After several consecutive days of sharp increases, Bitcoin finally experienced a significant correction, having once surged to nearly $100,000.

VX: TTZS6308

As of the time of writing today (27th), Bitcoin has fallen below $93,000 from around $98,000, with the lowest point reaching $90,791, a daily decline of 1.66%.

The decline in Bitcoin may be related to factors such as deleveraging, long-term holders taking profits, and capital rotation. The increased confidence in the US bond market and the large number of options expiring this Friday are key factors driving the correction in Bitcoin.

Although Bitcoin is currently fluctuating around $93,000, will it continue to decline in the short term?

Could Bitcoin fall below $90,000?

Call option trading valuation is lower than put option trading

On the well-known cryptocurrency derivatives exchange Deribit, the trading valuation of call options has turned negative for at least a month, indicating that investors are buying put options.

This may suggest that professional traders are preparing for a further decline in Bitcoin, and are therefore buying put options in advance to hedge. On Monday, traders sold call option spreads on the over-the-counter liquidity network Paradigm and bought put options related to Bitcoin.

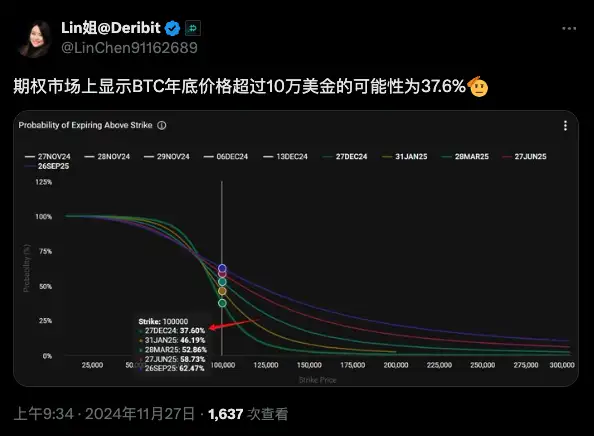

Currently, the Deribit options market predicts that the probability of Bitcoin reaching $100,000 by the end of the year has dropped to only 37.6%.

Changes in Coinbase premium

The demand for Bitcoin from US investors is weakening.

The Coinbase premium indicator shows that the price of Bitcoin on Coinbase is now at a discount compared to Binance, indicating a decrease in buying interest in the US market, which may signal a change in market sentiment.

Relative Strength Index (RSI) shows divergence

Although Bitcoin surged above $99,000 last week, the Relative Strength Index (RSI) did not rise in sync, showing a divergence.

From a technical analysis perspective, this may indicate that the bullish momentum of Bitcoin has weakened.

Where is the support level for Bitcoin?

Although there has been an 8.2% correction this week, it cannot be completely viewed as a trend reversal. The potential bottom for Bitcoin may be around $85,000, which is a normal correction. If the market sentiment turns bullish again, Bitcoin still has the opportunity to return to its historical high of $99,419.

It is worth noting that even if Bitcoin starts to correct in the short term, the interest of institutional investors has not waned.

For example, MicroStrategy recently announced the completion of a $540 million plan to buy Bitcoin, and companies like MetaPlanet in Japan and Semler Scientific in the US are also continuously buying Bitcoin, indicating that institutional capital has a long-term bullish attitude towards cryptocurrencies.

It is still expected that the price will reach $125,000 by the end of 2024.

Will the data determine the future direction?

The market is currently cautious about the interest rate cut in December. Traders are slightly inclined to another 0.25 percentage point cut, and Minneapolis Federal Reserve President Neel Kashkari believes this is "reasonable". Chicago Federal Reserve President Austan Goolsbee also supports the possibility of further rate cuts.

Currently, Bitcoin is fluctuating around $93,000, and Ethereum is around $3,450. Traders are adjusting their positions, and the volatility in the derivatives market is changing. The buying and selling intentions of Ethereum options have shifted from buying to selling, reflecting the market's concerns about potential downside risks.

The government bond market has reacted subtly to this. The yield on the policy-sensitive two-year Treasury note fell 0.02 percentage points after the release of the document, reaching 4.25%, the lowest level in a week. The S&P 500 index retreated slightly after the release of the minutes, but ultimately still closed up 0.6%, reaching a new all-time high.

The future direction of monetary policy will be highly dependent on the performance of inflation and employment data. The Federal Reserve will maintain a high degree of flexibility, closely monitor economic indicators, and adjust its policy stance in a timely manner if necessary. For the cryptocurrency market and the traditional financial market, the upcoming economic data will become the focus of attention, which may have a significant impact on the trend of asset prices.

Although Bitcoin is currently facing correction pressure, it is just a normal market adjustment and does not mean that the bull market has ended.

In the past cycles, there have been various obstacles to the inflow of capital into the cryptocurrency field, such as difficulties in depositing and withdrawing funds, uncertain regulations, pending legal cases, and the excessive caution of trading platforms and cryptocurrency companies. Now, this situation has undergone a complete transformation. The launch of spot ETFs and the clarity of regulations not only opened the floodgates for capital to enter the cryptocurrency field, but also provided opportunities for funds to invest in Altcoin startups.

Everything is in place... No one could have foreseen that so many positive factors would coincide so perfectly. This bull market has the most explosive potential in history, including Altcoins and Ethereum. Be patient! Once the big bull market starts, the scale of capital inflow will be incalculable.