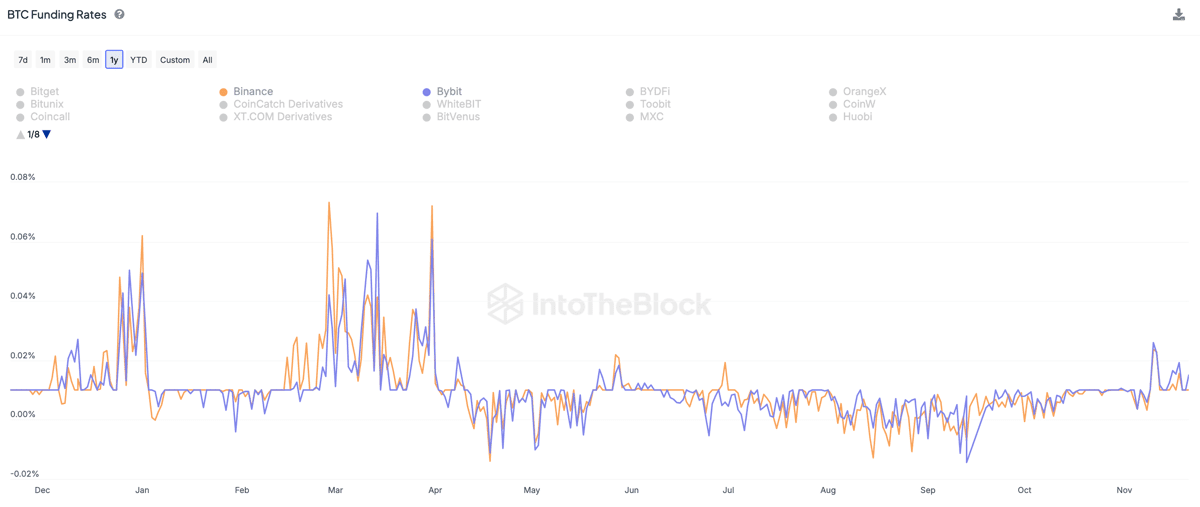

Since the election of Donald Trump as the President of the United States, the cryptocurrency market has been in a heated state: Bitcoin has risen by more than 30% in the past two weeks, aiming for $100,000, Robinhood and Coinbase have dominated the top two spots in the US App Store's finance category, and the funding rates of perpetual contracts have soared to over 10%, even reaching 20% on major exchanges.

IntoTheBlock commented on the cost of over 10% in fees, stating that this indicates a continuously strengthening bullish sentiment among traders, although it is still lower than the peak in the first quarter, but maintaining this level in the long run may indicate signs of overheated speculative activity.

Binance's monthly trading volume surpasses Nasdaq and NYSE

This heated situation has even surpassed the traditional capital markets, such as on November 19th, when the trading volume of the Bitcoin holding giant MicroStrategy surpassed Nvidia and Tesla, topping the "US stock trading volume champion".

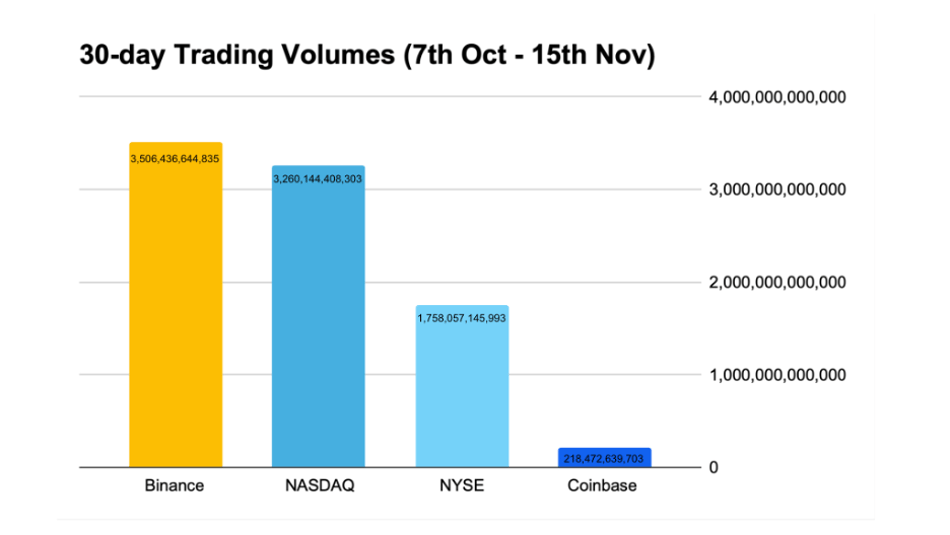

Recently, the crypto data insights company TokenInsight also released a report, pointing out that the position of cryptocurrencies in the financial market is becoming increasingly prominent. The report data shows that in the past 30 trading days (October 7 to November 15), Binance's total trading volume (spot + derivatives) reached $3.5 trillion, significantly surpassing the data of the world's major stock markets:

- Binance's trading volume is 10% higher than Nasdaq;

- It is twice that of the New York Stock Exchange (NYSE);

- It is 16 times that of Coinbase;

- And it accounts for about 50% of the global centralized exchange (CEX) trading volume.

The report stated that these data fully demonstrate that crypto assets are increasingly favored by investors and are gradually moving from the periphery to the core of mainstream finance.

Listing of meme coins is a major factor for Binance

Chain analyst Ai Yí analyzed that the growth of Binance's trading volume is not only affected by the heat of the market, but also related to its strategy of supporting meme coins. Since October, Binance has listed 11 popular meme coins.

Ai Yí pointed out that when we open the Binance market recently, we can see that half of the "24-hour trading volume" ranking are meme coins. For example, on November 13, the single-day contract trading volume of $Pnut reached $7.432 billion, even accounting for 39% of the ETH contract trading volume that day.

Ai Yí said that as the industry's largest exchange, "embracing Meme" is something Binance needs to humble itself and pay the corresponding price for. Recalling the previous dispute over the capitalization of Neiro, it has brought Binance a lot of criticism. But beyond the criticism, the voices saying "miracles only happen on Binance" are also getting louder and louder.

This report from TokenInsight confirms the effectiveness of Binance's recent foray into Memecoin

Since the end of October, when Binance launched the $GOAT contract, I've clearly felt that Binance's attitude towards Memecoin has started to change. In November, I compiled a tweet "Binance's Memecoin Projects Launched in 2024", which indirectly confirmed my own thoughts; but after reading the data in this report, I realized the trading volume was so exaggerated...

https://t.co/3fRwRwNLuE pic.twitter.com/7J4yCu0hro

— Ai Yí (@ai_9684xtpa) November 23, 2024

Binance sees record high stablecoin inflows

Furthermore, TokenInsight's report pointed out that another trend indicating a strong bullish signal is the inflow of USDT to centralized exchanges. During the US presidential election cycle, the total inflow of USDT to major exchanges exceeded $20 billion. Among them, Binance ranked first with an inflow of $7.7 billion, followed by Coinbase with $4.3 billion, and other exchanges with $6.5 billion.

CryptoQuant analyst also stated yesterday (22nd) that Binance's stablecoin inflows reached $10.2 billion over the past month, hitting a record high, highlighting Binance's core position in the cryptocurrency market and further confirming the significant effectiveness of Binance's strategy of supporting meme coins.

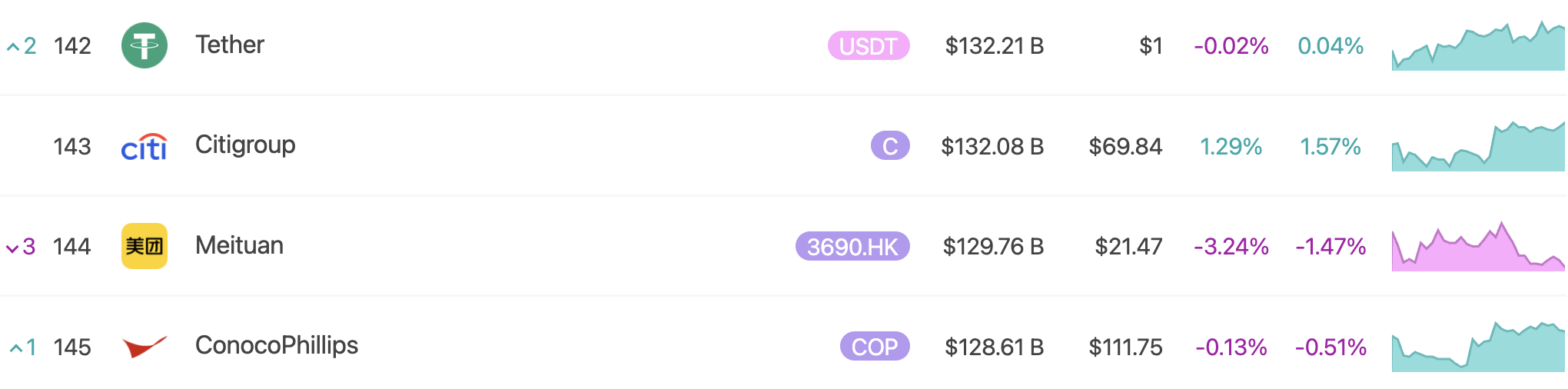

USDT market cap surpasses Citigroup

On the other hand, the market cap of USDT has surpassed $132.2 billion for the first time. The latest data from 8marketcap shows that its global asset ranking has surpassed traditional financial giants like Citigroup ($132 billion), China's leading life service platform Meituan ($129.76 billion), and the major US energy company ConocoPhillips ($128.61 billion), rising to the 142nd position.