Source: Yue Xiaoyu

Pumpfun is a Solana-based MEME coin issuance and trading platform that focuses on fair issuance.

Pumpfun was launched in January 2024 and quickly became a sensation in the community, catching the MEME coin craze, or even directly driving the MEME coin craze into a new stage.

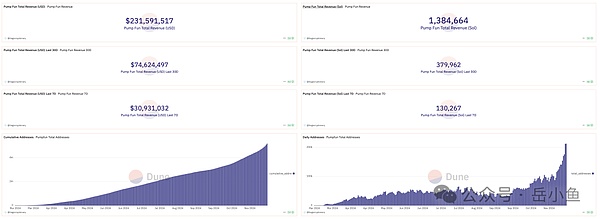

Pumpfun's data can be said to be very eye-catching. It has currently accumulated over $200 million in revenue, and at some peak periods, Pump.fun's daily revenue can reach millions of dollars, once exceeding Uniswap Labs to become the fourth largest protocol across all blockchain networks.

If trading MEME coins is like gambling, then pump is the most profitable casino. It's better to open a casino than to gamble.

Pump is a phenomenal product in this cycle, so it is very worthwhile to conduct research and learning.

01 Team Background

The Pump team did not initially work on a launchpad, but rather started with an NFT marketplace, and only turned to the current direction after several attempts.

Pump is a European team, and the founding members are all very young. Their CTO hasn't even gone to university, with the highest education being high school, but their technical strength is very strong. Their youth and technical prowess allow them to view problems in a different way, and they also have very keen intuition for products.

Therefore, the key to Pump's success lies in the youth and innovation capability of their team. Many people have had this idea, but only the Pumpfun team was able to truly make it happen.

The path to success is not crowded, because most people cannot persist.

When you have an idea, there may be a thousand people in the world who already have the same idea, but only a hundred people can turn the idea into action and truly put it into practice, and only a few can persist and solve one difficulty after another.

This is not only the case in Web3, but also in the Web2 industry and in the development history of various industries.

02 Operating Principle

Pump focuses on fair issuance, with no pre-sale and no team allocation, so how is this achieved?

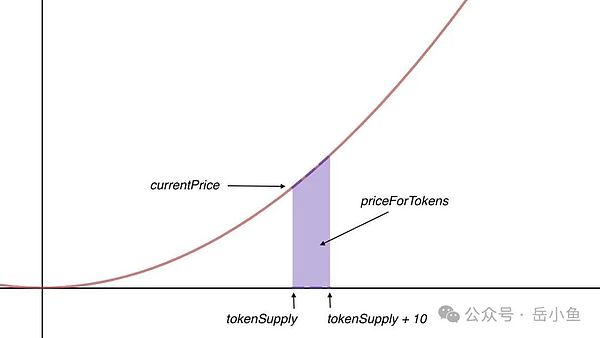

Like the automated market maker (AMM) used by decentralized exchanges (DEXs), a liquidity pool needs to be created and initial liquidity injected, but the Bonding Curve pricing model used by Pump.fun directly uses a function curve to realize price changes.

Simply put, in the Bonding Curve pricing model, the token price and token quantity have a positively correlated exponential relationship, the higher the token price, the more tokens will be released.

That is to say, the tokens will be "minted" or "released" into circulation as users purchase them.

The Bonding Curve function will cause the rate of price increase to accelerate as the token supply increases.

This is because it can achieve that in the early purchase stage, the token price does not rise too fast, but the later the purchase, the more the price can be pulled up with the same amount of funds.

In the early purchase stage, due to the relatively small number of tokens in circulation, each purchase has a relatively small impact on the price. That is, the price increase will not be too large.

When there is already a considerable base of tokens in the market, the number of tokens that can be purchased with the same amount of funds (SOL or other currencies) will decrease, but due to the characteristics of the price function, these purchase behaviors will lead to a more significant price increase.

What results will this functional characteristic bring?

First, it can encourage early investment. Early buyers can acquire tokens at a lower price, and then as the price rises rapidly, the value of the tokens they hold will increase significantly.

Second, late investment has a leveraging effect. In the later stage, due to the characteristics of the price curve, the same investment amount will have a greater impact on the price, which will provide stronger incentives for late entrants, more in line with the characteristics of MEME coins. Unlike some large-cap tokens, where late investment has little impact on the price, this provides no sense of participation.

Of course, the price increase is not unlimited, Pump's setting is: When a certain market value is reached, a liquidity pool will be automatically constructed in the DEX and transferred to the DEX for trading.

That is to say, the fundraising stage of token issuance on Pump uses the Bonding Curve function, which provides a price discovery mechanism for the early stage of the token.

But without external intervention, the price may rise indefinitely due to excessive speculation. By transferring to the DEX and using the AMM (Automated Market Maker), the natural equilibrium mechanism of the market can be introduced to avoid excessive price fluctuations.

Constructing a liquidity pool on the DEX can provide a stable trading environment for the token, and to some extent alleviate the extreme price fluctuations that the single curve model may bring.

When the token's market value is relatively large, a trading mechanism that can maintain price stability is needed, with better market liquidity depth, to avoid very violent price fluctuations.

03 Overall Process

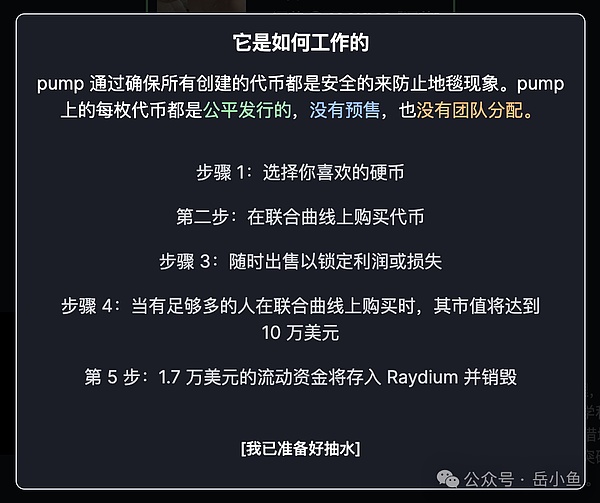

The overall process can be divided into two stages: the fundraising stage before listing and the trading stage after listing.

(1) Token Creation: First, users can create a token with one click, with users able to create a token at an extremely low cost (0.02 SOL) without any technical background. The creation process only requires entering the token name, symbol, description and an image.

(2) Fundraising Stage: The creator attracts other users to buy the token, and all the token models on pump.fun are the same, with a total supply of 1 billion, an initial circulating supply of 0, and an initial "virtual market value" set at 30 $SOL, released through user purchase behavior.

(3) Reach Listing Threshold: When the market value reaches $100,000 (priced in SOL), which is a fundraising amount of $17,000, at this time the circulating supply is 800 million tokens, Pumpfun will mint an additional 200 million tokens, combined to form a trading pair and added to the decentralized exchange Raydium, ultimately listing a decentralized issued Memecoin with a market value of $69,000 and a total supply of 1 billion.

(4) Successful Listing: After listing on Raydium, the price per token is 0.00000041 $SOL, 14.64 times the initial virtual pool price. Throughout the process, Pumpfun will charge a 1% transaction fee during the fundraising stage, and a 6 SOL listing fee when the token is listed on Raydium.

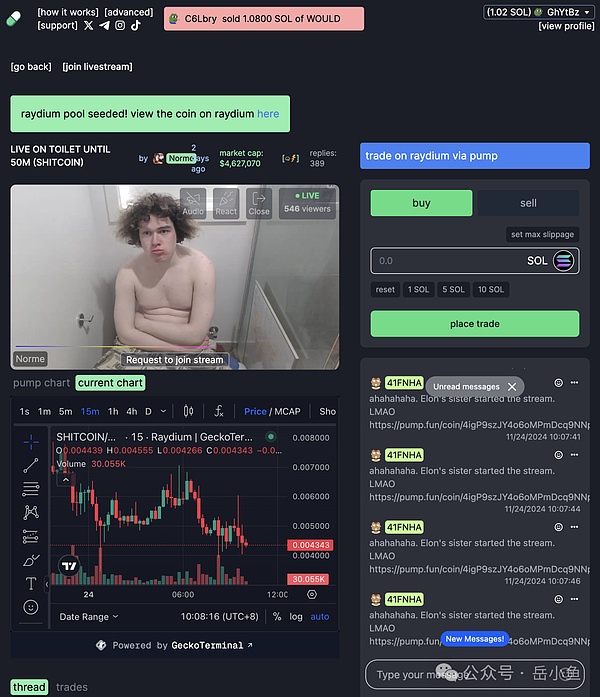

04 Highlight Feature: Live Streaming

Recently, Pump's live streaming feature has become a sensation. After browsing around, I was simply shocked, with some doing pornographic live streams, some locking up their grandmothers until a certain market value is reached before releasing them, and some continuously squatting on the toilet to hype up, simply going to extremes.

When it comes to live streaming to hype up coins, I initially thought of someone live streaming how they specifically operate to hype up coins, but I didn't expect that it has now turned into various ways of using abstract means to attract attention, just like live streaming e-commerce.

Attention is a scarce resource.

MEME coins themselves are a tool to attract attention,

by using humor and popular cultural elements to capture people's attention.

Live streaming further amplifies this appeal through real-time interaction, making the audience more willing to participate and pay attention.

In simple terms, MEME tokens inherently have an entertainment nature, and live streaming further amplifies this entertainment factor. Users can participate in a market-like game through live streaming, which is both entertaining and participatory.

More importantly, the "MEME coin + live streaming = attention economy" model has created a new economic model in the cryptocurrency ecosystem.

Through this combination, MEME coin creators can quickly accumulate a large amount of attention, and live streaming provides the opportunity to directly interact with the community, thereby converting this attention into investment and trading in the MEME coin.

Live streaming provides MEME coins with opportunities for instant promotion and real-time marketing. Creators can directly communicate with users, share the concept of the token, market analysis or real-time trading activities.

Pump's live streaming feature is not just a technical innovation, it has changed the way MEME tokens are marketed, making token issuance and trading more social and entertaining.

This not only increases user stickiness, but also provides a platform for creators who want to promote MEME tokens through social media influence.

All things have both positive and negative aspects.

In the live broadcasts of the Web2 industry, various anchors also try various ways to attract attention, and finally make a profit through tipping or live-streaming e-commerce.

In the pump live broadcasts of the Web3 industry, due to the weak supervision of the platform and the closer proximity to money, the anchors can directly issue coins and speculate on coins, which may catalyze more abstract and unprincipled behaviors.

The typical ones will be involved in pornography, gambling, and drugs, because pornography, gambling, and drugs are rooted in human nature.

For example, there are already a lot of pornographic anchors now.

It has to be said that the sense of smell of the pornography industry is actually very keen, and the pornography industry is often the first to use innovative technologies, such as the rapid emergence of AI face-swapping pornographic videos after the AI boom, replacing the faces of celebrities with pornographic videos, satisfying the dirty fantasies of many people.

The live broadcast function of pump has indeed achieved remarkable results in attracting attention and increasing user participation, but the lack of a certain review mechanism will make the platform become a breeding ground for unhealthy content, which will eventually backfire on the platform itself.

Not all traffic is valuable, some are toxic traffic.

At present, it seems that pump is tolerating the rampant spread of these undesirable contents, which can help the platform achieve the effect of breaking out in the early stage, but if it is not restricted in the later stage, more malicious negative events may occur, and regulation may have to intervene.

Therefore, pump needs to find a balance between attracting user attention and maintaining a healthy and compliant platform ecosystem.

05 Summary

The pump team has very strong product capabilities, and pump has great innovation in product mechanism design, meeting the market's demand for meme coin issuance and speculation.

More importantly, pump's live broadcast function has further promoted its breakout, meme coin + live broadcast = attention economy explosion.

Pump is no longer just a phenomenon-level product in the Crypto industry, but is constantly breaking out.

Although meme coins are gambling and pure speculation, this may also cater to the most primitive desires and needs of human nature.

Meme coins are also a unique manifestation of crypto culture and decentralization culture.

The meme coin craze is actually telling the market: the blockchain technology is so complex, the Web3 application threshold is so high, then let the ordinary users come to this big casino, experience the thrill of trading, and satisfy their desire for quick wealth.

Meme coins are the most primitive and purest Ponzi scheme, and Pump satisfies the demand for everyone to issue coins and everyone to speculate on coins.