It appears that XRP sellers have exceeded the pressure previously exerted by buyers. BeInCrypto observed that the price of XRP has risen 177% over the past 30 days due to various factors, putting sellers in a tight spot.

However, recent data suggests that the upward momentum enjoyed by altcoins has temporarily stalled. If this condition persists, the upward trend of XRP may also pause for a while.

XRP, Increased Selling Pressure... Investor Demand Remains Weak

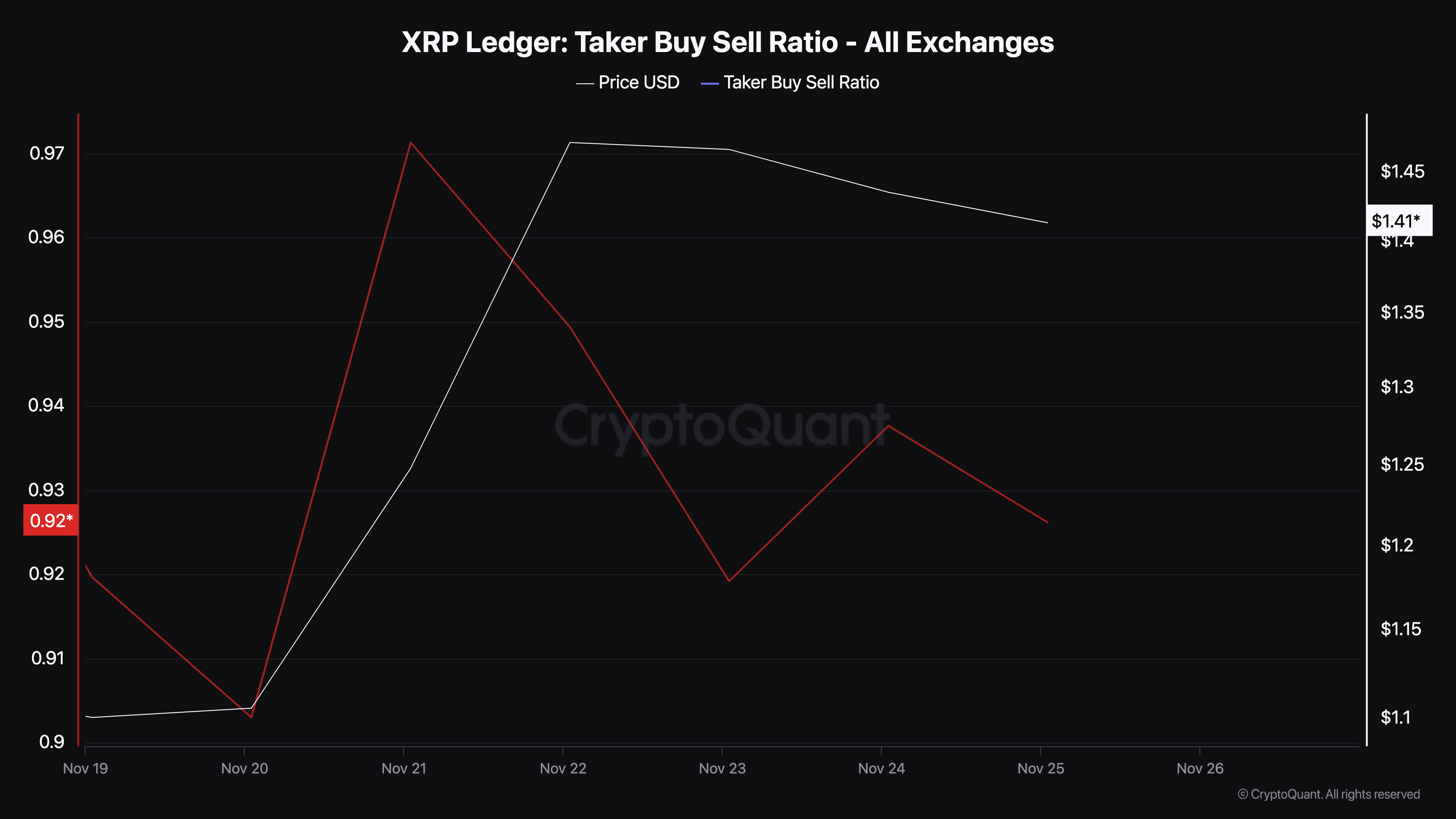

According to Cryptoquant, the XRP taker buy/sell ratio has fallen to 0.93. This ratio helps determine whether bullish or bearish sentiment is dominant in the derivatives market.

Generally, a ratio below 1 indicates that buyers are in the ascendancy, which suggests a more positive outlook. However, this is not the case currently, and XRP sellers appear to be in the lead. This situation may be related to traders with long positions realizing their profits.

In most cases, when traders realize their profits, it puts downward pressure on the price. Therefore, it is not surprising that the price of XRP has fallen to $1.42 at the time of reporting.

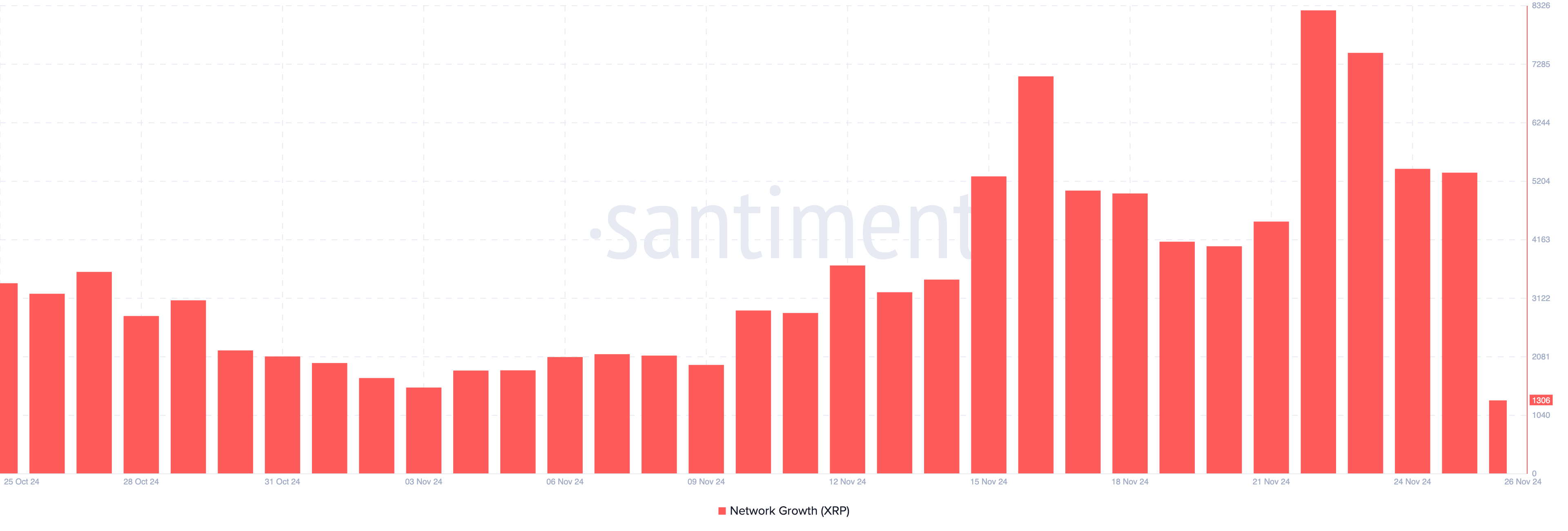

Additionally, network growth metrics suggest that XRP sellers are in control. Network growth tracks the number of new addresses making their first successful transaction on the blockchain, providing an indication of token adoption and market traction.

Increased network growth typically means new market participants are purchasing the token. However, this is not the case for XRP. According to sentiment, network growth on the XRP Ledger has declined significantly. If this trend continues, it may indicate persistent selling pressure and could lead to further price declines for XRP.

XRP Price Forecast: Bearish Outlook Prevails

Based on recent developments, the daily chart's Moving Average Convergence Divergence (MACD) has fallen into negative territory. MACD is a technical indicator that measures momentum using the difference between the 12 and 26-period Exponential Moving Averages (EMA).

A negative reading indicates a bearish momentum, while a positive reading suggests bullish momentum. Therefore, the reading below suggests that XRP sellers are in control.

If this condition persists, the price of the altcoin could fall to $0.92. However, if buyers regain control, the situation could change, and XRP's price could rise to $1.63.