Cryptocurrency investor Raoul Pal shared a positive outlook on Solana (SOL). Despite this altcoin recently hitting an all-time high, he suggests it has further upside potential. His prediction aligns with the filing of two new SOL-inclusive ETFs, which could increase cryptocurrency demand and visibility in the mainstream market.

For investors, this forecast is consistent with Solana's expanding ecosystem and growth. The key question is how high SOL can rise before reaching the peak of this upward cycle.

Pal Expects Solana Rally to Continue

Pal's comments came after SOL's price surpassed its previous high of $260. The investor, who is the founder of the cryptocurrency education platform Real Vision, suggests the rally is not over and the recent surge could be the start of another remarkable rise.

"SOL — quite a remarkable journey from the lows to new all-time highs. There's a lot more to come," Pal shared on X.

Moreover, Raoul Pal's Solana prediction may not surprise market observers. After the 2022 FTX collapse, Pal consistently argued that Solana was undervalued, especially after it dropped to $8.

What makes this forecast more intriguing is the timing. It coincides with two notable developments in the institutional space. Asset management giants VanEck and 21Shares filed for Solana-based ETFs.

These filings indicate growing institutional interest in Solana, which could drive demand and reinforce positive sentiment about its price potential.

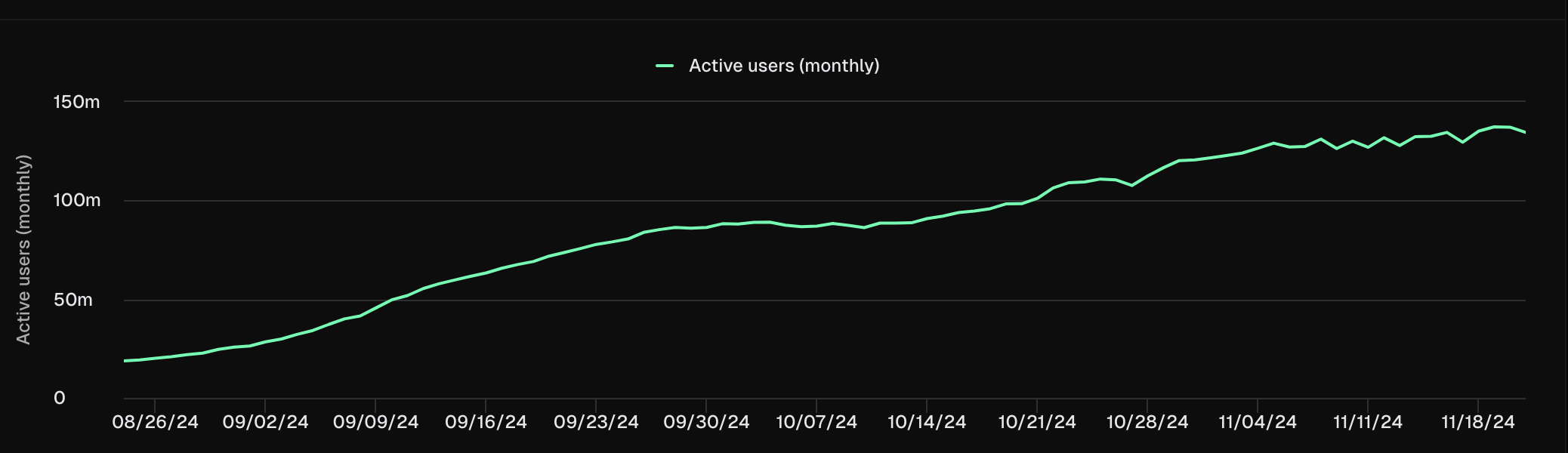

Beyond institutional developments, retail investors are also contributing to Solana's growth momentum. According to Token Terminal, Solana's monthly active users have surged to over 134 million.

This increase reflects the growing number of addresses actively trading SOL, suggesting widespread interest in the ecosystem.

Such sustained growth in active users generally indicates healthy network activity and adoption, which is a positive indicator for the long-term outlook of the altcoin.

SOL Price Prediction: $300 Possible

On the daily chart, Solana's price has risen to $258.81, forming an inverse head-and-shoulders pattern. The inverse head-and-shoulders is a bullish chart pattern that suggests a potential reversal from a downtrend to an uptrend.

Additionally, the neckline, which connects the highs of the two lows, acts as a key resistance level. If the price breaks above this neckline, it often confirms the reversal with an increase in trading volume.

As can be seen below, SOL's price has broken out of the pattern. With increased buying pressure, the altcoin could potentially rise to $300 in the short term.

However, a drop below the $235.91 support would invalidate the thesis. In that case, the cryptocurrency could decline to $215.21.