A quick overview of the major events this week (11/17-11/23)

- BTC dynamics: BTC price nears $100,000, market cap "surpasses the New Taiwan Dollar" and becomes the 12th largest currency globally.

- Fed rate cut progress: Nomura Securities predicts the Fed will pause rate cuts in December, with rates falling to 3.75% by 2025; Morgan Stanley predicts: by mid-2025, the US 10-year Treasury yield will fall to 3.75%, with a 75 basis point rate cut in the first half of 2025.

- BTC strategic reserve: US think tanks and Chinese state media criticize the inability to solve the US debt problem; a Polish presidential candidate promises to establish a BTC strategic reserve if elected; a US congressman proposes selling the Fed's gold to acquire 1 million BTC in reserves.

- Microstrategy: holds BTC worth $26 billion, with assets exceeding IBM and Nike. Short-seller Citron calls the valuation detached from fundamentals and shorts Microstrategy.

- Regulation and taxation: SEC chair to resign in January 2023; US financial regulators add a new crypto asset division; Japan to reduce crypto capital gains tax to 20%, Taiwan plans to implement tax auditing measures.

- Trump: nominates BTC proponent Howard Lutnick as Commerce Secretary; nominates pro-BTC Kennedy as Health Secretary; plans to establish a crypto advisory council to help BTC become a strategic reserve.

- Market heat: Solana usage surpasses Ethereum for the first time; Chris Burniske who pumped SOL "starts turning bullish" on ETH.

This week's trading market data changes

Sentiment and sectors

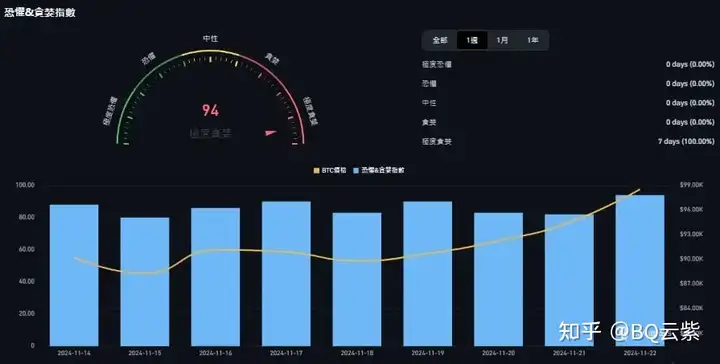

1. Fear and Greed Index

The market sentiment indicator rose from 90 (Extreme Greed) to 94 (Extreme Greed) this week, remaining in the (Extreme Greed) range throughout the week.

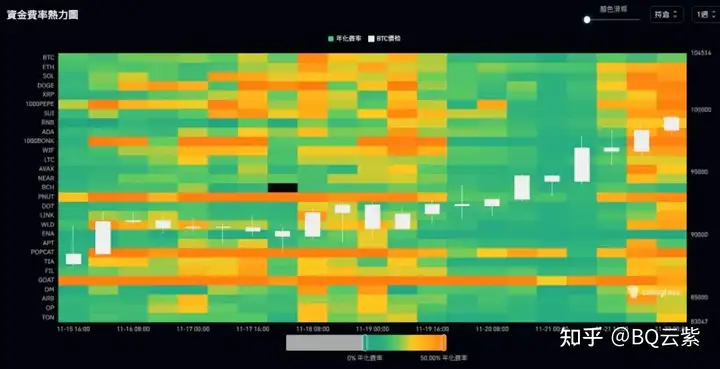

2. Funding rate heat map

This week, the highest BTC funding rate reached 47.97%, and the lowest was 7.21%, indicating a continued bullish sentiment. The funding rate heat map shows the trend of funding rate changes for different cryptocurrencies, with colors ranging from the zero-rate green to the 50% positive rate yellow, and black representing negative rates; the white candlestick chart shows BTC price fluctuations, contrasting with the funding rate.

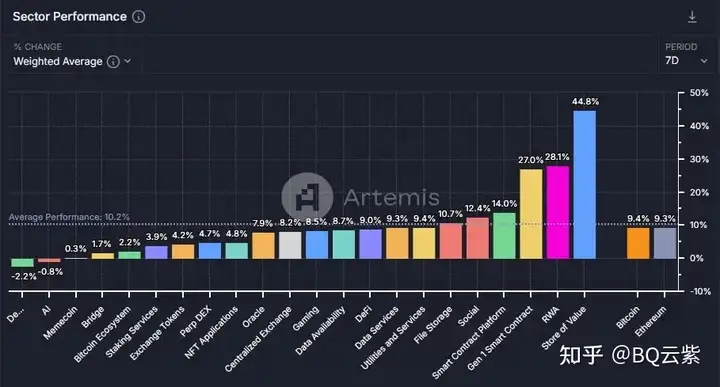

3. Sector performance

According to Artemis data, the average gain of the blockchain sector this week was (10.2%), with Store of Value, RWA, and Gen 1 smart contracts leading at (44.8%, 28.1%, 27.0%) respectively. BTC and ETH gained (9.4% and 9.3%) this week. The three worst-performing sectors were: DePIN (-2.2%), AI (-0.8%), and MemeCoin (0.3%).

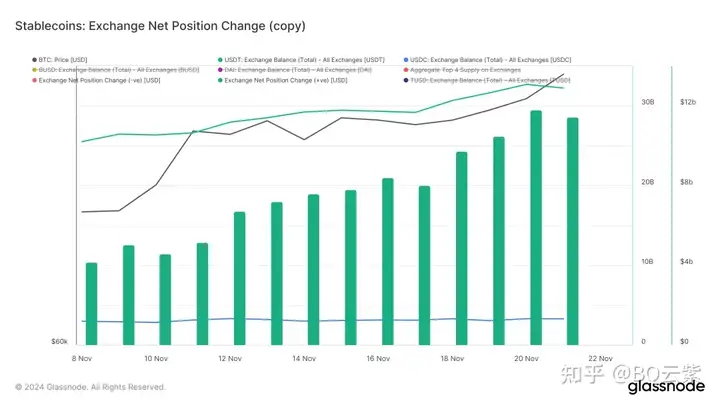

Market liquidity

1. Total crypto market cap and stablecoin supply

This week, the total crypto market cap rose from $3.08 trillion to $3.34 trillion, an increase of $260 billion, or about 8.44%. BTC dominance is 56.78%, and ETH dominance is 11.11%. As an important indicator of market health and liquidity, the total stablecoin supply increased from $172.66 billion to $176.10 billion, an increase of $3.44 billion, or about 1.99%.

2. Exchange potential buying power

Data shows that this week, exchange assets have shown a net inflow trend, mainly driven by the large inflow of USDT after the US election. This phenomenon may indicate that investors are preparing for upcoming market volatility, and the influx of funds into exchanges may mean an increase in short-term buying demand. Additionally, the single-day net inflow of $11.8 billion on November 20th exceeded the previous bull market's highest single-day net inflow of $6.7 billion, indicating ample market liquidity.

3. Crypto dynamics

The overall crypto market sentiment was bullish this week, with CLV, OM, and CTXC leading with gains of 190%, 147%, and 118% respectively. Major coins like XRP and ADA also showed impressive gains. According to Blockchaincenter data, the Altcoin Season Index is currently 33 (+6), indicating that the market is still BTC-dominated, but Altcoin activity is showing signs of a rebound.

Bitcoin technical indicators

1. Bitcoin spot ETF flows

This week, Bitcoin ETF inflows were $2.6036 billion.

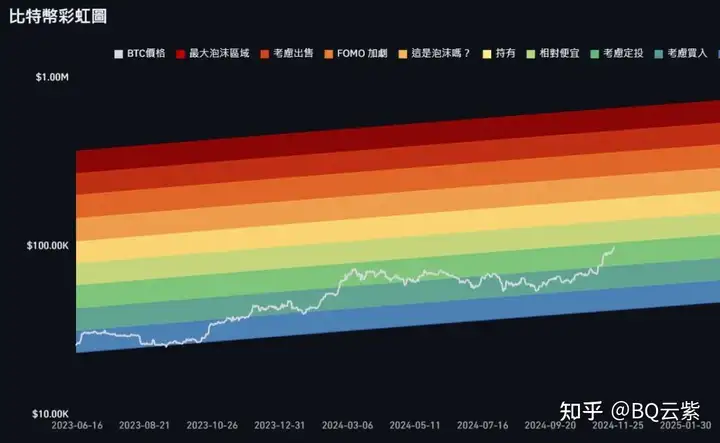

2. Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart shows that the current BTC price ($99,000) is in the "Consider DCA" zone.

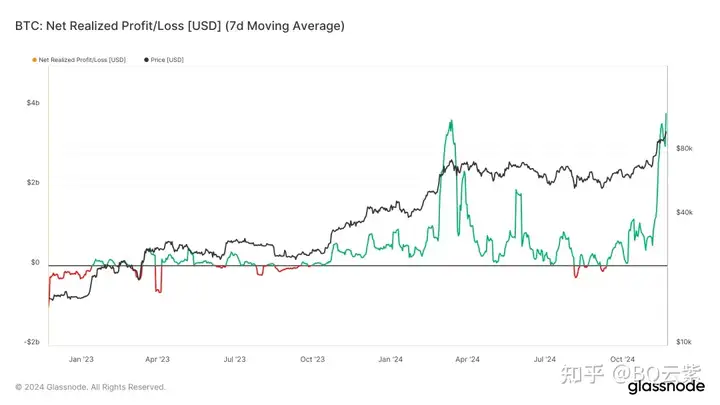

3. Bitcoin realized P&L

The Bitcoin realized P&L indicator shows that the current market sentiment is improving, with a situation similar to March this year when BTC price reached a high. However, potential correction risks should be noted, especially the possibility of profit-taking behavior in the market after a rapid price increase.

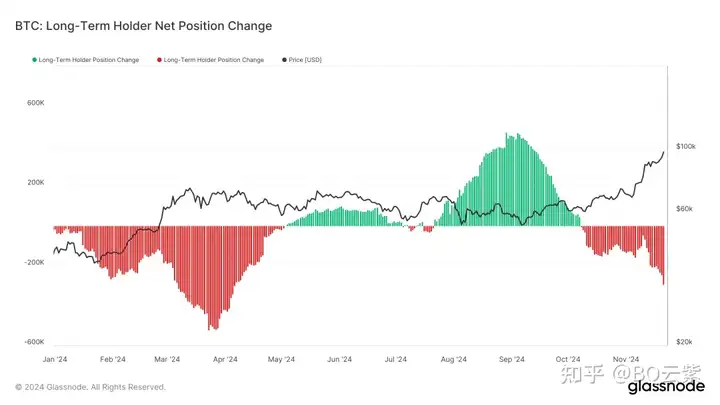

4. Long-term BTC holders

According to on-chain data, the net position of long-term BTC holders has shown a significant decrease, with the red bars indicating increasing selling pressure. Since mid-October, the net position of long-term holders has turned from positive to negative, indicating that some long-term investors have started to take profits. This phenomenon is particularly evident as BTC price approaches new highs, suggesting that some market capital chooses to take profits at high levels, but the selling pressure is not yet as intense as the peak in March this year. Although market sentiment is optimistic, the reduction in LTH positions may increase short-term selling pressure, and it is necessary to pay attention to whether the behavior of short-term holders (STH) and market demand can absorb the new supply.

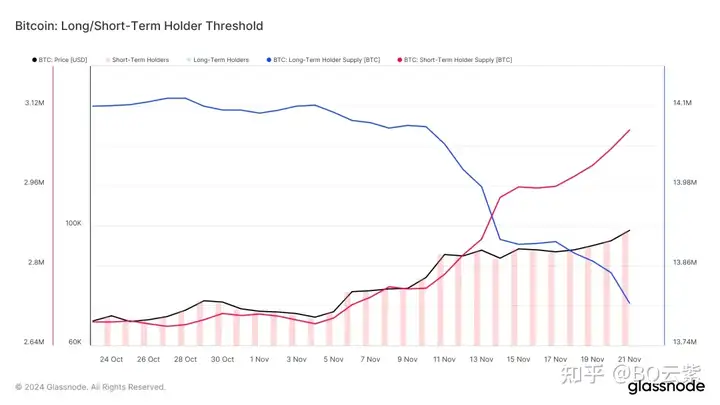

5. Bitcoin on-chain buying power

According to on-chain data, this week's data on long-term and short-term BTC holders shows that as the price has risen, the holdings of short-term holders (red line) have increased significantly, while the holdings of long-term holders (blue line) have decreased. This reflects a flow of funds from long-term investors to short-term speculators. With the increase in the proportion of short-term holders, the market's risk appetite has heated up, but the volatility risk has also increased simultaneously. The reduction in long-term holder positions indicates that profit-taking behavior at high levels has increased, and it is necessary to pay attention to whether short-term capital can stably support the market price.

6. Bitcoin futures open interest

According to the data, BTC's futures open interest on exchanges has risen rapidly this week, from $54.45 billion to $64.17 billion, not only setting a new high for futures open interest, but also coinciding with a new high in BTC price.

7. Coinbase BTC premium index

This week, the Coinbase BTC premium index turned positive from negative at the beginning of the month, indicating increased demand for BTC in the US market, driving the premium upward.

The positive premium difference may imply that US investors have greater buying power than global investors.

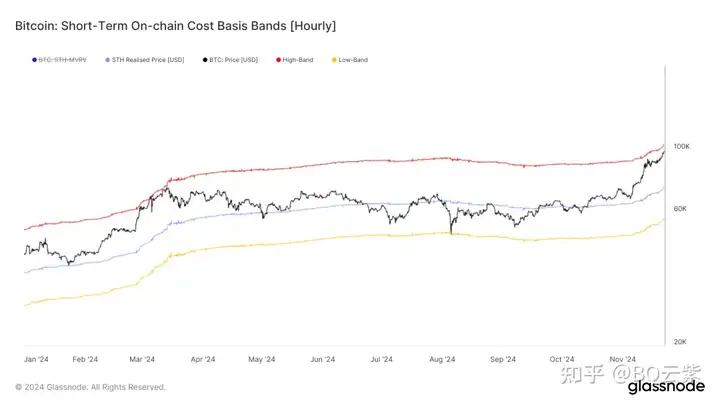

8. Short-term on-chain cost benchmark band

This week, the short-term on-chain cost benchmark band of BTC shows that the price is close to the upper band (red line) of $103,200, reflecting the high market sentiment and the increased willingness of short-term investors to profit. The realized price (blue line) of long-term holders is $72,700. In the short term, the price may face resistance at the upper band, and the risk of correction is increasing. It needs to be observed whether it can stabilize at a high level to support further upward movement.

9. Historical monthly returns of BTC

Based on historical data, BTC performed strongly in November, with a gain of 40.67%, close to the historical average of 46.30%; the average gain in December was 5.45%, and it was mostly positive in the past, but investors should be aware of the risk of profit-taking.