Longing Bitcoin (BTC) holders have started to realize profits after the cryptocurrency price attempted to reach $100,000. As a result, the Bitcoin price has dropped to $93,000, affecting the overall market capitalization of the cryptocurrency market.

Is the Bitcoin price rebounding? Short-term investors may want to know as they review this on-chain analysis.

Decrease in Bitcoin Activity... Profits for Holders

According to CryptoQuant, the long-term Bitcoin realized profit ratio has spiked to 2.86. This ratio measures the activity of long-term investors who have held their coins for more than 155 days.

A ratio above 1 means these long-term Bitcoin holders are realizing profits and selling. Conversely, a realized profit ratio below 1 indicates holders are selling at a loss. The current high figure suggests these holders have been realizing gains from the recent price increase.

Additionally, this profit-taking is the most that these holders have realized since August 30th. If this continues, there is a risk that the BTC price could fall below $93,000.

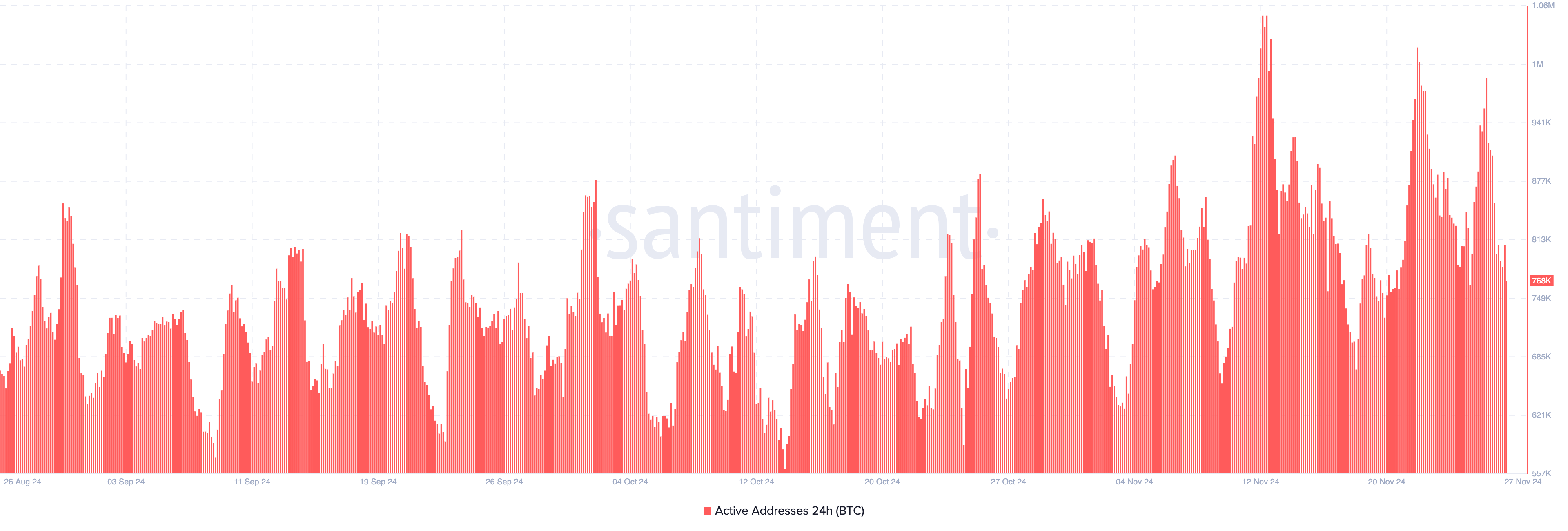

Furthermore, the number of active addresses on the Bitcoin network has significantly decreased this week. If this trend continues, it could be problematic for the cryptocurrency price. Active addresses measure the number of unique addresses participating in transactions, reflecting user engagement with the blockchain.

An increase in active addresses indicates growing network activity and adoption. Conversely, a decrease suggests declining participation.

On November 26th, Bitcoin's active addresses reached nearly 1 million, garnering significant attention. However, at the time of writing, that figure has decreased to 768,000. If active address activity continues to decline, market sentiment may weaken, potentially contributing to further price drops, as previously emphasized.

BTC Price Prediction: Below $90,000?

On the daily chart, Bitcoin's price has fallen below the dotted line of the Parabolic Stop and Reverse (SAR) indicator. This technical tool identifies support and resistance levels.

When the dotted line is below the price, it indicates strong support, and when it's above the price, it suggests resistance, which could lead to a downward trend. Currently, Bitcoin is facing the latter scenario.

If this resistance persists, BTC could drop to $84,640. However, if long-term holders reduce their profit-taking, the Bitcoin value could instead rise to $99,811.