Author: 0xLoki Source: X, @Loki_Zeng

The main line of this round is relatively clear:

1/ On-chain meme and AI are the absolute main tracks

This year's on-chain meme is very different from the past, it has gone beyond the concept of "shitcoin", corresponding to the DeFi concept of 2020, which is essentially a brand new asset issuance method, all infra and services must depend on asset issuance, the left-wing route of asset issuance is on-chain meme, and the right-wing route is RWA and VC coin.

The left-wing route is a global opportunity, while the right-wing route is more of a structural opportunity, such as the revival trend of DeFi,

The axis of evil of @ethena_labs+ @SkyEcosystem+ @MorphoLabs. Old protocols like @CurveFinance and @aave have also shown obvious business growth; There are also some structural opportunities in BTCfi, CeDefi, and Payfi.

So I still don't have a good outlook on ETH, as of now ETH can only carry the side narrative, although Coinbase will benefit greatly from the main narrative, in my view it's more like the eighteen warlords plotting against each other, rather than the three heroes fighting Lü Bu in unity. It is very likely that the ETH exchange rate will not be able to outperform BTC upwards, Solana in the middle, and DeFi blue chips downwards.

2/ The impact of Western policy narrative has only played a small part

In the campaign stage, the narratives of Trump and Musk have already played a huge potential. There are two bigger things to come: ① Formal inauguration ② Replacement of the SEC chairman. At the same time, ETH and MSTR have already taken over the task of the previous cycle of Grayscale, and there will be more companies and sovereign countries starting to allocate, this time it will be even bigger than 2020.

The long bull of the West has been extended.

With the combination of the above internal and external factors, the importance of the ecosystem has become very clear, I won't go into details about the ecosystems that already have strong consensus or relatively strong consensus, let's talk about two ecosystems with relatively low attention:

3/ Bittensor ecosystem

I recommend Vitlik's recent interview, which has nothing to do with ETH but some of the ideas in it are very interesting, including the authoritarian monopoly of AI and the reflection on the future symbiosis of AI, the big beta of on-chain meme is undoubtedly @ACTICOMMUNITY, the beta answer of the Alts sector is also very clear, Crypto AI can only be deAI or Fair AI so @bittensor_>> @worldcoin

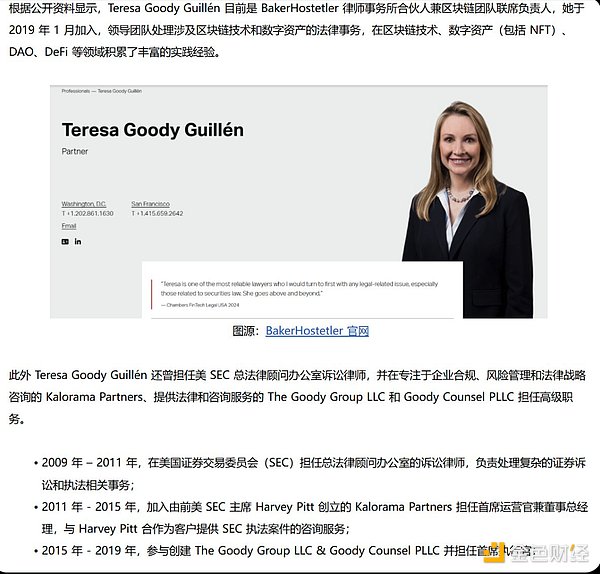

It is worth mentioning that last week the media reported that the current most likely candidate for the new SEC chairman is Teresa Goody Guillén, a partner and co-head of the blockchain team at the law firm BakerHostetler, and she is also the legal partner of Bittensor's first subnet @getmasafi, since the news came out a week ago, $MASA has risen about 30% while BTC has pulled back.

4/ Near ecosystem

As the saying goes, one step ahead eats meat, ten steps ahead eats shit, Near belongs to this case. At the beginning of this year when Solana on-chain meme was just heating up, Near's on-chain meme also quickly caught up, producing two targets, the Black Dragon and the One Dragon, Near founder @ilblackdragon also attended Nvidia's AI conference.

But in the following period, on-chain meme and AI were lukewarm. Now the wind of on-chain meme and AI has finally picked up, blowing to Solana, Base, SUI, BNB Chain, but the Near players have already had three meters of weeds on their graves.

However, the good news is that there is a metaphysical theorem, from DeFi to X2E, to Non-Fungible Token and Script, Near is always able to catch the last train and eat the last hot bite, but the public chains that are later than Near basically can't catch up with anything. Near belongs to the kind that eats but arrives late, can also make trouble and has a certain pattern. Just looked at it, the on-chain meme @dragonisnea with three meters of weeds and the Script @inscriptionneat with five meters of weeds, now they still have $7m and very good exit liquidity.