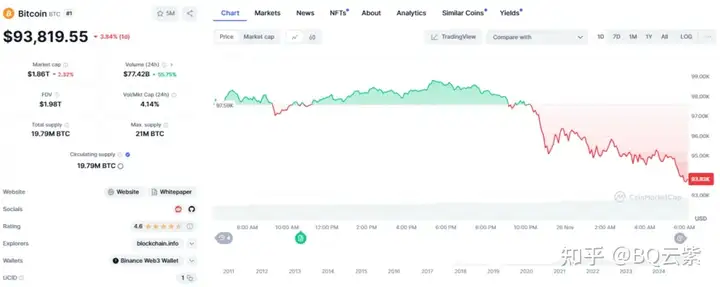

On Monday, November 25, Bitcoin continued to decline from the weekend, falling further and breaking through $94,000 during the session. Bitcoin failed to breach the $100,000 mark last week, and profit-taking sentiment was strong, with the cryptocurrency now down about $6,000 from its all-time high, breaking below the November 21 bottom of $93,850.62.

Ethereum, on the other hand, was relatively resilient, rising as much as 3.9% during the day to around $3,500, but later also retreated, following Bitcoin's trend.

On the same day, blockchain concept stocks had mixed performances. Kodak rose 18.6%, Beyond Inc. rose over 9.4%, Ebang International ADR rose over 8.6%, Applied Digital rose over 8.4%, the Ethereum ETF FETH rose 6.65%, Robinhood rose about 3.3%, and the crypto exchange giant Coinbase rose about 2.5%. "Bitcoin whale" MSTR fell more than 4%, TeraWulf fell more than 6%, and BTC Digital fell more than 8%.

On the news front, Yellen was nominated as US Treasury Secretary, and investors expect he will prioritize economic and market stability, ushering in the "Mnuchin 2.0" era, knowing where the red lines are, and the new government's fiscal policy will be implemented in a gradual manner, with tariff policies implemented in stages, rather than as aggressively as promised during Trump's campaign. This caused the US dollar and Bitcoin to fall, and US Treasuries to rise.

The crypto world also had good news that day. Currently, Wall Street is actively preparing to launch new crypto-related ETFs. With the support of digital asset supporters, the media reported that executives and lawyers involved in ETFs said they are formulating strategies to cater to the preferences of different investors.

The new crypto-related ETFs being prepared include both defensive-leaning ETFs targeting professional fund managers interested in cryptocurrencies, as well as highly speculative bets targeting risk-tolerant groups. The riskier crypto ETFs may focus on a variety of digital tokens, sometimes using leverage, options, or quantitative strategies.

Previously, some simple Bitcoin-tracking crypto-related ETFs have attracted billions of dollars since the US election.

The industry generally expects that the US Securities and Exchange Commission (SEC) under Trump will be more receptive to new digital asset products than under the Biden administration. The SEC will see new leadership, and the ETF industry is entering a "Wild West" era.

Currently, several digital asset companies have applied to the SEC to launch ETFs tracking cryptocurrencies such as Solana, XRP and Litecoin. Such ETFs have little chance of being approved under SEC Chair Gary Gensler, but their chances would be higher under the new administration. In addition, tokens such as Aave, Uniswap, and Maker are also suitable for ETF products.

On the same day, the well-known Wall Street firm Bernstein significantly raised its target price for "Bitcoin whale" MSTR, from $290 to $600, expecting another 40% upside. This is in contrast to Hindenburg's recent short position.

Bernstein expects that by 2033, MSTR will own 4% of the global Bitcoin supply. Currently, the company's Bitcoin holdings account for 1.7% of the supply. Bernstein believes that MSTR's Bitcoin asset management model is unparalleled. In Bernstein's view, Bitcoin is in a structural bull market, with favorable regulation, US government support, institutional adoption, and a favorable macroeconomic environment.

In addition, another broker, Canaccord, raised its target price for MSTR from $300 to $510 and reiterated a buy rating. Canaccord said a new valuation approach should be used for MSTR. "Traditional profit and loss statement earnings metrics no longer apply to MSTR, as the company's software business accounts for only a single-digit percentage of its current enterprise value. The dollar-denominated per-share BTC appreciation reflects everything that is happening with MSTR."

MSTR CEO Michael Saylor, when talking about being shorted, said that Hindenburg does not understand where MSTR's premium over Bitcoin comes from. While the company is profiting from Bitcoin's volatility, it is also leveraging through ATM operations, so as long as Bitcoin continues to rise, the company can still make money, which is an important profit point that short-sellers have overlooked. "Based on an 80% Bitcoin price spread, $3 billion in ATM financing can bring $125 per share in earnings over 10 years."

MSTR rose 6% in pre-market trading on Monday, but later retreated, ultimately closing down more than 4%.