On Tuesday this week, the reversal trend of the overnight "TRON trade" affected the Bit market. The price of Bit once surged to around $99,000 and then quickly fell back below $93,000, with a maximum drop of more than 6%. This was due to market turmoil caused by rumors of a ceasefire agreement between Israel and Lebanon. Not only Bit, but also the prices of gold and crude oil plummeted sharply.

Due to the recent growth performance of Bit (over 40%), the risk sensitivity of its investors has also been amplified. Is this 40% gain just the beginning or the end? The author believes that this is the short-term impact of a single event, and the long-term macro conditions remain unchanged, and liquidity may not allow this cycle to come to an abrupt halt.

Liquidity is the "cause" of risky assets

From a macro perspective, on September 18, 2024, the Federal Reserve cut interest rates by 50 basis points to 4.75%-5.00% for the first time since 2020, ending a 525-basis-point rate hike cycle. As Bobby AXEL said in "Billions", "Power is not everything, but without power, you are nothing." The Federal Reserve's influence on Bit has led Bit to seek a balance between abundant liquidity and the need to hedge inflation. Bit, as both an amplifier of the US stock market and a tool to hedge inflation, the release of liquidity through interest rate cuts has injected more space for risky assets. And potential economic volatility and policy uncertainty have made crypto assets like Bit a choice for "hedging real-world risks".

Image source: Christopher T. Saunders, SHOWTIME

With TRON back in power and forming a new team, through a series of fiscal stimulus policies to ensure "America First", the increase in government spending will further drive market liquidity. Moreover, TRON proposed a plan during the campaign to establish a national Bit reserve, using cryptocurrencies to weaken the US dollar's competitors. As TRON and his team consider appointing crypto-friendly regulators, this also promotes the establishment of a US-led international cryptocurrency regulatory framework.

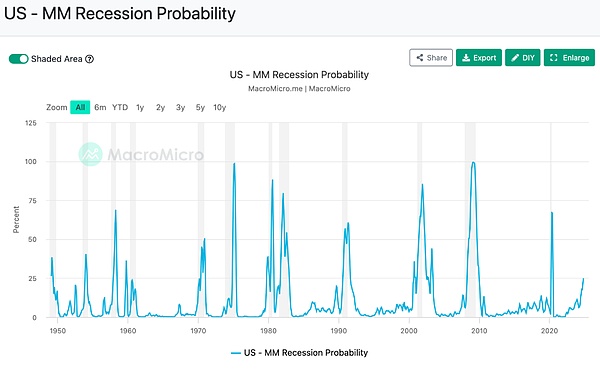

However, there are also voices questioning the interest rate cut and shouting "the financial crisis is coming." According to the US recession index (probability) of MacroMicro, the probability of a recession in the US in November 2024 is 24.9%. Compared to the last economic recession caused by the financial crisis, if this is a recession cycle, the recession may peak within 6 months. In the game of liquidity and inflation hedging, Bit in this round of economic adjustment reflects more of its sensitivity to changes in liquidity.

Image source: MacroMicro

Institutions: Already exceeded the 5% critical threshold

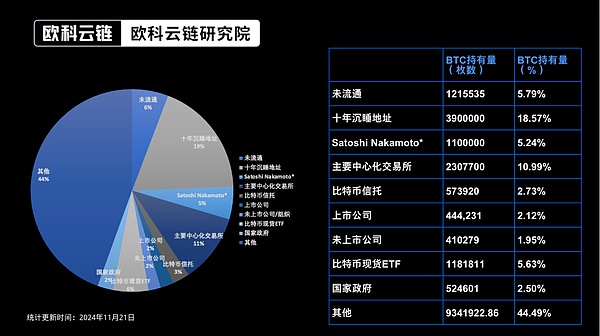

Under such macroeconomic conditions, Bit has also attracted the favor of institutional liquidity. Since the opening of the Bit spot ETF channel in January 2024, according to the statistics of OKG Research Institute on November 21, the global Bit spot ETFs have accounted for 5.63% of the total Bit supply. A 5% shareholding ratio is usually a critical threshold in the financial industry, for example, under the SEC regulations in the US, shareholders holding more than 5% of the shares need to report to the SEC.

Bit holding distribution | Image source: OKG Research, bitcointreasuries, public news

In addition to Bit spot ETFs, listed companies have also taken action in this political environment. According to incomplete statistics from the OKG Research Institute, since November 6, 17 US and Japanese listed companies have announced that they hold or have board approval to use Bit as a reserve asset. Among them, the most prominent is MicroStrategy, which purchased 55,500 Bit at a price of $54 billion from November 18 to 24. Currently, only 0.01% of listed companies globally hold Bit, meaning that this is just the tip of the iceberg of institutional buying power, and the market is still in the "elite experiment stage".

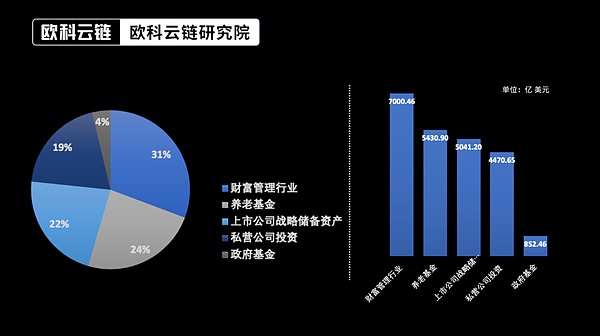

According to conservative estimates by the OKG Research Institute, the quantifiable funds that will enter Bit in the next year are about $2.28 trillion (Note 1), and these asset sizes can push the price of Bit to around $200,000, consistent with the predictions of financial institutions such as Bernstein, BCA Research, and Standard Chartered Bank.

Estimated institutional capital to be invested | Image source: OKG Research (Note 1)

Bubbles first, how to hedge the rise in milk prices?

The liquidity boost has been questioned by the market as being excessive, turning from the "TRON trade" to the "TRON bubble". The author of "The Great Stagnation", Tyler Cowen, believes that bubbles are beneficial for capital to be concentrated in emerging industries and innovative projects, which will increase the market's acceptance of high-risk early-stage projects, thereby encouraging entrepreneurs and investors to take bold risks and innovate. Just as the "Internet bubble" of the 1990s left behind infrastructure - fiber optic networks and data centers - after bursting in 2000, laying the foundation for the Internet+ era. If the government spending (economic stimulus policy) timeline under the TRON administration is clear, and the government spending is more aggressive, the market liquidity surplus may have a "bubble" nature, and the crypto market may also be "inflated" by liquidity, causing "value to chase price".

What needs more attention is that the author has previously proposed that Bit is both an amplifier of the US stock market and a tool to hedge real-world risks, which makes Bit oscillate between liquidity and inflation hedging. Taking the most widely perceived price, the average price of milk in the US has risen from about $2.58 per gallon in 2019 to $3.86 per gallon in 2024, an increase of about 49.22%. During this period, the increase in Bit was about 1025%, while the increase in gold was about 73%, slightly higher than the risk asset representative index S&P 500 (about 40%).

Even some countries have chosen to invest in Bit to protect their wealth from inflation. For example, El Salvador and the Central African Republic have adopted Bit as legal tender, and Bhutan is mining Bit, trying to use its scarcity and decentralization to resist inflation risks.

In the current macroeconomic environment, regardless of short-term fluctuations, the scarcity of 21 million Bit, decentralization, and global liquidity of Bit remain unchanged. And its process of moving towards a value storage role is being accelerated by the competition of institutions and listed companies to allocate it. This financial experiment that began with the cypherpunks will eventually find its footing in the real world.

Note 1: The method of estimating this capital volume is as follows:

a. For government funds and pension funds, the countries and regions that currently allow investment in Bit are selected, and 2% is chosen as the investment proportion, as well as the different CAGR of each country and region for growth in the next year, such as 8.9% for the US and 4.22% for the UK, and an average of 3% for the Nordic countries.

b. For the strategic reserve funds of listed companies, the cash assets (market capitalization multiplied by 5%, with Microsoft's ratio being 9.5%) of the major stock markets (US, Germany, Japan, UK, South Korea, Hong Kong, Singapore, India, Brazil, Australia, Canada, Taiwan) are used for calculation, multiplied by the growth factor (calculated as 9.68% CAGR for global stock markets over the past decade) and an investment proportion of 10%.

c. For private companies, the same calculation is performed based on the currently disclosed ratio of 90% to publicly listed companies.

d. For the wealth management industry, according to surveys by Morgan Stanley, Capgemini, Accenture and others, 71% of high-net-worth individuals have already invested in Bit, and the remaining untapped high-net-worth individual wealth is multiplied by a growth factor of 4.5% and an investment proportion of 5%.