WisdomTree, a global asset management firm, has started the process to launch an XRP ETF, managing around $113 billion in assets.

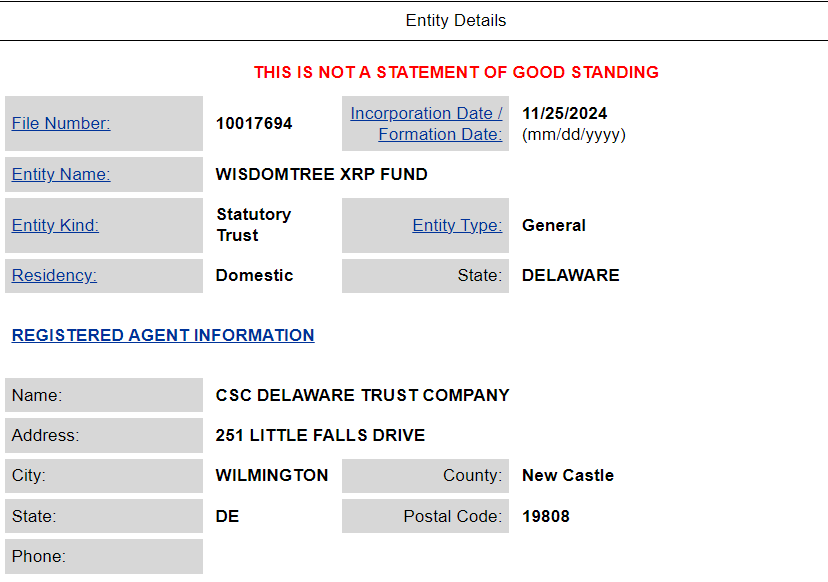

The company recently filed for a trust entity in Delaware, a necessary step before officially submitting an application to the SEC.

Optimism Grows for XRP ETF Approval

Earlier, Bitwise had also applied to the SEC for approval of a similar product last month. WisdomTree emphasized that it will store most of the XRP holdings in cold storage to ensure investor safety during the trust product management process.

In October, Canary Capital also filed for a physical XRP ETF launch. This fund will track the price of XRP by collecting data from regulated exchanges.

Now, WisdomTree has become the third and potentially the largest asset manager to apply for an XRP ETF. Unlike Bitwise and Canary Capital, the proposed ETF aims to track the market performance of XRP.

WisdomTree has not yet disclosed the exchange listing or ticker symbol for the fund.

"The company has confirmed that this filing is legitimate. WisdomTree manages over $100 billion in assets." - Eleanor Terrett, FOX Business reporter, posted on X (formerly Twitter)

Meanwhile, XRP has regained momentum in the bullish market since the departure of Gary Gensler from the SEC earlier this month. The token surged nearly 180% in November, reaching a 3-year high.

The change in SEC leadership could shift the agency's stance on digital assets. The legal battle between Ripple Labs and the SEC highlighted the need for regulatory clarity. Gensler's departure could pave the way for more favorable regulations for XRP ETFs.

Ripple has consistently emphasized the potential for institutional adoption of XRP. Ripple's CEO Brad Garlinghouse expressed optimism about the approval of XRP funds, calling it an inevitable evolution of the asset class.

Moreover, XRP is not the only digital asset seeking ETF approval, following the success of Bitcoin and Ethereum ETFs. VanEck and 21Shares have also filed for a Solana ETF, with the SEC required to make a decision on this application by January 6, 2025.