The price of Ripple (XRP) has surged 182.80% in the past 30 days and 30.26% in the past week. Although its EMA line remains bullish and the short-term line is above the long-term line, indicators such as RSI and CMF suggest that the uptrend may be losing momentum.

The weakening momentum may lead XRP to test the $1.05 support level, and if the selling pressure increases, there is a risk of it falling below $1. However, if buyers regain control, XRP may target the $1.63 resistance level and potentially reach $1.7, which would be the highest price since 2018.

Join the discussion group → → VX: TZCJ1122

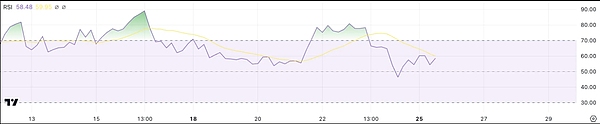

XRP RSI in the neutral zone

The Ripple RSI is currently at 58, down from over 70 a few days ago. The RSI (Relative Strength Index) measures the momentum of price movements on a scale of 0 to 100, with values above 70 indicating overbought conditions and potential for a correction, and values below 30 indicating oversold conditions and potential for a price recovery.

The drop from 70 to 58 reflects a cooling of the bullish momentum, suggesting that the recent rally may be slowing down, but it has not yet entered the bearish territory.

An RSI of 58 indicates that XRP is still in a healthy range, leaning towards a bullish sentiment, but the buying pressure has eased compared to the previous levels. After the 30.26% price surge in the past 7 days, the RSI decline suggests that a period of consolidation may be upcoming.

If the RSI continues to decline, it may signal an increase in selling pressure, potentially leading to a price correction. However, if the RSI stabilizes or rises, the XRP price may regain momentum and attempt further upside.

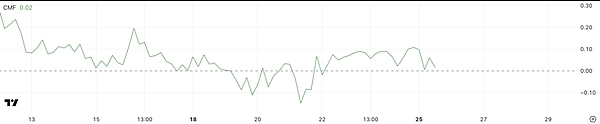

Ripple CMF drops significantly

The XRP CMF is currently at 0.02, down from 0.11 two days ago, indicating a significant easing of buying pressure. The CMF (Chaikin Money Flow) measures the capital flow in and out of an asset over a period, with values above 0 indicating net inflow (buying pressure) and values below 0 reflecting net outflow (selling pressure).

Since November 22nd, the Ripple CMF has remained positive, suggesting that despite the recent decline, buyers have maintained a dominant position.

With a CMF of 0.02, Ripple still reflects a slight net capital inflow, indicating that the bullish sentiment has not yet fully dissipated, but it is weakening. If the CMF turns negative, it would suggest that the capital is shifting towards net outflow, potentially signaling an increase in selling pressure and the possibility of a price correction.

Currently, the positive CMF supports a cautiously optimistic outlook, but further decline may signal that the XRP price momentum is starting to turn bearish.

XRP price prediction: Is $1.7 on the horizon?

The EMA lines for XRP remain in a bullish configuration, with the short-term line above the long-term line, indicating that the overall trend is still upward. However, other indicators such as CMF and RSI suggest that the uptrend may be losing momentum.

If the bullish trend further weakens and a downtrend emerges, the XRP price may test the critical $1.05 support level, and if the selling pressure intensifies, it could potentially fall below $1.

On the other hand, if the uptrend regains strength, the XRP price may break through the $1.63 resistance level, targeting $1.7, which would be the highest price since 2018.

That's the end of the article. Follow the public account: Web3 Tangy for more great articles~

If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have the most professional community, where we publish daily market analysis and recommend high-potential coins. There is no threshold to join the group, welcome everyone to join the discussion!

Join the discussion group → → VX: TZCJ1122