The cryptocurrency market is facing the expiration of $3.42 billion in Bitcoin and Ethereum options contracts today. This large expiration can lead to short-term price volatility, particularly in a market that is expecting Bitcoin to reach $100,000.

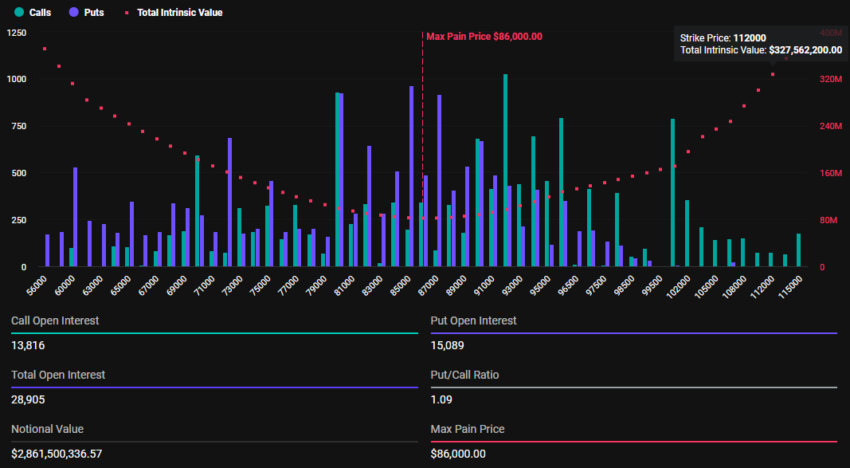

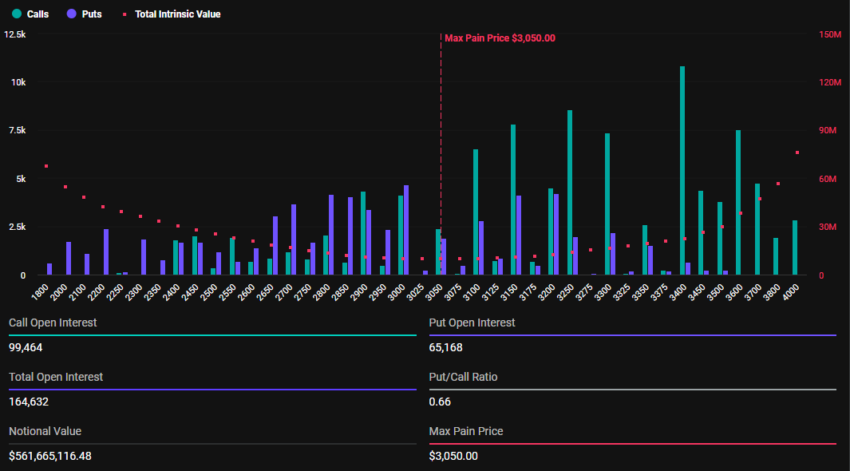

Bitcoin options are valued at $2.86 billion, and Ethereum at $566.6 million, with traders bracing for potential volatility.

Unlike Ethereum, traders are betting on a Bitcoin price decline

The Bitcoin (BTC) and Ethereum (ETH) contracts expiring today have increased significantly compared to last week. According to data from the cryptocurrency derivatives exchange Deribit, 28,905 Bitcoin option contracts will expire on Friday, with a put-call ratio of 1.09 and a maximum pain point of $86,000.

Meanwhile, 164,687 Ethereum contracts are expiring today, with a put-call ratio of 0.66 and a maximum pain point of $3,050.

The put-call ratio for Bitcoin is above 1, generally indicating a bearish sentiment. BTC whales and long-term holders have been driving the recent uptrend. In contrast, Ethereum's put-call ratio of 0.66 reflects a generally bullish market outlook.

The put-call ratio measures market sentiment. Put options represent bets on price declines, while call options represent bets on price increases.

A ratio above 1 indicates a lack of optimism in the market, with more traders betting on price declines. Conversely, a put-call ratio below 1 suggests optimism in the market, with more traders betting on price increases.

Bitcoin's put-call ratio and its impact on BTC

As the options expiration approaches, traders are betting on a BTC price decline and an ETH price increase. According to the maximum pain theory of options trading, BTC and ETH could be pulled towards their respective maximum pain points of $86,000 and $3,050, where the largest number of contracts, both calls and puts, will expire worthless.

The price pressure on the two assets is expected to ease after Deribit settles the contracts at 08:00 UTC today. However, at the time of writing, BTC is trading at $98,067, and ETH is trading at $3,295. Meanwhile, based on the put-call ratio, analysts at Greeks.live expect an extended northward move for ETH, while BTC is on the cusp of a correction.

"The roughly 8% of positions expiring this week have significantly increased the IV [implied volatility] of major Ethereum options, while the IV of major Bitcoin options has been relatively stable. The market sentiment is very bullish at this point," said the analysts at Greeks.live in a statement.

The analysts also note that while Bitcoin is at risk of a correction, the general market rally is holding back this potential pullback. They attribute the positive market sentiment to substantial capital inflows into ETFs, particularly the recent strong spot bullishness around BlackRock's IBIT options that have started trading.

Nevertheless, due to the massive expiration today, traders should expect volatility in Bitcoin and Ethereum prices, which could shape short-term trends.