Bitcoin price drops to $92,600 due to a surge in liquidations and long-term BTC holders taking profits

Today, the price of Bitcoin has experienced a flash crash, dropping to as low as $92,600, but has since recovered somewhat. This was primarily due to the dual pressure of long liquidations and long-term Bitcoin holders (LTH) taking profits. As the market sentiment changes, whether the buyers at the dip can enter the market in time will be the key to the subsequent market trend.

The dream of $100,000 shattered, the bears take control of the market

The price of Bitcoin once approached $100,000, but the bulls' pursuit ultimately fell into a dilemma, and the bears gradually took control of the situation. The multiple pressures in the market have led to violent fluctuations in the price of Bitcoin, which fell to $93,000 today, triggering massive liquidations across the network.

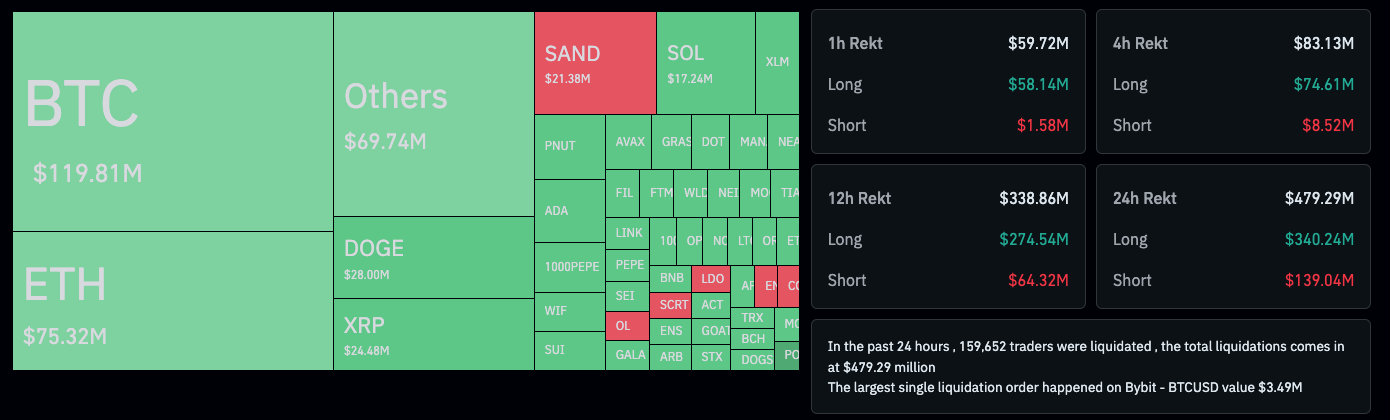

According to Coinglass data, in the past 24 hours, the total amount of liquidations across the network reached as high as $551 million, of which $414 million were long positions and $137 million were short positions. A total of approximately 169,786 traders were liquidated, with the largest single liquidation occurring on the BTC/USDT perpetual contract on the Binance platform, amounting to $4.67 million.

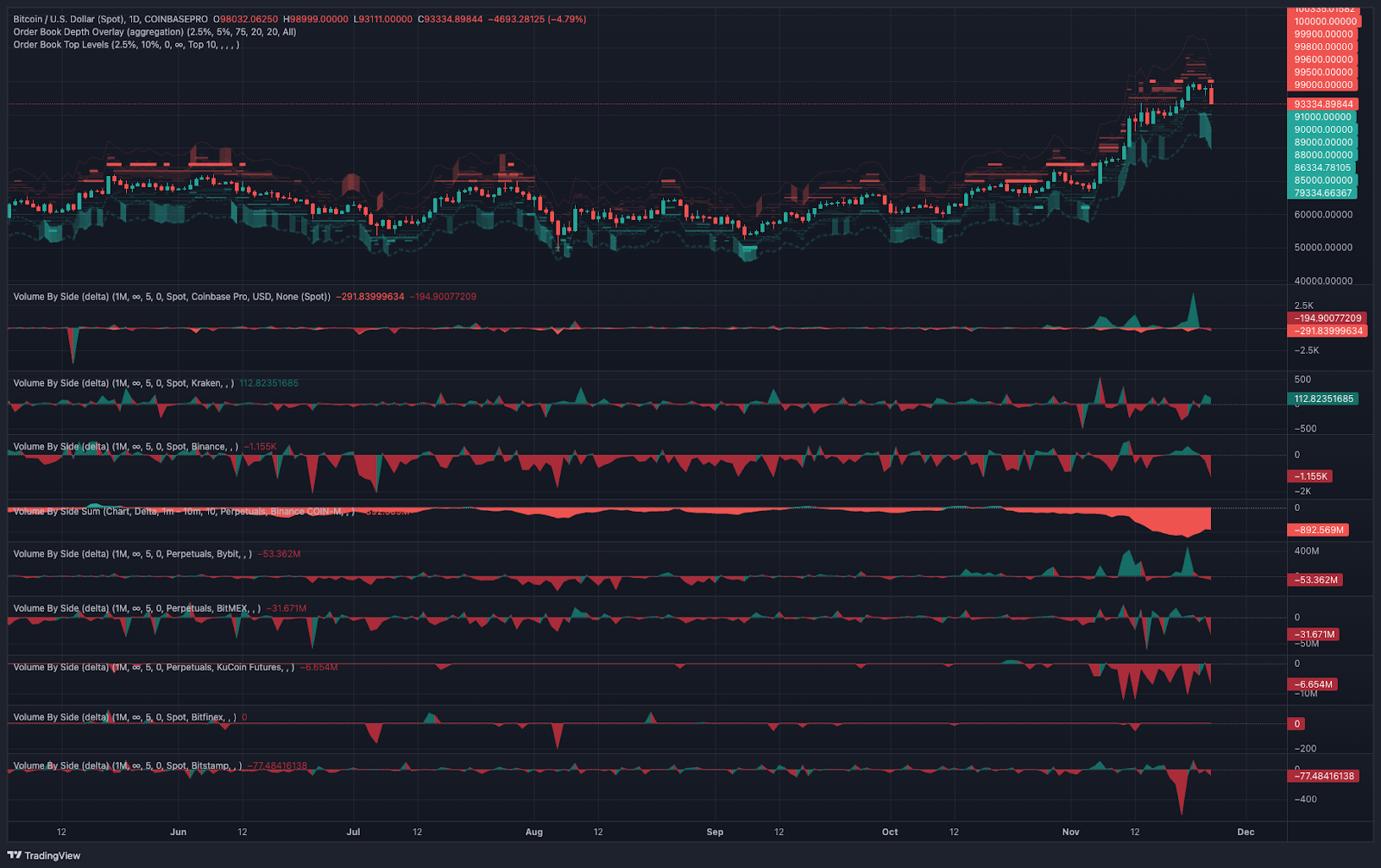

Sell-off triggered by liquidations: Trading volume surges, market loses control

The sell-off triggered by the large number of liquidations has further exacerbated the downward pressure on the market. The chart shows that the trading volume on centralized exchanges (CEXs) has surged, especially on exchanges that offer perpetual futures trading, with a large number of sell-off transactions causing severe volatility in market liquidity. The trading volume of BTC/USD and BTC/USDT on major trading platforms has risen significantly, and the liquidation mechanism has temporarily led to a loss of control in the market.

Long-term Bitcoin holders (LTH) become the source of selling pressure

In addition to the forced liquidation of long positions, long-term holders (LTH) have also played an important role in the current price fluctuations. According to Glassnode data, the LTH group that accumulated positions in the past 6 to 12 months is the main seller, as these investors have accumulated a large number of positions at Bitcoin's historical low points, with a cost basis 71% lower than the current market price (around $57,900). As Bitcoin rose from $74,000 to $99,000, they seized the opportunity to take profits at the high levels.

Analysts point out that the selling behavior of LTH indicates a change in market sentiment, especially when Bitcoin's price approaches its highs, investors begin to realize some of their gains. This also means that the selling pressure in the market comes not only from the liquidation of leveraged funds, but also from those who have locked in profits during Bitcoin's long-term upward trend.

From spot long to leveraged short: The subtle shift in the market

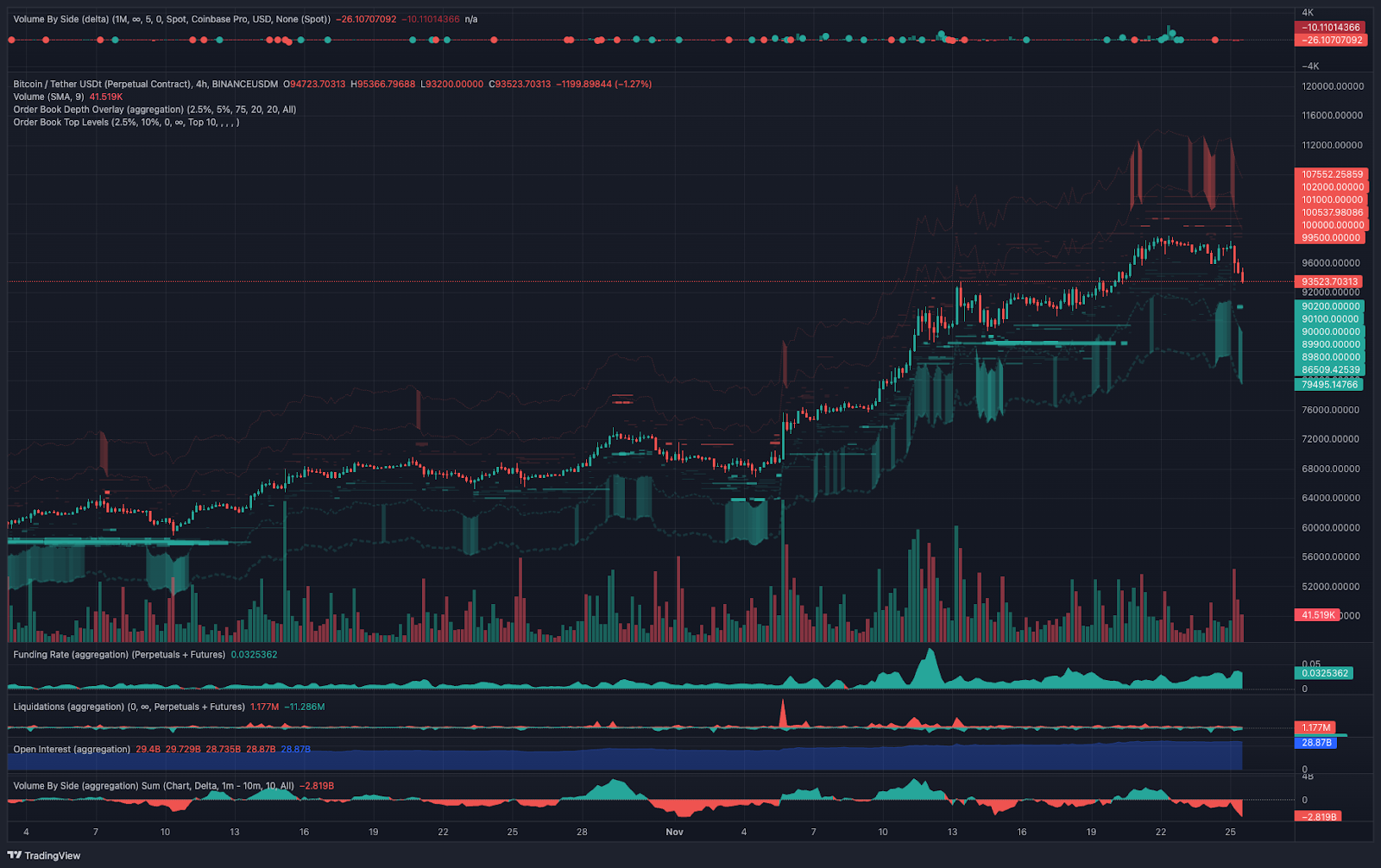

With the market volatility, the delicate balance between the buyers and sellers in the financial market has shifted. Today's market performance shows that the preference of capital has gradually shifted from short-term spot trading and leveraged long positions to the short camp. As liquidations intensify, short positions have surged, and the funding rate has also risen accordingly, from 0.019% to a peak of 0.04%, indicating an increase in market expectations for a further decline in Bitcoin's price.

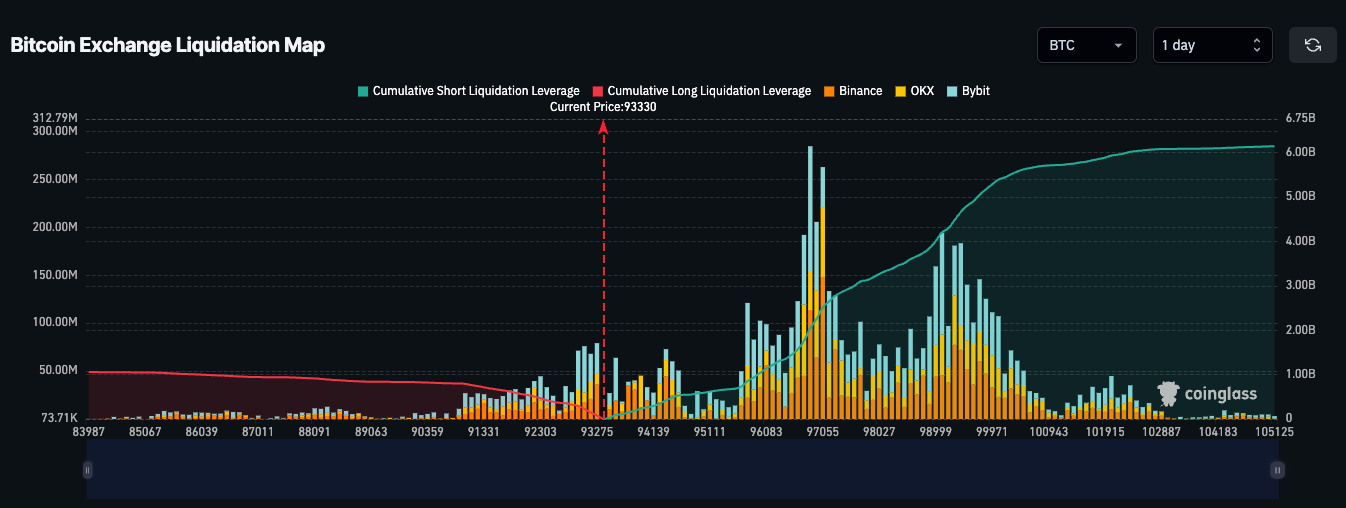

Bitcoin price approaches $90,000, liquidation pressure rises again

According to the liquidation data, the current Bitcoin price has broken below the critical support level of $94,000, triggering another wave of forced selling. Some traders have expressed strong interest in the $90,000 level, believing it could become a new buying support area. If the Bitcoin price further drops to $90,000, the market may face another round of price volatility.

Can the buyers at the dip enter the market in time?

Although the market is currently in a state of defeat for the bulls, many traders and investors remain optimistic about Bitcoin's long-term prospects. Whether the capital that buys at the dip can enter the market in time will determine the subsequent market trend. If the capital that is absorbed at low prices starts to flow in, it may to some extent alleviate the current selling pressure and support a rebound in Bitcoin's price.

In summary, today's Bitcoin flash crash is the result of the accumulation of multiple factors, including both the short-term pressure triggered by liquidations and the profit-taking of long-term holders. Although the market sentiment may continue to fluctuate in the short term, Bitcoin, as an asset, still attracts the attention of global investors, and its long-term growth potential remains.