Editor | Wu Blockchain about Blockchain

This issue is an AMA held by E2M Research on Twitter Space, with guests including Shenyu (Twitter @bitfish1), Odyssey (Twitter @OdysseyETH), Zhen Dong (Twitter @zhendong2020), and Peicai Li (Twitter @pcfli). This AMA deeply explored two key issues in the field of Web3 cryptocurrency: how to hold high-quality assets for a long time and how to adjust your mindset and re-position after selling.

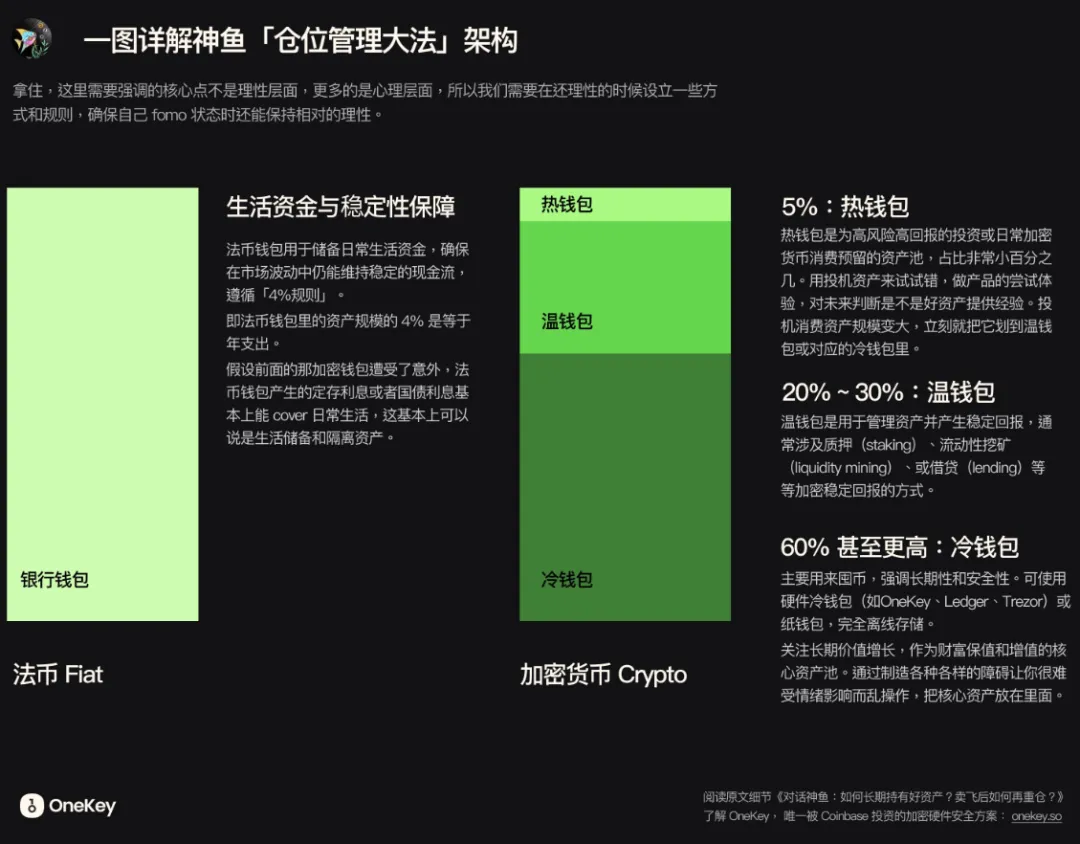

Based on actual cases, the guests proposed a number of operational methods and strategies: allocating assets through the "four wallets" rule to avoid emotional decisions; in the investment of core assets (such as Bitcoin and Ethereum), adopting batch purchases and cold wallet lock-up methods to ensure long-term holding. At the same time, for experimental assets (such as NFT), a small observation warehouse strategy is adopted to explore market potential. The exchange also shared psychological construction experience in dealing with market fluctuations, such as limiting irrational behavior by building rules and daring to adjust strategies when prices fall back. These practical experiences provide investors with a rational framework and long-term strategic support in the face of cryptocurrency market fluctuations.

Please note: The views of the guests do not represent the views of Wu Blockchain. Wu Blockchain does not endorse any products or tokens. Readers are requested to strictly abide by local laws and regulations.

The audio transcript was generated by GPT, so there may be some errors. Please listen to the full podcast:

Microcosm:

https://www.xiaoyuzhoufm.com/episodes/673a2ca943dc3a43875e8b0d

Youtube:

Definition of good assets, emotional management and the "four wallets rule"

E2M: Hello everyone, welcome to our E2M Research AMA this Friday. Today's AMA theme is how to own good assets for a long time, and how to re-position after selling. Before we start, we have to emphasize the risks, because the recent market has been very good, but at times like this, we hope that everyone can calm down and not be too FOMO. So we emphasize before the program starts that the program content is only for sharing and does not constitute any investment advice.

I am very happy to invite Shenyu as a special guest today to talk about this topic with you. I believe that whether it is about how to hold good assets for a long time or rebuilding positions after selling out, Peicai and Shenyu will have many stories to share. I look forward to hearing their views combined with their own industry experience during the exchange.

Today's topic is actually very interesting. A few days ago, the boss of Shenyu seemed to have posted a circle of friends, saying that Bitcoin has increased 100 times from 2021 to 2024. So, on the topic of how to hold good assets and hold good assets for a long time, why don't we throw it to the boss of Shenyu first to see if he has some ideas or experiences that he can share with us?

Shenyu: OK, first of all, this question is divided into two parts: the first is the definition of “good assets”, and the second is “how to hold them for a long time”.

The first question is that the dimension of "good assets" may need to be judged in the long term based on current cognition. If an asset has a clear development curve, or its possible future growth trend and key turning points have already appeared at the moment, then it may enter the basket of "good assets". Then compare it with other assets to finally determine whether it is a "good asset". I will not expand on the judgment of good assets, as everyone has some subjective understanding.

The final core question is, after discovering a good asset, how to hold it for a long time and "hold on"? The point I want to emphasize here is not the rational level, but the psychological level, that is, the irrational factors. Because human nature tends to be irrational, we need to set up rules and methods when we are rational and calm, so as to ensure that we can remain relatively rational even when we are out of control or in a state of FOMO. Even after making irrational decisions, these rules can help us avoid excessive impact on the overall investment.

How to build this architecture is a critical system in my opinion. This involves the so-called position management. When I first entered the circle, my seniors told me the importance of this skill. After years of practice, I summarized a "four-wallet rule" to divide assets into four parts.

The first is a cold wallet, which is mainly used to store core assets and set various operational barriers to make it difficult to use them easily. When you are in a FOMO state and want to sell most of your assets, you will find that it takes a series of operations to achieve it, and this period of time may allow you to calm down. Usually, this wallet will account for more than 60% of the total assets.

The second is the warm wallet, which is mainly used to manage assets and provide steady cash flow support to maintain a stable mentality, especially in the case of extreme market pessimism. This part of assets accounts for about 20% to 30%.

The third is the hot wallet, which is mainly used for consumption and speculation, such as trying new products, buying NFTs and other high-risk operations. The proportion of this part of assets is very small, accounting for only a small amount of funds. One feature of a hot wallet is that if its assets grow more, the profitable part needs to be transferred to a cold wallet or warm wallet in time to avoid long-term risks.

Finally, for the fiat wallet, I adopt the strategy of "only withdrawing but not recharging". The fiat wallet is mainly used for living expenses. I follow a "4% principle", that is, the assets in the fiat wallet and the interest generated can cover my annual expenses. Even if the assets in other wallets suffer losses, the fiat wallet can still guarantee my daily living expenses and help me be financially independent.

Through this system, I can maintain emotional stability in the short-term FOMO or irrational state. Even if the assets in the hot wallet are reduced to zero, it is still within the acceptable range, because these risks are what I have estimated in a rational state. At the same time, for some "envious" assets, such as meme tokens, I will try with a hot wallet, so that even if I fail, it will not affect the overall plan.

This is my core strategy and mindset management approach when holding assets for the long term.

Cognition and belief determine whether you can hold good assets for a long time

Peicai: I think, from my own experience, cognition is the most important thing. If you don’t have faith in an asset, when its price rises too much, to be honest, it is difficult to hold on to it. Especially in many cases, the market fluctuates repeatedly.

I also think impulsiveness is a problem. Many people get distracted by cash flow businesses or careers, which become obstacles. I can share two cases.

The first is the case of Litecoin. We held a lot of Litecoin from 2017 to 2018. The price rose from 20 yuan to more than 100 yuan, but then fell back to between 20 and 80 yuan. We were very scared at the time, afraid of profit taking, and finally sold it at around 80 yuan. However, six months later, Litecoin rose to about 2,500 yuan. This reflects that we did not have a deep understanding of assets at the time, not only Litecoin, but also Bitcoin. We didn't have much money at the time, and the demand for money was great, so it was difficult to hold it for a long time.

The second case is about Bitcoin. When Bitcoin was around 6,000 RMB, we sold half of it out of fear. At that time, Bitcoin experienced the Bitfinex coin loss incident, and the price fell from 6,000 to 3,000, and then rose back to 6,000. We sold it because we were worried about another drop, but later the price of Bitcoin continued to rise.

Another example is Dogecoin. When Dogecoin rose from $0.002 to $0.02, I impulsively sold it in the middle of the night, and the price doubled or even quintupled the next day. At that time, I did not deeply understand the driving logic behind Musk, nor did I expect that this price fluctuation would continue to rise. These experiences made me deeply realize the importance of cognition and expectation.

Now, we hold Bitcoin more stably because we have long-term optimistic expectations for it. For example, we believe that Bitcoin may rise to 5 million or even 10 million US dollars in the future. Because of this belief, when the price rises to 100,000 or 200,000, we will not easily have the urge to sell.

Looking back at the early days, our lack of a clear understanding of assets led to many mistakes, such as selling Ethereum when it rose from $2 to $6, missing out on more subsequent gains.

In summary, cognition is the basis for long-term holding of good assets. Without a clear judgment of the upper limit of the asset and the logic supporting its value, it is difficult to hold it for a long time. The cold wallet strategy and the "sell half" method mentioned by Shenyu are powerful supplements to help control impulses when cognition is insufficient. But in the final analysis, cognition and belief are the key.

How to overcome short-term trading impulses and achieve long-term holding of good assets?

Zhen Dong: In fact, we can divide this topic into two parts: first, how to identify good assets; second, how to hold good assets for a long time.

We have talked a lot about the understanding of good assets, such as why we think Bitcoin and Ethereum are good assets? Or why we think Tesla is a good asset? This requires knowledge and perspective, such as financial knowledge, understanding of cash flow and traditional investment theory, and even learning the cyclical theory of investment masters such as Buffett and Munger. At the same time, in the field of encryption, we also need to understand models such as complex systems, nonlinear growth and innovation diffusion, especially in the Internet era, the speed of information and knowledge dissemination is faster than ever before, which provides us with more possibilities to understand good assets.

The biggest enemy that prevents long-term holding of good assets is the enthusiasm for short-term trading. Many people confuse long-term holding with short-term trading, which is a cognitive misunderstanding. For example, many people rely on short-term trading to earn cash flow and meet living expenses, but such behavior will essentially interfere with long-term investment. Especially those who have just accumulated their first pot of gold are more easily affected by short-term price fluctuations.

In my observation, many people try to profit from short-term market fluctuations through high-frequency trading, such as taking profits immediately when the price rises by 20%, or making short-term operations due to favorable expectations of events such as elections. Such behavior may make them earn some money in the short term, but in the long run, this approach often misses out on greater returns from good assets.

The solution to this problem is to clearly distinguish between funds for short-term trading and long-term investment. You can allocate a portion of your mental account for trading, but the core assets must be held for the long term. This is like the founder of Nvidia. If he had kept half of his shares, or even 1/10, he would have reaped huge profits decades later. Similarly, for crypto assets, holding Bitcoin or Ethereum for a long time may be far better than frequent trading.

Regarding the issue of holding a heavy position after selling out, I think the key is to recognize your own limitations and correct mistakes in a timely manner. For example, when you realize that your views are biased, you should take immediate action to rebuild your position. This process requires a rational and humble attitude. Rationality is to continue to make investment decisions with positive expectations, and humility is to admit and correct your mistakes.

Finally, I want to emphasize that whether it is long-term investment or selling at a loss and then holding a large position, you need to keep learning and adjusting to truly realize the long-term value of compound growth. Mistakes are not terrible, but what is terrible is not correcting them. Holding assets is the same as interpersonal relationships. When misunderstandings are discovered, apologizing and repairing the relationship may be the best choice. Sincerity and frankness are always the cornerstones of success.

How to hold and invest heavily in good assets for a long time based on cognitive and monopoly advantages?

Odyssey: When it comes to holding good assets for the long term, I think there are two key points: awareness and long-term.

There are two aspects to this understanding: rational understanding and emotional understanding. I agree with Peicai's view that "buying and selling are symmetrical". You are impulsive when buying, and you are usually impulsive when selling. If you buy after careful research and careful consideration, you will be more rational when selling, rather than impulsive. This symmetry of buying and selling often reflects the combination of cognition and emotion.

Building an understanding of good assets requires a process. Many people mistakenly believe that they should fully understand the potential of an asset from the beginning, such as the value of Bitcoin or Ethereum when the price was very low in the early days. However, the world's information is gradually revealed as uncertainty decreases over time. The construction of understanding requires continuous updating of judgments and verification, such as observing whether the asset has reached certain monopoly critical points, whether it has shown network effects, etc.

Take ChatGPT as an example. It has strong technical advantages, but does not show bilateral network effects and strong monopoly. Therefore, when investing, you need to wait for certain critical points to appear, rather than just draw conclusions based on short-term user growth or technical strength. Understanding assets through monopoly advantages allows investors to transcend price fluctuations and sell only when monopoly weakens or stronger competitors emerge.

Regarding long-term holding, I think there are two levels of benefits: one is cognitive benefits, that is, the assets meet your product roadmap expectations; the other is extra-cognitive benefits, that is, non-linear growth beyond expectations. This kind of beyond-cognitive benefits requires investors to have an open mind and admit that the potential of good assets may be greater than their imagination.

How to re-enter the position after selling? This is a psychological challenge. Many people will have strong psychological barriers after selling, especially when it comes to face or the desire for self-affirmation. This psychological pressure may hinder rational decision-making. My suggestion is that making mistakes is not terrible, the key is how to deal with mistakes. If you can regard correcting mistakes as an achievement, then re-entering the position after selling is no longer a "face-slapping" behavior, but a correct choice based on new cognition.

In terms of specific operations, I tend to increase my holdings in batches as the product roadmap of the asset is gradually realized, and at the same time, I look for opportunities by taking advantage of short-term market adjustments and good news. For example, some recent policy changes of Tesla may affect profits in the short term, but also enhance long-term competitive advantages. Such opportunities are a good time to increase holdings.

In general, the core of investment is to constantly update your cognition, admit mistakes and adjust strategies to ultimately maximize long-term value.

From the lessons of others to self-growth: How to build a long-term investment strategy in uncertainty

Odyssey: I want to ask Shenyu a question. You mentioned earlier that when you first entered the industry, you didn’t understand the position management and mental accounts mentioned by your predecessors. So what experience led you to build this system now? Is there any big lesson that led to this change?

Shenyu: Actually, I have seen many lessons from others, especially some cases that left a deep impression on me. Let me give you two examples to illustrate.

The first example is about the story of selling out. In 2012, there was a person with a traditional financial background in the Chinese Bitcoin community named Lao Duan Hongbian. He launched a fund and raised 3 million RMB. At that time, the price of Bitcoin was between 30 and 50 yuan, and he used the funds to build a large number of Bitcoin positions, some of which he bought from me. However, when the price of Bitcoin rose from tens of yuan to tens of US dollars, he liquidated the fund. Subsequently, Bitcoin rose all the way to 1,000 US dollars, but he became an opponent of Bitcoin. This is a typical case of selling out and failing to adjust.

The second example happened on December 8, 2013. At that time, the Central Bank of China issued a policy related to Bitcoin, and the price of Bitcoin fell from 8,000 to 2,000. I saw with my own eyes that a friend of mine “sold cross margin” on the Bitcoin China platform, and the price dropped directly to 2,000. Because of the psychological trauma, these people never returned to the Bitcoin market.

I have also experienced similar lessons myself, such as selling Litecoin and Dogecoin at a loss in the early stage. In these experiences, I gradually realized a fact: everyone is irrational. We need to be honest with our emotions and behaviors. Although many mistakes seem ridiculous in hindsight, if the situation is repeated at that time, there is a high probability that similar choices will be made.

I have also counted my own trading decision winning rate, which is only about 40% to 43%, and never more than 45%. Therefore, I began to write a "decision log" to record the background, emotions, and predictions of major decisions, and then review these decisions regularly to analyze whether I regret it and whether there are areas that need improvement. This made me realize that the world is full of uncertainty. Even if you think a certain technology is excellent, the market may not buy it. Therefore, we need to face this complex world with an open mind.

Mistakes are essentially feedback from the world, and those most painful mistakes are often the key to growth. When we gain real and effective information from mistakes, it is important not to get caught up in emotions, but to improve ourselves through reflection. I have witnessed many people go from starting from scratch to repeated ups and downs, and I have also found that those who can survive in the crypto field for a long time, regardless of their background, have one thing in common: they keep an open mind and a growth mindset.

In summary, these experiences made me realize that I am not good at trading, but through observation, learning and reflection, I gradually built a position management system that suits me. This system helps me better manage emotions and assets in an uncertain environment and achieve long-term investment goals.

How to avoid investment traps through hierarchical management?

Odyssey: I have another question, which is divided into two levels: the first level is how to recognize mistakes, and the second level is how to conduct effective reflection and attribution. Some people, for example, after selling some meme coins, reflect that they should always hold such assets and not sell them anymore. But this kind of reflection may lead to another problem, such as eventually making the assets return to zero. How do you ensure that the reflection is correct and not fall into a new pit? For example, some people hold zero-return coins, but continue to configure them using conventional position management methods, which results in exacerbated losses.

Shenyu: Of course there are coins that have returned to zero, and I have held quite a few. But my position management has a big premise, which is that the allocation of assets is mainly managed according to market value or a certain ratio, not simply distributed evenly. Therefore, different assets have clear focuses in my system.

Many assets in my position management system cannot even enter the threshold of cold wallets. Most of them are in entertainment positions. To be promoted to the core asset level of cold wallets, it requires long-term observation and in-depth thinking. This is a long process. Usually, assets that have not experienced one or two complete market cycles find it difficult to enter a higher configuration level.

This hierarchical management approach helps me screen and manage assets more effectively, thereby avoiding falling into new investment traps due to incorrect reflection.

How to judge the turning point after selling out and buy back the core assets in large quantities?

Odyssey: Have you ever sold something and then bought it back? For example, have you bought back a large amount of core assets that you sold before? I know that most of Peicai’s Bitcoin and Ethereum were bought back through mining, and I don’t have the experience of buying back large positions directly, so I would like to ask you this question.

Shenyu: Yes, for example, Ethereum. I also bought a lot of Ethereum when it was 2 yuan in the early days. Later, when it rose to 20 yuan, I sold quite a lot of my positions. When Ethereum rose to RMB 140 and stabilized for a period of time, I liquidated most of my positions in batches again, leaving only about 1/4 of the positions for observation.

At that time, there was a key event, which was the hard fork rollback of Ethereum, which actually challenged the core logic of POW. This weakened my confidence in Ethereum and I basically cleared my position. Later, after the rise of the DeFi wave, Ethereum began to show some new features and the prototype of the ecosystem. When these features gradually emerged and reached an inflection point, I bought back Ethereum again.

I think this inflection point is very critical. It gradually made Ethereum monopolistic, although I may not have fully realized it at the time. As a frontline observer, I have accumulated knowledge and judged that it has become a core asset worth holding. So, this is a typical case of me selling it and then buying it back.

How to screen and discard assets that are not suitable for long-term holding?

Odyssey: Some people may think that you can easily buy back assets because you have enough redundancy and don't need to worry too much about whether the assets you buy back are zero. But on the other hand, it is easy to overweight when you buy back assets. So when you find that some assets are not suitable, how do you choose to abandon them? For example, the BAYC NFTs we talked about about a year ago, do you plan to hold them until they are zero, or do you have other plans?

Shenyu: Regarding NFTs like BAYC, I didn’t have a heavy position at the time, but put them in the observation warehouse. That batch of NFTs was essentially configured with a consumption mentality. I felt that it had certain potential, but it might not take off. In my full asset allocation, I didn’t let the NFT position exceed the critical value, so most of them were placed in hot wallets or consumer wallets, and only a few NFTs with rare value or emotional significance were transferred to cold wallets.

My basic idea is that for an asset to be heavily invested, it needs long-term observation and in-depth thinking. It must meet many conditions and cross a certain inflection point that I think is important before it can be included in the category of core assets. Before that, such assets are more of a process of cognitive establishment, with a small amount of allocation using consumption or gambling funds. For assets that do not meet the conditions for heavy investment, I will maintain a certain degree of flexibility, rather than blindly holding them until they return to zero.

Which is more difficult, finding good assets or holding more stocks after selling them off? Why?

Shenyu: I have a question for everyone. What do you think is the difficulty in finding good assets and holding a large position after selling them? Because in my opinion, it is not difficult to find good assets. Good assets are often visible to everyone. The key lies in whether you dare to hold a large position.

Odyssey: I also think that the difficulty lies in holding a large position after selling out. There is actually no essential difference between the ability to hold a large position after selling out and holding a large position itself. Both require very strong psychological preparation. It involves several core abilities, such as the ability to gradually increase your position as the monopoly of the asset increases, and the ability to calmly correct mistakes after facing them. This means that you must not only be able to judge the value of the asset, but also be able to exit in time when you make a wrong judgment, or even re-enter at a higher price.

Peicai: I have a similar view. I think the challenge of holding a large position is far greater than finding a good asset. Many people have held Bitcoin, but most people lock in profits after the price rises. Very few people can really hold it for a long time or even hold a large position to buy it back. Even among my relatives and friends, few can buy back Bitcoin after selling it, let alone holding a large position.

The difficulty of holding a large position is that human nature is not naturally adapted to large transactions. For example, when I bought Tesla, even though I had done in-depth research on it, I was limited by psychological barriers. When the absolute value of the chips increases, even if the proportion in the overall assets is not high, psychological depression will occur due to the huge absolute amount. This phenomenon is similar to the fact that the decision-making logic when we deal with small daily consumption and high-value real estate transactions is completely different.

At the same time, the difficulty of re-positioning after selling out lies in the attitude towards mistakes. Admitting mistakes requires not only courage, but also overturning the original logic and rebuilding the cognitive system. This is an extremely energy-intensive process. Many people would rather cover up their mistakes with simple assumptions rather than reflect thoroughly. Wrong attribution and obsession with image also exacerbate this difficulty.

From a philosophical perspective, for example, Popper's philosophy of science emphasizes that the progress of human knowledge essentially relies on conjecture and refutation. Making mistakes and correcting them is the only way to discover new knowledge. This understanding may help us face mistakes more calmly, but in actual investment, emotional pressure and psychological anchors are still huge obstacles.

For example, my perception of Bitcoin’s price was influenced by my early experiences. Although I know the long-term logic of Bitcoin, the historical anchor point of the price makes me uncomfortable buying at high prices. The same phenomenon happens with Tesla. I am more comfortable buying within a certain price range, but when the price deviates from this range, it is difficult to take action regardless of whether it goes up or down.

In summary, it is much easier to find good assets than to hold a large position, and it is even more difficult to hold a large position after selling out. It not only involves asset judgment, but also requires facing the challenges of one's own psychology and cognition, which are completely different in difficulty.

Can you make more by not making money?

Shenyu: I have another question for Odyssey. I found that, in addition to arbitrage, which has a certain return, it is often easier to make a lot of money when the purpose of doing something is not directly to make money. On the contrary, if the goal is to make money directly, the difficulty of making money seems to increase exponentially. What do you think of this phenomenon?

Odyssey: Haha, I agree with you very much. I think this is related to the difference between process orientation and result orientation. When the goal is completely focused on the result of "making money", the quality of decision-making will decline due to the volatility of money itself. For example, Tesla's share price is more than $300, but the value of cash itself is very difficult to measure. If you keep staring at these fluctuating results, your judgment and decision-making will also be constrained by them, and it will be difficult to make stable choices in the end.

Rational investment requires us to look beyond current fluctuations and see long-term consequences. The essence of investment is to make future decisions based on past information, so it is necessary to combine rationality, insight into the future and process orientation. If you only focus on the ever-changing indicator of money, it is easy to fall into short-term fluctuations and lead to disordered decision-making.

In general, I completely agree with your point of view. This change in mindset is indeed a very important part of investment.