In the past 10 months, the Bitcoin ecosystem has achieved three key consensuses:

Asset Standard Consensus: OridnalsNFT & Runes

Consensus of this bull market: BTCFi will lead the second half of the Bitcoin ecosystem

Current demand consensus: Bitcoin mainnet programmability needs to be strengthened

At this point, the Bitcoin ecosystem has been fully buffed: the global attention brought by BTC is the general background, Memecoins Oridinals NFT and Runes Casino are ecological endorsements, and the real demand for BTCFi to improve the efficiency of Bitcoin appreciation is the basic foundation.

Of course, objectively speaking, the Bitcoin ecosystem is still in its infancy, but it is sufficient to support a wave of market conditions with strong wealth-creating effects and has a high degree of certainty.

I am very sure that soon no one will say "BTC does not need an ecosystem" anymore.

PS: The following content is based on the rise and fall of Bitcoin ecological projects that @RunesCC has come into contact with, the thoughts of core builders, and the current trends that are brewing. There is a high probability that there is an information cocoon problem, so more solid builders are welcome to help me supplement my views in the comment area and introduce more reliable ecological projects.

1. Narrative of this bull market

First of all, 2025 will most likely follow the four-year cycle of Crypto and become a bull market. Whether it is investment or building, we need to see clearly where the core narrative of this bull market is:

❤️🔥The top narratives, I think, are $BTC and #memecoins . Both are deep in the Crypto level. Both the narrative and the implementation have been recognized. They have become a new species of Crypto: built on Crypto but surpassing the Crypto ecosystem. It is highly likely that they will be an asset class that can cross cycles.

Why did BTC become a new species?

Quoting the original text of Metrics Ventures Market Observation: "Bitcoin's asset attributes have been redefined in the past six months, and the new and old main funds have simultaneously completed the handover of pricing power. A new fund with Bitcoin as the core asset, ETFs and US stocks as the channels for capital inflow, and unlimited US dollar liquidity through the Ponzi model represented by US listed companies such as MSTR has officially started."

Simply put, whether it is the global macro-economy, the US government or US stock companies, they all urgently need a new wealth and asset reservoir as a settlement tool. Therefore, in the future, Bitcoin, as the most consensus-based encrypted asset, will usher in a wave of stable growth beyond the cycle, supported by both the macro-economy and traditional finance.

Why are Memecoins a new species?

Because Memecoins have become an attention finance system centered around hot topics, culture, and creativity, and are creating a whole new set of social movements and modes of operation, the impact of this real world on Memecoins may have been greater than that of Crypto.

PS: Looking back at the first round of the Bitcoin ecosystem, the new asset issuance method of "fair minting" is likely just a superficial phenomenon. The more essential logic may be that the "rise of the bitcoin ecosystem" fits the growth trend and needs of the two new species, $BTC and Memecoin.

🔥Focusing on the native bull market of Crypto in 2025, I believe it will still start and explode around the "Bitcoin ecosystem aimed at activating BTC liquidity":

1️⃣ BTCFi and Runes can accept $BTC respectively and Memecoins, two new species of overflow capital.

2️⃣ As an ecological narrative, the Bitcoin ecosystem includes multiple hot tracks: Runes, Ordinals NFT, BTC Layer2, BTCFi (Staking, BTC stablecoin, lending, etc.). With a volume of 2 trillion Bitcoin, each of the above sub-items not only has a convincing narrative, but also the implementation effect of its head projects is also good (listed later).

Therefore, apart from the two new species in this bull market, the "Bitcoin ecosystem" has the grandest narrative, the most certain value, and the most reliable implementation.

Regarding familiar narratives such as AI, PayFi, and DePin, I think they are still inferior to the Bitcoin ecosystem, mainly because although they have a very high narrative ceiling, they still have a long way to go in value verification and application implementation.

There are also some narratives about pure Crypto technology architecture, infrastructure, and technical solutions. I think dApp is king in this bull market, and the overall effect is more important. These underlying technologies still need time to build and verify.

2. Consensus has been reached within the Bitcoin ecosystem

The general context of the development of the Crypto ecosystem is: FT/NFT issuance boom 👉 DeFi boom 👉 Infrastructure boom 👉 Layer2 boom.

In 2024, the Bitcoin ecosystem can be said to have used one year to quickly test the 10-year development narrative of Crypto. Ecosystem builders and players have reached a lot of consensus:

Consensus 1️⃣: The NFT asset standard is the Ordinals protocol. Even if multi-chain NFTs are compared together, Ordinals NFT assets are already the largest NFT asset category under Ethereum.

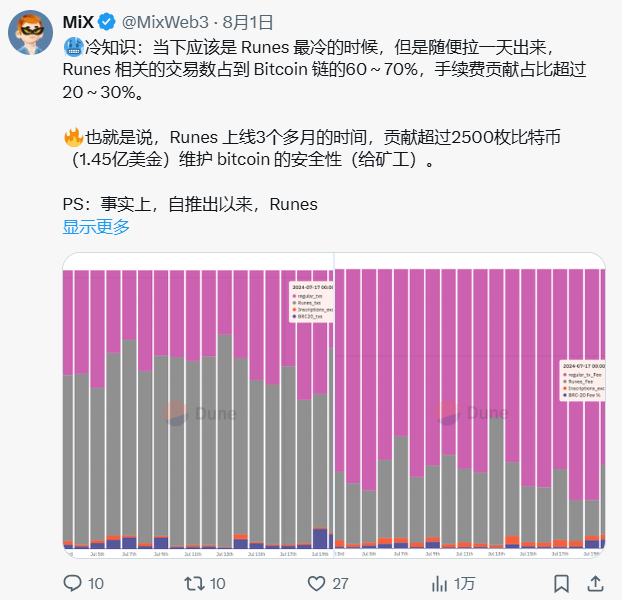

Consensus 2️⃣: The FT asset standard is the Runes protocol . The number of transactions related to the Runes protocol has long accounted for 60-70% of the Bitcoin chain, and the contribution of handling fees exceeds 20-30%. And after more than half a year of consensus building, the stablecoin projects of the Bitcoin ecosystem and the platform coins of the BTCFi project have all chosen to issue based on the Runes standard.

Data available at: https://dune.com/murchandamus/inscription-brc20-weight-and-percentage

Consensus 3️⃣: BTCFi is the key to the second half of the Bitcoin ecosystem

Bitcoin holders, even BTC maximalists, are shifting from a simple "buy BTC and hold" strategy to "hoping to find more paths to maximize asset utility under the premise of security."

💡Player attitude: After the wealth-creating effect of the issuance of assets such as Ordinals, BRC20 and Runes , old BTC holders are no longer satisfied with the narrative of value storage (the multiples of BTC from the halving price to the highest price in the bull market in the last four times are: 92, 29, 7.5 times, and only a little bit in this round), and a large number of new players originally expected BTC to have stronger playability and new application scenarios .

💡Liquidity: The dormant BTC has started to flow: for example, Babylon’s two rounds of staking attracted 24,000+ BTC in a short period of time under restrictions, and cross-border staking has earned rewards on BTC Layer2. LST projects are emerging one after another because BTC Holders have begun to explore ways to improve the efficiency of BTC appreciation.

💡MVP Minimum Viable Product Verification: The needs and scenarios of BTCFi applications based on new Bitcoin assets such as $BTC and Ordinals NFT and Runes are being verified. For example, the protocol revenue of @LiquidiumFi, the leader in Bitcoin ecosystem lending , has exceeded 600,000 U, and @bitsmiley_labs stablecoin has also been expanding its territory in the Bitcoin ecosystem.

💡Financial background: This wave of ecosystem builders all hope to activate the BTC liquidity on the bitcoin chain, and a large number of them believe that the custody funds of Bitcoin ETFs may be very flexible. In terms of actions, it is heard that many traditional asset management teams have also entered the Bitcoin ecosystem.

3. BTCFi development history and hot projects

BTCFi's key areas include: staking interest, DEX, lending, and stablecoins. If it wants to continue to be a hot topic, the bitcoin ecosystem has two major bottlenecks that need to be broken through, namely "expanding transaction throughput" and "improving programmability."

In terms of technical routes and narratives, the first to become popular was actually BTC Layer2, an application chain type that focuses on BTC staking and liquidity scenarios. Due to its huge TVL, it pays more attention to security and programmability, and is backed by top-level endorsements. All of them are industry leaders: old players are mainly represented by @babylonlabs_io and @SolvProtocol , who have been continuously building the Bitcoin ecosystem before everyone paid attention to it; new players are represented by @exSatNetwork , who jointly promote the transformation of Bitcoin from "digital gold" to "ecosystem participant."

When the Bitcoin ecosystem became popular, everyone rushed to the public chain BTC Layer2 development route with reference to the development path of Ethereum. At that time, it seemed that many projects were launched hastily and the first layer of verification was not taken care of.

PS: At present, some EVM-type BTC Layer2 will implement a layer of verification and enhance its own security by changing the architecture.

For the public chain BTC Layer2, the ones that are gradually emerging include @BitlayerLabs , @build_on_bob and @Stacks .

Bitlayer has strong overall management, technology and operations, focusing on the BTCFi narrative, 800 million TVL, 250,000+ transactions per day, cumulative financing of 25 million US dollars, and investment from old money such as the US ETF institution Franklin, which gives it a first-hand advantage. Technically, Bitlayer has accumulated experience in BitVM and is committed to making a Native Layer2 that is equivalent to BTC security. It is said that it can implement a layer of verification based on existing script code, and has a cost advantage of 10 times that of competing products. I will focus on Bitlayer in the future.

On Stacks, there is @ALEXLabBTC , which claims to be the No. 1 Bitcoin DeFi. It has been working on BTCFi since 2021 and will launch ALEX V2 in the fourth quarter, aiming to aggregate the liquidity of many BTC Layer2s.

The stablecoin track of the Bitcoin ecosystem is a narrative with a relatively high degree of certainty, and it is also a cross-BTC Layer2 existence. For example, @bitsmiley_labs and @Satoshi_BTCFi are continuing to build and issue BTC over-collateralized stablecoins on multiple BTC Layer2s.

In the second half of the year, after the heat of BTC Layer2 gradually declined, everyone's attention returned to the bitcoin mainnet, and they found that some BTCFi applications that continued to be built on the mainnet were bearing fruit, such as AMM Swap @Dotswap , lending protocol leader Liquidium , and stablecoins issued on the first layer @ShellFinance_, etc. Even with Bitcoin's well-known high gas, they still gained a wave of real reputation and expectations in the ecosystem. To be honest, it has become the biggest booster for me to be optimistic about BTCFi.

However, the programmability of the Bitcoin mainnet is too limited (Bitcoin's Discreet Log Contract (DLC), multi-signature escrow, PSBT and time locks, etc.). Bitcoin has finally broken out of the experience limitations of Ethereum's past development and boldly helped the Bitcoin mainnet gain composable smart contract capabilities by building an execution layer: that is, regardless of capacity expansion, only the programmability of the Bitcoin mainnet is expanded. @ArchNtwrk and @OmnityNetwork 's REE protocol both follow this idea.

The essence of the Bitcoin mainnet programmability extension protocol is to build a Bitcoin execution layer that does not need to carry Bitcoin mainnet assets, and always sense transactions initiated by Bitcoin mainnet users. After the execution layer completes the logical calculation of the smart contract, it directly broadcasts the results to the Bitcoin mainnet. In this way, user assets do not need to cross chains, and transactions are purely executed in Bitcoin natively, thus achieving a huge improvement in programmability.

As for security, Arch builds its own PoS chain, while the REE protocol is directly built on the current ICP public chain with a security level of billions. In comparison, it has stronger performance and is fully on-chain with a very high degree of decentralization and security.

The consensus on expanding the programmability of the Bitcoin mainnet has been supported by many teams that want to develop BTCFi. With the demonstration of a wave of BTC Layer2 and the suspicion of the Staking chain being a nested doll, Builder gradually realized that:

1️⃣ For low-frequency operations of large amounts of funds in BTCFi, such as staking, lending, and normal trading, the current Bitcoin mainnet can meet the needs of most scenarios. Let's just make applications!

2️⃣ If you want the Bitcoin ecosystem to thrive, you first need to make the mainnet solid and prosperous enough. Its Gas contribution is also conducive to the health and robustness of the Bitcoin mainnet.

3️⃣ Interacting directly on the Bitcoin mainnet, although there is gas, is a better experience than cross-chain operations. At the same time, there is another interesting narrative route, which is the public lightning network Fiber Network launched by the CKB team, focusing on real payment application scenarios, hoping to closely combine P2P and programmability, aiming to build an off-chain peer-to-peer financial settlement network.

( https://github.com/nervosnetwork/fiber/blob/main/docs/light-paper-cn.md

4. Runes are weather vanes

Back to the Runes, which I personally have always been very optimistic about.

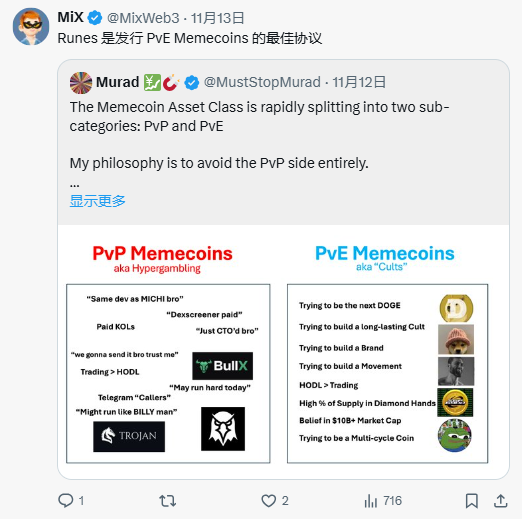

For those real communities, the issuance of their culture, memes or memes, the endorsement brought by the Bitcoin chain where the Runes Protocol is located, the diversified issuance method featuring fair minting, and the ability of interactive promotion between Runes runes and Ordinals NFTs all make the Runes Protocol the first protocol for issuing PvE Memecoins.

The first to smell the explosion of the Bitcoin ecosystem must be the Runes track. After all, when capital really starts to gather in the BTC ecosystem, Memecoins must be a weather vane.

However, unlike the Runes ecosystem rebound a few days ago, the next round of the biggest wealth-creating effect will most likely be concentrated in the newly issued Meme runes, because as far as I know: with the improvement of Bitcoin's first-layer programmability, the real Bitcoin mainnet, completely decentralized, and smooth AMM Swap is coming soon, and leverage protocols with better lending experience and greater decentralization are also being iterated!

Now the only thing missing is a Pump deployed on the first layer.fun: In fact, I have discovered a problem a long time ago, that is, Runes Meme, with good growth and cohesion, more than 95% are 100% Premine.

Therefore, I think that Open Mint's contribution of all gas to miners may not be suitable for all communities. We need to explore a healthier chip distribution logic, and Pump.Fun's model can be used as a reference.

I sincerely recommend it to teams with experience in this area. For the internal trading part, you can use the AMM Dex template (pattern operation) of the REE protocol to make one, and then match it with the issuance part. This is a very good opportunity.

To sum up, I am full of expectations for the second half of the Bitcoin ecosystem in 2025.