x on pump.fun.

What made Solana the winner?

In addition to low transaction costs and a 28x rise since 2022 (which is very important for the average retail), Solana has done another important thing.

They have created applications and ecosystems that cater to the greed through memes. Solana VCs have poured in a lot of cash, they have also subsidized network costs, and have actively created FOMO through memes.

They have also focused on creating applications and wallets that retail can easily understand. Retail doesn't care about infrastructure (unlike Ethereum developers), they care about price appreciation.

Solana has achieved this, and has allowed retail to gamble like Degens. Literally, Solana is a meme machine, the king of memes. Their ecosystem is constantly churning out new memes, just like TRON handles USDT transactions.

Other L1s don't have this advantage, and retail loves memes.

This has also led to unexpected outcomes.

If you talk to your friends about cryptocurrencies, Solana will be the first and most talked about Altcoin. In this cycle, the question you get from newbies is "How do I buy Solana" rather than "How do I buy Ethereum/BNB/TRX?".

This should not be underestimated. New money is flowing into Solana, and the price of SOL reflects this.

Even Solana's VCs are surprised by this success. They have done well. And they also plan to cash out big time.

In early 2025, tens of millions of SOL will be unlocked and dumped into the market. Retail may go crazy with FOMO and invest in SOL. A meme token will essentially cost hundreds of dollars.

In fact, the Solana token is the ultimate meme. Retail will actually think "I'll sell this meme coin and then put the profits into SOL".

They don't know that Solana is also a meme.

This idea will only drive up the price of Solana for now. As long as retail thinks Solana is "safe" or a "blue chip", the game will continue until the music stops.

Whenever people bet on memes on SOL and "profit" by buying SOL, the real winners are the VCs who sell SOL.

Solana has no real use cases like TRON's payments or remittances, nor DeFi like Ethereum. It has memes. Solana is very good at this, and has performed well in the bull market.

You can gamble on Solana, but ultimately you need to exit, don't leave your money in SOL or any tokens on the Solana network. It is a centralized database, not a decentralized currency like Bitcoin.

Perhaps someone will argue that Solana is full of fake users, and that's true.

But this does not prevent real retail from being lured into its ecosystem.

Once they join, the bots created by Solana will start working. On pump.fun alone, hundreds of bots will immediately rush to buy/purchase any newly created meme token.

It's a flywheel, incentivizing users to keep spending money, hoping their token will explode.

Some will, but most won't. It's effective, until retail exits in the bear market and liquidity dries up.

By then, all the plans will be complete, and the VCs will have cashed out hundreds of millions, if not billions of dollars.

You see, retail just needs to spend $100 to buy some meme tokens and become a millionaire. This story will satisfy the FOMO needs of thousands of new users.

Then the cycle will repeat. Over and over. Solana has captured this cycle very well. And there have been similar cycles in the crypto market in the past.