In 2023, the story of MicroStrategy in the financial market is like an adventure in the capital maze, full of adventure and ambitious calculations. Its market value has soared from $1.8 billion at the beginning of the year to the current $111 billion, and the driving force and logic chain behind this are thought-provoking. As a company with Bitcoin as its core strategy, MicroStrategy's actions are not only a bridge between traditional financial means and the cryptocurrency market, but also have a profound impact on the future of the web3 industry. Aiying FundInsight will delve into the strategic logic of MicroStrategy in Bitcoin-driven, capital leverage, and governance reform, as well as the implications for the entire web3 financial ecosystem.

I. Bitcoin-driven: From Marginal Asset to Core Strategy

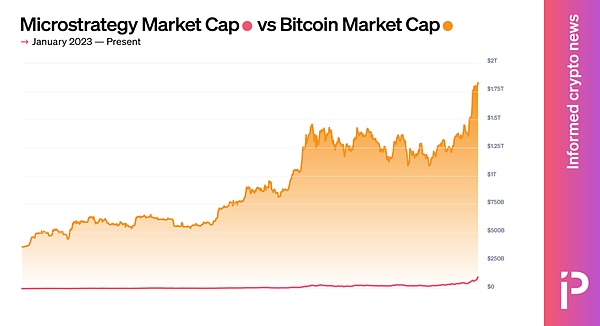

MicroStrategy's growth path is undoubtedly inseparable from its aggressive deployment of Bitcoin. At the beginning of 2023, the company's market value was far lower than the value of its Bitcoin holdings, but through large-scale financing and a series of high-risk capital operations, its market value is now 3.55 times the value of its Bitcoin holdings, equivalent to 5.9% of Bitcoin's market value.

Michael Saylor sees Bitcoin as digital gold that transcends traditional currencies, and uses this as the basis to build the core logic of the company's growth. In the context of web3, MicroStrategy represents a new type of enterprise that uses digital assets as the underlying support, trying to leverage the long-term appreciation expectation of Bitcoin to boost the confidence of the traditional capital market in the future. As the price of Bitcoin has risen, MicroStrategy's market value has also risen accordingly, and the capital market has given its Bitcoin-driven premium a very high level of trust.

However, the market's attitude towards this "digital gold standard" strategy is not entirely consistent. Although some investors are full of confidence in MicroStrategy's future, and some even believe that its market value may surpass Bitcoin itself in the future, this idea has not been recognized by all rational investors. The decentralized spirit of web3 and the volatility of Bitcoin make this speculation full of uncertainty, after all, market confidence is not unchanging.

II. Leveraged Capital Operations: A Combination of Dilution and Zero-Coupon Bonds

MicroStrategy's success lies not only in its choice of Bitcoin as a frontier asset, but also in how it cleverly uses the tools of the traditional capital market to obtain unprecedented capital leverage in an innovative way.

1. Equity Dilution: A Strategy of Appreciation Dilution

Aiying FundInsight has observed that MicroStrategy's financing methods are mainly of two types: equity dilution and zero-coupon bonds.

(1) The process and logic of equity dilution

MicroStrategy raises funds through the issuance of new shares, and uses almost all of the proceeds to purchase Bitcoin.

This approach forms a unique "appreciation dilution" logic, that is, although the company dilutes the equity of existing shareholders, due to the appreciation expectation of Bitcoin, this dilution is interpreted by the market as an increase in asset value, thereby driving the rise of the company's stock price.

Binding shareholder interests Each time new shares are issued, the company immediately reinvests the funds into the purchase of Bitcoin, and this immediacy of reinvestment makes the interests of shareholders closely linked to the long-term appreciation of Bitcoin. This transmission effect in the financial market continuously strengthens investors' confidence in the company's future. Many investors even see it as an indirect way to hold Bitcoin, and are willing to pay an additional premium for this asset allocation model.

2. Zero-Coupon Convertible Bonds: A Game of Capital Returns

(1) The strategy of issuing zero-coupon convertible bonds:

Another financing method of MicroStrategy is to raise funds through zero-coupon bonds. In the most recent round of financing, MicroStrategy expanded the bond size from $175 million to $2.6 billion, with a zero coupon rate.

Earnings depend on stock price growth: The holders of these bonds do not receive traditional interest income, but have their returns closely linked to the future growth of the MSTR stock price, they can be converted into MicroStrategy's common stock at a certain point in the future, which means that the final return of investors depends entirely on the rise of MicroStrategy's stock price, similar to the company's employee stock options, and this is directly related to the value of the Bitcoin held by the company.

(2) Investors' high-risk betting:

Investors are taking on high-risk bets. They choose to forgo regular interest income in exchange for a belief in MicroStrategy's future growth - especially its close connection to Bitcoin.

The nature of long-term call options: These bonds are essentially a long-term call option, and investors can only profit when MicroStrategy's stock price rises significantly. And this potential source of returns mainly depends on the trend of Bitcoin prices and the market's confidence in MicroStrategy's governance capabilities.

(3) The chain reaction in the capital market:

This financing method is not just about capital input, but more like a game with the future market. The chain reaction triggered by this game is huge, every link is driving the overall growth, full of the delicate balance between high risk and high return.

Synergistic effect with equity dilution: MicroStrategy's bond financing strategy and its equity dilution complement each other, forming a unique capital operation model. This model has resonated in the financial market, and the market's confidence in the company's future has continuously driven capital inflows, and the core of this game is the firm belief in Bitcoin and the optimistic expectation of the future digital asset world.

III. Governance Reform: From Saylor's Control to Institutionalized Governance

Along with the expansion of capital, MicroStrategy's governance structure has also undergone important changes. Michael Saylor has fallen from his absolute control of voting rights, marking the company's transition from a "controlled company" to a more market-oriented and institutionalized governance model.

In the past, Saylor had the final say in the company's decision-making through his control of Class B common shares, and MicroStrategy was therefore classified by NASDAQ as a "controlled company". However, with the large-scale issuance of Class A common shares, the voting advantage of Class B shares has been diluted, and Saylor's voting rights have fallen below 50%. The company has therefore been forced to set up an independent nomination committee, and the board's decision-making has begun to shift towards a more collective direction. This change not only means that the company needs to respond to market oversight more transparently, but may also bring more uncertainty to its future strategic decisions.

In the web3 ecosystem, the transformation of the governance structure often represents the company's transition from the aggressive growth stage of a startup to a more stable and sustainable development phase. The case of MicroStrategy reflects the typical characteristics of this transition: rapid expansion under individual leadership and gradual standardization under institutionalized governance. For the web3 industry that pursues the idea of decentralization, this change is also an inevitable trend of internal checks and balances.

IV. Aiying FundInsight's In-depth Thoughts

MicroStrategy's capital operation path has led to deep reflection by Aiying FundInsight. Can this strategy be sustained, or how will it change the entire web3 financial ecosystem? Under the leadership of Michael Saylor, MicroStrategy has almost recklessly pushed Bitcoin to the center of the traditional capital market. Through a combination of equity dilution and zero-coupon bonds, the company has boldly entered the capital market, fully betting on the long-term value of Bitcoin, but is this model a desperate gamble or a forward-looking vision of the future asset landscape?

From a deeper perspective, MicroStrategy has transformed the company into a structured tool for indirect holding of Bitcoin by leveraging the faith of shareholders and bondholders in Bitcoin. It not only relies on the market's perception of Bitcoin, but also opens up a new path in the financial field by linking traditional financing tools with digital assets. However, this path is full of risks and uncertainties, especially in the case of violent fluctuations in Bitcoin prices, the leverage risk faced by MicroStrategy will be greatly amplified.

More worth thinking about is the demonstration effect of this capital operation method on the web3 industry as a whole. Many companies may be inspired to emulate MicroStrategy and use crypto assets as the main assets for structured holding and financing. However, without hedging measures and diversified risk management, this strategy is likely to bring systemic market risks. Although MicroStrategy's debt and equity dilution measures seem successful, the logic behind them is based on the premise of continued rise in Bitcoin prices. Once this premise is shaken, the foundation of financing and growth will also be impacted.

Aiying FundInsight believes that the case of MicroStrategy is both a profound experiment on a new type of capital operation and a high-risk market gamble. It shows how web3 companies can use the traditional financial market to expand their digital asset holdings, but it also reveals the significant risks inherent in this strategy. If the future crypto asset market ecosystem can continue to optimize, MicroStrategy may become a pioneer of a new corporate model; but if the market sentiment reverses, this high-leverage operation may become a huge risk point. And the analysis of MicroStrategy's debt structure and potential risks.