The cryptocurrency exchange Bitfinex stated in a report released on Monday that long-term holders have been taking profits as BTC (Bitcoin) has risen significantly, leading to the recent price correction. However, analysts believe that the selling pressure from long-term holders is still relatively under control, and the market is expected to continue its upward trend in the medium term. Bitfinex's report also mentioned that speculative capital is flowing into Altcoins, and it warned of the extreme funding rates.

Table of Contents

ToggleThe price correction of Bitcoin

According to the Bitfinex report, the spot demand for Bitcoin remains strong, with the net inflow of funds into the US Bitcoin spot ETFs (Exchange Traded Funds) exceeding $3.35 billion in the past week. However, Bitfinex pointed out that since ETFs and other institutional entities usually do not execute buy orders on weekends, and long-term holders continue to sell, the market experienced profit-taking behavior on weekends, and the lack of sufficient demand to match these supplies led to a decline in the price of Bitcoin.

Bitfinex stated that as Bitcoin approaches the $100,000 mark and remains above $90,000, it is necessary to closely monitor the daily ETF fund flows. If the inflow slows down, it may indicate a decrease in interest in spot Bitcoin at the current high prices, which could be a warning signal for a more significant correction.

Bitfinex even expects a larger correction this week, especially against the backdrop of the release of the US Consumer Price Index (CPI) data and the publication of the Federal Open Market Committee (FOMC) meeting minutes, although the analysts believe that "any sell-off is a healthy correction".

Long-term holders taking profits

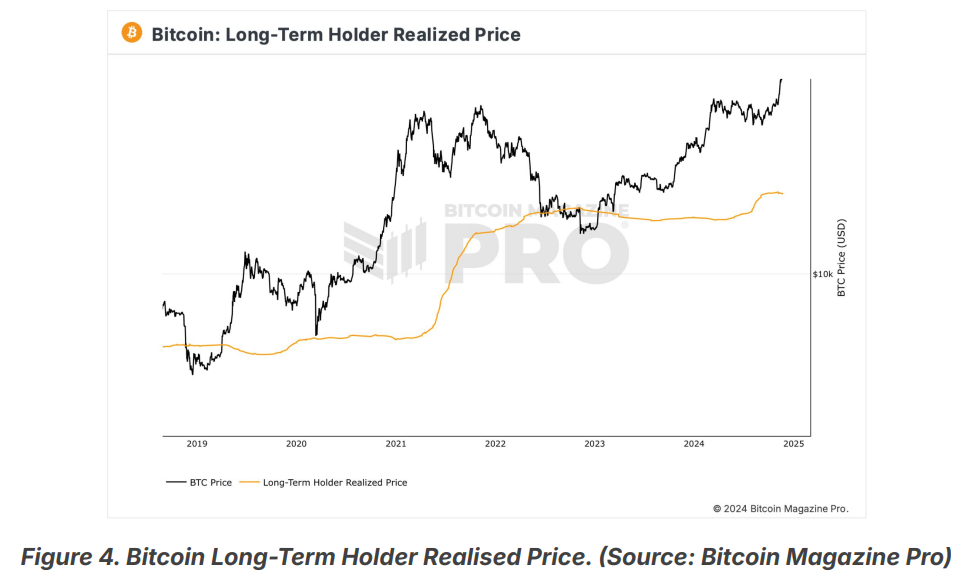

The Bitfinex report indicates that long-term holders have been taking profits as Bitcoin has risen significantly, with over 461,000 BTC spent (transferred out of Bitcoin) since the previous high of $73,666 last month, realizing gains far above their $24,912 realization price (the average purchase price of long-term holder wallets).

Bitfinex noted that while the selling pressure from long-term holders has increased, it is still relatively under control compared to the historical peaks in March 2021 and March 2024 (when the long-term holder supply decreased by 2.5 million and 1.4 million BTC, respectively). The analysts then wrote:

"These dynamics suggest a healthy and temporary momentum pause, with the broader market likely to absorb the selling pressure and continue its upward trend in the medium term."

Speculative capital flowing into Altcoins

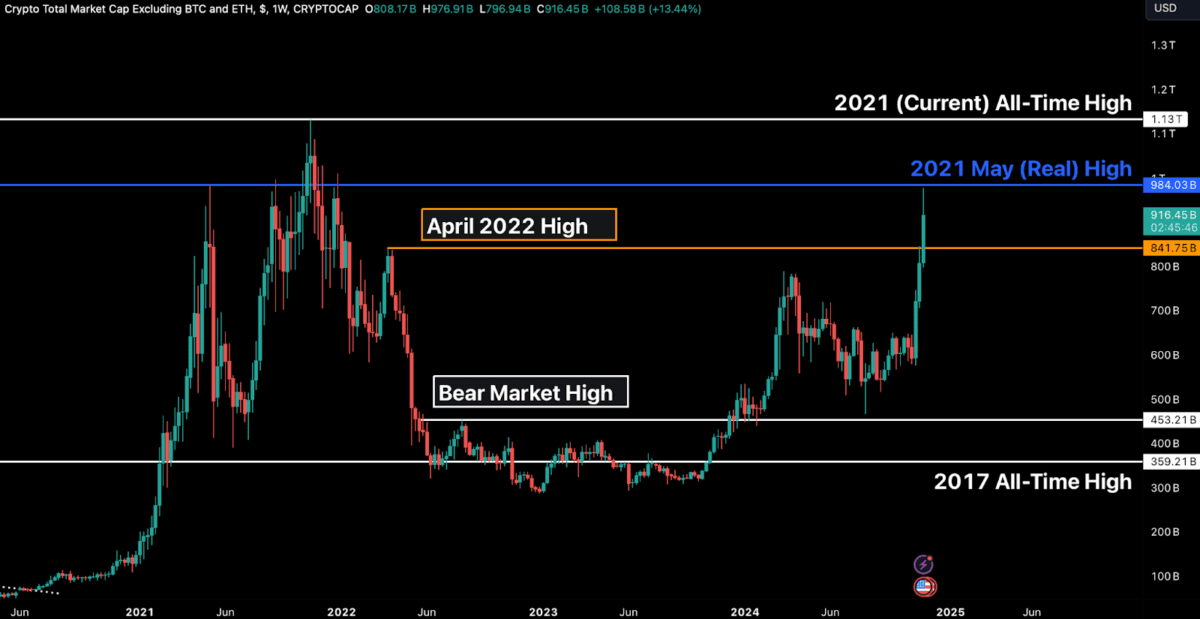

Bitfinex noted that the market capitalization of cryptocurrencies other than Bitcoin and Ethereum (referred to as the Total3 index) has also reached a new cycle high, thanks to a sharp rebound in investor sentiment.

The Altcoin market capitalization is now approaching the $984 billion peak of May 2021, indicating that speculative capital is shifting from Bitcoin to Altcoins. The analysts wrote:

"Historically, this type of rotation typically heralds the start of an 'alt season', a period characterized by Altcoin outperformance relative to Bitcoin."

Bitfinex stated that the annualized funding rates of large-cap Altcoins are breaking through the 45% threshold, indicating an increase in speculative activity. With the increase in retail participation, the volatility in shorter time frames is expected to increase, further fueling the momentum of Altcoins. However, the analysts warned that this situation also needs to be viewed with caution, as extreme funding rates often precede violent adjustments.