Table of Contents

ToggleBit coin single day decline 4.99%

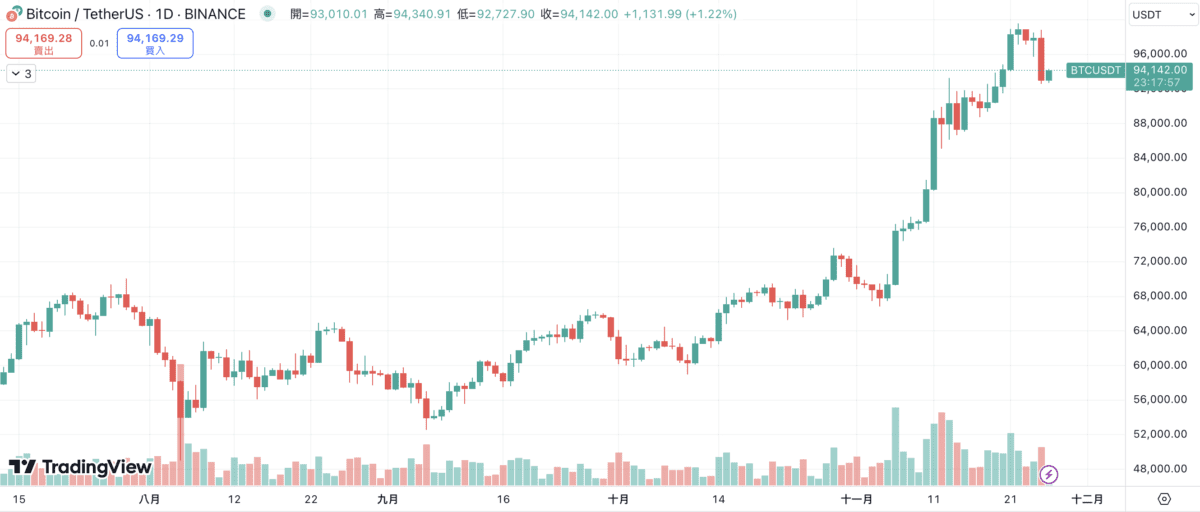

The trend of Bit coin has turned weak recently. Starting from 8 o'clock last night, it has been falling all the way from the $98,000 level, and has fallen below $93,000 this morning. The daily line closed down 4.99%, the largest single-day decline since August 27.

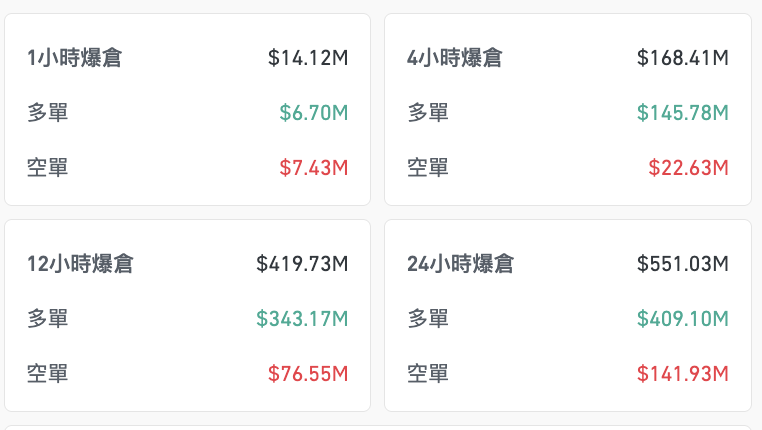

According to data from Coinglass, in the past 24 hours, a total of 169,025 people were liquidated in the crypto currency market, with a total liquidation amount of $551 million, mainly in long positions.

Compared to Bit coin, the major US stock market indices have shown an upward trend. The Dow Jones Industrial Average rose 426.16 points, up 0.97%, to close at 44,296.51 points; the S&P 500 index rose 20.63 points, up 0.35%, to close at 5,969.34 points; the Nasdaq Composite index rose 31.23 points, up 0.16%, to close at 19,003.65 points.

Ether coin trend turns strong

In addition, Ether coin, which has been lagging behind Bit coin, has shown a relatively strong trend in the past two days, with ETH/BTC closing up 6.9% yesterday, the largest increase since May 20.

Wintermute analyst pointed out in a report that capital is shifting from Bit coin to Ether coin, and the open interest contracts on Ether surged over the weekend, accompanied by a rise in implied volatility and a significant increase in demand for call options, indicating that derivatives traders are increasingly confident in the market.

The shift from Bit coin to Ether is accompanied by a sharp rise in Ether's implied volatility and the put-call skew reaching a 12-month high, indicating a strong preference for upside exposure. According to the Wintermute analyst, traders are actively buying to drive the market upward.

"The large trades over the weekend included Ether call option spread contracts expiring on December 27, with strike prices ranging from $3,600 to $5,000."

On the other hand, analysts at QCP Capital also share the same view as Wintermute. The institution pointed out that capital has continued to flow from Bit coin to Ether and other Altcoins in the past 24 hours, and derivatives market data shows that the risk reversal of Ether is clearly biased towards short-term call options, while the call options of Bit coin are mainly concentrated in contracts expiring after December 27, 2024. QCP analysts said:

"The market seems to expect Bit coin to continue to consolidate until December, while the focus in the short term has shifted to Ether."

(This article is reprinted with permission from GT Radar)

About GT Radar

GT Radar focuses on building a long-term, stable growth quantitative investment portfolio, with over 10 years of stock and crypto currency quantitative trading experience. The trading system integrates more than 150 strategies, aiming to provide extremely high adaptability and flexibility to ensure profits are obtained from the market in the most stable manner.