From November 13 to November 14, the Altcoin gainers list welcomed a group of familiar faces, with DOT, FIL, SAND, and MANA - the old kings of the previous bull market - making a comeback. After sitting on the sidelines for nearly half a year, old Altcoin holders finally felt the bull market atmosphere. Driven by the collective surge of old Altcoins, the money-making effect of this bull market has reached a stage-wise peak, and the market sentiment has remained in an extremely greedy state (93-94). Over a relatively long period, the catch-up rally of old Altcoins has often been seen as a signal of the exhaustion of existing positions and optimistic sentiment. Therefore, the catch-up rally of old Altcoins has also raised market concerns about a potential correction.

After countless roller coaster market conditions, many investors have formed deeply rooted bear market mindsets, so that every time Altcoins rise, the chips are quickly cashed out. This is precisely the reason why the market has always been highly vigilant about the catch-up rally of Altcoins. However, from two aspects, this round of Altcoin market may be different from the past.

First, during the 13th to 14th when Altcoins surged by more than 20%, the scale of Altcoin long liquidations in the futures market was only $67 million, indicating that the intention of the main force is more to sweep orders rather than to squeeze shorts. At the same time, during the Altcoin rally, the Altcoin futures open interest and spot lending rates did not rise significantly, indicating that the short-side main force currently does not have the intention to build large positions.

Secondly, unlike the past, where the market was driven by the increase in existing positions, the November launch of the market was the month with the largest and fastest USDT issuance in the past year, meaning that the driving force for the market rise mainly comes from the influx of incremental funds.

Although the current Altcoin market is more booming than November 13, the daily trading volume in the market is still maintained at around $300 billion, far lower than the peak of $556 billion set on November 13. The main reason for this phenomenon is that Bitcoin has entered a sideways consolidation phase during the Altcoin rally, which has eased the pressure of liquidity competition in the market. Historically, when Bitcoin does not rise and Altcoins are active, it is often the stage with the most significant money-making effect of the bull market. For example, in March 2021, when Bitcoin entered a range shock, many coins in sectors such as distributed storage, metaverse, and Layer2 experienced monthly gains of over 10 times. If the FOMO sentiment in each sector follows the path of "questioning - hesitation - confusion - fear - buying", then the funds that have missed the Altcoin pump are only in the hesitation stage.

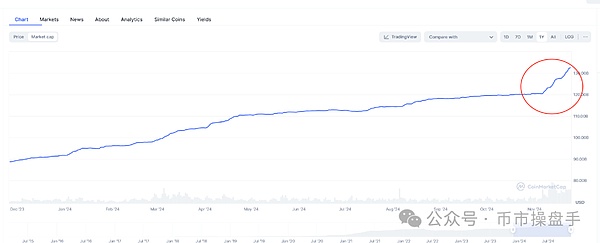

As Bitcoin has failed to break through $100,000 multiple times, market expectations for its correction have gradually heated up, with some even jokingly referring to the potential adjustment as a "Thanksgiving sale". However, from the current perspective, the trend of Bitcoin is still completely dominated by the bulls.

First, as the "number one bull" of the universe, MicroStrategy currently has $3.7 billion in cash reserves on its balance sheet (of which $3 billion comes from convertible bond fundraising), and the unused issuance quota is still $15.3 billion (which can be immediately raised through the secondary market by issuing orders to underwriters such as Barclays and TD Securities), meaning that the total ammunition available for future Bitcoin purchases is a staggering $19 billion. At the same time, more and more institutions and entities around the world have joined the wave of Bitcoin allocation under the leadership of MicroStrategy. According to CoinDesk, over the past week, entities including MARA and MetaPlanet have collectively purchased over $1 billion worth of Bitcoin. As long as MSTR continues to buy Bitcoin, these institutional entities are most likely to continue to follow suit. Clearly, with ample bull ammunition, any Bitcoin correction will inevitably trigger a counterattack by the bulls.

Secondly, SoSoValue's data shows that the first trading day of the BlackRock Bitcoin spot ETF options saw a total of 354,000 contracts traded, with a nominal trading volume of $1.86 billion. Of these, 288,700 were call options and 65,000 were put options, with a call/put ratio of 4.44, indicating an almost one-sided optimistic market sentiment. The data shows that the option with the largest trading volume is the long call option expiring on January 17, 2024, with a price range of $55-60, corresponding to a Bitcoin price of $97,000-$105,000. In other words, the market still expects Bitcoin to break through $100,000 before Trump's inauguration.

In summary, although market sentiment has become extremely greedy, and technical indicators have become severely overbought, shorting is still not a wise choice.

In terms of operations, if the suggestions in the previous article to take positions in DOT, ATOM, ICP, and FIL as targets are followed, the returns last week would have exceeded the market average. After a daily trading volume of $300 billion becomes the norm, the direct beneficiaries of the market will undoubtedly be DEXs and CEXs. Currently, platform tokens such as UNI, DYDX, and BNB have not shown significant performance, and using them as a defensive bottom position to prevent missing the pump is also a good defensive strategy.