Written by: Nanzi, Odaily Planet Daily

This morning, Coinbase Chief Legal Officer Paul Grewal posted on X saying: "Privacy wins. Today, the Fifth Circuit Court ruled that the U.S. Treasury Department's sanctions on the Tornado Cash smart contract were unlawful. This is a historic victory for cryptocurrency and all who care about defending freedom." Uniswap founder called it "an immutable smart contract defeating the Treasury Department in court."

After the news broke, the Tornado Cash protocol token TORN quickly surged, rising from the lowest point of $3.7 to the highest of $43 within an hour.

How are the specific details of the ruling, and what impact will it have on users, the protocol, and related assets? Odaily will analyze it in this article.

Analysis of the Protocol Impact

Background of the Story

In August 2022, the U.S. Treasury Department's Office of Foreign Assets Control (OFAC) added Tornado Cash to the sanctions list (SDN), after which Germany, France, South Korea, and other countries conducted investigations, warnings, and sanctions on Tornado.

Regarding the OFAC sanctions in the U.S., it can be simply summarized as:

Prohibiting access, including shutting down the front-end website and prohibiting technical access;

Prohibiting interaction, prohibiting all entities, citizens, and other objects under U.S. jurisdiction from interacting with Tornado Cash, covering financial institutions, cryptocurrency platforms, wallet providers, and others;

Prohibiting fund flows, prohibiting any inflow or outflow of funds related to Tornado Cash by U.S. financial institutions and cryptocurrency trading platforms.

Freezing assets, all assets owned or controlled by Tornado Cash within the United States, including virtual currencies, have been frozen.

Additionally, in May 2024, one of the founders of Tornado Cash, the core developer, 31-year-old Russian citizen Alexey Pertsev, was sentenced to 5 years and 4 months in prison in the Netherlands for laundering $2.2 billion through the cryptocurrency mixer platform.

This September, the criminal case against Tornado Cash developer Roman Storm will enter the trial process. The U.S. Department of Justice has accused Storm and his colleague Roman Semenov of three charges, including conspiracy to launder money, operating an unlicensed money transmitting business, and violating the International Emergency Economic Powers Act, involving assisting the North Korean hacker group Lazarus Group in laundering over $1 billion.

Court Ruling and Impact

Coinbase Chief Legal Officer Paul Grewal said: "Tornado Cash will be removed from the sanctions list, and Americans will be allowed to use this privacy-protecting protocol again. In other words, the government's overreach will not be able to continue."

Uniswap founder Hayden Adams pointed out that the key content in the judgment document is: "We find that the immutable smart contracts (privacy-supporting software code) of Tornado Cash are not the 'property' of a foreign national or entity, meaning (1) they cannot be blocked under IEEPA, and (2) OFAC exceeded the powers granted by Congress." (See the last section for a detailed analysis)

Impact on Protocol Revenue and Token

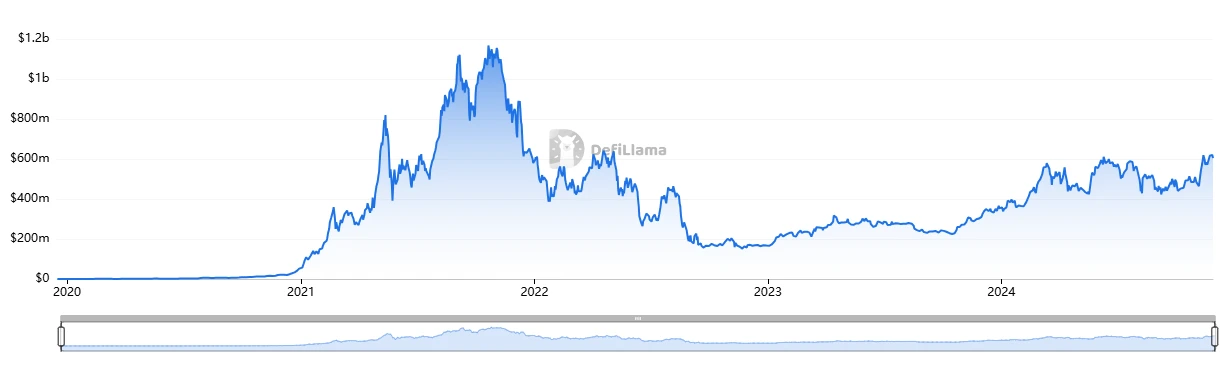

After being sanctioned by OFAC in 2022, Tornado Cash's TVL plummeted, but due to historical deposits and the depth of the liquidity pool, Tornado is still the mixer of choice for hackers, and its TVL has been gradually recovering.

Although the front-end was blocked, hackers directly call the on-chain smart contracts to mix coins, so the sanctions have little impact on these "core users." The author believes that the "fundamental revenue" of TORN will not undergo major changes due to the ruling, and the main factors affecting the token's rise and fall are sentiment and confidence. Therefore, although TORN surged tenfold within an hour this morning, it then fell by nearly 70% in the following two hours, and readers are advised to focus on news and sentiment as the core basis for price judgment going forward.

Will the Trial of Roman Be Affected?

After the Fifth Circuit Court's ruling was released, some users asked ConsenSys lawyer Bill Hughes, "Will Roman be released?"

Bill's response was: "This is a completely separate matter. This does not mean that Tornado Cash is not a service, but rather that the immutable smart contracts that are part of the platform are not a service. The U.S. Department of Justice has stated that the service Roman operated was in violation of sanctions, illegally transferring funds and facilitating money laundering, and this has not changed."

Key Content of the Ruling

This section specifically explains the logic and basis of the Fifth Circuit Court's ruling that the U.S. Treasury Department's sanctions on the Tornado Cash smart contract were unlawful. Readers can choose to read selectively.

Tornado Cash is Not a Service

OFAC's argument: Smart contracts are essentially a service because they can be used by users to perform specific types of operations (such as anonymous transactions).

The court's view: Immutable smart contracts do not require any human operation. Even by the Treasury Department's definition, immutable smart contracts are merely lines of code, and it is more accurate to say they are tools used to provide services rather than 'services' themselves.

Tornado Cash is Not Property

According to the International Emergency Economic Powers Act (IEEPA), OFAC's sanctions targets must be 'property' or 'property' in which a foreign person has an interest.

However, the Tornado Cash smart contracts are immutable, decentralized code, with no economic entity able to control them, and these smart contracts cannot be owned, as more than a thousand volunteers participated in a trusted setup ceremony to "irrevocably remove the ability of any person to update, remove or control these lines of code." Therefore, no one can exclude others from the right to use the Tornado Cash pool smart contracts. Even under the OFAC sanctions regime, North Korean hackers cannot be prevented from withdrawing assets, so Tornado Cash does not qualify as sanctionable property.

In law, the government can only sanction objects that meet the definition of 'property' or 'service.' If something is neither property nor a service, the sanctions lack a legal basis.

(Note: The full text of the court ruling can be found here.)