There are some common characteristics in the start of each bull market:

1. In the early stage of the bull market, BTC will slowly rise, standing out from the rest, driving the rise of Ethereum. At this time, some good mainstream coins will follow the rise, other coins will slowly follow the rise, and a few Altcoins will soar crazily, like the meme and AI sectors and the SOL ecosystem, while most Altcoins are not very active.

2. In the middle stage of the bull market, BTC and Ethereum will fluctuate and rise, the mainstream coins will start to rise strongly, and a large number of Altcoins will slowly start to rise.

3. In the late stage of the bull market, BTC will fluctuate and fall, Ethereum as the Altcoin leader may continue to surge, the mainstream coins will surge one after another, and the second-tier Altcoins will surge several times, even dozens or hundreds of times.

So, what stage are we in now? Obviously, we are in the transition between the first stage and the second stage. Many people holding value coins may not be able to outperform BTC and Ethereum, nor can they outperform Dogecoin, Shiba Inu, etc., and some have even doubled. They are very anxious, even unable to sleep at night, so they chase the rise and kill the fall, frequently change positions, one step wrong and step by step wrong, and the final result is that although they have experienced a big bull market, others have made a fortune, but they have lost a mess. What I want to tell you is that this is very normal, every bull market is like this, choose your own targets, hold on! Don't change cars, the wind and water take turns, it will have its time to perform!

Buy the dips of 3 Altcoins that may increase 100 times in the future!

1.RAY

Raydium is a decentralized automated market maker (AMM) and liquidity provider based on the Solana blockchain, providing fast and low-cost transactions. The company recently listed on the famous Korean cryptocurrency exchange Bithumb, driving its price up 10%. Raydium is currently priced at $5.90, up 6.04% during the day.

Over the past 24 hours, the price has fluctuated between $5.73 and $6.49, with a trading volume of $214 million and a market cap of $1.7 billion. In addition, the price is far above the 200-day simple moving average of $0.296, with a deviation of 1,961.27%, indicating a strong upward trend over time.

Raydium has had 16 positive price movements out of 30 days, with a success rate of 53%. Given its market capitalization, its high liquidity further consolidates its position in the market.

The recent increase in trading volume has driven the price rise, highlighting the good market sentiment. If the current trend continues, Raydium may approach the $7.00 mark, but this depends on its continued adoption and performance in the broader cryptocurrency market.

2.PEPE

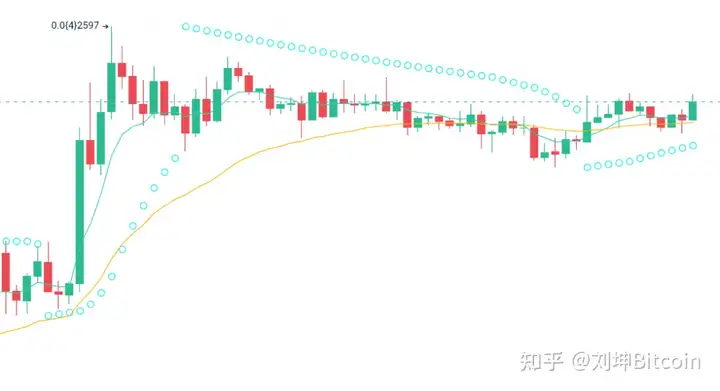

PEPE has performed well recently, hitting a new all-time high of $0.00002524 on November 14, and then falling back to $0.00002026, down 5.87% in the past 24 hours. With the 50-day moving average breaking through the 200-day moving average, this token has recently broken through a key technical milestone, which is often seen as a sign of potential bullish momentum.

Over the past month, PEPE's price has risen 15 times, with half of the time seeing steady price increases. The Fear & Greed Index shows an extremely high level of greed, with a score of 94, highlighting the strong positive sentiment. However, the 14-day Relative Strength Index is 42.74, indicating that the token is neither overbought nor oversold, and may consolidate in the short term.

At the same time, the 24-hour trading volume to market cap ratio is 0.3678, indicating moderate liquidity. Community interest in meme tokens remains high, as evidenced by trading activity and price volatility. While the token shows potential for further volatility, its current indicators present a mixed outlook.

3.AAVE

Aave is considering integrating with Spiderchain, a Bitcoin Layer 2 network developed by Botanix Labs. The proposal aims to connect the Ethereum DeFi ecosystem with the Bitcoin network, creating opportunities for users of both communities to participate in new financial activities.

Spiderchain is focused on attracting Bitcoin investors, especially those exploring on-chain transactions for the first time. By integrating Aave's lending and liquidity services, the plan can allow Bitcoin holders to access decentralized finance tools without leaving their ecosystem. This approach could potentially bridge liquidity from Ethereum to Bitcoin, encouraging interaction between the two networks.

This collaboration could also expand Bitcoin's applications in DeFi, while demonstrating how blockchain platforms can work together. However, such integration will need to address technical, security, and adoption challenges to ensure the trust and functionality of the ecosystem.

The native token of the protocol, AAVE, is currently trading at $178, well above its 200-day simple moving average of $78.04. This performance reflects strong market liquidity and interest.