The core business of business intelligence (BI) has been performing averagely, but the side business of investing in Bitcoin has been thriving. MicroStrategy is undoubtedly one of the biggest winners in this bull market. Benefiting from the strong momentum of Bitcoin, MicroStrategy has achieved huge profits after boldly betting on Bitcoin, and this "lying down and winning" strategy is also attracting more and more imitators who are trying to replicate its success.

However, while MicroStrategy has achieved capital appreciation through the super-strong returns of Bitcoin, the high premium of its stock price has also raised market concerns, and the well-known short-seller Citron has even publicly taken a short position. Can MicroStrategy's leverage game continue to play out?

Bitcoin holdings worth over $32.6 billion, stock price up 497% this year

Since adopting the Bitcoin investment strategy in 2020, MicroStrategy has become an undisputed whale, and the value of its Bitcoin reserves has now surpassed the cash and securities held by companies like IBM and Nike.

According to data from BitcoinTreasuries.com, as of November 22, MicroStrategy has purchased over 331,000 Bitcoins at an average price of around $49,874, accounting for nearly 1.6% of the total Bitcoin supply, with a current value of over $32.69 billion. If calculated at the current Bitcoin price of around $99,000, MicroStrategy has realized about $16.2 billion in unrealized gains over the past four-plus years.

Despite the handsome returns, MicroStrategy has not stopped increasing its Bitcoin holdings, and its unlimited money printing is backed by issuing stocks and convertible bonds to purchase Bitcoin. According to MicroStrategy's latest announcement, the company has completed the issuance of $3 billion in zero-coupon convertible senior notes due 2029, with a conversion price 55% above the market price, or about $672 per share. The net proceeds of about $2.97 billion from this issuance will be used by MicroStrategy to purchase more Bitcoin and for other corporate purposes. Furthermore, of the $21 billion raised through previous stock offerings, MicroStrategy still has $15.3 billion available to purchase Bitcoin, and plans to raise $42 billion over the next three years to invest in Bitcoin.

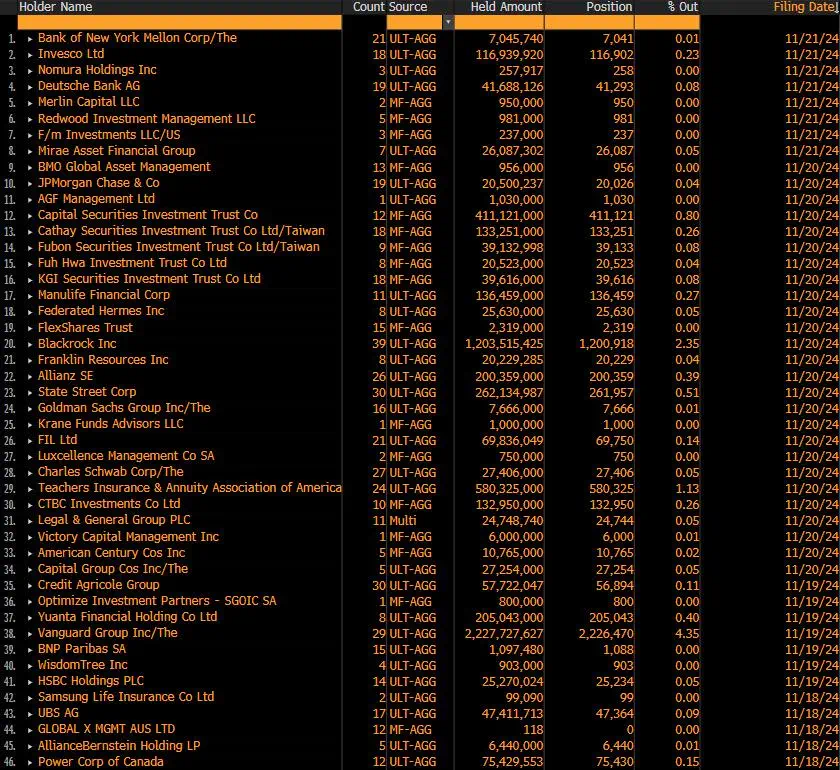

According to the latest data shared by @thepfund, since November 18, the list of MicroStrategy's major debt holders (with the right to choose to convert the bonds into stocks) shows that Vanguard Group is ranked first, followed by BlackRock, with well-known financial institutions and investment companies such as Goldman Sachs, JPMorgan Chase, and Deutsche Bank also appearing on the list.

The strong performance of Bitcoin returns has also boosted market optimism about MicroStrategy's prospects. Data shows that MicroStrategy's market capitalization has reached $80.51 billion, a premium of nearly 2.5 times over the value of its Bitcoin holdings. The company has even briefly ranked among the top 100 U.S. listed companies by market value. In terms of stock price performance, MSTR has risen to $397.28, about 14 times the stock price when the company first purchased Bitcoin, and has increased by 497.8% so far this year, far exceeding the rise in Bitcoin. Of course, MSTR's trading is also very active, with the trading volume reaching $39.9 billion yesterday (U.S. time), second only to Nvidia's $58.8 billion, ranking second on Tradingview's most active U.S. stock Top 100 data.

MicroStrategy's shareholders have also seen significant appreciation. According to a recent disclosure by MicroStrategy founder Michael Saylor on a social media platform, MSTR's financial operations have achieved a 41.8% Bitcoin return, providing its shareholders with a net gain of about 79,130 BTC. This is equivalent to about 246 BTC per day, and without the usual costs, energy consumption, or capital expenditures associated with Bitcoin mining. According to 13F filings tracked by Fintel in the third quarter, the number of institutional holders of MSTR has increased to 1,040, holding a total of 102 million shares (currently worth $405.2 billion), including Capital International, Vanguard Group, Citadel, Jane Street, Morgan Stanley, Invesco, and BlackRock.

In this regard, CoinDesk analyst James Van Straten previously analyzed that MicroStrategy's shareholders are a unique group, and while shareholder dilution is usually seen as a bad thing, MicroStrategy's shareholders seem to be very happy to have their shares diluted, as they know that MicroStrategy is buying Bitcoin, a strategy that effectively increases the value per share, meaning that shareholder value also increases accordingly.

High premium of stock price sparks controversy, sustainability of leverage strategy becomes a focus

Faced with the high premium of MicroStrategy's stock, the market has also begun to show divergence on the leverage strategy behind it.

The bulls believe that MicroStrategy has successfully combined the upside potential of Bitcoin with the performance of its company stock through leveraged positioning, creating a huge value growth space, especially against the backdrop of Bitcoin's strong price appreciation. For example, Mechanism Capital partner Andrew Kang posted on the X platform that MicroStrategy has been pushed up by Bitcoin, with its premium continuously hitting new highs, which traditional finance cannot understand, and there is a certain degree of sluggishness towards MicroStrategy's model; BTIG analyst Andrew Harte praised MicroStrategy's plan, believing that the company's management has done an excellent job in using volatility to raise additional legal capital to purchase Bitcoin, and has significantly raised its target price for MicroStrategy from $290 to $570.

"According to recent statistics, MicroStrategy's average cost of Bitcoin is $49,874, which means it is now close to 100% in unrealized gains, which is an extremely thick safety cushion. MicroStrategy is borrowing over-the-counter leverage, and there is no forced liquidation mechanism at all. The angry creditors can only convert their bonds into MSTR shares at the designated time, and then angrily dump them into the market. Even if MSTR is dumped to zero, it still does not need to be forced to sell these Bitcoins, because the earliest debt it borrowed will not mature until February 2027. Furthermore, due to MicroStrategy's convertible bonds, creditors are generally risk-free, so the interest is quite low," said 0xTodd, a partner at Nothing Research.

In the view of dForce founder Yang Mindao, MicroStrategy is not just a triple arbitrage of stocks, bonds, and coins, but has turned MSTR into a real Bitcoin in traditional finance, a "borrowing to cultivate the truth" top-level work. As for when the flywheel stops spinning and the music stops, the key is how long the stock and single-stock net coin premium can be maintained. If the market trend breaks expectations, the supply of Bitcoin derivatives increases, and MicroStrategy's stock/coin premium shrinks to within 1.2, this financing will be difficult to sustain. He also pointed out that MicroStrategy is currently trading at a 300% premium to Bitcoin, and if secondary market participants do not understand the variables involved, the risk is extremely high. The continuously growing scale means that the premium will only shrink rather than expand; the ability to continue financing is one of the variables that turns the premium from virtual to real.

However, the short-sellers believe that MicroStrategy's current stock price premium has far exceeded the intrinsic value of Bitcoin itself, and may quickly narrow or even amplify the downside risk of the stock price as market sentiment fluctuates.

For example, Citron believes that as investing in Bitcoin has become easier than ever before (with the availability of ETFs, COIN, and HOOD, etc.), MSTR's trading volume has completely divorced from Bitcoin's fundamentals. Although Citron is still bullish on Bitcoin, it has already hedged by taking a short position on MSTR. Even Michael Saylor must know that MSTR is now overheated.

Steno Research also pointed out in a recent report that "the recent stock split effect of MicroStrategy is gradually weakening, further reinforcing the belief that its premium is unlikely to be sustainable. The company's premium relative to its Bitcoin holdings has recently soared to nearly 300%, indicating that the company's valuation 'differs greatly from the direct calculation of its assets and business fundamentals'". As regulatory authorities become increasingly fond of Bitcoin and cryptocurrencies, investors may choose to hold Bitcoin directly rather than MicroStrategy stock.

BitMEX Research believes that MicroStrategy's price performance and upward model is a "Ponzi scheme" and is not reasonable. The stock price is greatly overpriced compared to the value of the Bitcoin it holds, partly because some financial regulatory agencies prohibit people from buying Bitcoin ETFs, but investors are very eager for Bitcoin exposure, so they disregard the premium and buy MSTR, and MSTR also has a "yield strategy".