Author: Michael Nadeau, Founder of The DeFi Report

Translator: Glendon, Techub News

Translator's note: In the current cycle, Solana has been on a meteoric rise, with its native token SOL reaching a historic high of $264 USDT, while Ethereum has appeared somewhat stagnant. Moreover, the ratio of Solana's market capitalization to Ethereum's has increased from 17% in July 2022 to nearly 30%. Since the December 2022 low, SOL has achieved an astonishing 25-fold growth, while ETH has only increased by 1.7 times. Is Ethereum lacking momentum, or has it yet to unleash its full potential? This is a question worth exploring, and this article will analyze it from various perspectives, including data, market sentiment, cognition, and narratives, to determine whether Solana has a chance to surpass Ethereum and what catalysts could drive Ethereum's price upward.

Looking back to January 2023, Solana's market capitalization was only 3% of Ethereum's, and the gap seemed insurmountable. However, by July 2022, this gap had narrowed significantly, with Solana's market capitalization reaching 17% of Ethereum's. At the time, we asked: "Should SOL's market cap be 83% lower than ETH's?" The fundamental data provided a negative answer.

Since then, the market has reevaluated SOL, and its market capitalization has continued to soar, reaching nearly 30% of Ethereum's. Faced with this change, I can't help but ask again: Should SOL's market cap be 70% lower than ETH's?

And is the market still in a state of chaos? Let's delve deeper into this.

SOL vs. ETH (and Top L2s):

Comparative Data

When comparing Solana and Ethereum, we pay particular attention to an important variable - the second-layer networks (L2s): Arbitrum, Base, Optimism, Blast, Celo, Linea, Mantle, Scroll, Starknet, zkSync, Immutable, and Manta Pacific.

Our view is that these L2s not only create new demand for Ethereum L1 block space but also further enhance the network effects of ETH as a core asset. Therefore, including these L2s in the comparison between Solana and Ethereum provides a more comprehensive and in-depth perspective.

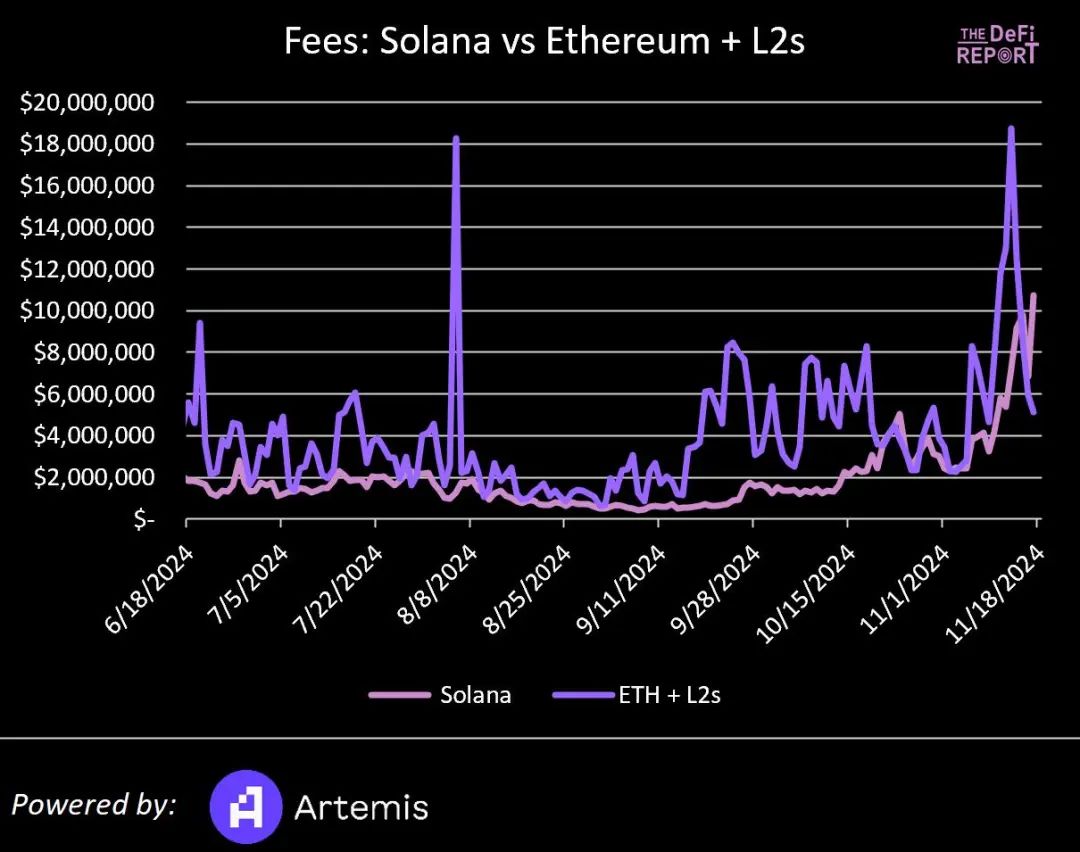

Fees

In Q2 2024, Solana's fee revenue was $151 million, accounting for 27% of the total fee revenue of Ethereum and the top L2s.

Over the past 90 days, Solana's fee revenue has reached $192 million, accounting for 49% of the total fee revenue of Ethereum ($374 million) and the top L2s ($21 million).

Note that the above fees only include Gas fees and do not include MEV (Maximum Extractable Value) fees.

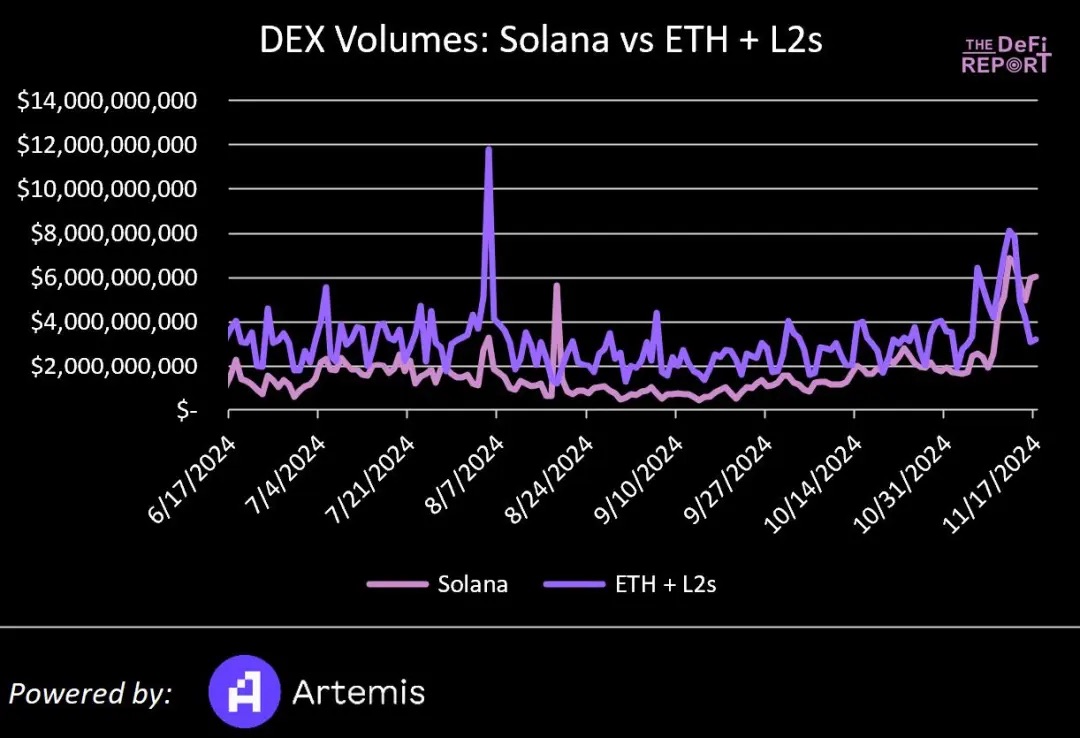

DEX Trading Volume

Solana's DEX trading volume in Q2 reached $108 billion, accounting for 36% of the trading volume of Ethereum and the top L2s.

Over the past 90 days, Solana's DEX trading volume has increased to $153 billion, accounting for 57% of the trading volume of Ethereum ($125.5 billion) and the top L2s ($145 billion).

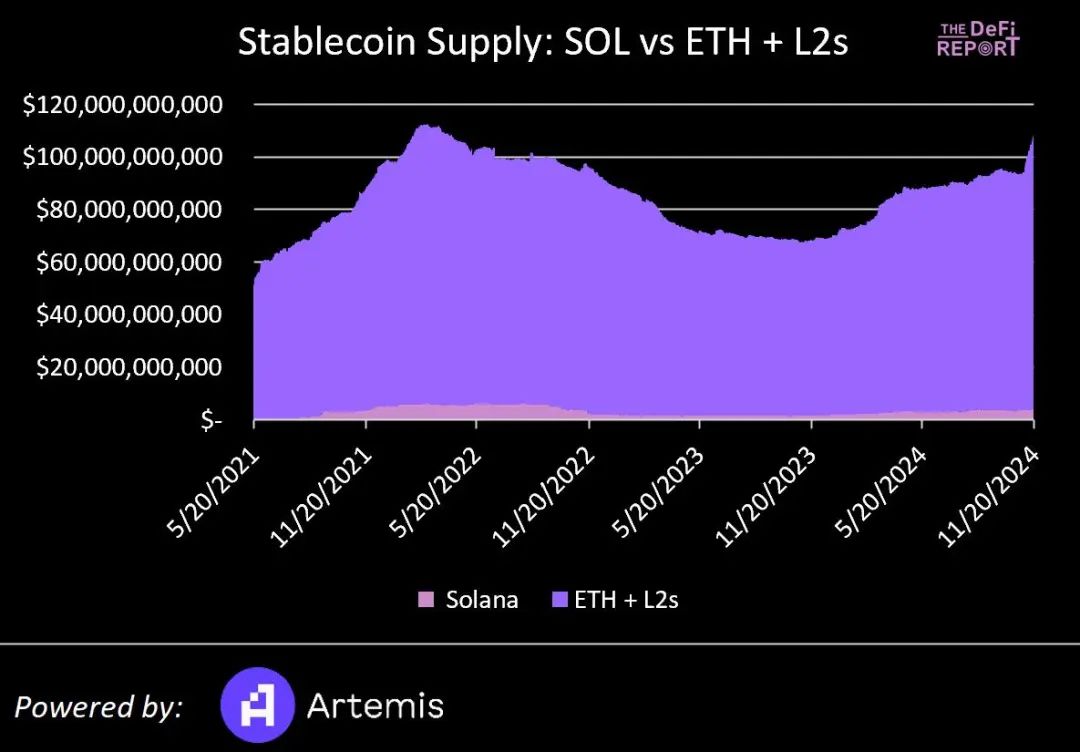

Stablecoin Supply

In July 2024, Solana's stablecoin supply was around $3.1 billion, accounting for 3.5% of the stablecoin supply of Ethereum and the L2s.

Currently, its stablecoin supply has reached $4.3 billion, accounting for 4.1% of the stablecoin supply of Ethereum + L2s.

Note that Arbitrum's stablecoin supply has surpassed Solana, and Base's stablecoin supply has reached 80% of Solana's.

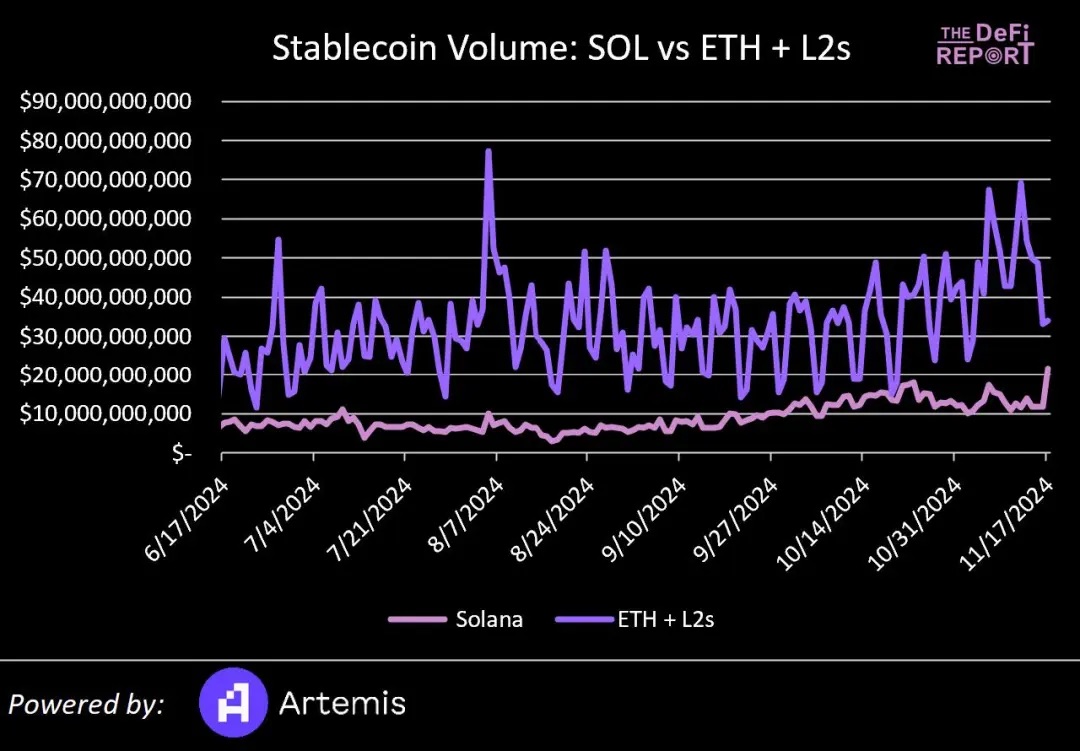

Stablecoin Trading Volume

Solana's stablecoin trading volume in Q2 reached $4.7 trillion, which was 1.9 times the trading volume of Ethereum and the top L2s.

However, over the past 90 days, Solana's stablecoin trading volume has decreased to $963 billion - about 30% of the trading volume of Ethereum ($1.9 trillion) and the top L2s ($1.26 trillion).

Why has Solana's trading volume decreased?

We believe that the growth in Solana's trading volume in the second quarter was primarily driven by wash trading and algorithmic trading.

According to Artemis' data, only about 6% of Solana's stablecoin trading volume is peer-to-peer transfers. In contrast, this figure is close to 30% on the Ethereum L1, indicating that Ethereum is used for non-speculative activities to a much greater extent than Solana.

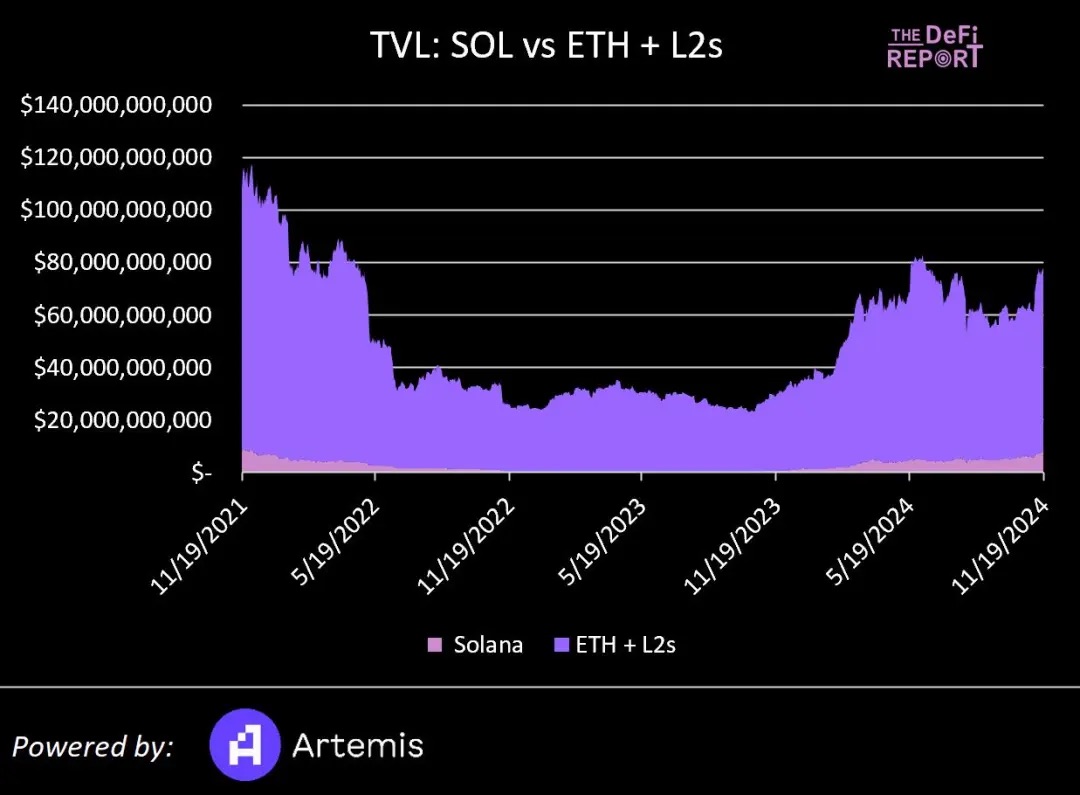

TVL

At the end of Q2, Solana's TVL was $4.2 billion, accounting for 6.3% of the TVL of Ethereum ($60.3 billion) and the top L2s ($9.5 billion).

Currently, Solana's TVL has risen to $8.2 billion, accounting for 12% of the TVL of Ethereum and the top L2s.

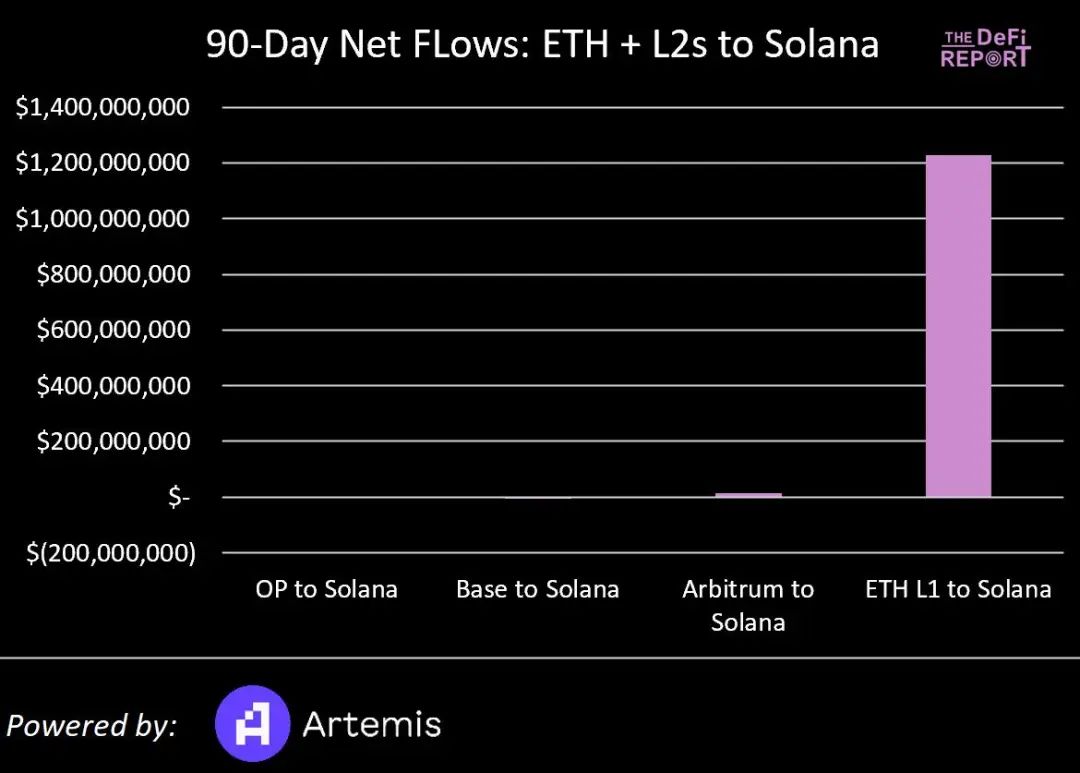

Capital Flows

Over the past 90 days, Solana has attracted over $1.2 billion in TVL from Ethereum, which is about 2% of Ethereum L1 TVL. During the same period, it has also attracted $14 million in TVL from Arbitrum.

Meanwhile, Solana has also lost some TVL to OP (540,000) and Base ($5 million).

Based on the 90-day performance, the Solana data can be summarized as follows:

1. Accounts for 49% of Ethereum's fee revenue (higher than 27% at the end of Q2).

2. Accounts for 57% of Ethereum's DEX trading volume (higher than 36% at the end of Q2).

3. Accounts for 4.1% of Ethereum's stablecoin supply (higher than 3.5% in Q2)

4. Accounts for 30% of Ethereum's stablecoin trading volume (much lower than 190% at the end of Q2)

5. Accounts for 12% of Ethereum's TVL (higher than 6% at the end of Q2)

6. Solana has attracted slightly less than 2% of TVL from Ethereum.

Again, the current market pricing of SOL has risen to 70% of Ethereum's market capitalization. We will delve deeper into the reasonableness of this valuation later. Before that, let's conduct some more qualitative analysis.

Market Sentiment, Cognition, and Narratives

In the cryptocurrency space, price movements often precede changes in cognition, narratives, and fundamentals. Given the price trends of SOL and ETH, the current narratives may lead you to believe that Solana is poised to surpass Ethereum.

However, the reality is that Solana currently exists primarily as a MEME coin casino. Of course, there are genuine projects on Solana, such as Helium and Hivemapper, but the current price dynamics (and fundamentals) are largely driven by this casino. From what I've heard, this phenomenon is quietly influencing Wall Street's perception of the blockchain.

Therefore, while the current market narratives are favorable for Solana, we should anticipate that this trend may change quickly. If Ethereum experiences a resurgence in 2025, the market narrative could rapidly shift from "Ethereum is dead" to "Ethereum is the future of finance".

At the same time, Solana's acceptance of the MEME coin casino may also negatively impact its overall perception and narratives.

Catalysts

Ethereum

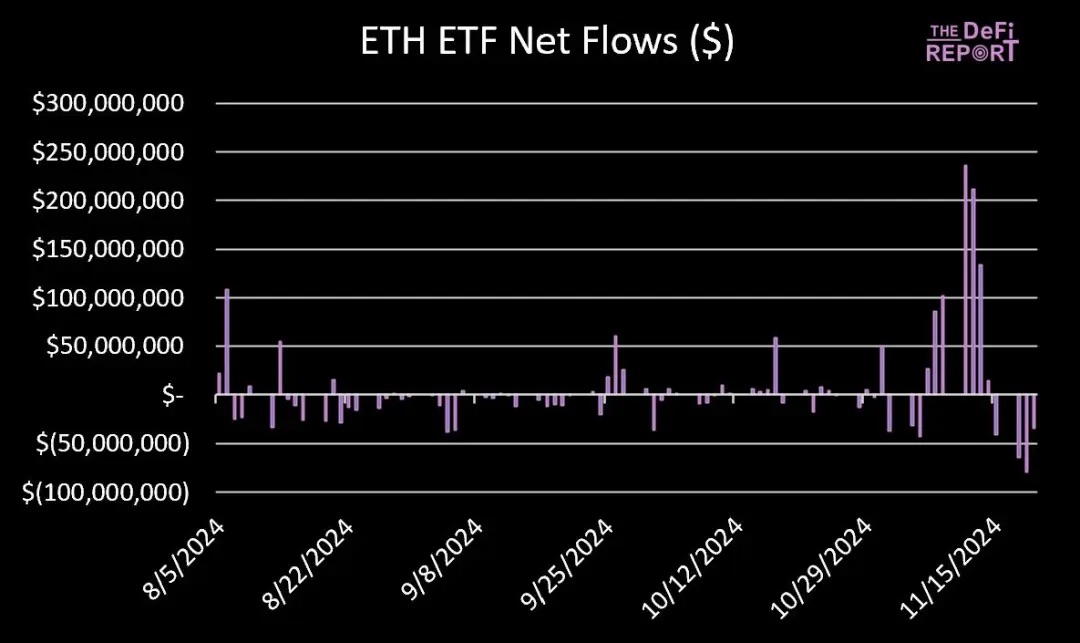

Exchange-Traded Funds (ETFs)

Ethereum spot ETFs have recently started to see some capital inflows, although the inflows are only a small fraction compared to Bitcoin spot ETFs. As of November 20, the net inflows into Ethereum spot ETFs were $469 million, which is only 1.7% of the net inflows into Bitcoin spot ETFs, far lower than our initial expectation of a 10-20% capital capture ratio.

So far, this real-world situation has deviated significantly from our predictions, but this gap will not last too long. We still believe that as the market cycle develops, capital will shift towards Ethereum.

DeFi and Real-World Assets (RWA)

As the global regulatory environment becomes increasingly clear, we will focus on whether the narratives around DeFi and RWA will heat up. If this happens, we may see companies like Blackrock drive more funds to tokenize on-chain.

There are three reasons for this speculation: 1. They want to tokenize existing assets to improve the efficiency of blockchain-based accounting and management work; 2. They want to capture the fees associated with (traditional financial services companies) transformation; 3. Blackrock has sufficient incentive to bring more utility use cases to Ethereum, positioning it as a new financial infrastructure, thereby paving the way for the legitimization of Blackrock's ETF products.

Once more and more funds undergo tokenization, we may see new use cases emerge in "Permissioned DeFi" to serve asset trading.

In fact, if Ethereum can now exhibit a positive price trend, the new narrative of Ethereum as the "Wall Street Chain" may emerge.

Coinbase and Base

In the Ethereum L2, Base stands out with its rapid growth in fees, active users, and stablecoin trading volume, becoming the fastest-growing L2. Considering the profitability that Base brings to Coinbase (around $68 million so far this year), we believe they may have created a blueprint for other financial services companies to launch L2s on Ethereum.

Imagine what would happen if giants like JPMorgan, Blackrock, Fidelity, or Robinhood announced the launch of Ethereum L2s?

Clearly, this would further reinforce the potential narrative of Ethereum as the "Wall Street Chain".

Solana Memecoin Frenzy

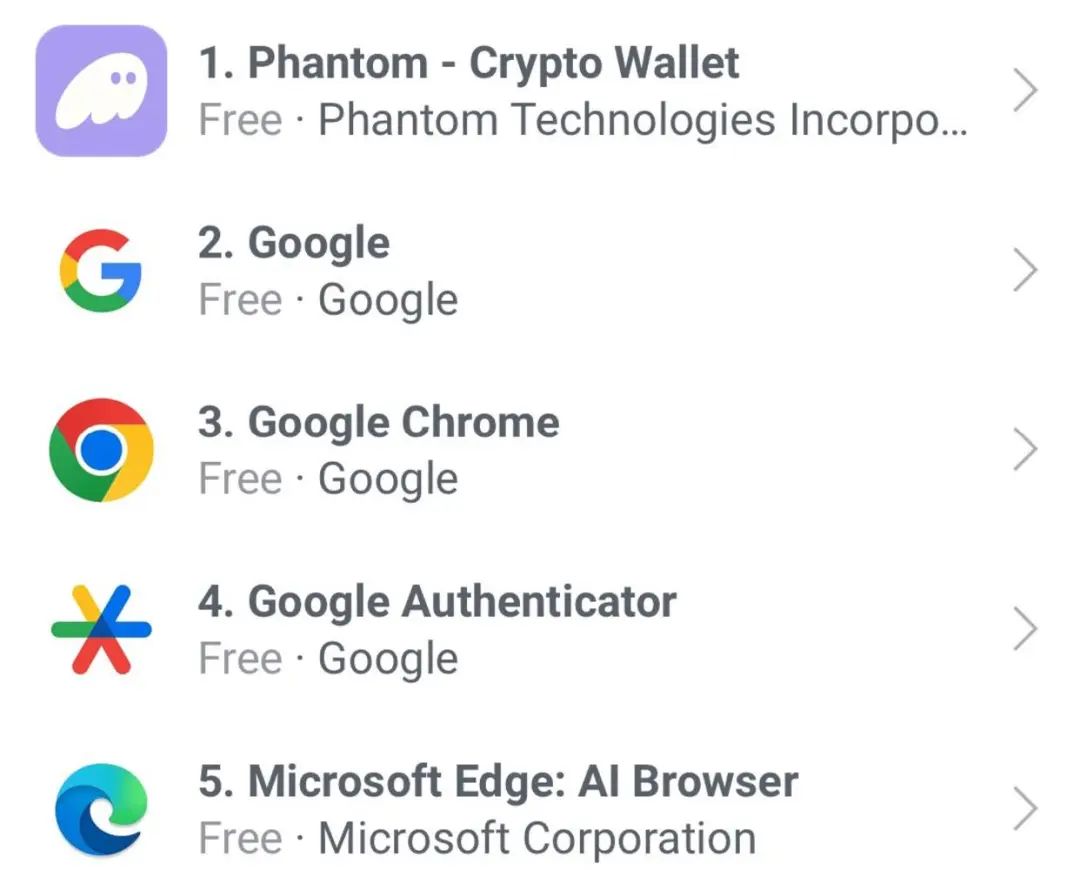

Phantom has recently surpassed Google to become the #1 free utility app on the Apple App Store.

This is undoubtedly a clear signal that Solana is attracting a large number of new users into the cryptocurrency space. At the same time, it is also a sign of market overheating.

The question now is: how much more room for growth is there?

Retail investors have indeed entered the market, although on a smaller scale than the previous cycle. One way to measure this phenomenon is to look at the view counts of popular cryptocurrency YouTube channels. From the chart below, we can see that the current market activity is still about 50% lower than the peak of the previous cycle.

While we tend to believe that this figure will rise to an extreme level after Bitcoin reaches $100,000, we remain cautious in the short term.

SOL ETF?

Regarding the SOL ETF, the Chicago Board Options Exchange (Cboe) has filed with the U.S. Securities and Exchange Commission (SEC) for 4 Solana spot ETFs, issued by VanEck, 21 Shares, Canary Capital, and Bitwise. Given the upcoming changes in the SEC, we expect to see a Solana spot ETF as early as next year. However, unlike Bitcoin and Ethereum, Solana has not yet established a regulated futures market in the U.S. - a key criterion the SEC has emphasized in approving Bitcoin and Ethereum ETFs.

Therefore, the question with this narrative is whether the positive headlines will become a "buy the rumor, sell the news" event, as we have seen so far with Ethereum ETFs.

Firedancer

Firedancer is crucial for Solana's future development.

Firedancer is a new Solana validator client developed by the cryptocurrency company Jump Crypto. It promises to significantly improve Solana's performance, reliability, and scalability by supporting more concurrent transactions. It will also improve overall network efficiency and reduce the operating costs for node operators.

Most importantly, the introduction of Firedancer will eliminate the current single point of failure (SPOF) in Solana and reduce the likelihood of future chain halts.

Firedancer is expected to be ready for mainnet deployment by 2025. While we believe it will greatly benefit Solana's future, it may not be a significant price catalyst within this cycle.

Decentralized Physical Infrastructure Networks (DePIN)

As for the narrative around Decentralized Physical Infrastructure Networks (DePIN), it has not really taken off yet. The decentralized wireless network Helium is up 147% year-to-date, but still 43% below its cycle high; the decentralized mapping network Hivemapper is up 164%, but 80% below its cycle high. Compared to July, we have somewhat less confidence in the DePIN space now. At the same time, we note that Memecoins (and to some extent Bitcoin) are absorbing attention and liquidity from other areas of the market.

Social Media

In July, I wrote: "We expect a social media app that integrates cryptocurrency in some way to go mainstream through celebrities and influencers." While this is still possible, the "attention economy" is currently being expressed through Memecoins. In the short term, it is difficult to see this situation changing.

Conclusion

Should SOL's market cap be 70% lower than ETH?

Given the following:

SOL/ETH has reached an all-time high

The market has re-priced SOL relative to ETH by 10x over the past few years

SOL has rallied 25x from the December 2022 low, while ETH has only rallied 1.7x

Solana's on-chain fundamentals are largely attributable to Memecoin trading

We tend to believe that SOL's relative valuation is reasonable. But the key question is whether SOL can continue to outperform, or even surpass Ethereum?

In our July report, we had anticipated that the performance of Ethereum ETFs would be better than SOL, and that SOL's market cap would peak at around 25% of Ethereum's in this cycle. However, it turns out we were off on both counts: Ethereum ETFs have performed more like a "sell the news" event (but we still believe the demand will come), while SOL has continued to rally alongside Bitcoin.

Currently, Bitcoin has seen a significant rally over the past few weeks. We expect some volatility and pullbacks before the end of the year, but overall, the market still has upside potential by 2025.

Historical data shows that in the previous cycle, Bitcoin reached a new all-time high in Q4 2020, while Ethereum peaked in early February 2021 and gained 5.4x in the first four months of that year.

To reiterate, in the cryptocurrency space, price leads narrative.

The market may see a similar trajectory in this cycle. If so, we may see a positive shift in the sentiment and narrative around Ethereum by 2025.

As for Solana, as the "retail casino/Memecoin chain", it may face some challenges.

Of course, there is also the opposing view that "things that perform well early in a crypto cycle tend to continue their strong performance later" - which provides strong support for a continued rise in SOL.

In summary, we believe the market has largely re-priced SOL relative to ETH, and the current fundamentals are broadly in line with the relative valuation. However, the future trajectory remains uncertain, and we'll have to wait and see what happens next.