The price of XRP has risen 25% in the last 24 hours after Gary Gensler, the chair of the U.S. Securities and Exchange Commission (SEC), announced on January 20, 2025 that he will resign from his position.

This development has provided relief to the popular "XRP Army". They had to endure suppressed price movements due to the SEC's relentless lawsuit against Ripple led by Gensler. However, this is not all.

XRP Short Positions Liquidated Massively After Gensler's Announcement

Gensler's announcement appears to be a positive development for the cryptocurrency market as a whole. However, XRP holders seem to have benefited the most. This was particularly important given the unresolved Ripple-SEC legal issues during Gensler's tenure as SEC chair.

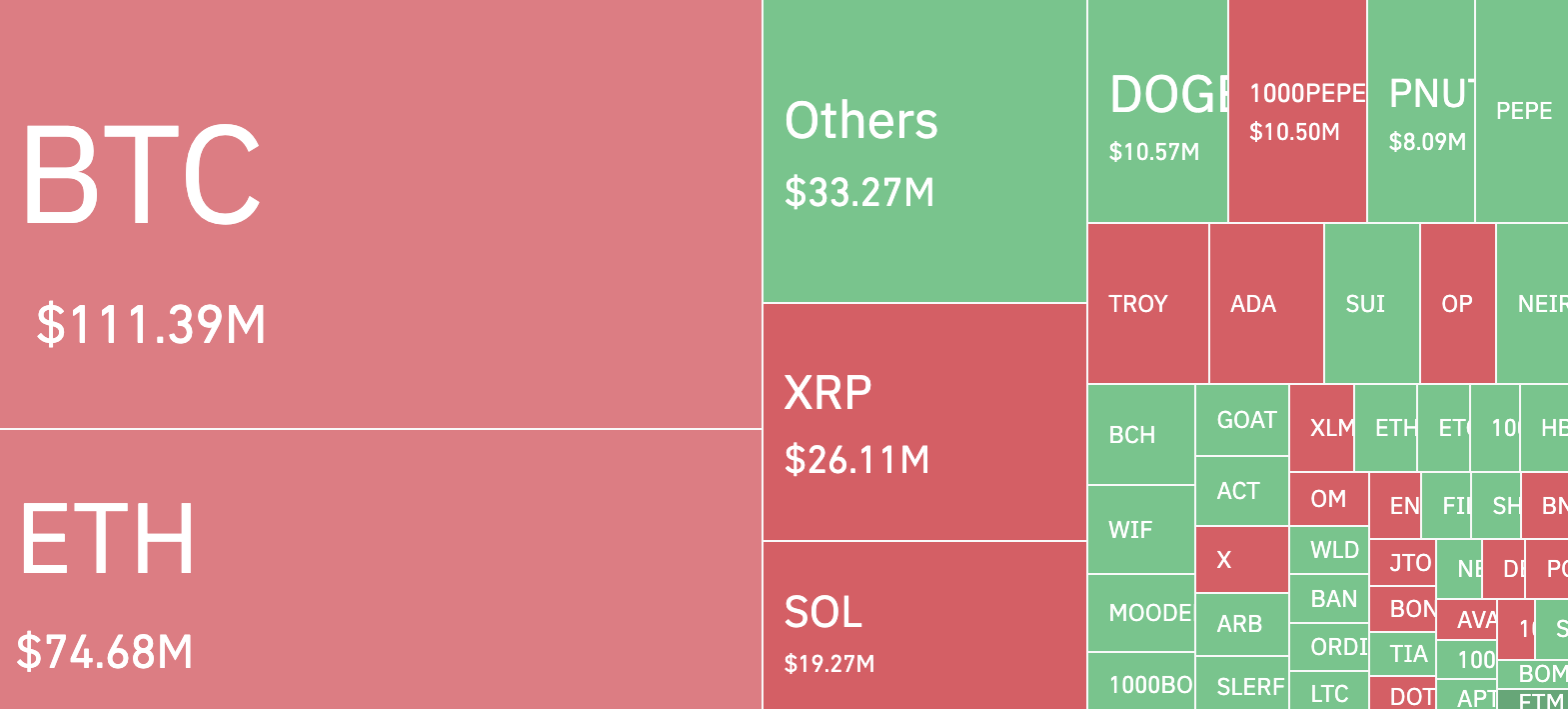

As a result, the XRP price has surged, outperforming any other top 10 cryptocurrency. Additionally, this development has triggered a total of $26.11 million in liquidations over the past 24 hours.

Liquidations occur when a trader fails to meet the margin requirements for their leveraged position. This forces the exchange to sell the assets to prevent further losses. In the case of XRP, the liquidations have primarily led to a short squeeze.

A short squeeze happens when many short positions (traders betting on a price decline) are forced to buy back the asset, causing the price to rise.

At the time of reporting, XRP is trading at $1.40, and its current market capitalization is $80.64 billion. As Gensler is set to depart, crypto lawyer John Deaton mentioned that the XRP price surge could go even higher, potentially reaching a market cap of $100 billion.

"XRP will soon reach a $100 billion market cap. The times are changing." – John Deaton, crypto lawyer

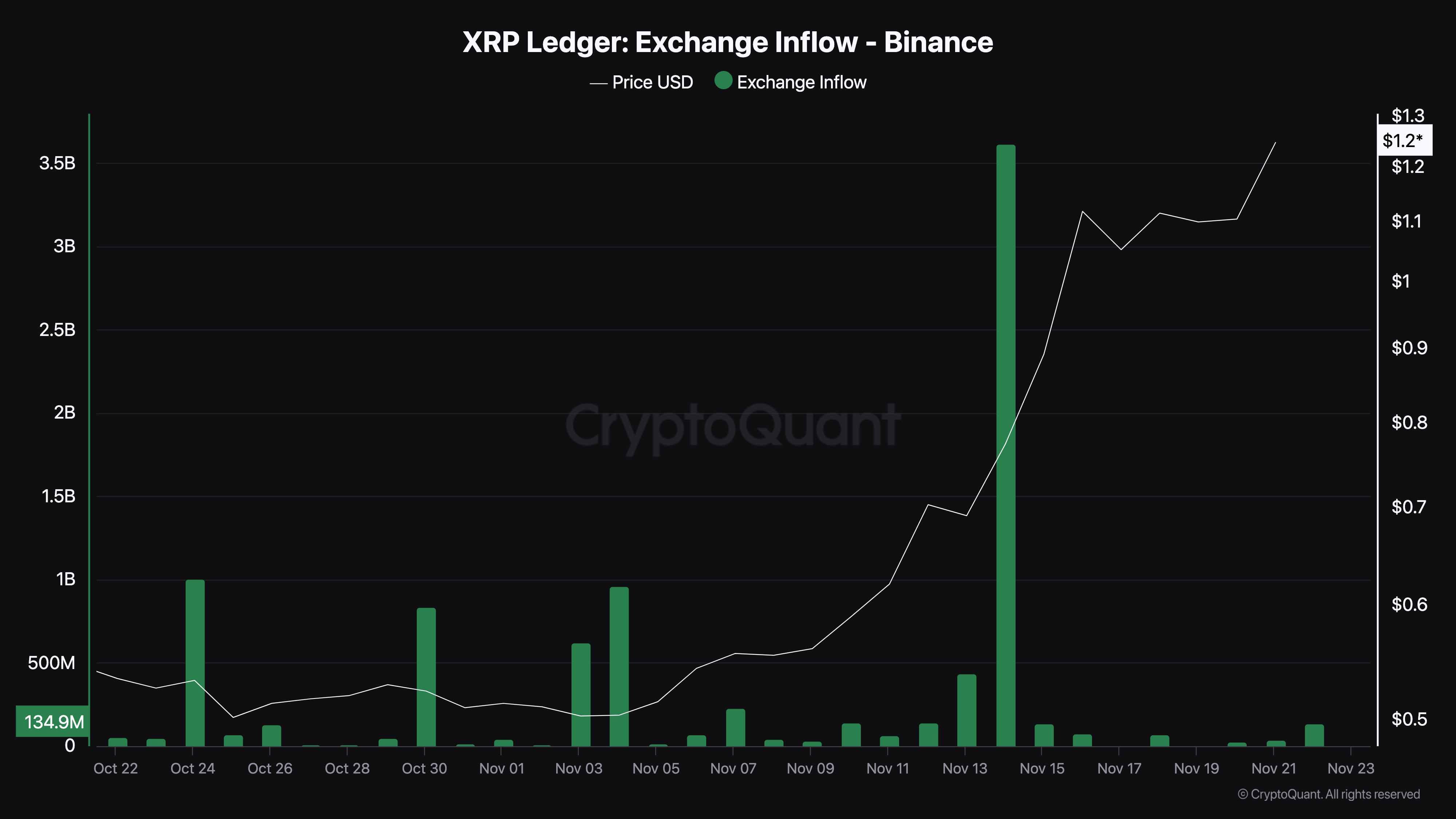

Meanwhile, according to CryptoQuant data, the total amount of XRP transferred to exchanges has significantly decreased. Generally, a high value indicates increased selling pressure in the spot market. This suggests that more assets are being withdrawn, which could put upward pressure on the price.

However, as the current state is low, XRP holders are refraining from selling. If this continues, the token's value could rise above $1.40.

XRP Price Prediction: Can it Reach $2?

According to the 4-hour chart, XRP has been trading between $1.04 and $1.17 since November 18. This sideways movement has formed a bullish flag pattern, signaling potential upward momentum.

A bullish flag starts with a sharp price increase, where buying pressure overcomes sellers, forming the pole. The price then pulls back slightly and moves within parallel trendlines, creating the flag structure.

Yesterday, XRP broke out of this pattern, indicating that the bulls have taken control of the market. If this momentum continues, XRP's price could exceed $1.50 and potentially approach $2.

However, this bullish scenario depends on market behavior. If holders decide to take profits, selling pressure could push XRP's price below $1, erasing the recent gains.